Estate Planning for High Net Worth Individuals in Boca Raton

High net worth families face unique challenges that standard estate plans simply can’t address. Complex asset structures, significant tax implications, and multi-generational wealth transfer require sophisticated strategies.

At Rubino Findley, PLLC, we understand that estate planning for high net worth individuals demands careful coordination between legal, tax, and financial considerations. The stakes are too high for generic solutions.

What Makes High Net Worth Estate Planning So Complex

High net worth individuals typically own assets across multiple categories that traditional estate plans cannot handle effectively. The IRS reports that individuals with assets exceeding $5 million typically derive income from at least four different sources, which creates intricate tax scenarios that require advanced planning strategies. Business ownership, real estate portfolios, investment accounts, and intellectual property rights each demand different approaches to minimize tax exposure and protect value.

Multiple Asset Classes Require Different Strategies

Investment portfolios, private equity stakes, and closely-held business interests each face unique valuation challenges and tax implications. Family businesses present particularly complex succession issues, with the Small Business Administration finding that only 30% survive to the second generation due to inadequate planning. Real estate holdings across multiple states create additional complications, as each jurisdiction has different tax rules and exemptions. Florida residents with assets in states like New York face potential estate tax exposure (since New York maintains a $1 million exemption threshold compared to Florida’s lack of state estate taxes).

Federal Tax Thresholds Create Immediate Pressure

The federal estate tax exemption stands at $13.61 million per individual for 2024, but this figure will drop to approximately $7 million in 2026 unless Congress intervenes. Estates that exceed these thresholds face a devastating 40% federal tax rate, which makes immediate action necessary for wealth preservation. Generation-skipping trusts provide an additional $13.61 million exemption, which effectively doubles tax-free transfer capacity for families who implement sophisticated strategies. The Tax Foundation indicates that 12 states impose estate taxes (creating additional compliance burdens for those with multi-state assets).

Asset Protection Demands Proactive Planning

High net worth families face constant litigation risks that require defensive strategies beyond basic insurance coverage. Florida’s homestead exemption protects unlimited equity in primary residences, but investment properties and business assets remain vulnerable to creditors. Irrevocable trusts remove assets from taxable estates while they provide creditor protection, but timing matters tremendously. Asset protection strategies become much harder to defend once litigation threats arise, which makes early implementation vital for effective wealth preservation.

These complex challenges require sophisticated solutions that go far beyond basic wills and trusts, which leads us to examine the advanced strategies that wealthy families use to protect and transfer their wealth effectively.

Advanced Strategies That Protect Multi-Generational Wealth

Dynasty Trusts and Generation-Skipping Transfers

Dynasty trusts represent the most powerful tool for wealthy families to avoid estate taxes across multiple generations. These trusts operate in states that have abolished the rule against perpetuities and allow wealth to pass indefinitely without estate tax consequences. The Federal Reserve reports that Grantor Retained Annuity Trusts allowed families to transfer over $100 billion in wealth over the past decade with minimal tax consequences.

Generation-skipping trusts provide families with an additional $13.61 million exemption on top of standard estate tax exemptions (effectively doubling tax-free transfer capacity). Qualified Personal Residence Trusts reduce estate taxes on appreciating properties by 20-50% based on IRS valuation tables, which makes them particularly valuable for Florida real estate holdings.

Strategic Charitable Structures

Charitable Lead Trusts and Charitable Remainder Trusts provide immediate tax deductions while they support philanthropic goals. The timing of these strategies matters tremendously for tax optimization. These structures work best when families implement them before significant asset appreciation occurs rather than after wealth has already grown substantially.

Charitable trusts also create opportunities for families to maintain some control over assets while they receive substantial tax benefits. The key lies in proper structure design and timing to maximize both charitable impact and tax advantages.

Business Succession and Family Partnerships

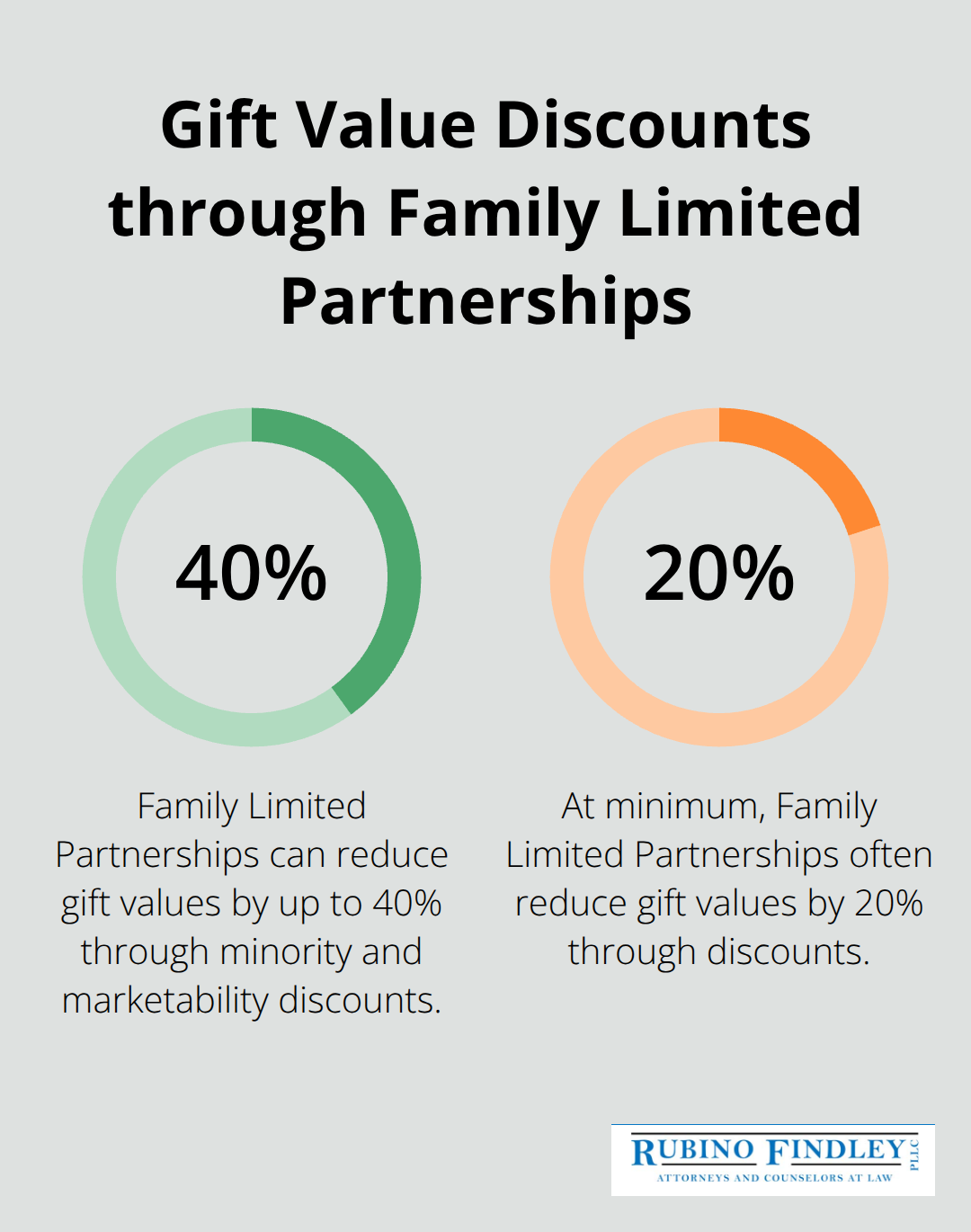

Family Limited Partnerships allow parents to gift minority interests to children at discounted valuations. These discounts often reduce gift values by 20-40% through minority and marketability discounts. Multi-member LLCs in Florida provide charging order protection that limits creditors to receiving only distributions rather than seizing underlying assets.

Families who maximize the annual $18,000 per recipient gift exclusion before potential reductions create substantial wealth transfer opportunities over time. The strategy requires consistent implementation across multiple years to achieve maximum benefit (but the cumulative effect can transfer millions without gift tax consequences).

These sophisticated structures require careful implementation and ongoing management, but they pale in comparison to the costly mistakes that many wealthy families make when they fail to coordinate their estate planning properly.

Why Wealthy Families Make These Costly Planning Errors

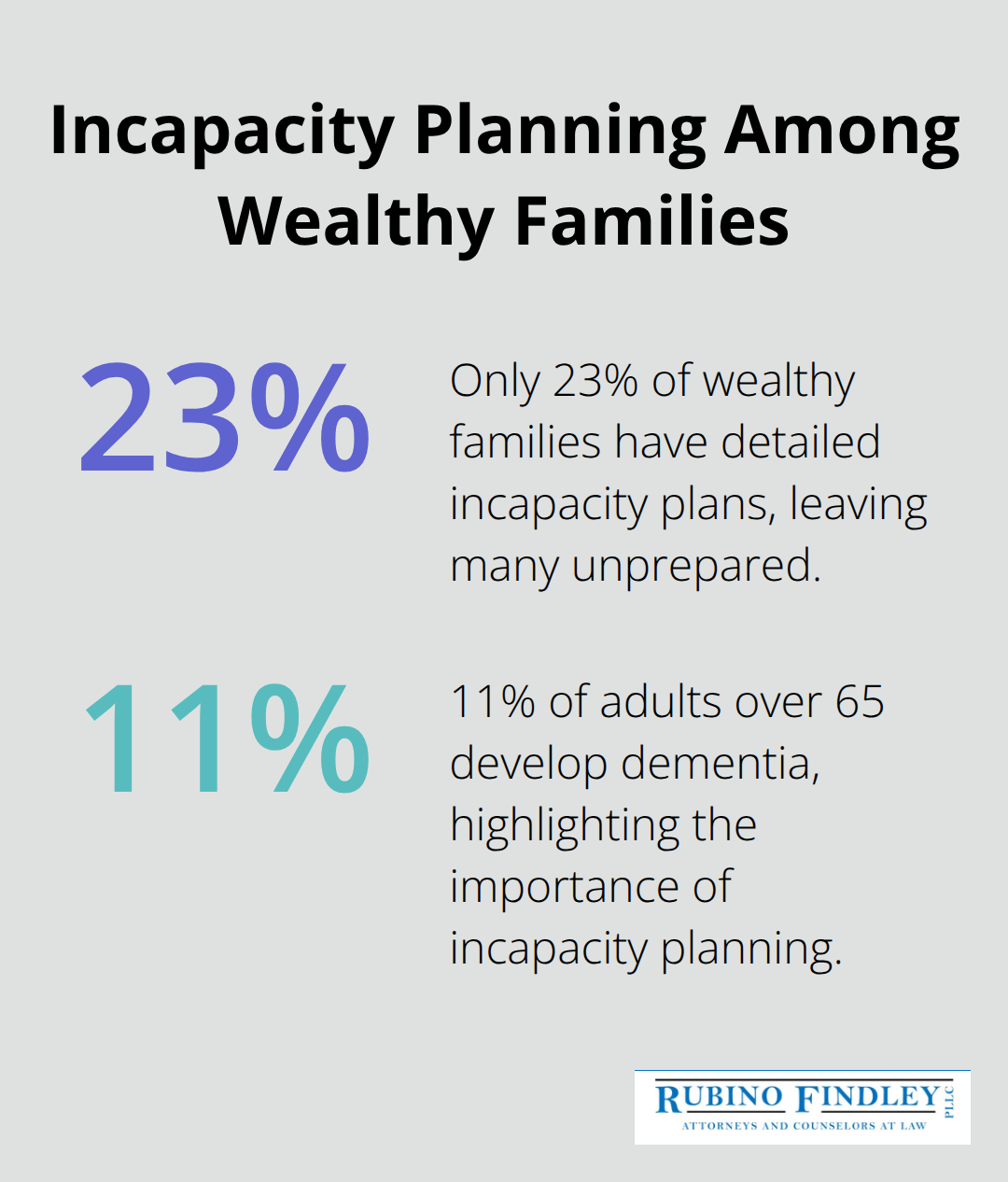

High net worth families repeatedly make three devastating mistakes that cost millions in unnecessary taxes and legal fees. The most damaging error involves failure to update estate plans after major life events, which leaves outdated strategies that no longer serve their intended purpose. Only 23% of wealthy families have detailed incapacity plans according to recent studies, despite the Alzheimer’s Association report that 11% of adults over 65 develop dementia. Marriage, divorce, births, deaths, and business sales all trigger immediate needs for plan revisions, yet families often wait years before they address these changes.

Coordination Failures Between Professional Teams

The second critical mistake involves poor coordination between financial advisors, tax professionals, and estate attorneys. When these professionals work in isolation, families end up with strategies that conflict and undermine each other. Investment advisors may recommend tax-deferred strategies while estate attorneys structure trusts that require current income recognition (which creates unnecessary tax burdens). Families lose hundreds of thousands annually because their CPA implements one tax strategy while their attorney pursues another approach that directly conflicts with the first.

Florida-Specific Tax Traps for New Residents

New Florida residents face particularly dangerous tax traps when they fail to properly establish domicile while they maintain ties to high-tax states. New York aggressively audits former residents who move to Florida, and maintenance of a New York address, club memberships, or business activities can trigger full state tax liability on worldwide income. The Federal Trade Commission reports that families lose access to $2.7 billion in digital assets annually due to insufficient plans, but Florida residents face additional risks when they hold assets in multiple states without proper coordination of state-specific exemptions and tax rules.

Digital Asset Oversights

Wealthy families consistently overlook digital assets in their estate plans (which creates significant access problems for heirs). Cryptocurrency holdings, online business accounts, and digital intellectual property require specific provisions for transfer. Without proper documentation and access protocols, families cannot retrieve these assets after death or incapacity occurs.

Final Thoughts

Estate planning for high net worth individuals requires ongoing professional guidance that extends far beyond one-time document preparation. The complexity of federal tax law changes, state-specific regulations, and asset structures demands continuous attention from qualified attorneys who understand wealthy families’ unique challenges. Regular plan reviews become absolutely vital when dealing with multi-million dollar estates.

Tax law modifications, family changes, and asset growth can quickly render existing strategies ineffective or even counterproductive. We recommend comprehensive reviews every two to three years, with immediate updates after major life events like marriage, divorce, business sales, or significant asset acquisitions. The cost of professional guidance pales in comparison to the devastating financial consequences of inadequate planning (families who attempt to handle complex estate matters without proper legal counsel often face unnecessary tax burdens that exceed attorney fees by hundreds of thousands of dollars).

At Rubino Findley, PLLC, we help clients throughout Palm Beach County establish comprehensive estate plans that protect their wealth and honor their wishes. Our team handles everything from basic wills and trusts to complex probate administration and litigation matters. Action now protects your family’s financial legacy and provides peace of mind that your wealth will transfer according to your intentions rather than government default rules.