Choosing the Right Probate Administration Lawyer

Losing a loved one brings emotional challenges alongside complex legal requirements. Florida’s probate process can overwhelm families during their most difficult time.

Finding the right probate administration lawyer makes all the difference in protecting your family’s interests. We at Rubino Findley, PLLC understand how important this decision becomes for Palm Beach County families navigating estate matters.

Understanding Probate Administration in Boca Raton

What Probate Administration Actually Involves

Probate administration in Florida transforms a deceased person’s assets into legal property transfers for beneficiaries. The process starts when someone files a petition with the Palm Beach County court, typically within 10 days of will discovery. Florida Statute 733 mandates formal administration for estates that exceed $75,000 or when the decedent died within two years.

The personal representative must inventory all assets, pay outstanding debts, file tax returns, and distribute property according to the will or state law. Florida’s probate timeline averages 6-8 months for straightforward cases, though complex estates often extend beyond two years.

Common Obstacles That Delay Florida Probate Cases

Family disputes over asset distribution create the most significant delays in probate cases. Missing or unclear wills force courts into lengthy investigations, while contested guardianship appointments for minor children can stall the entire process for months.

Creditor claims against the estate require 90-day waiting periods under Florida law. Business asset sales often need professional appraisals that add weeks to the timeline. Tax complications arise frequently since Florida has no state inheritance tax, but federal estate taxes apply to estates that exceed $12.92 million in 2023.

Florida Probate Costs Range From Hundreds to Thousands

Attorney fees in Florida follow a statutory scale based on estate value. Estates under $40,000 incur flat legal fees of $1,500, while larger estates between $1-3 million face charges of $30,000 plus 2.5% of value over $1 million (making costs predictable for families).

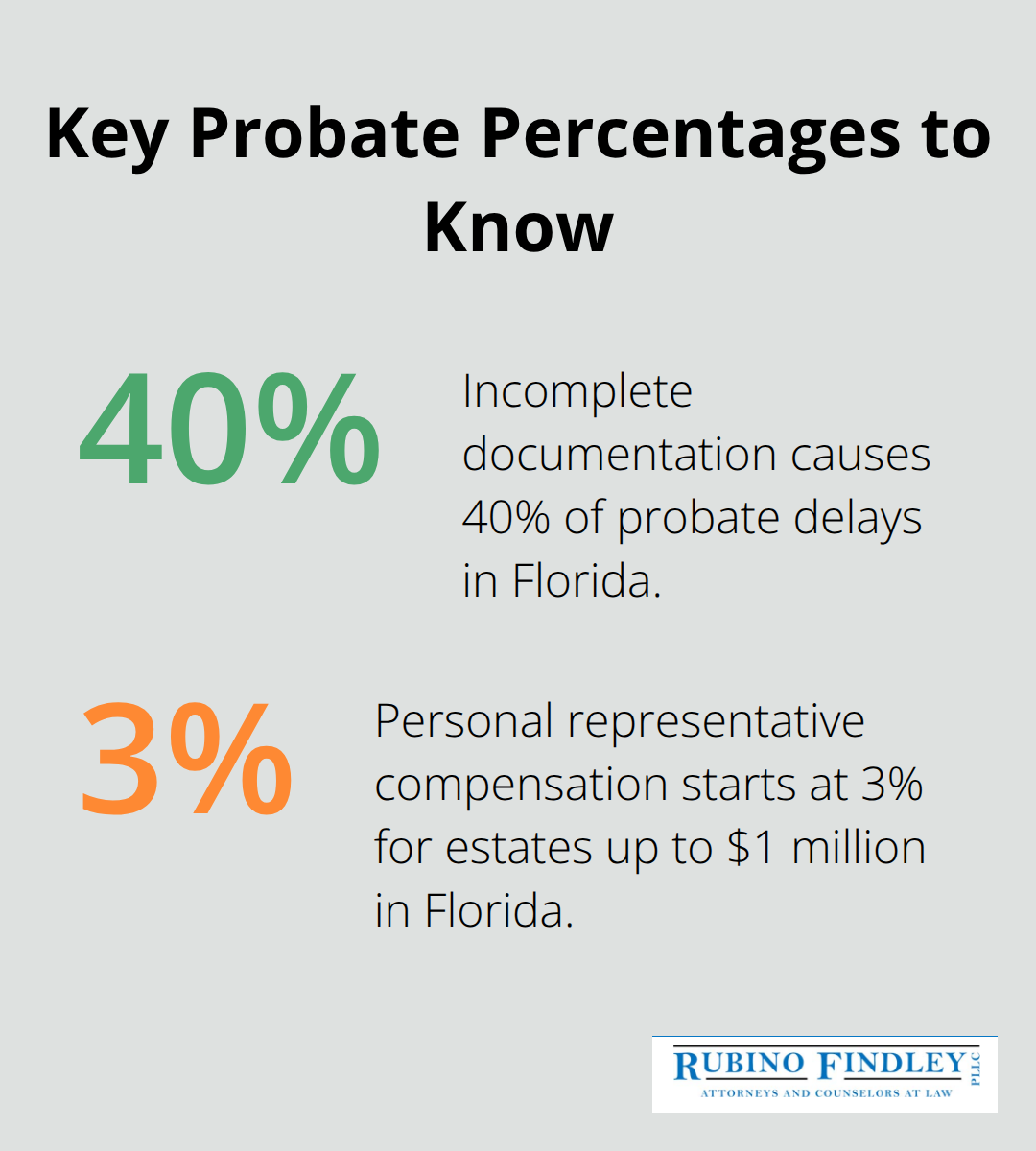

Personal representative compensation starts at 3% for estates up to $1 million. Court fees typically cost $300-400, though complex cases that require multiple court appearances increase these expenses substantially. Summary administration for smaller estates reduces total costs to approximately $2,000-3,000.

These complexities highlight why families need attorneys who understand Florida’s specific probate requirements and can navigate the process efficiently.

Key Qualities to Look for in a Probate Administration Lawyer

Florida Law Knowledge Determines Your Case Outcome

Florida probate laws change frequently, and attorneys who handle general practice cannot keep pace with these updates. Look for lawyers who focus exclusively on probate and estate matters in Palm Beach County courts. These attorneys understand that Florida Statute 733.212 requires specific language for creditor notices, while general practitioners often miss these technical requirements that can delay your case by months.

Ask potential attorneys about recent changes to Florida probate statutes. Knowledgeable lawyers will reference the 2023 updates to homestead exemptions and the current $12.92 million federal estate tax threshold without hesitation. This immediate familiarity with current law demonstrates their active practice in probate matters.

Past Performance Predicts Future Results

Track records matter more than promises when you select probate counsel. Request specific examples of similar cases the attorney resolved in the past 12 months, including average completion times and any complications encountered. Attorneys with strong performance histories will readily share case studies that show how they reduced probate timelines from the typical 6-8 months to 4-5 months through efficient document preparation and court scheduling.

Ask about their relationship with Palm Beach County probate judges and court staff. Established attorneys often secure faster hearing dates due to their professional reputation and consistent quality work (which directly benefits your case timeline).

Communication Standards Separate Good Lawyers From Great Ones

Responsive communication becomes vital when probate deadlines approach. Set clear expectations during initial consultations about response times for emails and calls. Professional probate attorneys typically respond within 24-48 hours during business days and provide weekly status updates throughout your case.

Probate administration involves multiple moving parts that require constant monitoring. The best probate lawyers provide clients with direct phone numbers and explain complex legal concepts in plain language rather than hide behind legal jargon that confuses families already dealing with grief and stress.

Fee Structure Transparency Protects Your Estate

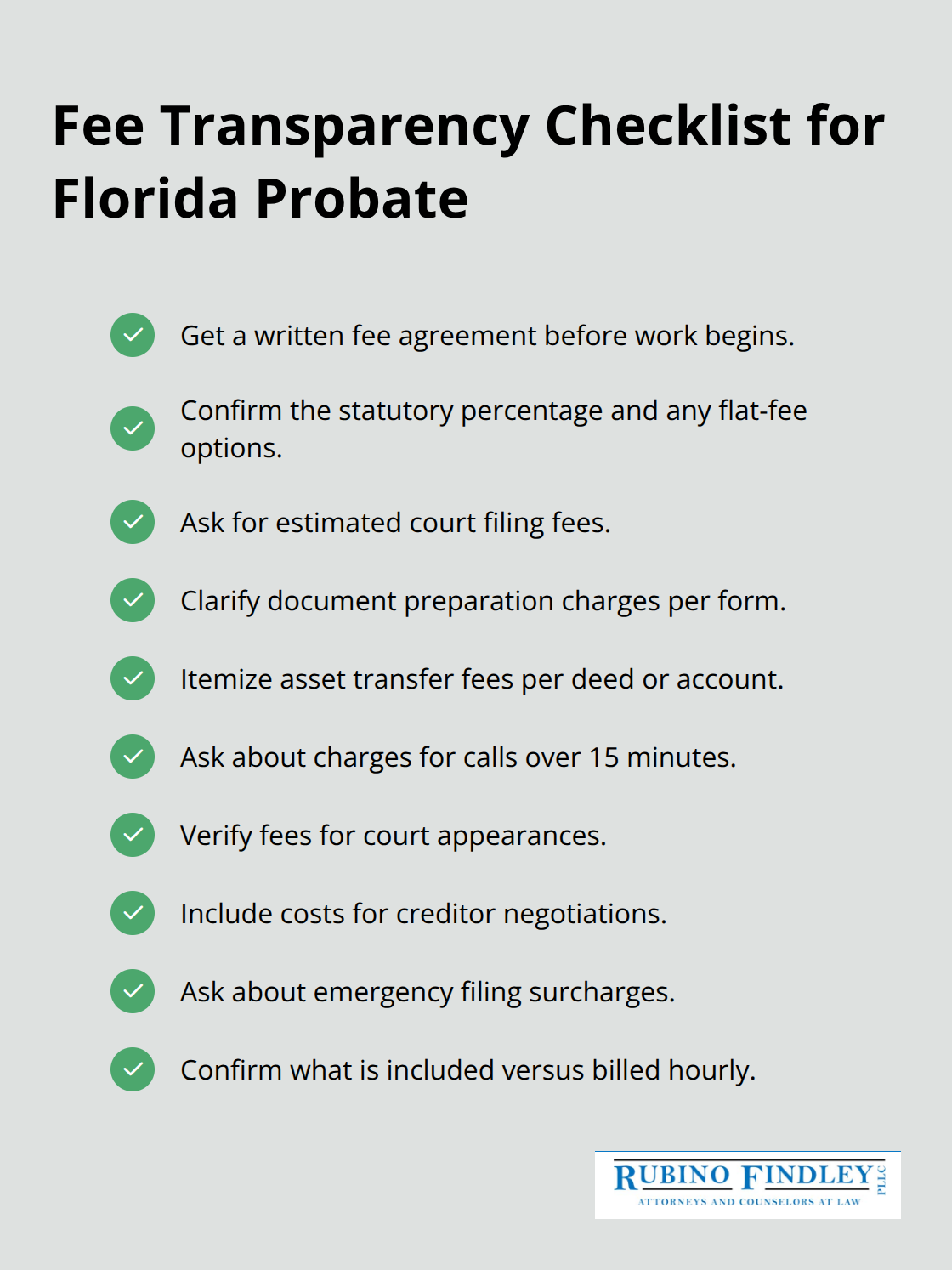

Florida’s statutory fee scale provides predictability, but additional costs can surprise families. Attorneys should explain their complete fee structure upfront, including charges for court appearances, document preparation, and asset transfers. Some lawyers charge flat fees for straightforward cases (which can save money on simple estates), while others prefer hourly billing for complex matters.

Request a written fee agreement before any work begins. This protects both parties and prevents disputes later in the process. Understanding these financial aspects helps you make informed decisions about legal representation and prepares you for the important questions you should ask during attorney consultations.

Questions to Ask Before Hiring a Probate Attorney

Demand Complete Fee Transparency Before You Sign Anything

Florida’s statutory fee structure provides a baseline, but hidden costs destroy estate budgets. Demand a written breakdown that includes all potential charges beyond the basic attorney fee percentage. Court fees average $400 in Palm Beach County, but document preparation can add $200-500 per form (depending on complexity). Asset transfer fees often surprise families with charges of $150-300 per property deed or financial account.

Some attorneys charge separately for phone calls that exceed 15 minutes, while others include routine communication in their base fee. Ask specifically about charges for court appearances, creditor negotiations, and emergency filings that might arise during your case. Written fee agreements protect both parties and prevent disputes later in the process.

Pin Down Realistic Timeline Expectations With Specific Milestones

Generic timelines mean nothing when you need accurate information for your plans. Request a month-by-month breakdown that shows when major milestones will occur in your specific case. Straightforward estates in Palm Beach County typically complete formal administration in 6-7 months, but attorneys should identify potential delays upfront.

Missing heirs can add 3-4 months to the process, while business asset sales often extend timelines by 60-90 days. Ask about their current caseload and average completion times for similar estates in the past six months. Attorneys who handle more than 50 active probate cases simultaneously cannot provide adequate attention to your matter.

Prepare Your Document Checklist to Avoid Delays

Incomplete documentation causes 40% of probate delays according to Florida Bar statistics. Request a comprehensive list of required documents during your initial consultation, then gather everything before your second meeting. Original wills, death certificates, property deeds, bank statements from the past two years, tax returns, and insurance policies form the foundation of most cases.

Digital asset passwords and cryptocurrency wallet information have become increasingly important since 2022. Ask whether the attorney uses secure document portals for file sharing and how they handle sensitive financial information throughout the process (this protects your family’s privacy and financial security).

Final Thoughts

The right probate administration lawyer protects your family’s financial future and reduces stress during difficult times. Your attorney will handle thousands of dollars in estate assets and make decisions that affect your loved ones for years. Professional legal guidance reduces average probate timelines from 8-12 months to 6-7 months through efficient document preparation and court scheduling.

Schedule consultations with qualified attorneys who focus on Florida probate law. Prepare your questions about fees, timelines, and required documentation before these meetings. Compare responses carefully and trust your instincts about communication style and responsiveness (this decision affects your entire family’s experience).

We at Rubino Findley, PLLC help Palm Beach County families navigate probate administration with confidence. Our team handles wills, trusts, probate administration, and probate litigation throughout Florida. Contact us today to schedule your free consultation and protect your family’s interests during this time.