Why Estate Planning Matters: Securing Your Legacy

Most adults postpone estate planning until it’s too late. Without proper planning, your family faces court battles, frozen assets, and financial uncertainty during their most vulnerable moments.

We at Rubino Findley, PLLC see families struggle with preventable complications daily. Understanding why estate planning is important protects your loved ones from unnecessary hardship and preserves your hard-earned wealth for future generations.

What Happens Without Estate Planning

State laws control your assets when you die without an estate plan. Florida courts appoint administrators who may not understand your family dynamics or financial goals.

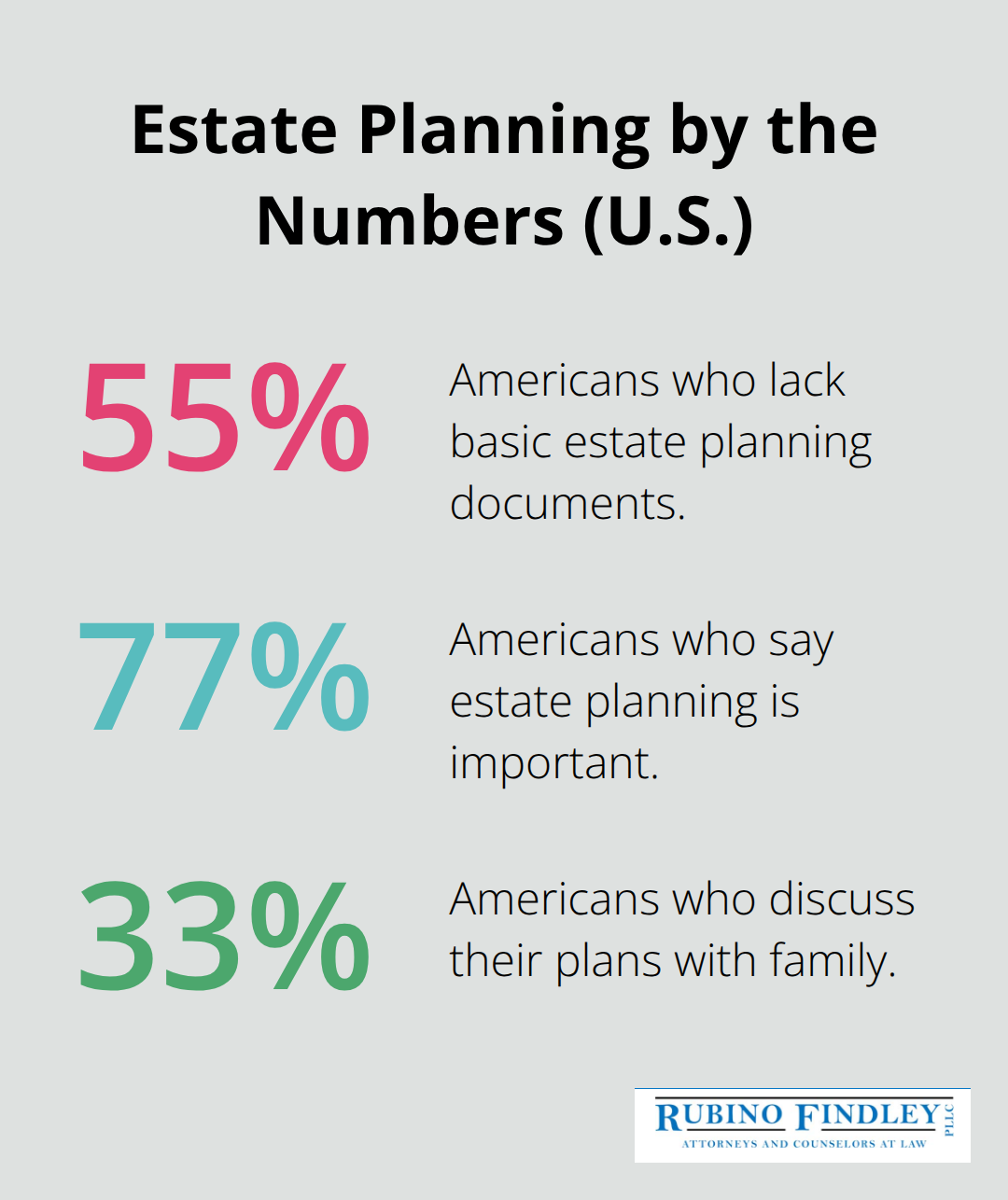

The American Bar Association reports that 55% of Americans lack basic estate planning documents, which forces their families into expensive court proceedings that last months or years. The probate process in Florida takes 6 to 12 months for simple estates, but complex cases extend beyond two years while legal fees consume 3% to 7% of your estate value.

Court Control Replaces Family Decisions

Without a will, Florida’s intestacy laws determine who receives your property. Your spouse receives everything only if you have no children or parents. Otherwise, assets split between your spouse and children in predetermined percentages that ignore your actual wishes. Courts also choose guardians for minor children based on statutory preferences rather than your knowledge of family relationships and values.

Probate Creates Financial Roadblocks

Probate freezes your accounts immediately upon death and prevents families from access to funds for daily expenses or funeral costs. Banks require court orders before they release money, even for joint accounts in some situations. The National Academy of Elder Law Attorneys reports that probate costs average $15,000 for estates worth $500,000 (money that could support your beneficiaries instead of court systems and attorneys).

Children Face Uncertain Futures

Parents who die without named guardians leave judges to decide their children’s residence arrangements. Courts consider relatives they’ve never met over close family friends who know your children well. Additionally, children inherit assets directly at age 18 without financial guidance or protection from poor decisions that could waste their inheritance within years.

These consequences affect families across all income levels, but proper estate planning prevents these problems entirely. The next section examines the most common mistakes that even well-intentioned families make when they attempt to plan their estates.

Common Estate Planning Mistakes That Cost Families

Even families who attempt estate planning often make costly errors that create the same problems they tried to prevent. The most devastating mistake involves outdated beneficiary designations on retirement accounts and life insurance policies. These designations override your will completely, which means your ex-spouse could receive your 401k even if you remarried and updated your will. Fidelity’s 2022 Estate Planning Study found that 77% of Americans consider estate planning important, but only 33% discuss their plans with family members (this creates confusion and conflicts when decisions matter most).

Outdated Beneficiary Forms Override Your Will

Life insurance and retirement account beneficiaries receive assets directly without probate, but only if you keep these forms current. Divorced individuals frequently forget to remove former spouses from these accounts, and remarried people often fail to add new spouses or stepchildren. Financial institutions follow the most recent beneficiary form on file, regardless of your will’s instructions. Check all beneficiary designations annually and update them immediately after marriage, divorce, births, or deaths in your family.

Missing Power of Attorney Creates Financial Chaos

Without a durable power of attorney, your family cannot access your accounts or pay your bills if you become incapacitated through illness or accident. Courts must appoint a guardian through expensive proceedings that last months while your mortgage, utilities, and medical bills accumulate unpaid. Your spouse cannot automatically handle your individual accounts, business interests, or tax matters without proper documentation. The National Academy of Elder Law Attorneys reports that guardianship proceedings cost families an average of $3,000 to $5,000 initially (plus ongoing court supervision fees).

Digital Assets Vanish Without Proper Access

Your online accounts, cryptocurrency, and digital files vanish when you die unless someone has access credentials and legal authority to manage them. Tech companies lock accounts permanently after death without court orders, and many platforms delete inactive accounts after specific periods. Create a secure digital inventory with account information and appoint a digital executor with proper legal authority to handle these assets.

These mistakes affect families regardless of wealth level, but the right legal documents prevent these costly oversights. Attorney fees typically consume 3-5% of your estate’s value, while personal representative fees add another 3%. A $500,000 estate can lose $40,000 or more to preventable estate planning errors that proper documentation would have avoided. The next section outlines the specific documents every adult needs to protect their family’s financial future.

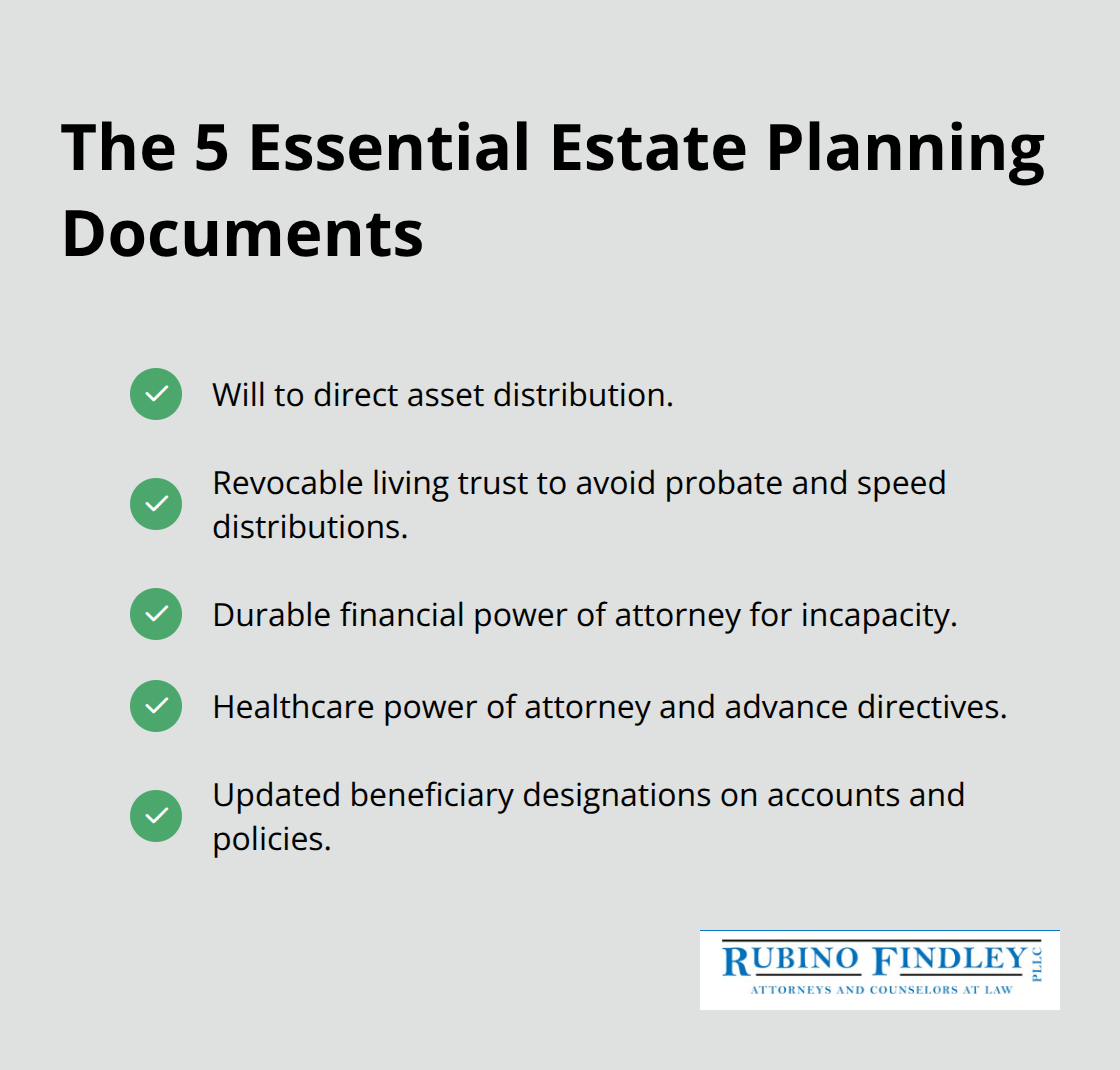

Essential Estate Planning Documents Every Adult Needs

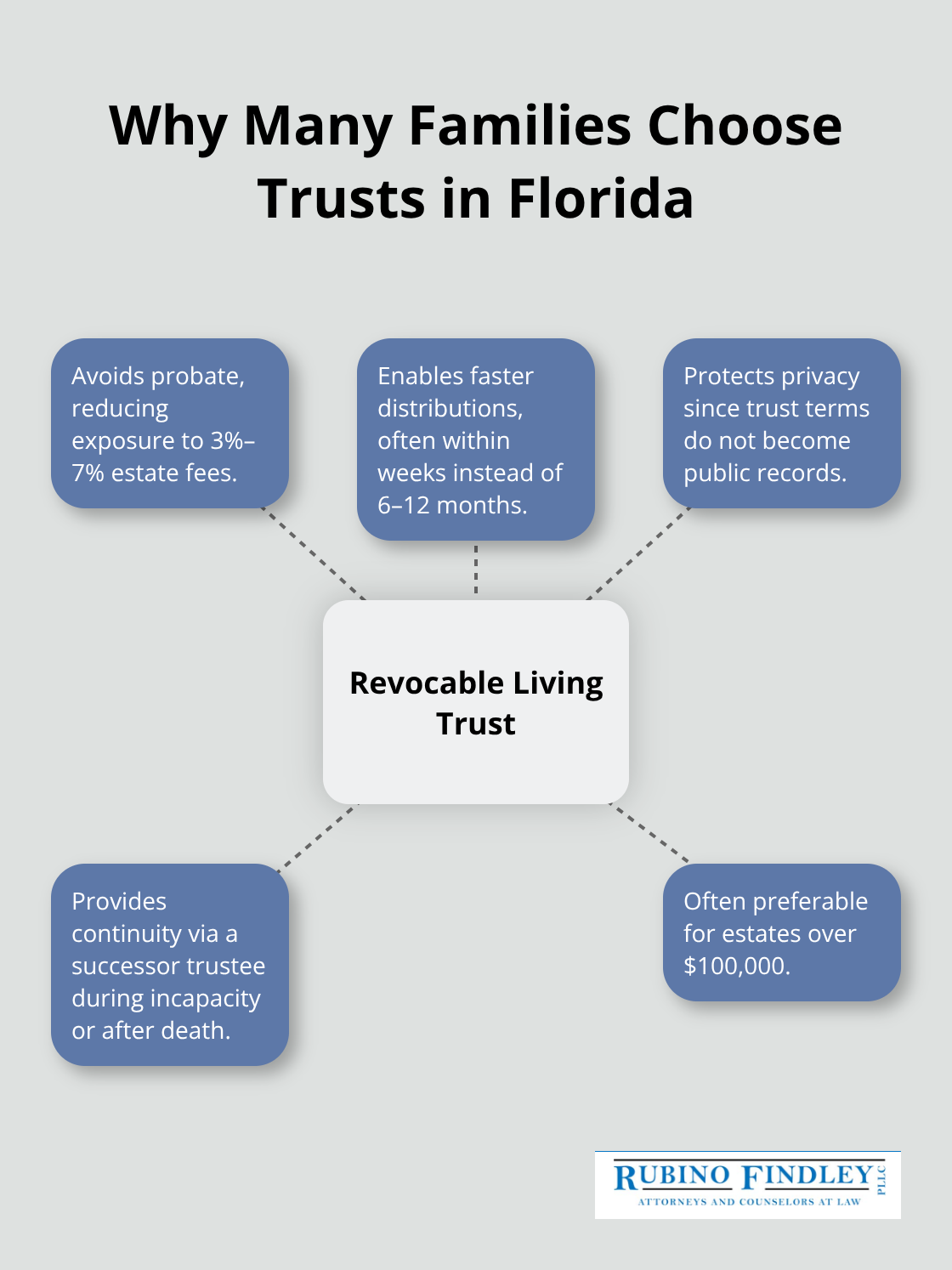

Every adult needs four specific legal documents to protect their family from court intervention and financial chaos. Your will controls asset distribution after death, but trusts provide superior protection by avoiding probate entirely. Revocable living trusts transfer ownership of your assets to the trust during your lifetime, which allows your successor trustee to distribute property immediately upon your death without court supervision.

Florida probate takes 6 to 12 months minimum, while trust distributions happen within weeks. Trusts also remain private documents, unlike wills which become public records that expose your family’s financial details to anyone who requests them.

Wills vs Trusts: Choose the Right Protection

Wills direct courts how to distribute your assets but must pass through probate first. This process costs 3% to 7% of your estate value and takes months to complete. Trusts avoid probate completely because you transfer asset ownership to the trust while alive. Your successor trustee distributes assets immediately after your death without court involvement. Trusts protect privacy since they never become public records (unlike wills that anyone can access through court files). Families with assets over $100,000 typically benefit more from trusts than wills alone.

Financial Power of Attorney Prevents Account Freezes

A durable power of attorney for finances allows your chosen agent to access your accounts, pay bills, and manage investments if you become incapacitated through illness or accident. Without this document, your spouse cannot touch your individual retirement accounts, business interests, or investment portfolios. Courts must appoint a guardian through proceedings that cost $3,000 to $5,000 initially plus ongoing supervision fees. Your agent can act immediately when you cannot, which prevents mortgage defaults, utility shutoffs, and missed investment opportunities that destroy wealth during medical emergencies.

Healthcare Directives Control Medical Treatment

Healthcare power of attorney designates someone to make medical decisions when you cannot communicate your wishes. This document prevents family disagreements about treatment options and allows your agent to access medical records, speak with doctors, and authorize procedures. Advance directives specify your preferences for life-sustaining treatment, feeding tubes, and resuscitation efforts. Without these documents, hospitals follow default protocols that may conflict with your values while your family argues about your care preferences.

Beneficiary Forms Override Everything Else

Retirement accounts, life insurance policies, and bank accounts with beneficiary designations transfer directly to named individuals without probate. These forms override your will completely, so outdated beneficiaries receive assets regardless of your current wishes. Review all beneficiary designations annually and update them immediately after marriage, divorce, births, or deaths. Name primary and contingent beneficiaries for every account, and consider per stirpes designations that protect your assets if beneficiaries predecease you.

Final Thoughts

Your family’s financial security depends on decisions you make today. The statistics reveal why estate planning is important: 55% of Americans lack basic estate planning documents, which leaves their families vulnerable to court battles and frozen assets during their most difficult moments. Without proper planning, Florida courts control your assets and choose guardians for your children based on state laws rather than your wishes.

Probate proceedings consume 3% to 7% of your estate value while your family waits months or years for access to funds they need immediately. The right legal documents prevent these costly delays and protect your loved ones from unnecessary hardship. Wills, trusts, and power of attorney forms give you control over your assets and medical decisions while they avoid expensive court supervision.

We at Rubino Findley, PLLC help families throughout Palm Beach County create comprehensive estate plans that protect their wealth and preserve family relationships. Our team handles wills, trusts, probate administration, and durable power of attorney documents that prevent court intervention when your family needs stability most (estate planning protects every adult who wants to control their legacy). Contact Rubino Findley, PLLC today to schedule your consultation and start protection for your family’s future.