Ultimate Estate Planning Checklist for Boca Raton Don’t Miss These Steps

Estate planning protects your family’s financial future and prevents costly legal disputes. Without proper documentation, Florida courts decide how your assets get distributed.

We at Rubino Findley, PLLC have seen families lose thousands due to incomplete planning. This estate planning checklist covers the essential steps every Palm Beach County resident needs to take.

Which Documents Form Your Estate Plan Foundation

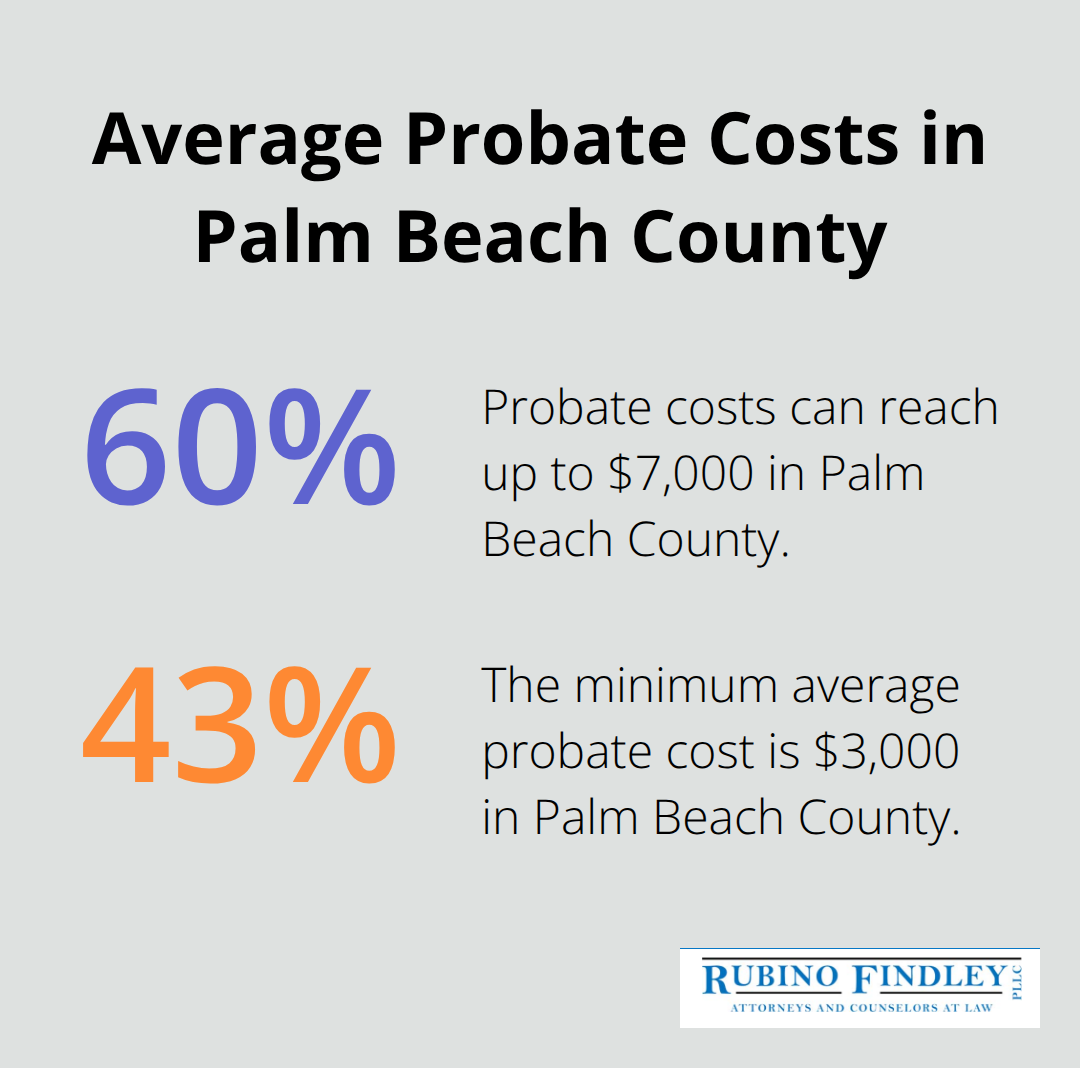

Florida estate planning requires four fundamental documents that work together to protect your assets and family. A valid will in Florida must be signed by you and two witnesses, according to Florida Statute 733. This document controls asset distribution and names guardians for minor children. However, wills guarantee probate court involvement, which costs families an average of $3,000 to $7,000 in Palm Beach County.

Trusts Provide Superior Asset Protection

Revocable trusts avoid probate entirely while you maintain control during your lifetime. Florida residents save significant time and money when they transfer assets into properly funded trusts. Pay-on-death accounts and ladybird deeds provide additional probate avoidance for bank accounts and real estate. These tools automatically transfer ownership upon death without court intervention. Special needs trusts preserve government benefits for disabled beneficiaries (maintaining the $2,000 asset limit for singles and $3,000 for married couples who receive assistance in 2025).

Power of Attorney Prevents Guardianship Court

Durable power of attorney documents prevent costly guardianship proceedings if you become incapacitated. Financial power of attorney allows your chosen agent to manage bank accounts, investments, and property transactions. Healthcare power of attorney gives someone authority to make medical decisions when you cannot. Without these documents, Florida courts appoint a guardian through expensive legal proceedings that can cost $15,000 or more. Advanced directives specify your medical treatment preferences and reduce family conflicts during difficult times.

Healthcare Documents Complete Your Protection

Healthcare surrogate designation works alongside your power of attorney to address medical decisions. This document names someone to make healthcare choices when you cannot communicate your wishes. Living wills outline your preferences for life-sustaining treatment in terminal conditions. These documents prevent family disputes and guarantee medical professionals follow your specific instructions (rather than making assumptions about your care preferences).

Even with these foundational documents in place, many Palm Beach County residents make critical mistakes that undermine their estate plans.

What Estate Planning Mistakes Cost Families the Most

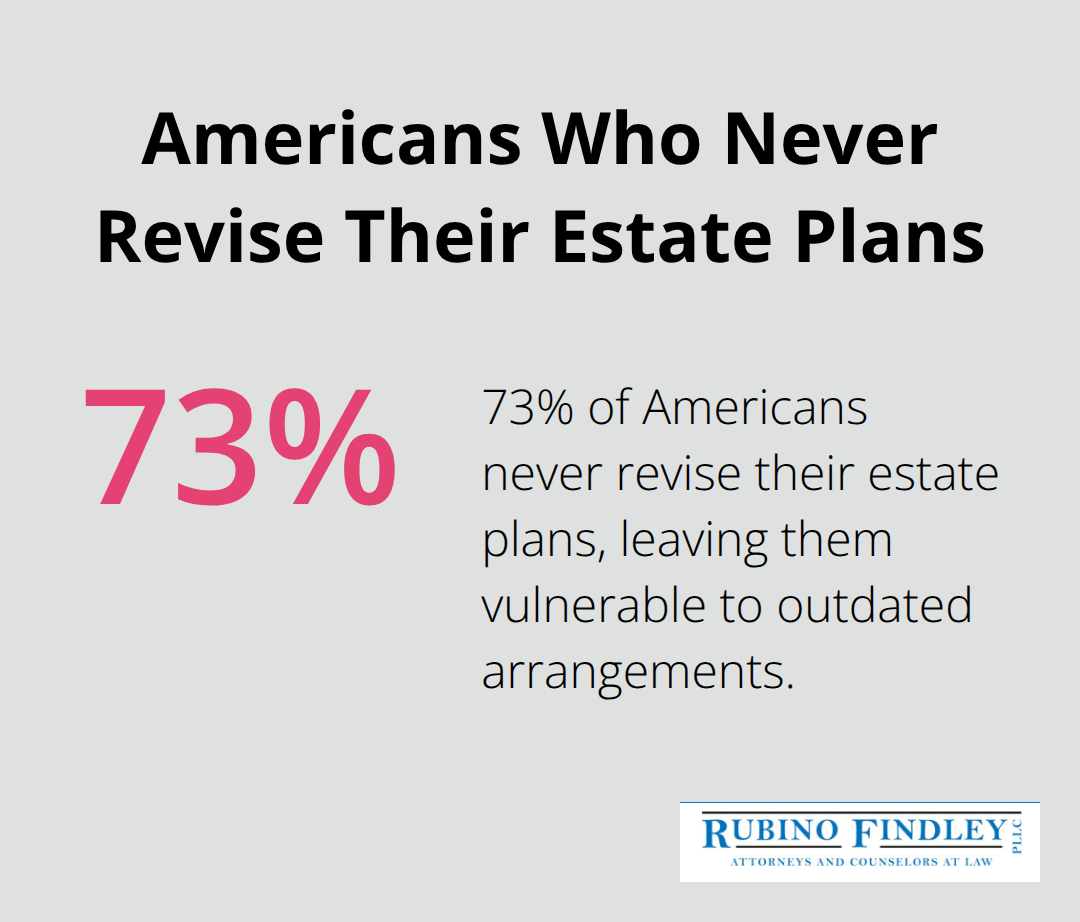

Life changes destroy estate plans faster than any other factor. Divorce, remarriage, births, and deaths require immediate document updates, yet 73% of Americans never revise their estate plans according to Caring.com research. Outdated beneficiary designations create the biggest problems. Gene Hackman’s estate faced complications due to ambiguous beneficiary language, while countless families battle in court over outdated wills that name ex-spouses or deceased relatives.

Life Events Trigger Immediate Plan Updates

Marriage automatically revokes previous wills in Florida, which leaves new spouses with nothing if you die before you update documents. The birth of children can disinherit older kids when parents add new beneficiaries incorrectly. Divorce creates additional complications when ex-spouses remain as beneficiaries on retirement accounts or life insurance policies. Florida courts see these disputes regularly, and families spend years in litigation over assets that should have transferred smoothly.

Trust Creation Without Asset Transfer Wastes Money

You create a trust without value when you fail to transfer assets into it. Empty trusts provide zero protection because assets titled in your personal name still go through probate. Real estate requires new deeds that list the trust as owner. Bank accounts need retitling with trust language. Investment accounts must show the trust as the account holder. Many Palm Beach County families spend $5,000 on trust creation only to leave everything in personal names.

Digital Assets Present New Inheritance Challenges

Your cryptocurrency, social media accounts, and online businesses die with you unless you document access information. Apple, Google, and Facebook require specific procedures for account access after death. Families lose valuable digital assets worth thousands when they lack proper documentation and passwords. Most estate plans ignore these modern assets entirely (despite their significant financial value in many cases).

Annual Reviews Catch Problems Before They Become Expensive

Estate plans need annual reviews to catch problems before they become expensive. Major life events trigger immediate updates within 30 days. Tax law changes affect trust structures and beneficiary strategies. Professional attorneys spot issues families miss, like joint ownership problems that expose assets to creditor claims or gaps that leave children vulnerable. These oversights cost families far more than regular maintenance would.

The next step involves creating your comprehensive estate plan through proper legal channels in Palm Beach County.

How Do You Build Your Estate Plan Step by Step

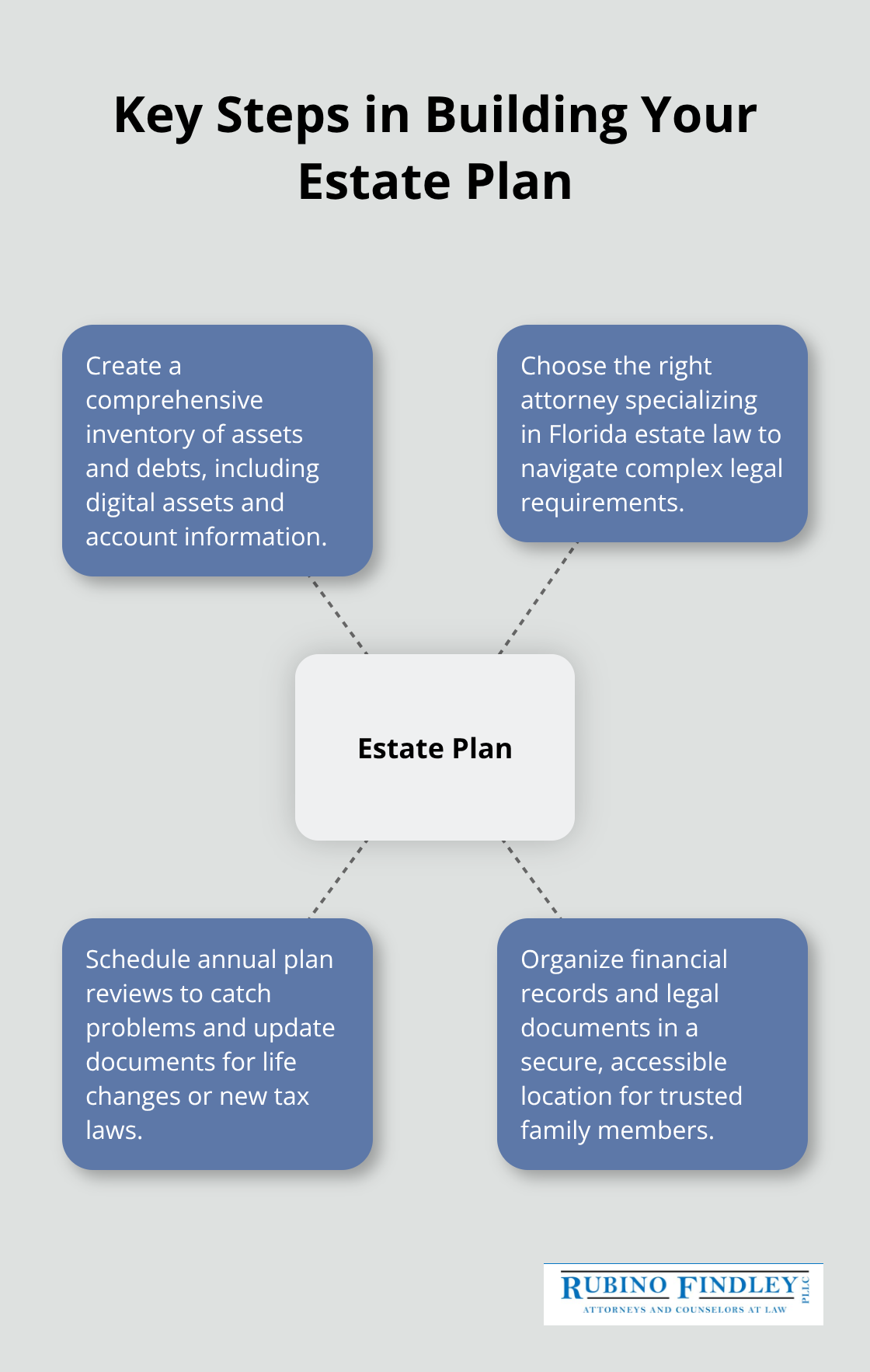

Create a comprehensive inventory of everything you own and owe to start your estate plan. Document all bank accounts, investment accounts, real estate properties, life insurance policies, retirement accounts, and personal property with estimated values. Include account numbers, financial institution names, and approximate balances for each asset. List all debts including mortgages, credit cards, student loans, and personal loans with current balances and creditor information. This asset inventory forms the foundation that determines which estate planning strategies work best for your situation. Florida residents often overlook digital assets like cryptocurrency wallets, online business accounts, and social media profiles that require special documentation for access after death.

Choose the Right Attorney for Complex Florida Laws

Estate planning attorneys charge between $1,500 and $5,000 for comprehensive plans in Palm Beach County, but this investment prevents much larger costs later. Interview attorneys who focus exclusively on Florida estate law rather than general practitioners who handle multiple practice areas. Ask specific questions about their experience with trust funding, probate avoidance strategies, and Florida homestead laws that affect your property. Request references from recent clients and verify their Florida Bar standing before making decisions. Many attorneys offer free consultations, but avoid firms that push standardized documents without customizing plans for your specific family situation and asset structure.

Schedule Annual Plan Reviews to Prevent Costly Oversights

Set calendar reminders for annual estate plan reviews every January to catch problems before they become expensive legal disputes. Major life events like marriage, divorce, births, deaths, or significant asset changes require immediate document updates within 30 days. Tax law changes affect trust structures and beneficiary designations (particularly with federal estate tax exemptions that fluctuate annually). Review beneficiary designations on all retirement accounts, life insurance policies, and bank accounts to confirm they match your current wishes and family structure. Document storage also needs annual attention to verify that family members can locate original wills, trust documents, and financial account information when needed.

Organize Your Financial Records for Easy Access

Gather all financial statements, insurance policies, and legal documents in one secure location that trusted family members can access. Create a master list that includes bank account numbers, investment firm contact information, and insurance policy details with beneficiary information. Store original documents in fireproof safes or safety deposit boxes while keeping copies in separate locations. Digital storage solutions work well for scanned copies, but original wills must remain in physical form to meet Florida legal requirements. Update this master list quarterly as you open new accounts or change financial institutions (this prevents families from losing track of assets after your death).

Final Thoughts

This estate planning checklist provides the essential documents and strategies that protect Palm Beach County families from costly legal disputes. Wills, trusts, power of attorney documents, and healthcare directives work together to avoid probate court and preserve your assets for beneficiaries. Regular updates prevent the common mistakes that destroy estate plans when life circumstances change.

Professional legal guidance makes the difference between effective protection and expensive family conflicts. We at Rubino Findley, PLLC help clients throughout Palm Beach County create comprehensive estate plans that address their specific needs. Our team provides consultations to review your situation and develop customized solutions (including wills, trusts, and power of attorney documents).

Action now prevents your family from facing complicated legal proceedings to access assets or establish custody arrangements. Estate planning protects everyone regardless of age or wealth level. Contact Rubino Findley, PLLC today to schedule your consultation and start building the legal framework that secures your family’s future.