Estate Planning Tips for Business Owners in Boca Raton

Business owners face unique challenges when planning their estates, from complex valuations to succession concerns. Without proper planning, your life’s work could face unnecessary tax burdens or family disputes.

We at Rubino Findley, PLLC understand that estate planning for business owners requires specialized strategies that protect both personal and business interests across Palm Beach County, Florida.

Key Estate Planning Challenges for Business Owners

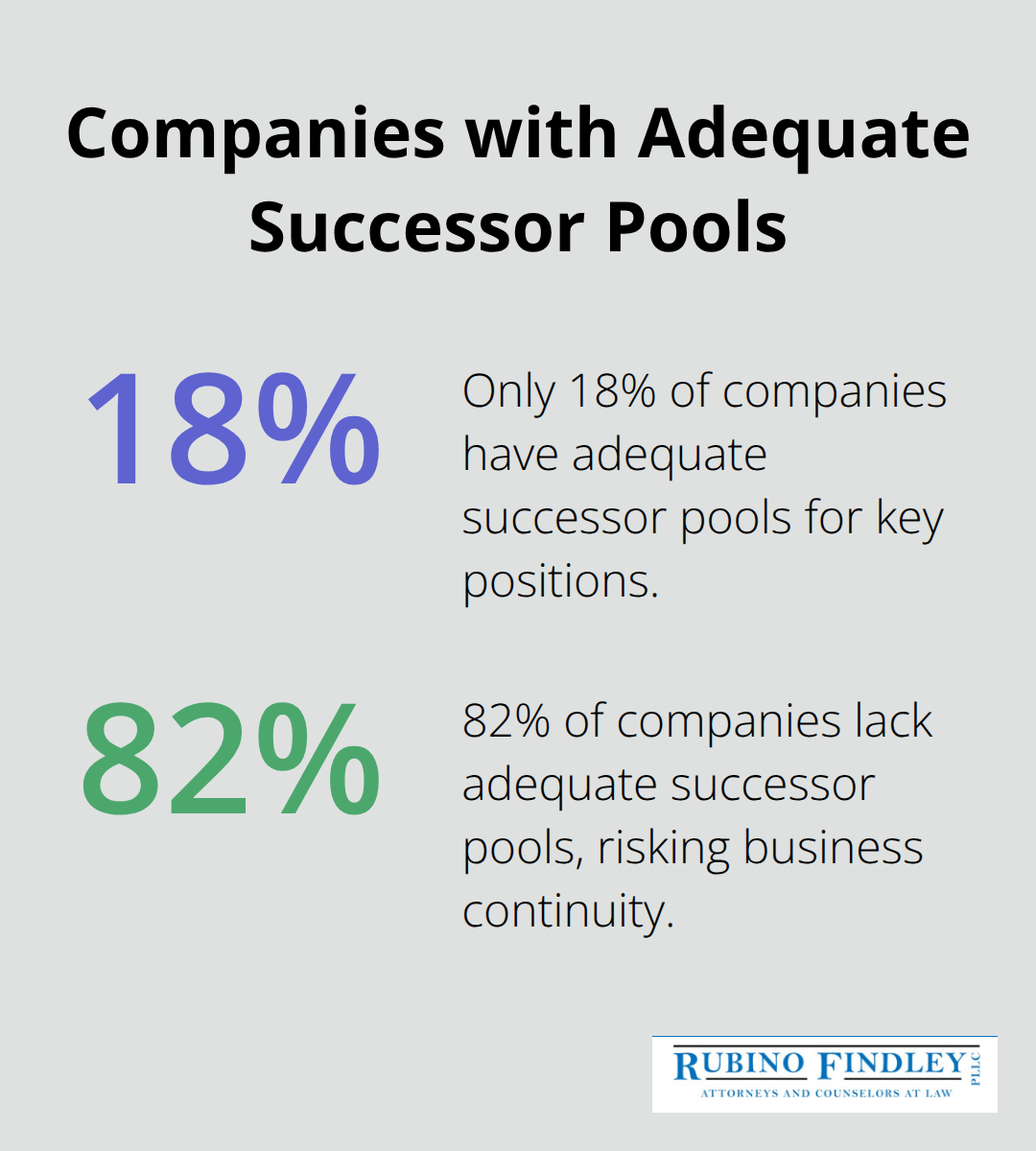

Business owners in Palm Beach County face three major estate planning obstacles that can destroy decades of hard work. First, business valuation presents enormous tax exposure because the IRS often disputes valuations during estate transfers. The National Association of Corporate Directors found that only 18% of companies have adequate successor pools for key positions, which makes proper valuation and succession planning urgent priorities.

Without professional appraisals conducted annually, your heirs could face inflated tax assessments that force asset sales to pay estate taxes. The federal estate tax exemption currently stands at $12.92 million per individual, but this drops significantly in 2026 unless Congress acts.

Business Valuation Creates Tax Nightmares

The IRS challenges business valuations aggressively during estate transfers, often inflating values by 30-50% above fair market assessments. This aggressive stance forces families to sell business assets to pay unexpected tax bills. Professional appraisers must document discount factors for minority interests and marketability restrictions (which can reduce values by 20-40%). Annual valuations establish historical patterns that support your position during IRS audits. Florida businesses face additional complexity because the state has no estate tax, but federal obligations remain substantial for larger estates.

Succession Plans Fail Without Proper Structure

Most business owners postpone succession planning until it’s too late, which creates chaos for families and employees. Florida law doesn’t protect business assets from creditors the way it protects homesteads, leaving companies vulnerable during ownership transitions. Smart owners establish buy-sell agreements funded with life insurance, preventing forced sales and family disputes. Family Limited Partnerships allow you to transfer business interests at discounted values while maintaining control. Too many families lose businesses because parents assumed children would naturally take over operations without formal training or legal documentation.

Asset Protection Demands Strategic Legal Structures

Personal liability from business operations threatens everything you’ve built outside the company. Florida’s unlimited homestead exemption protects your residence, but business assets remain exposed to lawsuits and creditor claims. Limited Liability Companies provide better protection than corporations because creditors face charging order limitations under Florida law. Separate legal entities for different business operations prevent one lawsuit from destroying your entire empire. Irrevocable trusts remove assets from your estate while maintaining indirect control through carefully drafted trust provisions.

These challenges require sophisticated legal tools and strategies that go far beyond basic estate planning documents.

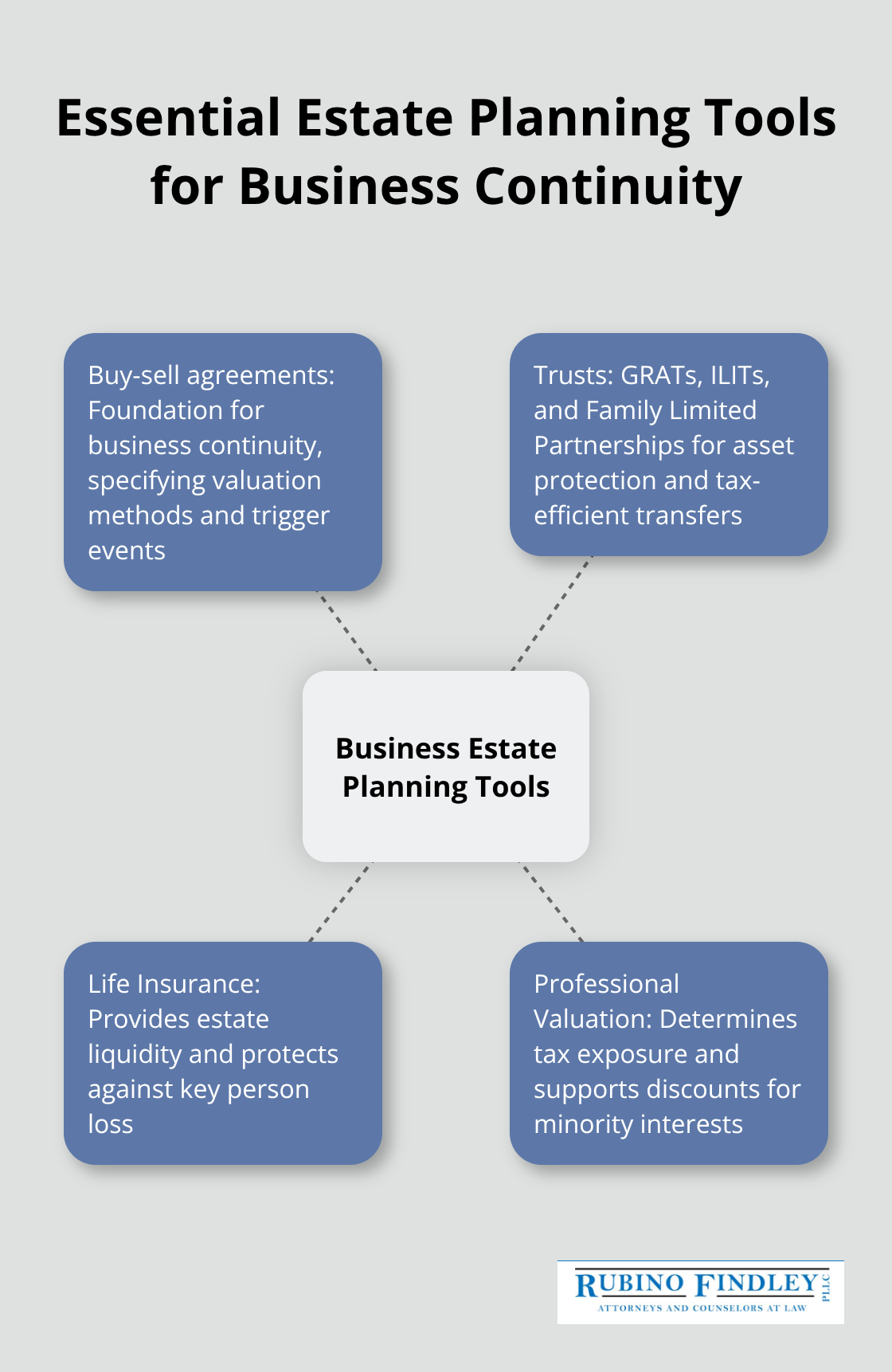

Essential Estate Planning Tools for Business Continuity

Buy-sell agreements serve as the foundation for business continuity, yet most owners draft inadequate provisions that create family warfare. These contracts must specify exact valuation methods, trigger events, and funding mechanisms to prevent disputes during emotional transitions. The agreement should mandate annual appraisals that use multiple valuation approaches including asset-based, income-based, and market-based methods. Price adjustment mechanisms protect against stale valuations, while installment payment terms prevent cash flow disasters for surviving owners. Life insurance funding eliminates the need for business borrowing or asset liquidation during buyouts.

Trusts Shield Business Assets from Multiple Threats

Grantor Retained Annuity Trusts have seen 73% increased filings according to IRS data because they transfer appreciating business assets at minimal gift tax cost. These trusts work best for rapidly growing companies where you retain annuity payments while you transfer future appreciation to heirs. Irrevocable Life Insurance Trusts keep death benefits outside your taxable estate, which provides liquidity for estate taxes without increasing your tax burden. Family Limited Partnerships allow you to gift business interests at 20-40% discounts due to minority interest and marketability restrictions while you maintain management control. Each trust structure serves specific purposes, and multiple trusts create layered protection against creditors and tax authorities.

Life Insurance Creates Immediate Estate Liquidity

Key person insurance protects against revenue loss from critical employee deaths, typically covering 5-10 times annual salary plus replacement costs. The federal estate tax exemption drops to approximately $6 million per person in 2026 (making life insurance liquidity planning urgent for business owners with estates exceeding this threshold). Split-dollar life insurance arrangements allow businesses to pay premiums while they keep death benefits in family trusts, which creates tax-efficient wealth transfer strategies.

Business Valuation Methods Determine Tax Exposure

Professional appraisers must document discount factors for minority interests and marketability restrictions, which can reduce values by 20-40% during estate transfers. Asset-based valuations work best for companies with substantial tangible assets, while income-based approaches suit service businesses with strong cash flows. Market-based valuations compare your business to similar companies that sold recently, though finding comparable transactions proves difficult for unique enterprises.

These legal tools form the backbone of comprehensive business estate planning, but tax-efficient strategies maximize their effectiveness while minimizing government claims on your wealth.

Tax-Efficient Strategies for Business Estate Planning

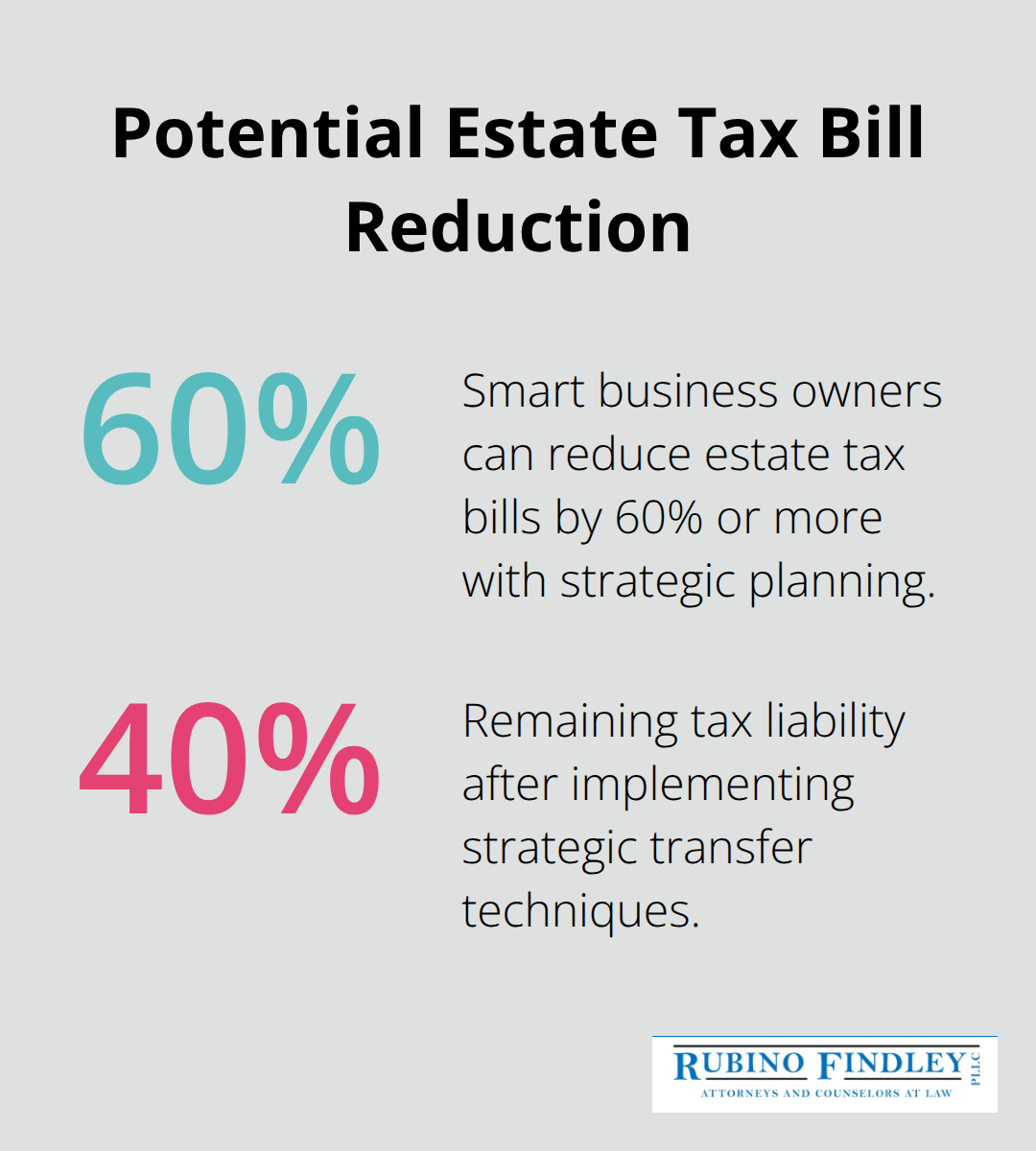

Smart business owners reduce estate tax exposure through strategic transfer techniques that IRS data shows can cut tax bills by 60% or more when you implement them correctly. The annual gift tax exclusion allows you to transfer $17,000 per recipient tax-free each year, but business owners achieve much larger transfers through valuation discounts and advanced strategies. Grantor Retained Annuity Trusts transfer assets while you retain annuity payments for a specified term, which effectively moves future growth out of your estate at minimal gift tax cost. Family Limited Partnerships create 20-40% valuation discounts for gifted interests due to minority ownership and marketability restrictions (this allows you to transfer $1 million in business value while you use only $600,000-$800,000 of gift tax exemption).

Installment Sales Outperform Outright Gifts for Large Transfers

Installment sales to family members provide steady income streams while they remove future appreciation from your estate, which makes them superior to large taxable gifts for most business owners. The transaction freezes your estate value at today’s business worth while your children gain all future growth through affordable terms. Self-Canceling Installment Notes automatically forgive balances at death, which removes substantial estate value without gift tax consequences. Sales to Intentionally Defective Grantor Trusts allow you to pay income taxes on trust income, which constitutes additional tax-free gifts to beneficiaries that compound wealth transfer benefits.

Strategic Transfer Timing Maximizes Tax Savings

Business owners should complete major transfers during temporary valuation dips or before anticipated growth events like new contracts or market expansion. The federal estate tax exemption drops to approximately $6 million per person in 2026 unless Congress extends current levels (this makes immediate transfers more valuable than delay). Florida’s lack of state estate tax provides additional incentive for Palm Beach County business owners to maximize federal exemption usage before the reduction takes effect.

Family Limited Partnerships Create Substantial Discounts

Family Limited Partnerships allow you to maintain control while you transfer ownership interests at discounted values to family members. The general partner retains management authority while limited partners receive income distributions and appreciation rights. Courts consistently uphold 20-40% valuation discounts for limited partnership interests due to lack of control and marketability restrictions. These discounts multiply your gift tax exemption effectiveness, which allows larger wealth transfers within annual limits.

Final Thoughts

Estate planning for business owners in Palm Beach County demands sophisticated legal strategies that protect decades of hard work and family financial security. Generic documents and DIY approaches fail when your business represents your family’s primary wealth source. Professional guidance becomes essential when you navigate Florida’s complex trust laws, federal tax regulations, and asset protection strategies that can save millions in taxes and legal fees.

We at Rubino Findley, PLLC help business owners throughout Palm Beach County create comprehensive estate plans that protect both personal and business assets. Our team assists with wills, trusts, probate administration, and durable power of attorney documents tailored to your unique business structure. The process begins with a thorough assessment of your current business structure, ownership agreements, and family dynamics.

Proper estate planning prevents family disputes, maintains business operations during transitions, and protects your legacy for future generations (without adequate planning, your life’s work could face unnecessary tax burdens or forced liquidation). Contact Rubino Findley, PLLC today to schedule your consultation and begin protecting your business and family’s future.