Estate Planning Organizer: What You Need to Get Started

Estate planning can feel overwhelming without proper organization. An estate planning organizer helps you gather the right documents and information before meeting with an attorney.

We at Rubino Findley, PLLC see many clients who struggle with knowing what to prepare. Having everything organized saves time and reduces costs during the planning process.

Essential Documents for Estate Planning in Boca Raton

Your estate planning organizer must start with the right legal documents. Each document serves a specific purpose and protects different aspects of your life and assets.

Wills and Their Key Components

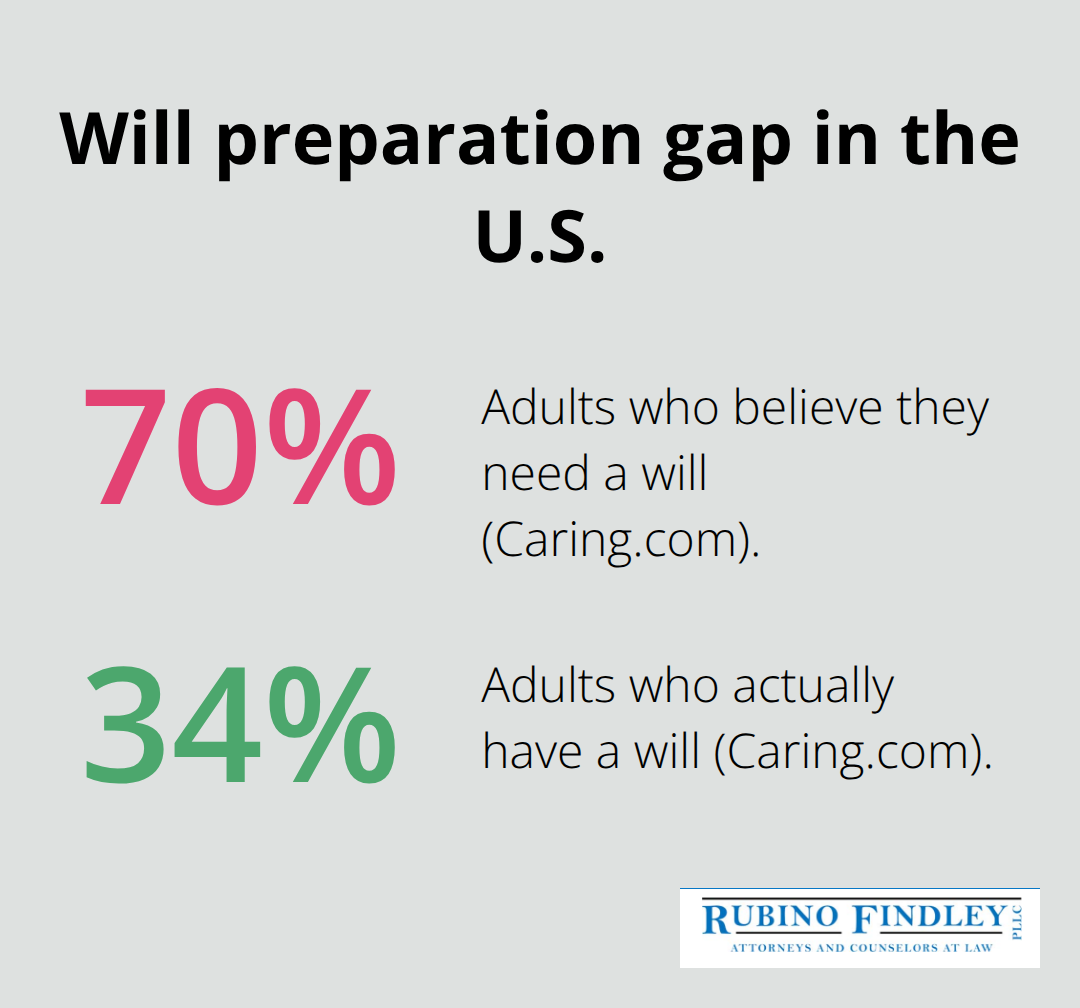

A valid will in Florida requires written format with your signature witnessed by two people who are not beneficiaries. The will should name an executor, specify asset distribution, and designate guardians for minor children. According to Caring.com surveys, 70% of people believe they need a will, yet only 34% actually have one.

This gap creates significant problems for families who face probate without proper documentation. Your will becomes the foundation that guides asset distribution and protects your family’s interests after your death.

Trust Documents and Asset Protection

Trust documents offer better asset protection and probate avoidance compared to wills alone. Revocable living trusts let you maintain control during your lifetime while they transfer assets automatically upon death. Trust paperwork should include the trust agreement, funding documents that show which assets transfer into the trust, and current beneficiary designations.

These documents work together to create a comprehensive system that protects your wealth and simplifies the transfer process for your heirs.

Power of Attorney and Healthcare Directives

Power of attorney documents grant someone authority over your financial decisions if you become incapacitated. Healthcare directives specify your medical preferences and appoint a healthcare proxy to make decisions on your behalf. Without these documents, Florida families often face expensive guardianship proceedings (which can cost thousands in court fees).

Healthcare directives should include both living wills that detail end-of-life preferences and medical power of attorney that designates your healthcare decision-maker. Keep all original documents in a fireproof safe with copies accessible to your executor and healthcare proxy.

Once you have these essential documents in place, you need to gather comprehensive financial information to complete your estate planning organizer.

Financial Information to Gather

Your estate planning organizer requires complete financial documentation to protect every asset you own. The average person under 70 holds more than 160 digital accounts according to recent studies, which makes comprehensive financial record-keeping more complex than ever before.

Bank Accounts and Investment Portfolios

Create detailed lists of all bank accounts that include account numbers and financial institution contact information. Document checking accounts, savings accounts, money market accounts, and certificates of deposit with current balances and bank statements from the past year. Investment portfolios need documentation that shows current balances, recent account statements, and beneficiary designations for all brokerage accounts, mutual funds, and retirement plans. These records form the foundation of your financial inventory and help attorneys understand your complete asset picture.

Insurance Policies and Retirement Benefits

Life insurance policies require immediate attention in your estate planning organizer because they transfer directly to named beneficiaries without probate. Collect all policy documents that show coverage amounts, premium payment schedules, and current beneficiary information for term life, whole life, and employer-provided group policies. Retirement accounts like 401k plans, IRAs, and pension benefits need current statements with beneficiary designations that supersede what your will states. The asset limit for SSI and Medicaid qualification in Florida is $2,000 for singles and $3,000 for married couples as of 2025 (making accurate retirement account documentation vital for benefit planning).

Property Deeds and Business Documentation

Real estate property deeds must show current ownership structure and any liens or mortgages on the property. Homestead properties in Florida receive creditor protection during probate, but better asset protection comes from proper planning that transfers property outside probate. Business owners need partnership agreements, corporate bylaws, and current business valuations to address succession planning. Digital assets that include cryptocurrency accounts, online business platforms, and domain ownership require login credentials and designated digital executors to prevent asset loss after death.

Personal information and family details complete the final section of your estate planning organizer.

Personal Information and Family Details

Your estate planning organizer needs complete personal information that goes far beyond basic contact details. Accurate family information prevents legal disputes and protects your loved ones from costly court proceedings when they need support most.

Contact Information for Key People

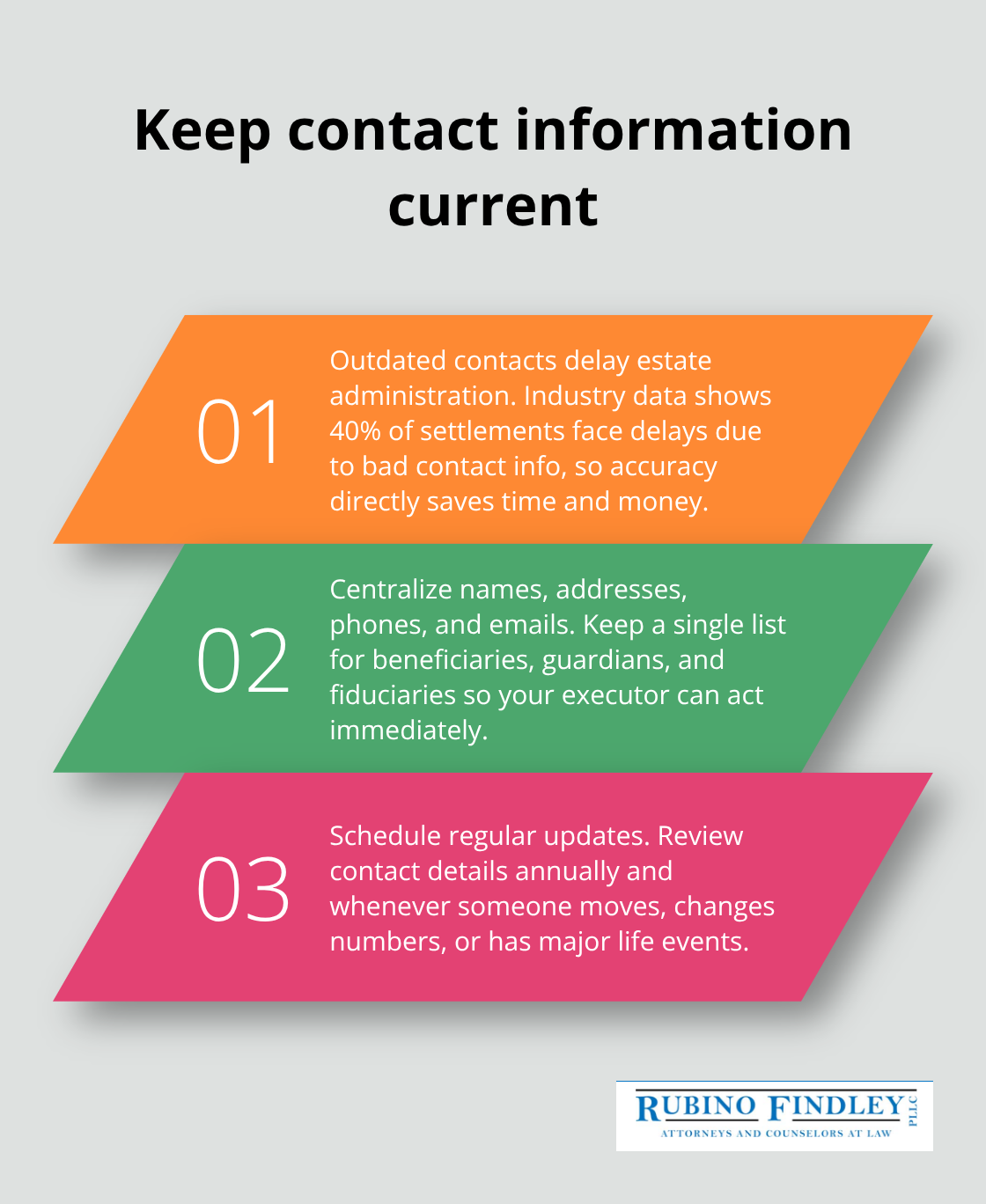

Document current addresses, phone numbers, and email addresses for all beneficiaries, heirs, and potential guardians. Include backup contact methods because people move frequently and phone numbers change. The National Association of Estate Planners & Councils reports that outdated contact information causes delays in 40% of estate settlements.

Create a separate section for professional contacts that includes your current attorney, accountant, financial advisor, and insurance agents with their direct phone numbers and office addresses. Your executor will need immediate access to these professionals during estate administration. Update this information annually or whenever someone moves, changes jobs, or gets married.

Guardian Designations for Minor Children

Name primary and alternate guardians for minor children with their complete contact information and written consent to serve. Florida law requires court approval for guardian appointments, but your written preferences carry significant weight in judicial decisions (which makes detailed documentation essential).

Include detailed information about each potential guardian’s financial stability, parenting philosophy, and relationship with your children. Document any relatives or friends who should not have custody and explain your reasoning clearly. Special needs children require additional planning that includes information about current care providers, medical professionals, and educational support teams.

Care Instructions and Family Preferences

Create detailed care instructions that include daily routines, medical needs, and educational preferences to help guardians maintain stability for your children during difficult transitions. Include information about schools, extracurricular activities, religious preferences, and family traditions that matter to your children.

Document any family conflicts or estranged relationships that could complicate estate administration. Your executor needs to understand family dynamics to handle potential disputes effectively (particularly in blended families where children from previous relationships may face unintentional disinheritance). Understanding why estate planning matters helps ensure your family’s future remains secure through proper documentation and planning.

Final Thoughts

Your estate planning organizer serves as the roadmap that guides your family through difficult times. Create a secure filing system that separates essential documents, financial records, and personal information into clearly labeled sections. Store original documents in a fireproof safe while you keep copies accessible to your executor and healthcare proxy.

Palm Beach County estate planning attorneys provide significant advantages over attempting to navigate complex Florida laws alone. We at Rubino Findley, PLLC help clients establish wills, trusts, probate administration, and durable power of attorney documents that protect their families from costly legal proceedings. Our team understands the specific requirements for valid estate planning documents in Florida and can prevent common mistakes that invalidate important paperwork.

Schedule a consultation to review your organized documents and create a comprehensive estate plan. Rubino Findley, PLLC offers consultations to discuss your estate planning needs and develop strategies that honor your wishes while protecting your loved ones from unnecessary probate complications (which can cost thousands in court fees and delays). Your estate planning organizer becomes the foundation for protecting everything you have worked to build.