Critical Estate Planning Documents in Boca Raton You Shouldn’t Overlook

Estate planning documents are vital for protecting your assets and ensuring your wishes are respected. In Boca Raton, certain legal papers are essential for a comprehensive estate plan.

At Rubino Findley, PLLC, we often see clients overlook critical documents that can make a significant difference in their estate planning. This post will highlight the key papers you shouldn’t neglect when preparing for the future.

Why You Need a Will in Boca Raton

The Foundation of Estate Planning

A will forms the foundation of any estate plan in Boca Raton. This legal document outlines how you want your assets distributed after your death. Without a will, Florida’s intestacy laws determine who inherits your property, which may not align with your wishes.

The Impact of a Well-Crafted Will

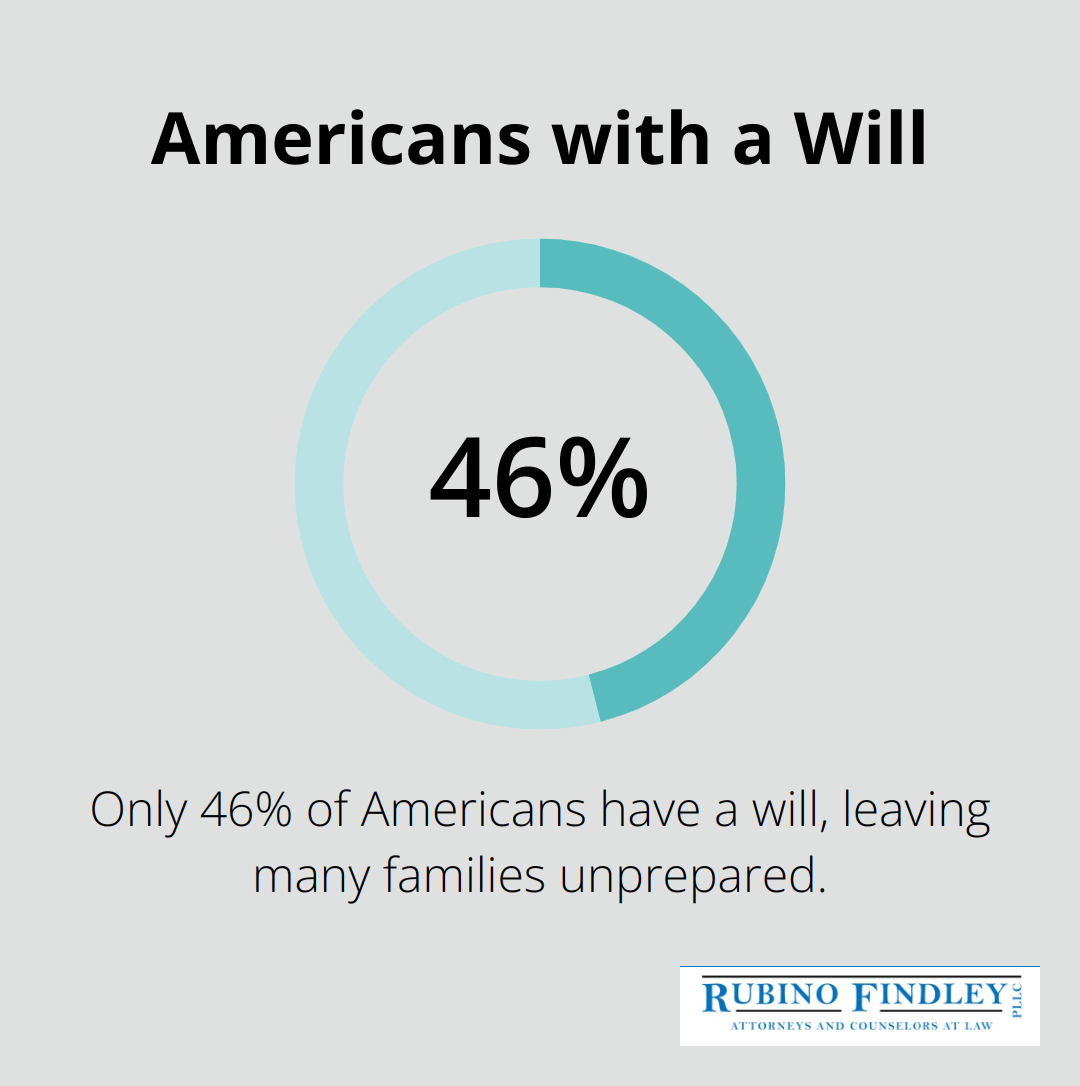

A properly drafted will can save your family time, money, and emotional stress. It allows you to name an executor to manage your estate, designate guardians for minor children, and specify how you want your assets distributed. A 2021 Gallup poll revealed that only 46% of Americans have a will, leaving many families vulnerable to lengthy probate processes and potential disputes.

Florida’s Legal Requirements

For a will to be legally binding in Florida, it must meet specific criteria:

- The testator (person making the will) must be at least 18 years old and of sound mind.

- The will must be in writing.

- The testator must sign the will in the presence of two witnesses.

- The two witnesses must also sign the document.

While Florida doesn’t require a will to be notarized, doing so can simplify the probate process.

Common Mistakes to Avoid

Many people make errors when creating their wills, which can lead to complications later. Some frequent mistakes include:

- Failing to update the will after major life events (marriage, divorce, birth of a child)

- Being too vague about asset distribution

- Not considering Florida’s specific laws (such as homestead provisions)

We’ve seen cases where DIY wills led to unintended consequences. For example, a client once used an online template that didn’t account for Florida’s homestead laws, resulting in an invalid provision that required court proceedings to correct.

The Value of Professional Guidance

Working with an experienced estate planning attorney can help you avoid pitfalls and ensure your will accurately reflects your wishes while complying with Florida law. An attorney can also advise you on more complex estate planning tools, such as trusts, which offer additional benefits beyond a simple will.

As we move forward, let’s explore another powerful estate planning tool: living trusts. These versatile instruments can provide even more control over your assets and offer significant advantages in certain situations.

How Living Trusts Can Enhance Your Boca Raton Estate Plan

Living trusts serve as powerful tools in estate planning, offering unique advantages for Boca Raton residents. These legal arrangements allow you to transfer your assets into a trust during your lifetime, providing more control over how your estate is managed and distributed.

Types of Trusts Available in Boca Raton

Boca Raton residents can choose from various trust types to suit their needs. Revocable living trusts remain popular because they allow you to maintain control of your assets while alive and make changes as needed. Irrevocable trusts, in contrast, offer stronger asset protection and potential tax benefits but come with less flexibility.

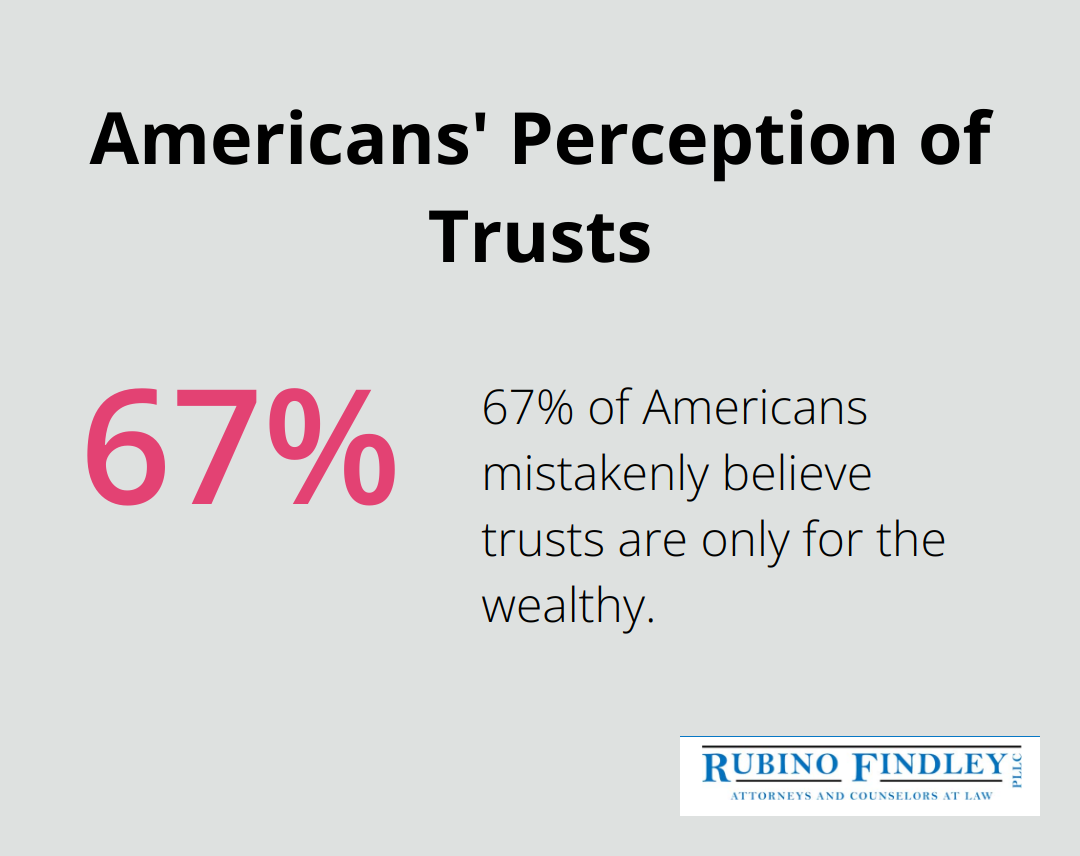

A 2022 survey by Wealth Counsel revealed that 67% of Americans believe trusts are only for the wealthy. This misconception often leads people to overlook the benefits of trusts in their estate plans. In reality, trusts can provide value for many individuals, regardless of wealth level.

Key Benefits of Living Trusts

One of the primary advantages of a living trust is privacy. Unlike wills (which become public record during probate), trusts keep your affairs confidential. This privacy can prove particularly important for business owners or individuals with complex family situations.

Living trusts also offer more control over asset distribution. You can specify exactly how and when your beneficiaries receive their inheritance. For example, you might set up a trust that provides for your children’s education before they receive full access to their inheritance at a certain age.

Probate Avoidance Through Trusts

The most significant advantage of a living trust is its ability to bypass probate. In Florida, probate can become a lengthy and expensive process, often taking six months to a year or more. According to a study by the American Association of Retired Persons (AARP), probate fees can consume up to 5% of an estate’s value.

By placing your assets in a trust, you ensure they pass directly to your beneficiaries without court intervention. This not only saves time and money but also reduces stress for your loved ones during an already difficult period.

Tailoring Trusts to Your Needs

While living trusts offer numerous benefits, they don’t provide a one-size-fits-all solution. Your individual circumstances, including your assets, family situation, and long-term goals, will determine whether a trust is right for you. An experienced estate planning attorney can help you make an informed decision about incorporating trusts into your estate plan.

As we move forward, let’s explore another critical component of comprehensive estate planning: advance directives and healthcare proxies. These documents play a vital role in ensuring your medical wishes are respected, even if you’re unable to communicate them yourself.

Advance Directives in Boca Raton: Protecting Your Medical Wishes

The Importance of Healthcare Proxies

A healthcare proxy (also known as a healthcare power of attorney) allows you to appoint someone to make medical decisions for you if you become incapacitated. This person becomes your voice in critical situations, ensuring your healthcare preferences are respected.

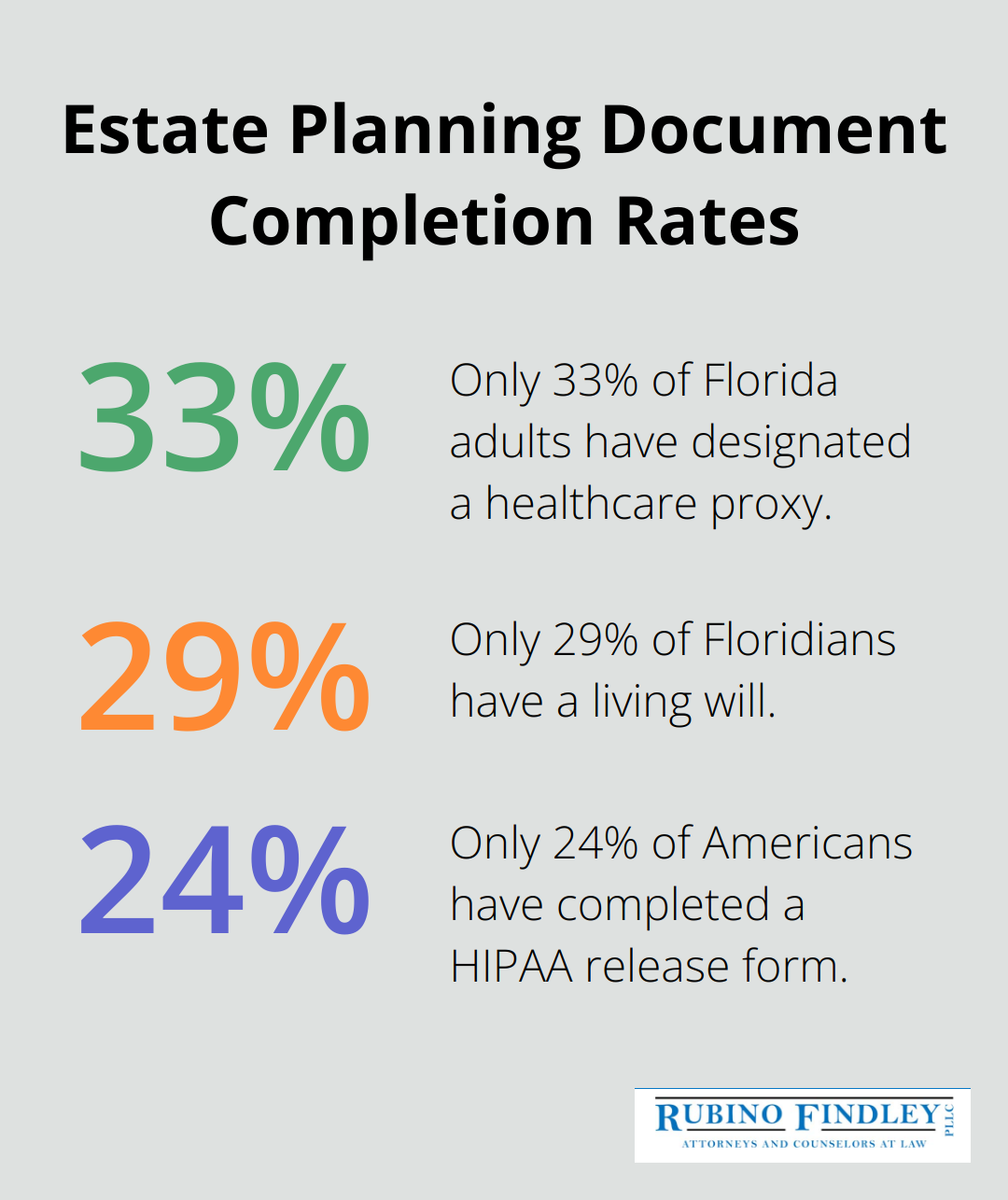

In Florida, only 33% of adults have designated a healthcare proxy (according to a 2021 study by the Florida Hospital Association). This low percentage leaves many families unprepared for medical emergencies.

When you select a healthcare proxy, consider someone who:

- Understands your values and wishes

- Can make difficult decisions under pressure

- Will advocate for your interests

The absence of a healthcare proxy can lead to family conflicts and delayed medical decisions. Designating a proxy can prevent such situations and provide peace of mind for you and your loved ones.

Living Wills: Directing End-of-Life Care

A living will specifies your preferences for end-of-life medical care. It takes effect when you’re terminally ill, in a persistent vegetative state, or at the end stage of a condition and unable to communicate your wishes.

Florida law recognizes living wills, but only 29% of Floridians have one (based on data from the Florida Agency for Health Care Administration). This gap leaves many families struggling with difficult decisions during emotionally charged times.

Your living will can address:

- Use of life-sustaining treatments

- Pain management preferences

- Organ donation wishes

You should review your living will every few years or after significant life changes to ensure it still reflects your current wishes.

HIPAA Authorization: Granting Access to Medical Information

The Health Insurance Portability and Accountability Act (HIPAA) protects your medical privacy. However, it can also prevent your loved ones from accessing your health information in emergencies. A HIPAA authorization form allows you to specify who can receive your medical information.

Only 24% of Americans have completed a HIPAA release form (according to a 2022 survey by the American Bar Association). This oversight can lead to delays in medical decision-making and added stress for families.

When you create your HIPAA authorization, consider including:

- Your healthcare proxy

- Close family members

- Your primary care physician

Advance directives are not just for the elderly or ill. Unexpected medical emergencies can happen at any age, making these documents essential for all adults in Boca Raton.

Final Thoughts

Estate planning documents form the cornerstone of a secure future for you and your loved ones. A well-crafted will, living trust, healthcare proxy, living will, and HIPAA authorization protect your assets, honor your wishes, and provide peace of mind. These essential papers ensure your legacy and healthcare preferences receive respect.

Life changes such as marriages, divorces, births, or significant financial shifts can impact your estate planning needs. We recommend you review your documents every three to five years or after major life events to keep them current and effective. This practice helps maintain the strength of your estate plan over time.

Rubino Findley, PLLC understands the complexities of estate planning in Boca Raton. Our team of attorneys can guide you through creating a comprehensive estate plan tailored to your unique situation (we assist clients throughout Palm Beach County and Broward County). Contact Rubino Findley, PLLC today to schedule a free consultation and start securing your future with confidence.