Essential Estate Planning Tools for Your Future in Boca Raton

Estate planning tools are vital for securing your future and protecting your loved ones in Boca Raton. At Rubino Findley, PLLC, we understand the importance of having a solid plan in place.

This guide will walk you through the essential components of estate planning, including wills, trusts, and advance directives. By understanding these tools, you’ll be better equipped to make informed decisions about your legacy and ensure your wishes are carried out.

Why Do You Need a Will in Florida?

A will forms the foundation of any estate plan in Florida. At Rubino Findley, PLLC, we often witness the consequences when individuals don’t have a will in place. In Florida, if you die without a will, the state decides how to distribute your assets. This can result in unintended outcomes and family disputes.

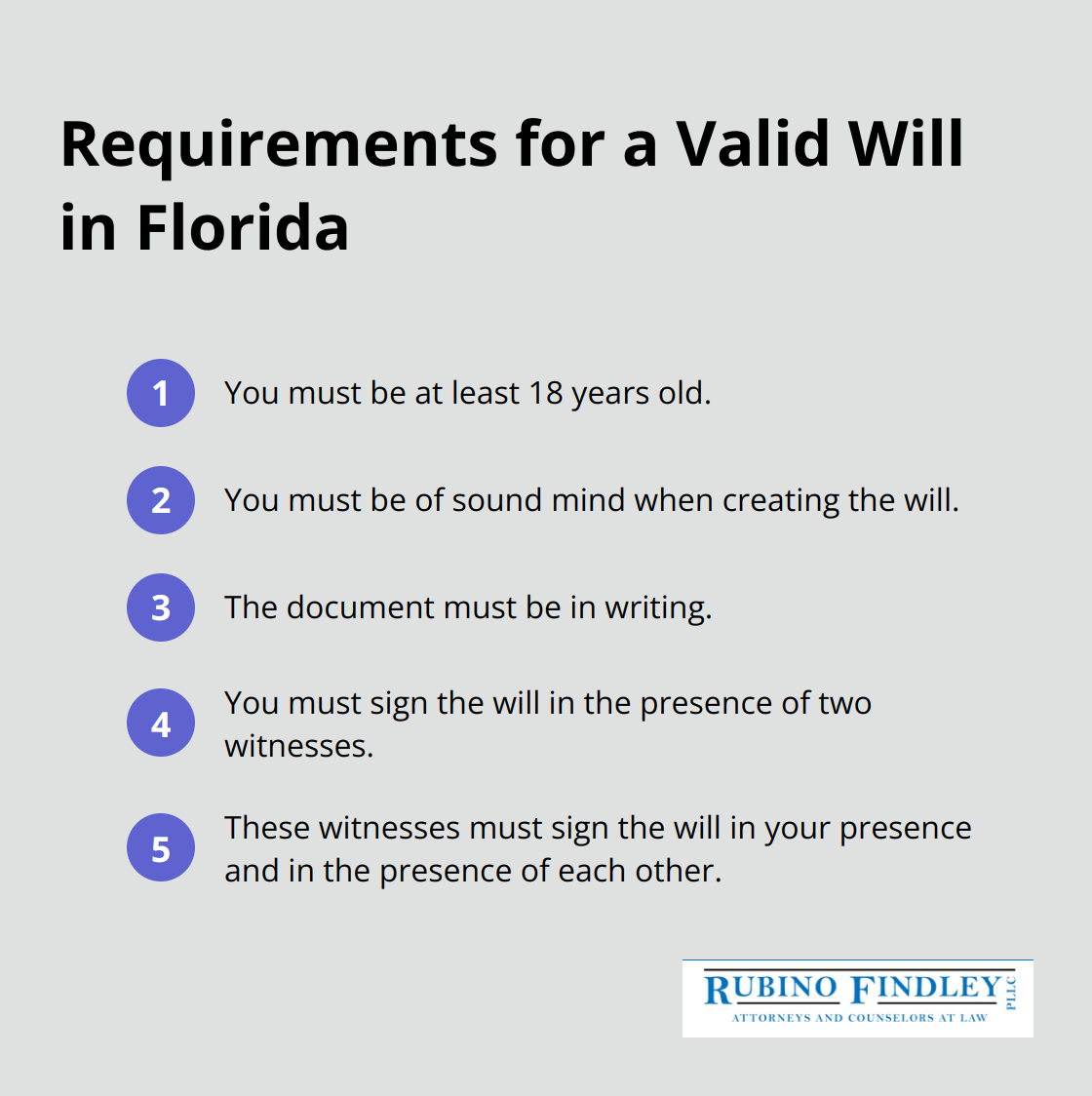

Requirements for a Valid Will in Florida

For a will to be valid in Florida, it must meet specific requirements:

Protection of Assets and Loved Ones

A well-crafted will does more than distribute your assets. It can:

- Name guardians for minor children

- Specify funeral arrangements

- Create trusts for beneficiaries

Without a will, courts may make these crucial decisions, potentially leading to outcomes that don’t align with your wishes.

Common Will-Making Mistakes to Avoid

One frequent mistake is the failure to update a will after major life events (such as marriage, divorce, births, and deaths). These events can significantly impact your estate plan.

Another error involves unclear identification of beneficiaries or assets, which can lead to confusion and potential legal challenges.

The choice of executor is also critical. This person will carry out your wishes, so they should be trustworthy and capable of handling the task.

Lastly, don’t assume a do-it-yourself will is sufficient. While these may seem cost-effective, they often fail to account for the complexities of Florida law and your unique situation. Working with an experienced estate planning attorney in Palm Beach County can help ensure your will is comprehensive and legally sound.

The Role of Professional Guidance

Estate planning can be complex, especially when considering Florida’s specific laws and regulations. An experienced attorney (like those at Rubino Findley, PLLC) can provide invaluable guidance throughout the process. They can help you navigate potential pitfalls, ensure your will meets all legal requirements, and tailor your estate plan to your unique circumstances.

As we move forward, let’s explore another essential tool in estate planning: trusts. These flexible instruments offer additional protection and control over your assets, complementing the foundation laid by your will.

How Can Trusts Protect Your Assets in Florida?

Trusts serve as powerful tools in estate planning, offering flexibility and protection for your assets in Florida. Many estate planning attorneys recommend trusts to their clients in Palm Beach County as a complement to their wills.

Types of Trusts in Florida

Florida law recognizes several types of trusts, each serving different purposes:

- Revocable living trusts: These allow you to maintain control of your assets during your lifetime while providing for seamless transfer upon death.

- Irrevocable trusts: These offer stronger asset protection but require you to relinquish control of the assets.

- Special needs trusts: These trusts prove essential for beneficiaries with disabilities, allowing them to receive inheritances without jeopardizing their eligibility for government benefits. The Florida Department of Children and Families sets the asset limit for Medicaid eligibility at just $2,000 for an individual, making these trusts invaluable for many families.

Benefits of Creating a Trust

One of the primary advantages of a trust is the ability to avoid probate. The Florida Bar reports that probate can take anywhere from six months to two years (depending on the estate’s complexity). By placing assets in a trust, you can significantly reduce this time frame and minimize associated costs.

Trusts also offer greater privacy than wills. While probate proceedings become public record in Florida, trust administration typically remains private. This can prove particularly important for high-net-worth individuals or those concerned about potential challenges to their estate.

Selecting a Trustee

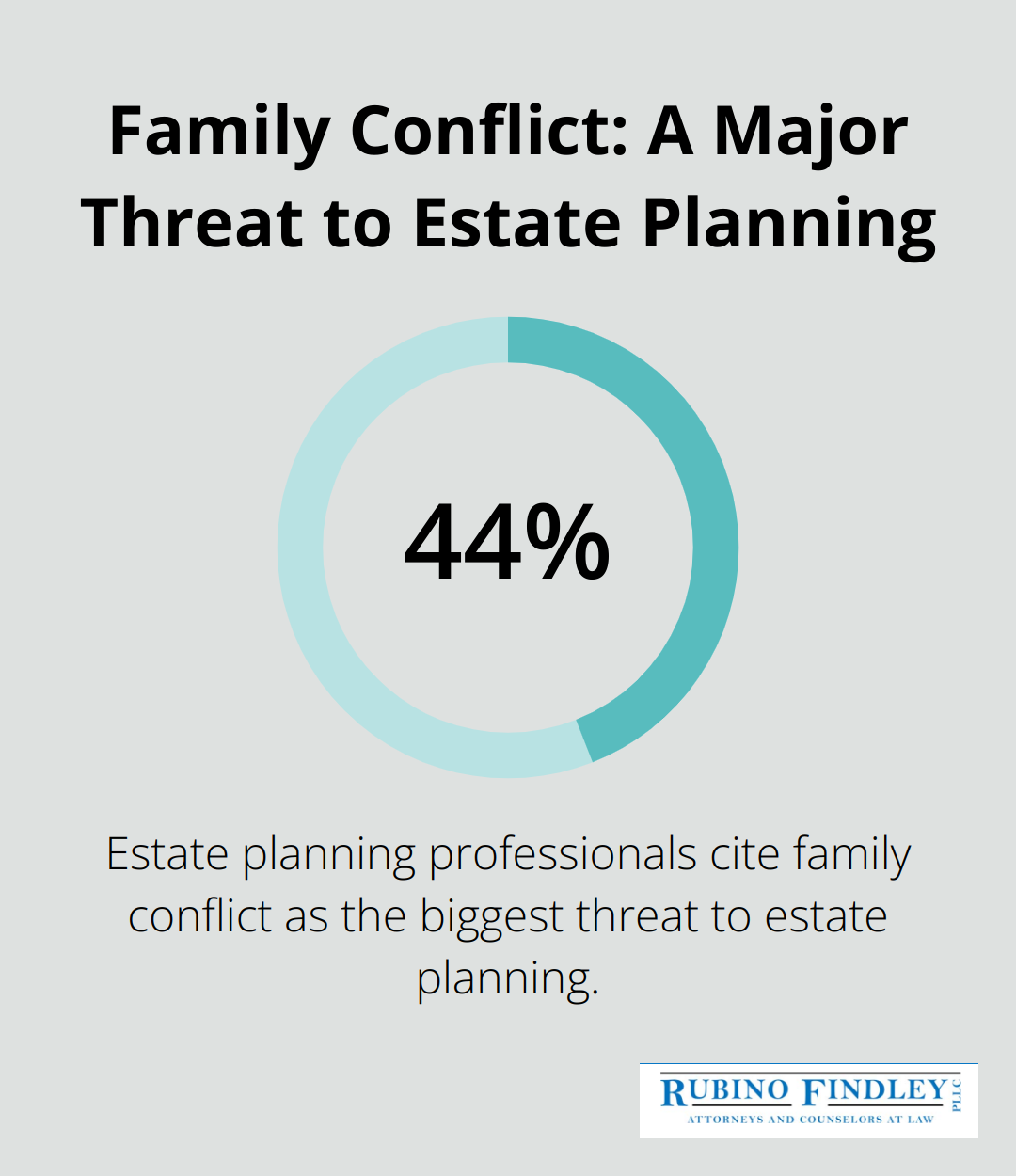

The selection of the right trustee proves critical to the success of your trust. This person or entity will manage and distribute your assets according to your wishes. While many people choose family members, this can sometimes lead to conflicts. A study by TD Wealth found that 44% of estate planning professionals cited family conflict as the biggest threat to estate planning.

Professional trustees, such as banks or trust companies, offer experience and impartiality but may come with higher fees. An experienced estate planning attorney can help you weigh the pros and cons of different trustee options based on your specific situation.

Tax Considerations

Trusts can also play a significant role in tax planning. While Florida doesn’t have a state estate tax, federal estate taxes can still apply to larger estates. The 2023 federal estate tax exemption stands at $12.92 million per individual, but this will decrease in 2026 unless Congress acts. A well-structured trust can help minimize these potential tax liabilities.

Trusts offer a versatile and powerful way to protect your assets and ensure their distribution according to your wishes. However, they require careful planning and ongoing management. As we move forward, let’s explore another essential component of estate planning: power of attorney and advance directives. These documents provide critical protection in case of incapacity and ensure your healthcare wishes are respected.

Why You Need Power of Attorney and Advance Directives

The Importance of Durable Power of Attorney

A durable power of attorney (POA) remains effective even if you become incapacitated. This sets it apart from a general power of attorney, which becomes invalid if you can’t make decisions. Florida law considers all powers of attorney durable unless explicitly stated otherwise.

The Florida Bar notes that without a durable POA, your family might face a costly and time-consuming guardianship proceeding to manage your affairs if you become incapacitated. This process can cost thousands of dollars and take several months (during which time your assets may be frozen).

Healthcare Decisions and Living Wills

While a durable POA typically covers financial matters, a healthcare surrogate designation allows someone to make medical decisions on your behalf. This document works alongside a living will, which outlines your preferences for end-of-life care.

A study by the Pew Research Center found that only 37% of American adults have advance directives in place. This low percentage highlights the need to address these issues proactively.

In Florida, a living will can specify your wishes regarding life-prolonging procedures in terminal conditions. You should discuss these preferences with your healthcare surrogate to ensure they understand and can advocate for your wishes.

Selecting Your Decision Makers

Choosing the right person to act as your agent under a POA or as your healthcare surrogate is a critical decision. This individual should be trustworthy, capable of handling complex decisions, and willing to respect your wishes.

Estate planning attorneys often advise clients to consider family dynamics when making these selections. Sometimes, choosing a neutral third party can prevent potential conflicts among family members.

It’s wise to name alternate agents in case your first choice can’t serve. This provides a backup plan and ensures continuity in decision-making.

Reviewing and Updating Your Documents

The Florida Statutes allow for revocation or amendment of powers of attorney and advance directives. You should review these documents periodically, especially after major life events (such as marriages, divorces, or births).

Protecting Digital Assets

In our technology-driven world, protecting digital assets has become an increasingly important aspect of estate planning. Consider including provisions for managing your online accounts, digital currencies, and other electronic assets in your POA and advance directives.

Final Thoughts

Estate planning tools protect your assets and secure your future in Boca Raton. Wills, trusts, powers of attorney, and advance directives work together to ensure your wishes are respected. These instruments serve unique purposes, from asset distribution to healthcare decision-making.

Professional guidance proves invaluable when navigating Florida’s complex estate planning laws. An experienced attorney can help you create a tailored plan and avoid costly mistakes. We recommend you gather information about your assets and consider your future goals before seeking legal advice.

Estate plans should evolve as your life changes. Regular reviews and updates will keep your plan aligned with your current wishes and compliant with the law. Contact an estate planning attorney to start protecting your assets and providing for your loved ones today.