The Probate Process in Boca Raton Explained Step-by-Step

When someone passes away in Florida, their estate typically goes through probate court. This legal process validates wills, pays debts, and distributes assets to beneficiaries.

The probate process in Boca Raton follows specific Florida statutes and Palm Beach County procedures. We at Rubino Findley, PLLC guide families through each required step, from filing initial petitions to final asset distribution.

When Does Florida Probate Apply

Probate becomes necessary when someone dies and owns assets solely in their name without beneficiary designations. Florida Statute 731 requires probate for estates where the deceased person owned real estate, bank accounts, or investments titled only in their name. The process validates the will, settles debts, and transfers ownership to rightful heirs. Palm Beach County handles approximately 8,000 probate cases annually, with formal administration cases accounting for 65% of these proceedings according to court records.

Formal Administration Requirements

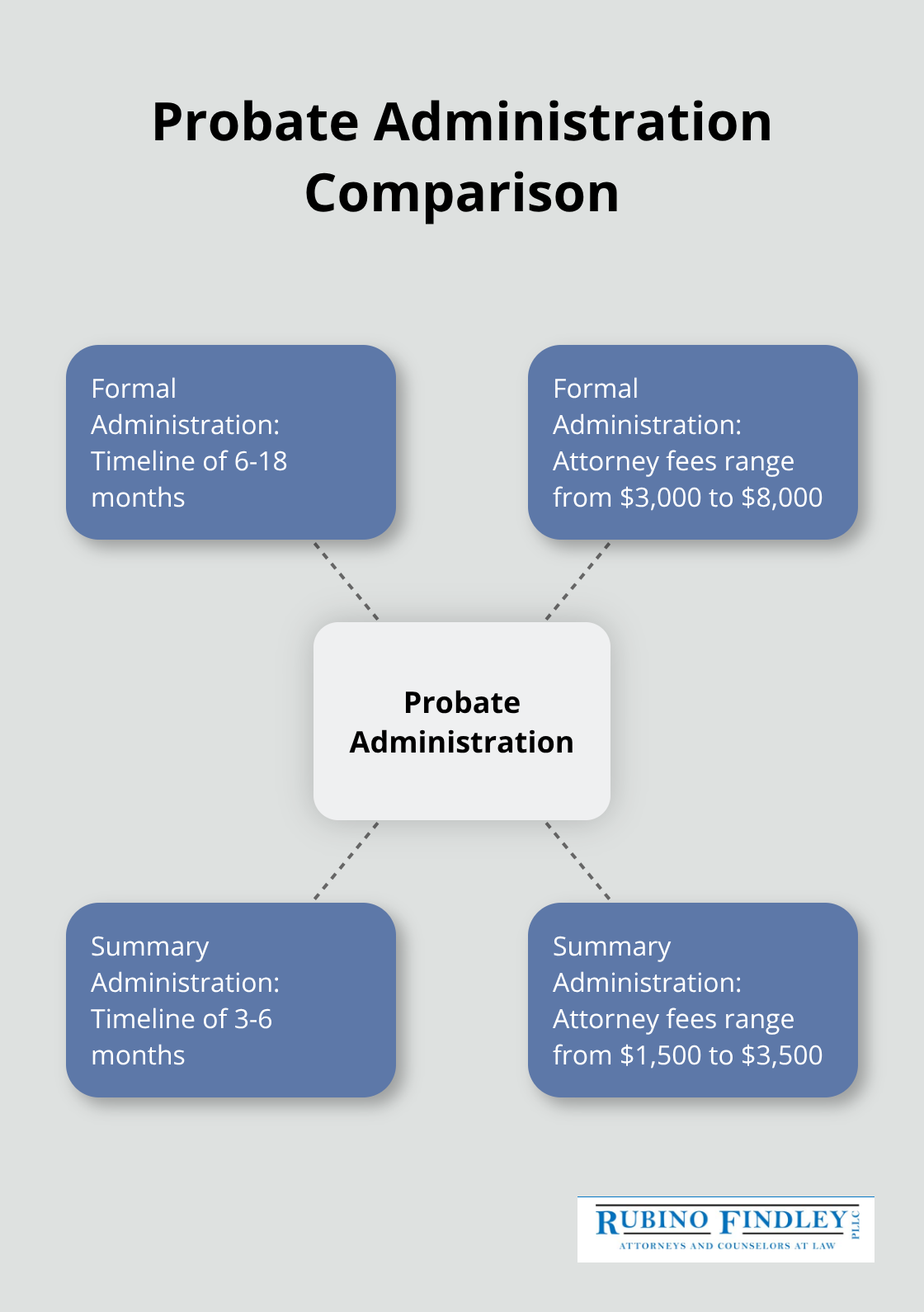

Florida law mandates formal administration for estates that exceed $75,000 in value. Courts supervise this process throughout the entire 6-18 month timeline. Personal representatives must file detailed accountings, obtain court approval for major decisions, and follow strict notification procedures. Attorney fees for formal administration typically range from $3,000-$8,000, depending on estate complexity and potential disputes.

Summary Administration Benefits

Summary administration offers a streamlined alternative for qualifying estates. This option works for estates under $75,000 or when the decedent died more than two years ago. The process completes in 3-6 months with minimal court involvement. Attorney fees for summary administration range from $1,500-$3,500, making it significantly more cost-effective than formal proceedings.

Assets That Skip Probate Completely

Several asset types transfer automatically without probate proceedings. Joint bank accounts with survivorship rights pass directly to the surviving owner upon death. Retirement accounts, life insurance policies, and investment accounts with named beneficiaries avoid probate entirely when properly designated. Real estate held as joint tenants with rights of survivorship transfers immediately to the surviving owner (without court intervention). Trust-owned assets bypass probate when properly funded before death, though this requires careful advance planning.

Florida homestead property may qualify for simplified transfer procedures under specific conditions. However, homestead transfers can create complications if not handled correctly, particularly when multiple heirs exist or when the property carries outstanding debts.

The next phase involves understanding the specific steps required once you determine that probate administration is necessary for your situation.

How Does Palm Beach County Probate Work

Palm Beach County probate starts when someone files a Petition for Administration at the circuit court clerk’s office in West Palm Beach. The petitioner must submit the original will, certified death certificate, and filing fee of $401 within 10 days of death notification according to Florida Statute 733.2123. The court schedules hearings within 30-45 days of filing, though backlogs in Palm Beach County can extend this to 60 days during peak periods. Once the court approves the petition, it issues Letters of Administration that grant the personal representative legal authority to manage all estate matters.

Creditor Notification Process

Florida law requires personal representatives to notify creditors within three months of appointment through both direct mail and newspaper publication. Known creditors receive certified letters that detail the estate proceedings and 90-day claim deadline. Publication must run once weekly for two consecutive weeks in a Palm Beach County newspaper (typically costing $200-400). Creditors who miss the notification deadline lose their right to file claims, which makes proper notification procedures essential for protecting the estate from future liability.

Asset Inventory and Valuation

Personal representatives must compile a complete asset inventory within 60 days of appointment and file it with the probate court. This inventory includes real estate appraisals, bank account statements, investment portfolios, and personal property valuations. Professional appraisals cost $300-800 per property but prevent disputes over asset values later. The representative must also open an estate bank account, transfer all liquid assets, and obtain court approval before selling any estate property worth more than $15,000.

Court Supervision Requirements

The probate court maintains oversight throughout the entire administration process. Personal representatives must file periodic accountings that detail all financial transactions, asset sales, and creditor payments. The court reviews these accountings before approving any major estate decisions or asset distributions. This court-supervised process protects beneficiaries but also extends the timeline significantly compared to non-probate transfers.

Even with proper procedures, probate cases often face unexpected complications that can derail timelines and increase costs substantially.

What Probate Problems Should You Expect

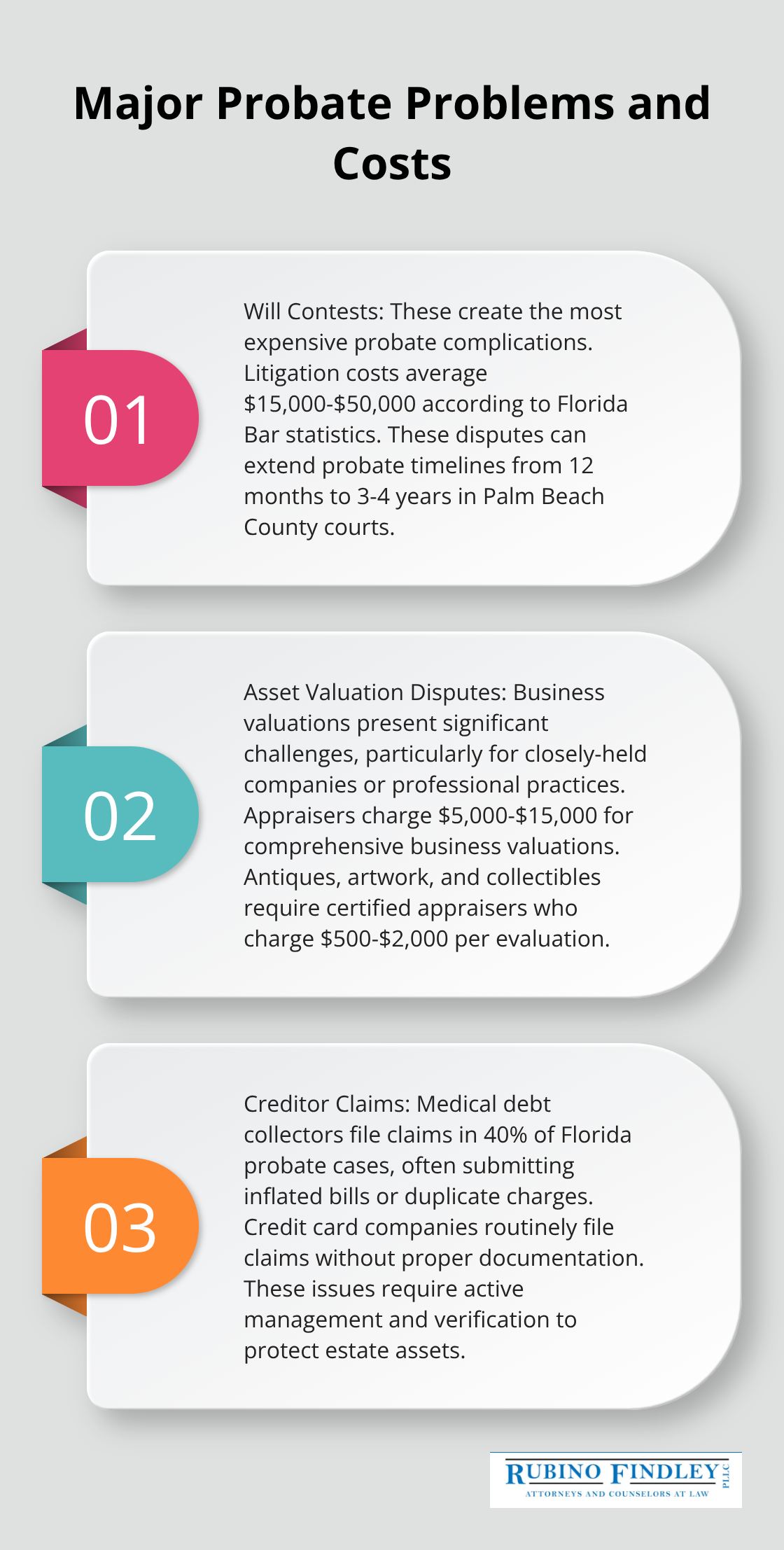

Will contests create the most expensive probate complications, with litigation costs that average $15,000-$50,000 according to Florida Bar statistics. Family members challenge wills when they suspect undue influence, lack of mental capacity, or improper execution procedures. These disputes extend probate timelines from 12 months to 3-4 years in Palm Beach County courts. Personal representatives must defend the estate against these challenges while they manage administration duties, which doubles legal expenses and creates significant stress for all beneficiaries.

Asset Valuation Disputes Cost Time and Money

Business valuations present the biggest headaches in probate administration, particularly for closely-held companies or professional practices. Appraisers charge $5,000-$15,000 for comprehensive business valuations, but beneficiaries often disagree with the results and demand second opinions. Real estate appraisals become contentious when properties have unique features or market conditions change between death and sale dates.

Personal representatives should obtain multiple appraisals upfront to avoid disputes later, even though this increases initial costs. Antiques, artwork, and collectibles require certified appraisers who charge $500-$2,000 per evaluation (but these costs prevent larger disputes over distribution values).

Creditor Claims Require Active Management

Medical debt collectors file claims in 40% of Florida probate cases, often when they submit inflated bills or duplicate charges that personal representatives must challenge. Credit card companies routinely file claims without proper documentation and hope estates will pay without verification. Personal representatives should demand itemized statements and proof of debt validity before they pay any creditor claims.

Insurance companies sometimes refuse to pay life insurance benefits or dispute policy terms, which forces estates into lengthy negotiations. The 90-day creditor claim period provides protection, but personal representatives must actively monitor and challenge questionable claims to preserve estate assets for beneficiaries.

Court Delays Impact Timeline Expectations

Palm Beach County probate courts handle over 8,000 cases annually, which creates significant backlogs during peak filing periods (typically January through March). Judges schedule hearings 60-90 days out during busy seasons, compared to the standard 30-45 day timeframe. Personal representatives cannot distribute assets until courts approve final accountings, which means beneficiaries wait longer for their inheritance when delays occur.

Final Thoughts

The probate process in Boca Raton involves complex legal requirements that overwhelm families during difficult times. Palm Beach County courts handle thousands of cases annually, with formal administration taking 6-18 months and attorney fees ranging from $3,000-$8,000. Will contests average $15,000-$50,000 in litigation costs, while improper creditor notifications expose estates to future liability.

Professional legal guidance prevents costly mistakes that extend timelines and increase expenses significantly. Asset valuation disputes and court backlogs create additional complications that families cannot navigate alone. Summary administration offers faster resolution for qualifying estates but still requires proper legal procedures (and careful attention to statutory requirements).

We at Rubino Findley, PLLC help families through every step of probate administration in Palm Beach County. Our team handles petition filings, creditor notifications, asset inventories, and court accountings while we protect your interests throughout the process. Contact us today to schedule your consultation and learn how proper planning protects your family from unnecessary probate burdens.