How to Handle Summary Administration in Probate

Probate can feel overwhelming, especially when you’re grieving. Summary administration in probate offers a faster, simpler path for smaller estates in Florida.

At Rubino Findley, PLLC, we help families navigate this streamlined process. This guide walks you through what summary administration is, who qualifies, and exactly how it works.

What Is Summary Administration in Boca Raton

Summary administration under Florida Statute 735.201 is a streamlined probate process designed for estates that meet specific financial or timing criteria. Unlike formal probate, which requires appointing a personal representative and navigating court supervision for six to eighteen months, summary administration cuts through red tape when conditions align. The process applies when the total probate estate is $75,000 or less (excluding homestead and exempt property), or when the decedent has been deceased for more than two years. This distinction matters enormously because it determines whether your family waits months for asset distribution or receives funds within weeks.

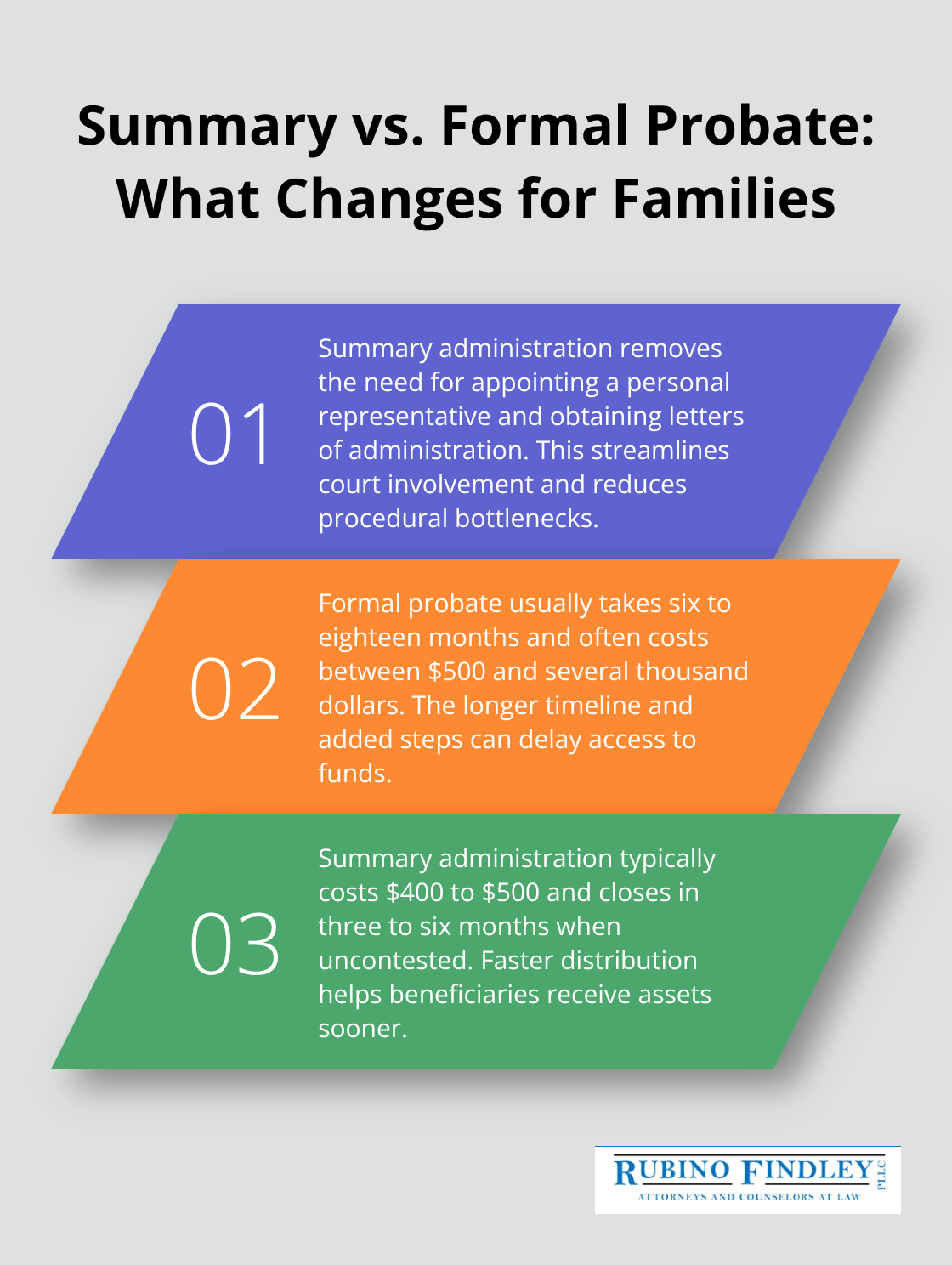

How Summary Administration Differs from Formal Probate

Formal probate involves filing a petition to open the estate, having a personal representative appointed by the court, and obtaining letters of administration. Banks typically demand these letters before releasing any funds, which creates a bottleneck. In contrast, summary administration skips the personal representative appointment entirely. Instead, a petition goes directly to the court requesting an order to distribute assets. The court issues an order allowing beneficiaries to receive their shares without the intermediary step of letters of administration. This structural difference saves time and money. Formal probate typically costs between $500 and several thousand dollars and takes six to eighteen months. Summary administration generally costs $400 to $500 and closes in three to six months, assuming no disputes or creditor claims emerge. The financial savings alone make summary administration attractive for qualifying estates.

Estate Value Thresholds and Timing Requirements

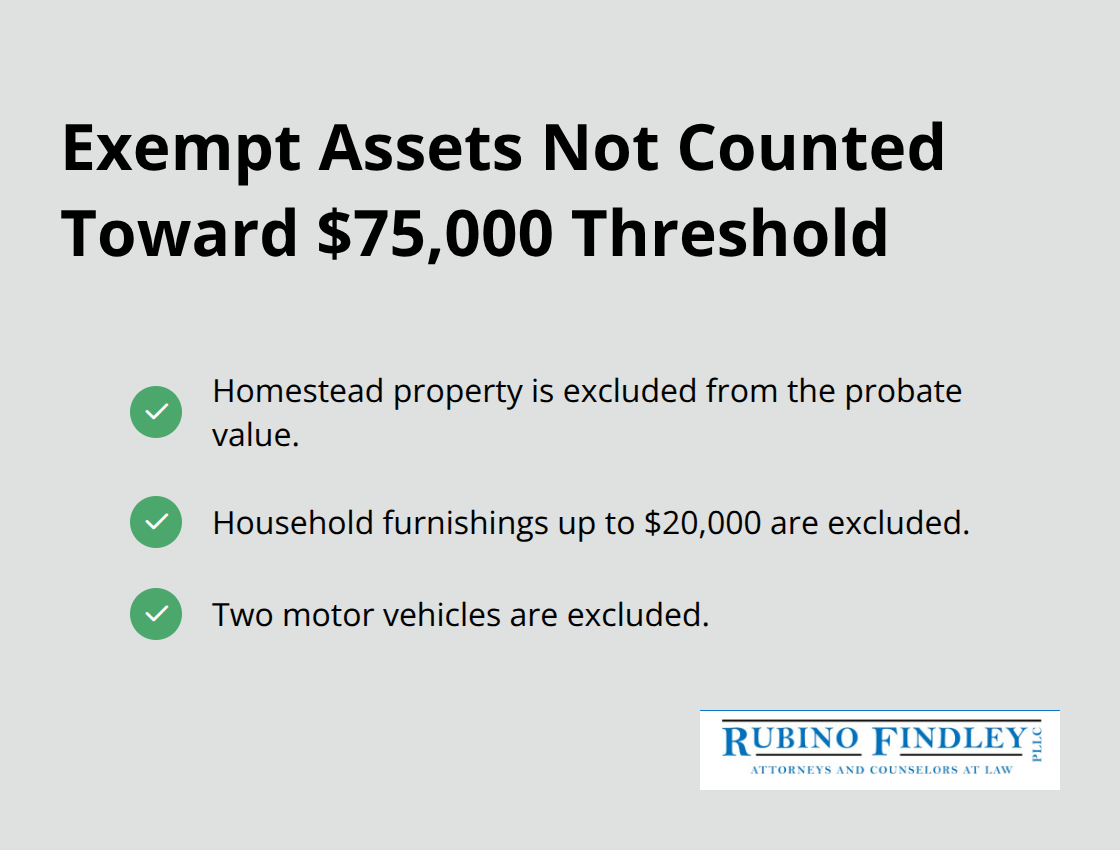

Your estate qualifies if the net probate value sits at or below $75,000 after removing exempt assets like homestead property and household furnishings up to $20,000. Two motor vehicles also fall outside this calculation. If your estate exceeds $75,000 but the decedent died more than two years ago, you still qualify because creditors have a statutory bar after two years from death. This two-year rule is powerful.

If creditors have not filed claims within that window, they lose the right to do so, and summary administration becomes available regardless of estate size.

Will Requirements and Creditor Considerations

One critical requirement: the will cannot explicitly direct formal administration. If the decedent’s will states that formal probate must occur, summary administration is not an option, even if the estate is small. Additionally, if creditors exist and have not been barred, you must notify them and demonstrate that assets will cover their claims or that you have a plan to handle them. Homestead property requires special attention because it passes free of creditor claims once the court determines homestead status, removing it from the creditor calculation. Understanding these requirements helps you move forward with the right probate path for your situation.

Who Qualifies for Summary Administration in Boca Raton

The Two Pathways to Eligibility

Your estate qualifies for summary administration if it meets one of two conditions under Florida Statute 735.201. First, the total probate estate value must not exceed $75,000 after you exclude exempt assets. Homestead property, household furnishings up to $20,000, and two motor vehicles do not count toward this threshold, which means many estates that appear larger on paper actually qualify. Second, if the decedent died more than two years ago, summary administration becomes available regardless of estate size because creditors lose their right to file claims after that statutory bar expires. This two-year rule is powerful and often overlooked. Families sometimes assume they need formal probate because assets exceed $75,000, but if death occurred in early 2024 or earlier, summary administration becomes viable.

Will Directives and Estate Complexity

The will itself cannot direct formal administration. If the decedent explicitly stated that formal probate must occur, you cannot use summary administration even if all other conditions align. Additionally, if the estate holds assets that generate ongoing disputes among beneficiaries or if significant creditor claims exist and have not been barred, the court may convert summary administration to formal probate after you file, adding months to the timeline.

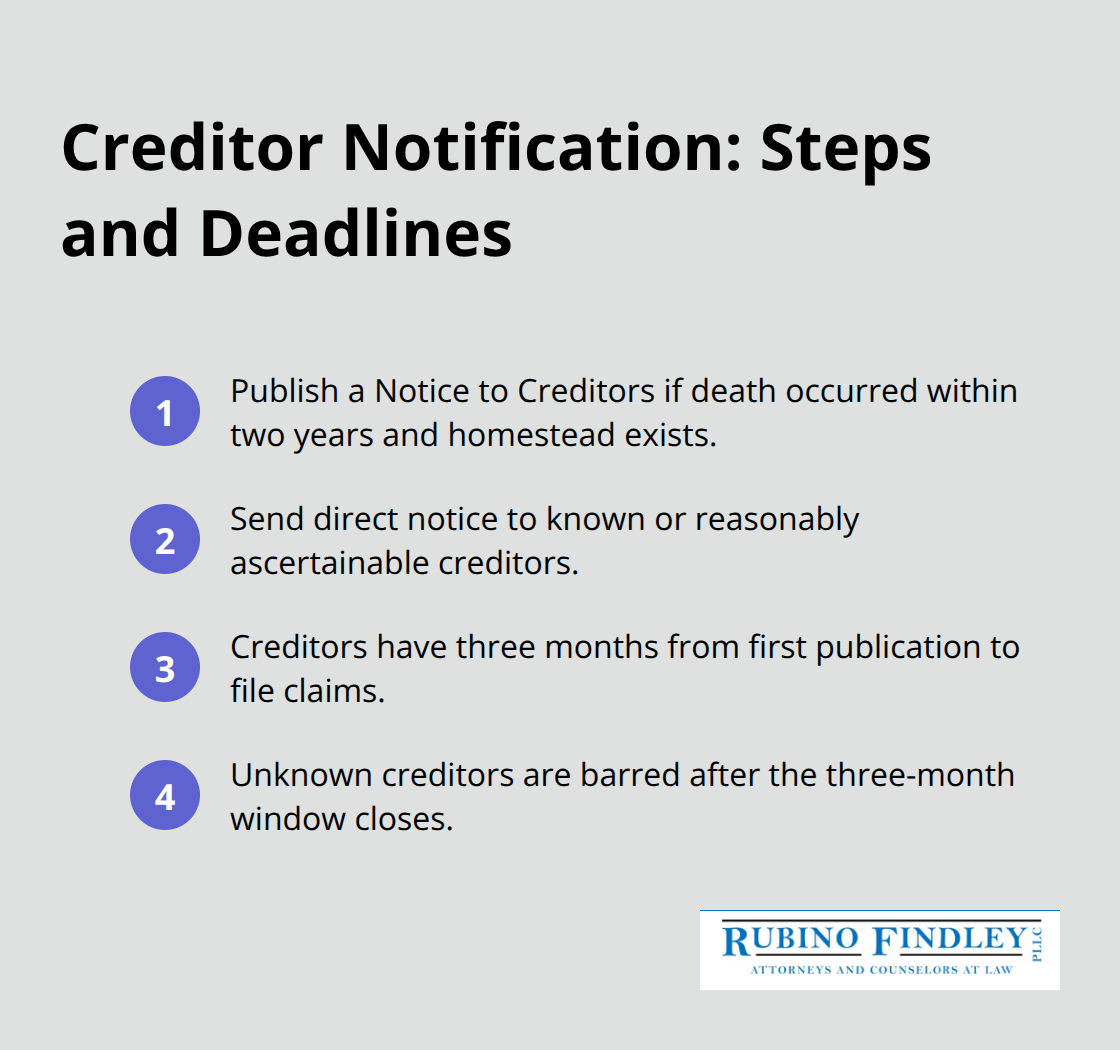

Creditor Notification and Timing Requirements

Creditor notification requirements differ based on timing and asset status. If the decedent died within the last two years and homestead property exists, you must publish a Notice to Creditors in a newspaper of general circulation. Known or reasonably ascertainable creditors must receive direct notice. Creditors have three months from the first publication to file claims, and unknown creditors are barred after that window closes.

The $75,000 threshold calculation assumes creditors will be paid from available funds or are already barred.

Filing Requirements and Documentation

When you file the Petition for Summary Administration with the court, you must include verified statements about your diligent search for creditors, the estate’s total value, asset descriptions, and your proposed distribution plan. The petition requires signatures from all parties who receive full distributive shares or from designated substitutes if required signers are deceased or incapacitated. Courts in Palm Beach County typically process these petitions within one to two months if no creditor objections emerge and all documentation is complete and accurate. Understanding these filing requirements helps you prepare the right documentation before you submit your petition to the court.

The Summary Administration Process Step-by-Step

Filing Your Petition with the Court

Your petition marks the moment summary administration becomes real. You submit a verified Petition for Summary Administration to the court in Palm Beach County, and this document must include your diligent search for creditors, the estate’s total value, descriptions of each asset, and your proposed distribution plan. The petition requires signatures from all beneficiaries receiving full distributive shares, or from designated substitutes if any required signer is deceased, incapacitated, or a minor. Courts typically process complete petitions within one to two months.

The 15th Judicial Circuit uses an Online Scheduling System for submitting proposed orders-you cannot mail them or use the general e-filing portal. If you’re unfamiliar with this system, the court provides a YouTube tutorial titled “Online Scheduling: Submitting an Order” on their website.

Publishing Notice and Managing Creditor Notification

One critical step many families miss: you must arrange publication of the Notice to Creditors in a newspaper of general circulation if the decedent died within two years and homestead property exists. The Clerk does not handle this publication automatically, so you coordinate directly with the newspaper and file the proof of publication yourself. Known creditors receive direct notice by mail or service.

Creditors then have three months from first publication to file claims, and unknown creditors are barred after that window closes. If no creditors file claims and all documentation is accurate, the court issues an order permitting immediate distribution.

Handling Creditor Claims and Objections

Creditor claims can derail your timeline, but they rarely do in qualifying estates. If a creditor files a claim, the distribution plan may require modification, and in some cases, the court converts the proceeding to formal administration, adding six to eighteen months to closure. This conversion happens when disputes become too complex for summary administration to handle. However, the vast majority of summary administrations close without conversion because creditors are either barred or already accounted for in the asset distribution.

Distributing Assets to Beneficiaries

Once the court approves distribution, beneficiaries receive their designated portions directly from the estate assets. Property holders and financial institutions transfer assets to beneficiaries under the court’s order, and bona fide purchasers for value who acquire property through this order generally take free of creditor claims and the rights of other beneficiaries. Recipients owe pro rata liability for valid claims only to the extent of the value they received, protecting them from unlimited exposure.

The entire process-from petition to distribution-typically takes three to six months when no creditor disputes emerge.

Final Thoughts

Summary administration probate offers a genuine advantage for families in Boca Raton managing smaller estates or those where the decedent passed away more than two years ago. The three to six month timeline and lower costs make this path attractive compared to formal probate’s six to eighteen month process. If your estate qualifies, you avoid appointing a personal representative and skip the lengthy court supervision that slows down asset distribution.

Eligibility requirements are strict, and missing even one disqualifies you from this streamlined path. Your estate must fall under $75,000 in probate assets after excluding homestead and exempt property, or the decedent must have been deceased for over two years. The will cannot direct formal administration, and creditor notification must follow Florida’s statutory rules precisely.

Consulting with an attorney early prevents costly mistakes and ensures you file correctly with the 15th Judicial Circuit’s Online Scheduling System. We at Rubino Findley, PLLC help families throughout Palm Beach County assess whether summary administration fits their situation and prepare the Petition for Summary Administration with accuracy. Reach out to our team to discuss your estate and determine the right probate path forward.