Key Documents Needed for Effective Estate Planning in Boca Raton

Estate planning is a vital process for protecting your assets and ensuring your wishes are carried out. At Rubino Findley, PLLC, we often encounter clients who are unsure about what documents are needed for estate planning.

This guide will outline the key documents required for effective estate planning in Boca Raton and throughout Palm Beach County, Florida. Understanding these essential components will help you create a comprehensive plan that safeguards your legacy and provides peace of mind for you and your loved ones.

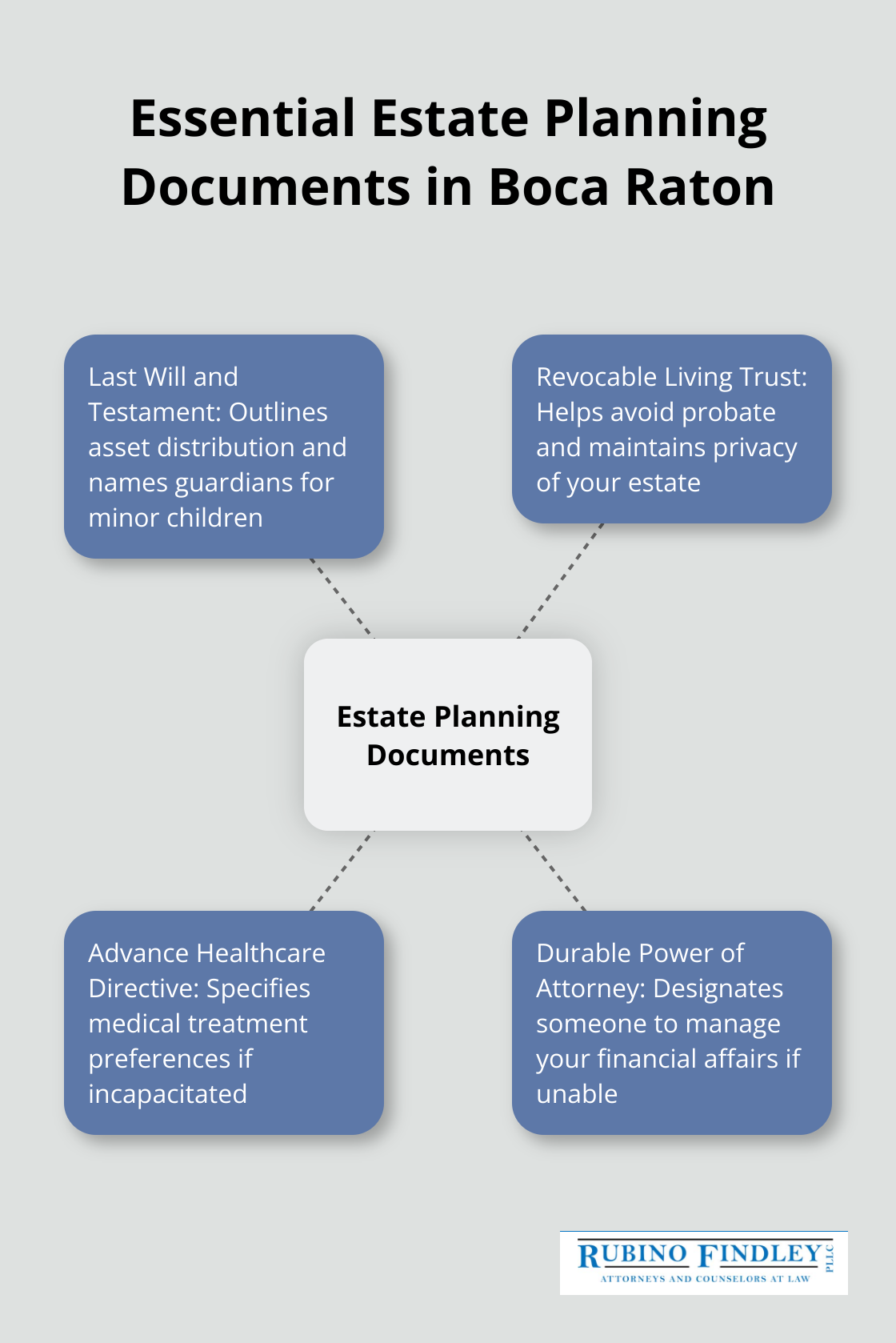

What Documents Do You Need for Estate Planning in Boca Raton?

Estate planning in Boca Raton requires several key documents to protect your assets and ensure your wishes are carried out. This chapter outlines four essential documents that form the foundation of a solid estate plan in Palm Beach County, Florida.

Last Will and Testament

A Last Will and Testament outlines how you want your assets distributed after your death. In Florida, a valid will must be in writing and signed by you in the presence of two witnesses. Without a will, the state’s intestacy laws will determine the distribution of your assets, which may not align with your wishes.

Revocable Living Trust

A Revocable Living Trust helps you avoid probate and maintain privacy. Unlike a will (which becomes public record upon death), a trust keeps your affairs private. It also allows for more complex asset distribution strategies and can provide for minor children or family members with special needs.

Advance Healthcare Directive

An Advance Healthcare Directive (also known as a living will) specifies your medical treatment preferences if you become incapacitated. This document ensures your healthcare wishes are respected and can alleviate the burden on your family during difficult times. In Florida, two witnesses must sign this document (with at least one being a non-family member).

Durable Power of Attorney

A Durable Power of Attorney designates someone to manage your financial affairs if you become unable to do so. This document prevents financial hardship and legal complications for your family. In Florida, a power of attorney must be signed before two witnesses and a notary public to be valid.

These documents work together to create a comprehensive estate plan. However, estate planning is not a one-time event. You should review and update your plan every 3-5 years or after significant life changes (such as marriage, divorce, or the birth of a child).

While online resources are available, working with an experienced estate planning attorney in Boca Raton ensures your documents are properly drafted and legally binding under Florida law. Professional guidance can help you navigate the complexities of estate planning and create a plan tailored to your unique situation and goals.

As we move forward, let’s explore the importance of each document in more detail and how they contribute to an effective estate plan in Boca Raton.

Why These Documents Are Essential for Your Estate Plan

Estate planning documents form the cornerstone of protecting your assets and ensuring your wishes are carried out. Each document plays a unique role in safeguarding your interests and those of your loved ones.

The Power of a Well-Crafted Will

A Last Will and Testament is more than just a list of who gets what. It allows you to control the distribution of your assets and name guardians for minor children. Without a will, Florida’s intestacy laws determine how your property is distributed, which may not align with your wishes. For example, if you’re unmarried with no children, your parents would inherit your entire estate under Florida law, even if you wanted your assets to go to a sibling or partner.

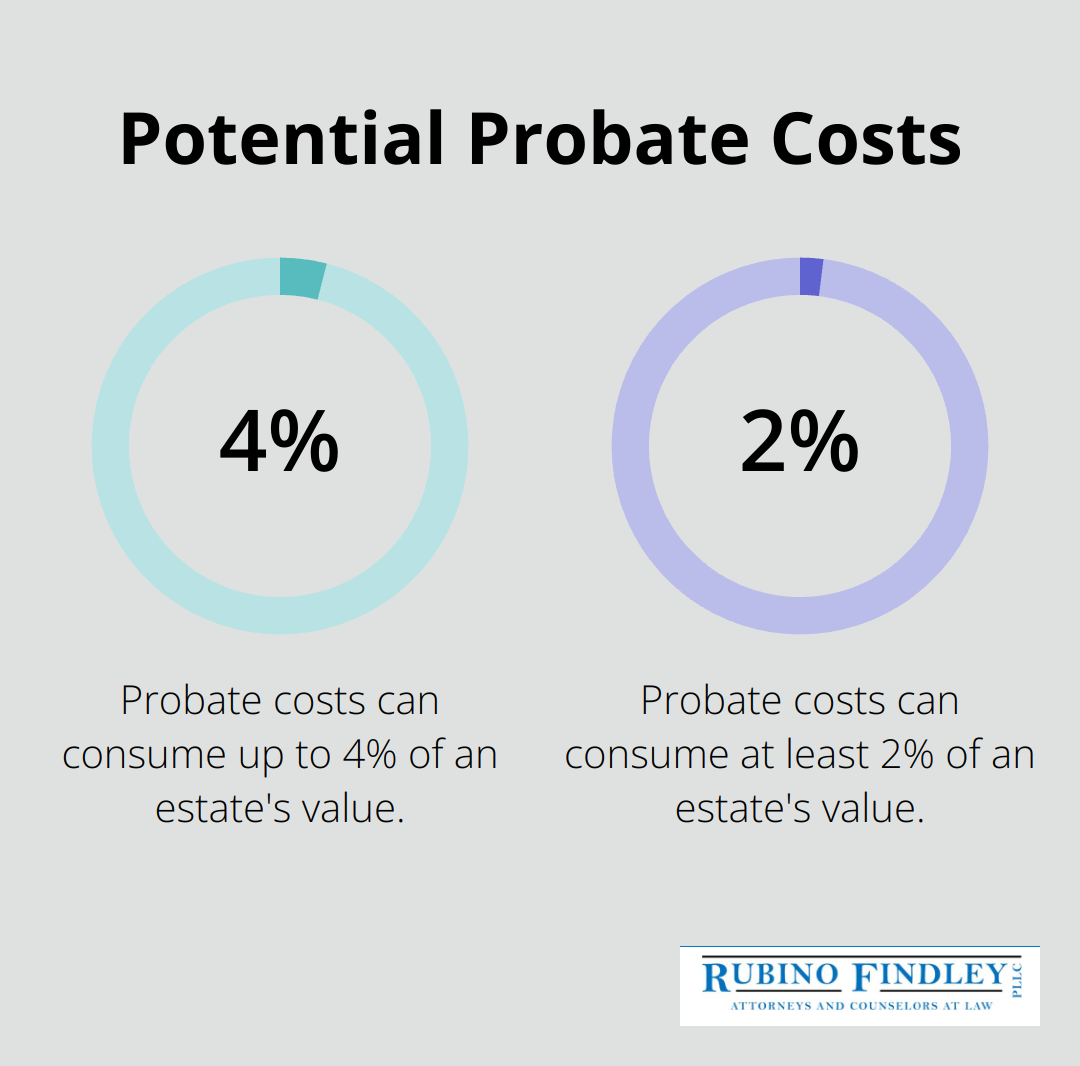

Trusts: Your Shield Against Probate

Revocable Living Trusts offer significant advantages over wills alone. They allow your estate to bypass probate, potentially saving your beneficiaries thousands in court fees and months of waiting. A study by the American Bar Association found that probate costs can consume 2-4% of an estate’s value. For a $500,000 estate in Boca Raton, that’s $10,000 to $20,000 in potential savings by using a trust.

Healthcare Directives: Ensuring Your Medical Wishes Are Respected

An Advance Healthcare Directive is your voice when you can’t speak for yourself. It spells out your preferences for medical treatment if you become incapacitated. Without this document, your family might face agonizing decisions about your care, potentially leading to conflicts. A survey by the Pew Research Center found that only 37% of Americans have documented their end-of-life wishes, leaving the majority at risk of receiving unwanted medical interventions.

Durable Power of Attorney: Protecting Your Finances

A Durable Power of Attorney is your financial safeguard. It allows your chosen agent to manage your finances if you’re unable to do so. This document is particularly important for small business owners in Boca Raton. Without it, your business operations could stop if you’re incapacitated, potentially leading to significant financial losses.

These documents work together to create a comprehensive estate plan. They provide a safety net for your loved ones, ensuring that your hard-earned assets are protected and your wishes are honored. Estate planning isn’t just about what happens after you’re gone – it’s about protecting yourself and your family throughout your lifetime.

As we move forward, let’s explore some common mistakes people make when creating their estate plans and how to avoid them. Understanding these pitfalls will help you create a more robust and effective estate plan for your Boca Raton property and assets.

Estate Planning Pitfalls to Watch Out For in Boca Raton

Estate planning involves complex processes, and even minor errors can lead to significant consequences. Many clients in Boca Raton make avoidable mistakes that complicate their estate plans. This chapter outlines common pitfalls and provides strategies to avoid them.

Failure to Update Documents

One of the most significant errors is the lack of regular updates to estate planning documents. Life changes rapidly, and your estate plan should reflect these changes. A Caring.com study found that only 33% of Americans with a will or living trust have updated it in the last five years. This oversight can result in unintended consequences.

For instance, if you divorce but don’t update your will, your ex-spouse might still inherit your assets. Similarly, if you have a child but don’t update your trust, that child might not be included in your estate plan. We suggest a review of your estate plan every 3-5 years or after major life events (marriages, divorces, births, or deaths in the family).

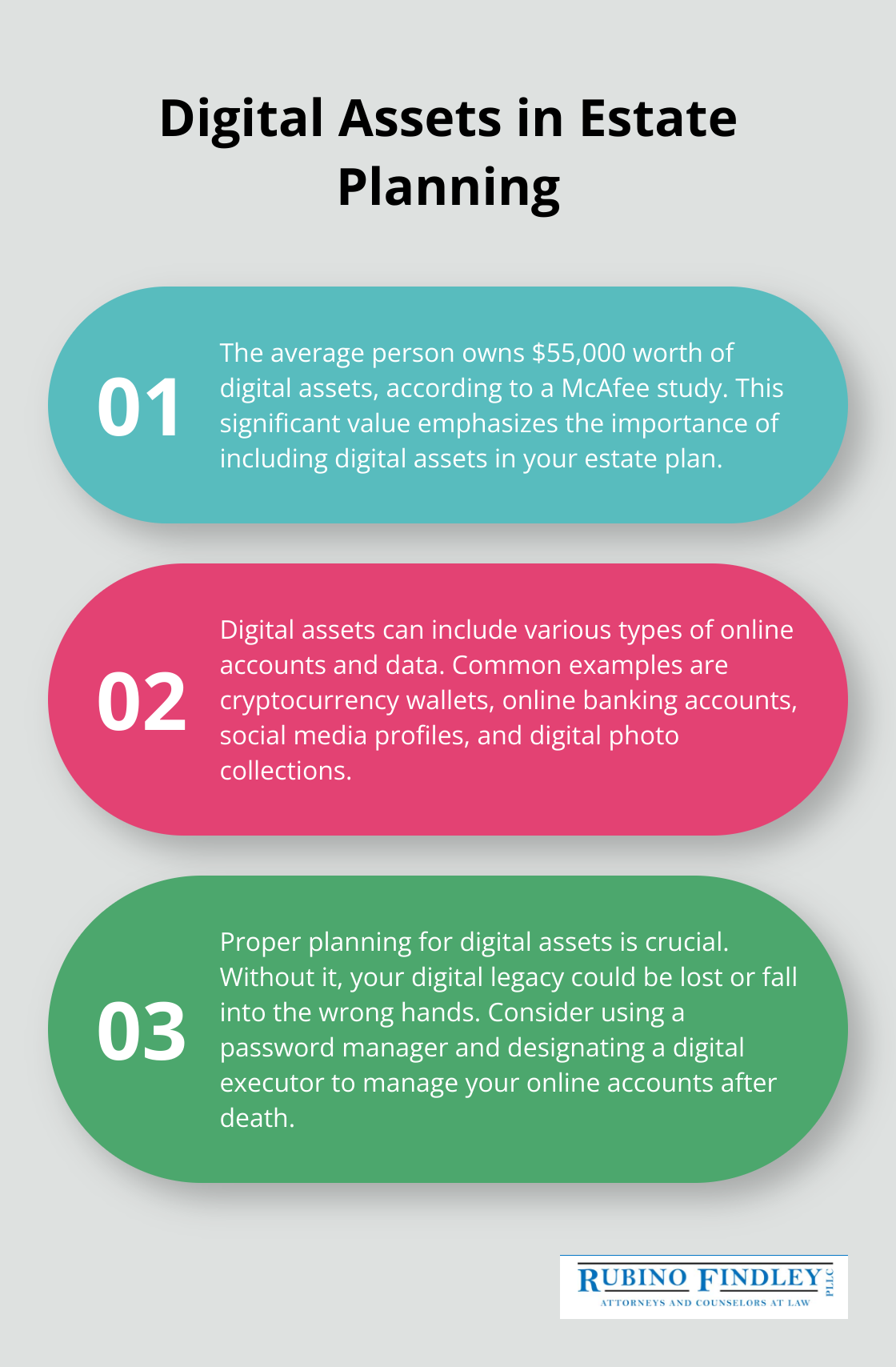

Neglect of Digital Assets

In our digital age, the oversight of online accounts and digital assets is a critical error. A McAfee study revealed that the average person owns $55,000 worth of digital assets. These assets can include cryptocurrency, online banking accounts, social media profiles, and digital photos.

Without proper planning, your digital legacy could disappear or fall into the wrong hands. Your estate plan should include a digital asset inventory and instructions for accessing and managing these assets. The use of a password manager and the designation of a digital executor to handle your online accounts after your death can prove beneficial.

Tax Miscalculations

Many Boca Raton residents underestimate the tax implications of their estate plans. While Florida doesn’t impose a state estate tax, federal estate taxes can still apply to larger estates. In 2023, the federal estate tax exemption stands at $12.92 million per individual, but this figure may change in the future.

Moreover, beneficiaries might face income tax on certain inherited assets, such as traditional IRAs. Improper planning can lead to substantial tax bills for heirs. Strategies like lifetime gifting or the establishment of irrevocable trusts can help minimize tax burdens on your estate and beneficiaries.

Lack of Professional Guidance

Estate planning is not a one-size-fits-all process. What works for your neighbor in Palm Beach County might not be the best solution for you. The engagement of an experienced estate planning attorney who understands the nuances of Florida law can result in a plan tailored to your specific needs and goals.

Final Thoughts

Estate planning protects your assets and ensures your wishes are carried out. The key documents needed for estate planning include a Last Will and Testament, Revocable Living Trust, Advance Healthcare Directive, and Durable Power of Attorney. These documents safeguard your interests and those of your loved ones in Boca Raton and Palm Beach County.

A comprehensive estate plan provides peace of mind and helps avoid costly probate processes. Regular updates to your plan are essential to reflect life changes, asset modifications, and legal amendments. Professional guidance can help you navigate Florida’s specific laws and create a tailored plan for your unique situation.

We at Rubino Findley, PLLC can assist Boca Raton residents in securing their legacy. Our team has experience in estate planning, probate administration, and related legal matters (including the creation of essential documents). Take action today to protect your assets and provide for your loved ones in Palm Beach County and beyond.