Understanding Probate Administration in Boca Raton

Losing a loved one brings emotional challenges alongside complex legal requirements. Florida’s probate laws require court supervision when settling many estates, creating additional stress for grieving families.

We at Rubino Findley, PLLC help Palm Beach County residents navigate probate administration in Boca Raton with compassion and experience. This guide explains when probate is required and how the process works in Florida courts.

What Happens During Probate Administration

Court Supervision Requirements

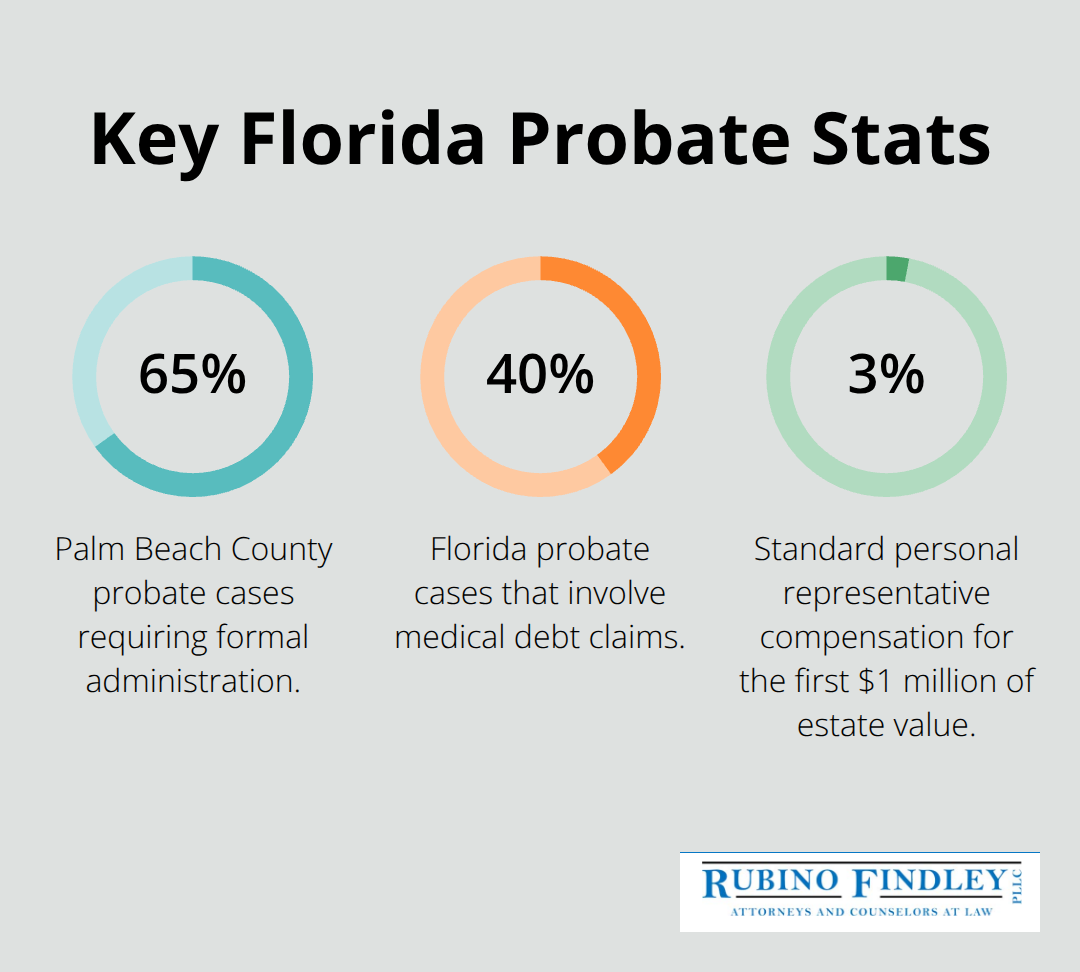

Probate administration transforms a deceased person’s assets into legal inheritance through Florida’s court system. Palm Beach County handles approximately 8,000 probate cases annually, with 65% requiring formal administration. The court validates the will, appoints a personal representative, and supervises asset distribution to beneficiaries. Florida law mandates formal probate for estates that exceed $75,000 in value, with the process lasting 6-18 months on average.

Essential Documentation Process

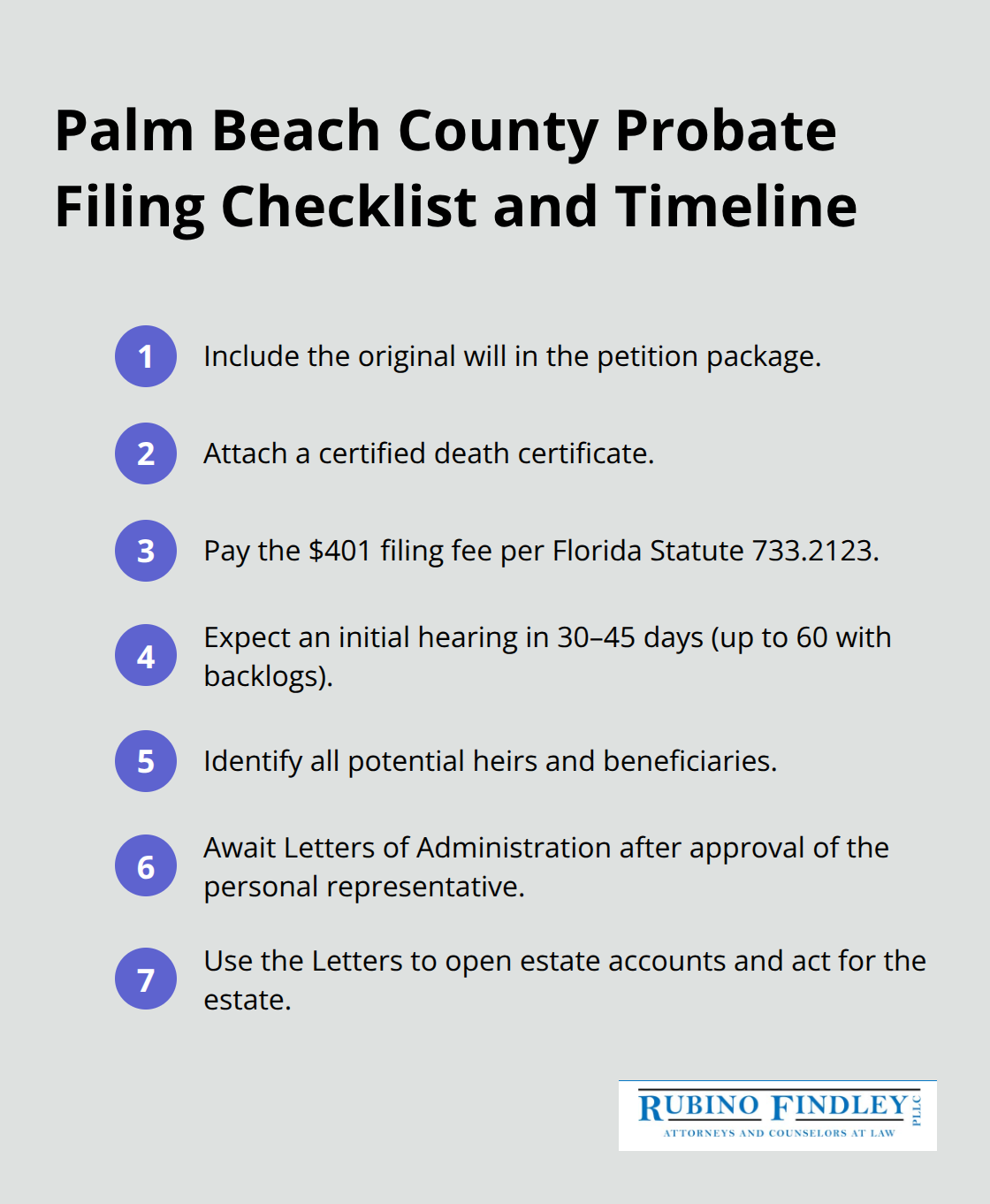

The probate filing requires specific documents within strict deadlines. Florida Statute 733.2123 mandates that personal representatives file the original will, certified death certificate, and $401 filing fee within 10 days of death notification. Personal representatives must compile asset inventories within 60 days, which include bank statements and property appraisals (ranging from $300 to $800 per property). The court schedules hearings within 30-45 days of filing, though backlogs can extend this to 60 days.

Creditor Notification Timeline

Florida law requires personal representatives to notify creditors within three months of appointment through certified letters and newspaper publications, which cost $200-400. Approximately 40% of probate cases involve medical debt claims that require active management. Creditors who miss the three-month notification window lose their right to collect from the estate, which protects beneficiaries from future liabilities. This notification process prevents estates from facing unexpected claims years after distribution.

Asset Management and Distribution

Personal representatives take control of all probate assets and manage them throughout the administration process. They must secure bank accounts, real estate, and personal property while maintaining accurate records for court review. The representative pays valid debts and taxes before distributing remaining assets to beneficiaries according to the will or Florida intestacy laws (if no will exists). This systematic approach protects both the estate and beneficiaries from potential legal complications during the distribution phase.

When Does Florida Law Require Probate

The $75,000 Threshold Rule

Florida law mandates formal administration for estates that exceed $75,000 in value, according to Florida Statutes Chapter 733. This threshold applies to all probate assets combined, not individual items. Real estate, bank accounts, investment portfolios, and personal property count toward this limit when the decedent owned them solely. Palm Beach County courts processed over 5,200 formal administrations in 2024, which represented estates that crossed this financial threshold. The $75,000 rule has remained unchanged since 2001, and this makes many modest Florida estates subject to full court supervision today.

Assets That Trigger Probate Requirements

Property ownership structure determines probate necessity more than asset value. Bank accounts, real estate, vehicles, and investment accounts that the deceased person owned solely require probate administration. Joint accounts with rights of survivorship, retirement accounts with named beneficiaries, and life insurance policies with designated beneficiaries transfer directly without court involvement. Florida courts see frequent disputes over jointly-titled real estate where parties did not clearly establish ownership. Assets held in revocable trusts also avoid probate, though the trustee must file a notice of trust with the court within three months of the settlor’s death.

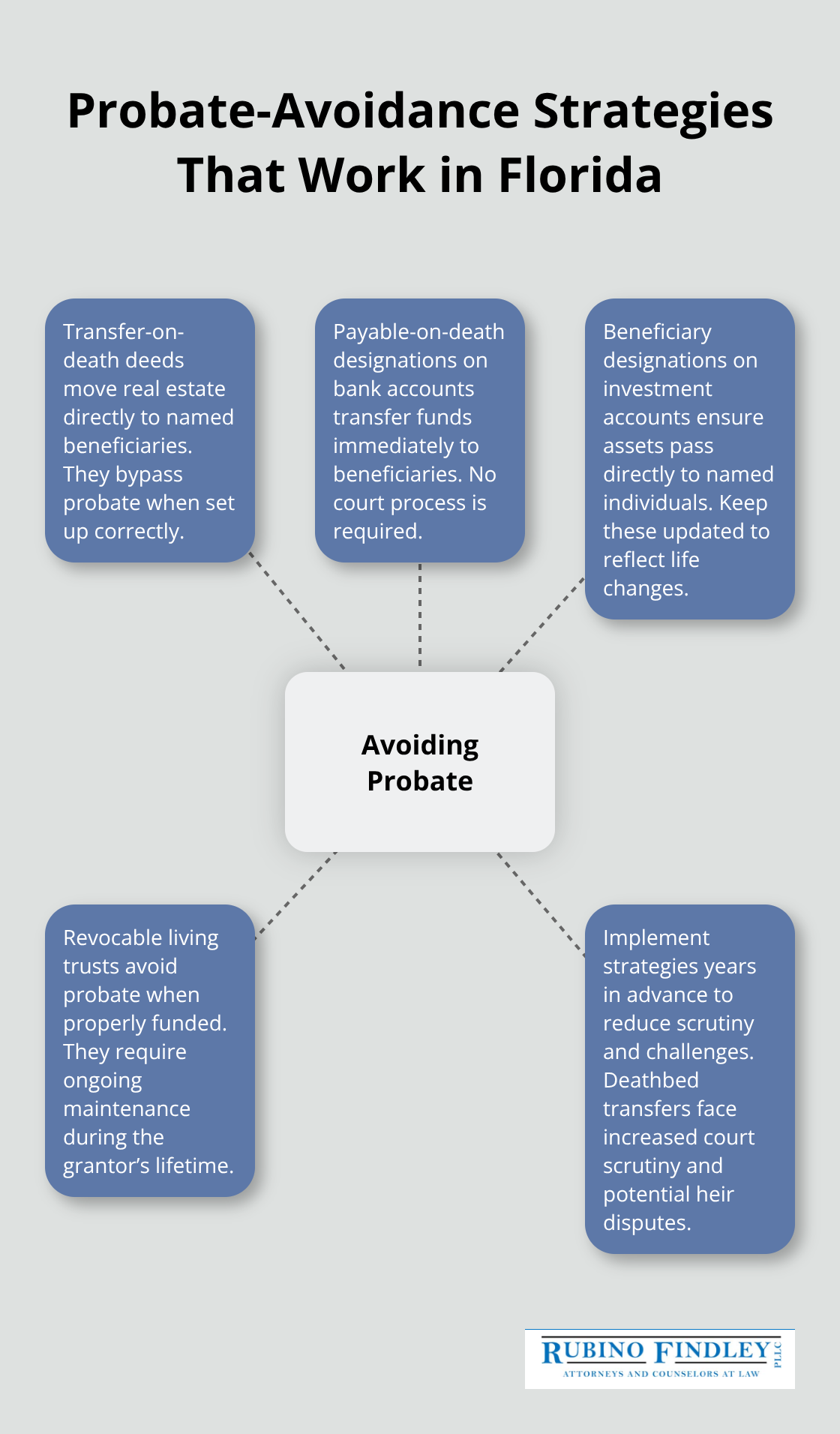

Strategic Probate Avoidance Methods

Florida residents can structure their assets to minimize probate requirements through proper estate planning. Transfer-on-death deeds for real estate, payable-on-death designations for bank accounts, and beneficiary designations on all investment accounts eliminate probate for these assets. Revocable living trusts provide comprehensive probate avoidance but require ongoing maintenance and funding during the grantor’s lifetime (though they offer significant long-term benefits). These strategies work best when people implement them years before death, as deathbed transfers face increased scrutiny from courts and potential challenges from heirs.

Summary Administration Alternative

Florida offers summary administration for estates valued under $75,000 or when the decedent died more than two years ago. This expedited process takes only 3-6 months compared to formal administration’s 6-18 month timeline. Attorney fees for summary administration typically range from $1,500 to $3,500, which represents significant savings over formal administration costs ($3,000 to $8,000). Summary administration requires fewer court hearings and simplified paperwork, though it still demands proper legal procedures and creditor notifications.

The probate requirements in Florida create clear pathways for estate administration, but the actual process involves multiple steps and strict deadlines that families must navigate carefully.

How Does Florida Probate Administration Work

Filing Your Petition in Palm Beach County

The probate process begins when you file a petition for administration at the Palm Beach County Courthouse within 10 days of death notification. Your petition package must include the original will, certified death certificate, and a $401 fee according to Florida Statute 733.2123. Palm Beach County courts schedule initial hearings within 30-45 days of your petition, though current backlogs extend this to 60 days during busy periods. You must identify all potential heirs and beneficiaries in your petition. The court issues Letters of Administration once it approves the personal representative, which grants legal authority to act on behalf of the estate.

Personal Representative Selection and Authority

Florida law establishes a priority system for personal representative appointments. Surviving spouses receive first preference, followed by adult children, then parents and siblings. The chosen representative must be a Florida resident or closely related to the decedent, and cannot have felony convictions that disqualify them from service. Personal representatives receive compensation based on Florida law (typically 3% of the estate’s value for the first $1 million), though complex estates may justify higher fees. The representative assumes immediate responsibility for asset security, opens estate bank accounts, and maintains detailed financial records for court review.

Asset Inventory Requirements

Personal representatives must compile and file a complete asset inventory within 60 days of their appointment, which includes current market valuations for all property. Professional appraisals cost $300-800 per property but prevent valuation disputes later in the process. The representative must obtain a federal tax identification number for the estate and may need to file income tax returns for both the decedent and the estate itself. This inventory forms the foundation for all subsequent probate proceedings and asset distribution decisions.

Creditor Notification Process

The three-month creditor notification period runs simultaneously with asset inventory preparation. You must send certified letters to known creditors and publish the Notice to Creditors in newspapers at a cost of $200-400. Medical debt appears in approximately 40% of Florida probate cases, which makes thorough creditor research vital for estate protection. Creditors who fail to file claims within this three-month window lose their right to collect from the estate. This protection allows for final asset distribution to beneficiaries without future liability concerns.

Final Thoughts

Probate administration in Boca Raton demands strict adherence to Florida statutes and court procedures. The three-month creditor notification period, asset inventory deadlines, and court filing requirements create multiple opportunities for costly mistakes. These errors can delay estate settlement for months or years beyond the standard timeline.

We at Rubino Findley, PLLC understand the emotional burden families face while they manage these legal obligations. Our team guides Palm Beach County residents through every step of the probate process, from initial petition filing to final asset distribution. We handle creditor notifications, court filings, and asset management while we keep families informed throughout the administration.

Professional legal guidance protects estates from common pitfalls like missed deadlines, improper creditor notifications, and valuation disputes that frequently arise in probate cases (which often plague self-represented cases). Our experience with Palm Beach County courts and Florida probate law helps families avoid the delays and additional costs that complicate estate settlement. Contact Rubino Findley, PLLC today to schedule your free consultation and learn how we can help your family navigate probate administration with confidence and peace of mind.