How to Use Power of Attorney in Estate Planning

Power of attorney is one of the most overlooked documents in estate planning, yet it gives someone you trust the ability to manage your finances and healthcare when you can’t.

Most people focus on wills and trusts but ignore the immediate protection a power of attorney provides during your lifetime. At Rubino Findley, PLLC, we see families struggle with financial decisions and medical choices simply because they never set up this document. This guide walks you through how power of attorney works and why it belongs in your estate plan.

What Power of Attorney Actually Does

How a Power of Attorney Works in Florida

A power of attorney is a legal document that authorizes someone you choose, called an agent, to act on your behalf in financial and legal matters. In Florida, this document is governed by Florida Statutes Chapter 709, and it becomes effective the moment you sign it unless you specify otherwise. The agent can handle everything from selling property to accessing bank accounts, signing contracts, and managing investments, but only within the specific powers you grant them.

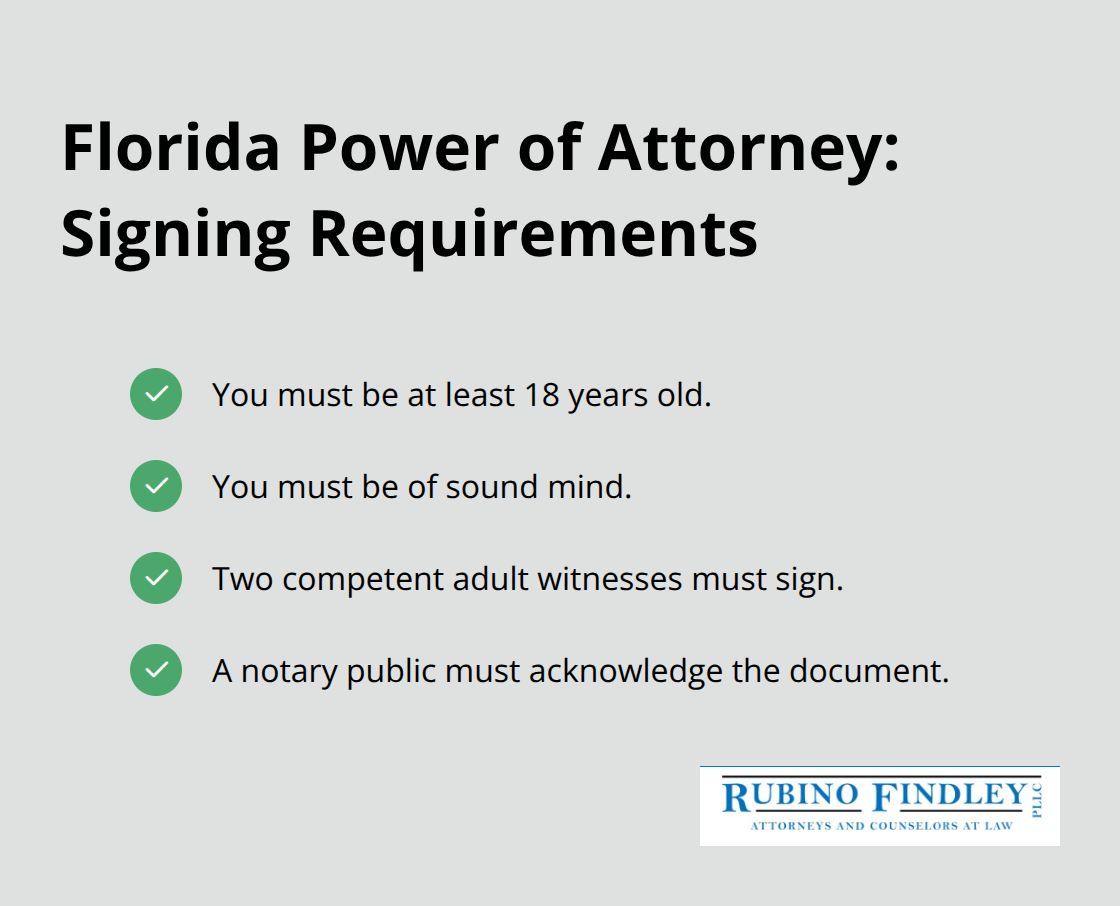

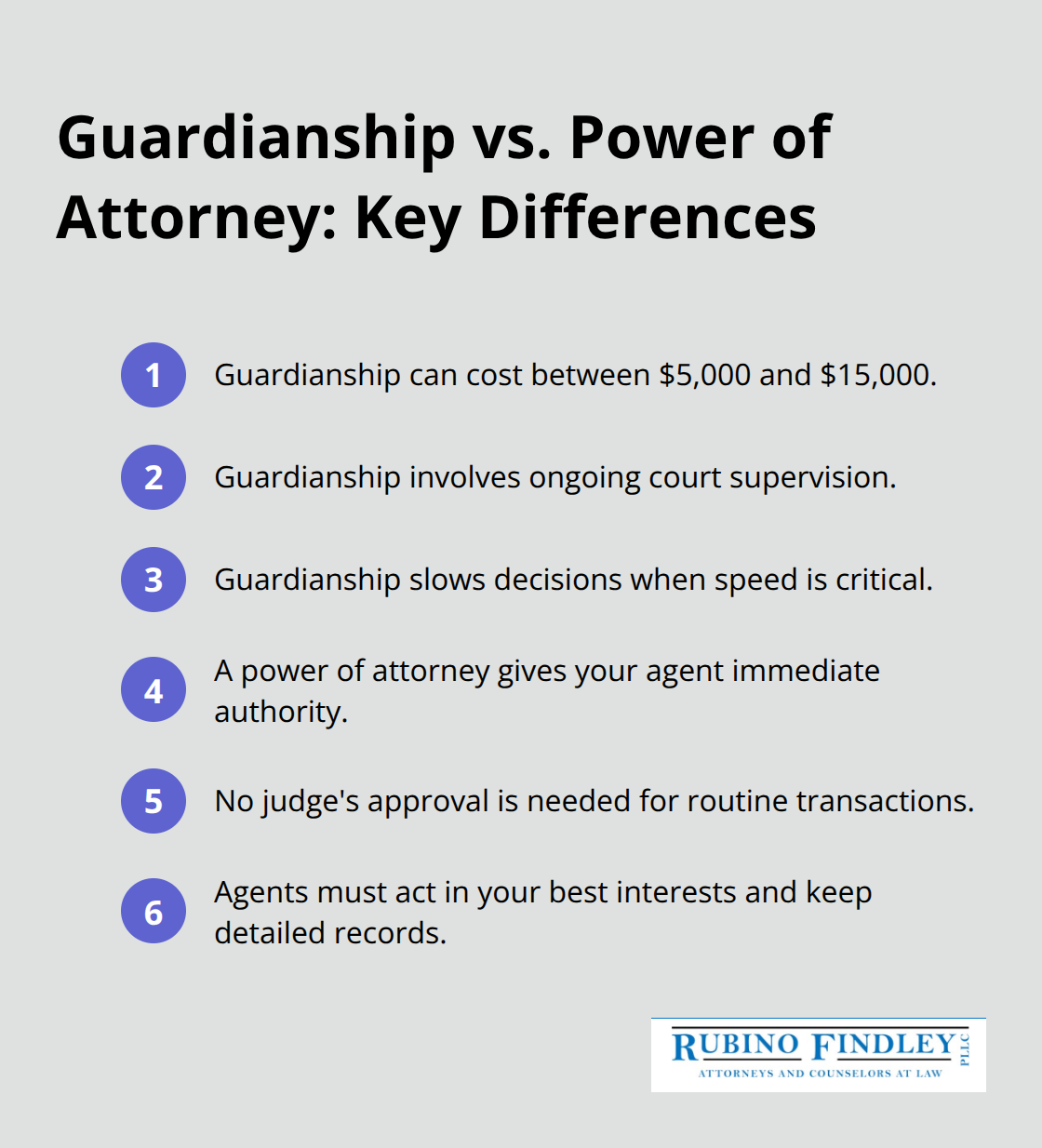

Without a power of attorney, your family faces a costly court process called guardianship if you become incapacitated and cannot make decisions yourself. According to The Florida Bar, guardianship proceedings can cost thousands of dollars and involve ongoing court supervision, making a power of attorney a far more practical alternative. In Florida, you must be at least 18 years old and of sound mind to create a valid power of attorney, and the document requires signatures from two competent adult witnesses and a notary public to be enforceable.

Types of Power of Attorney Available to You

Florida recognizes several types of power of attorney, each designed for different situations. A durable financial power of attorney remains in effect even if you become incapacitated, which is why this version works better than non-durable alternatives for most people. A healthcare power of attorney, formally called a designation of health care surrogate under Florida Statutes 765.204, allows your agent to make medical decisions when you cannot communicate your wishes. For specific situations, you can create a limited power of attorney that covers only certain transactions, such as selling a particular property or handling a single banking matter while you travel. Florida also offers specialized forms like the DR-835 for tax matters with the Department of Revenue and a dedicated DMV form for vehicle-related authority.

What Your Agent Can and Cannot Do

Your agent must act as a fiduciary, meaning they are legally bound to act in your best interests and preserve your estate plan. However, your agent cannot vote in public elections, create or revoke your will, or practice law on your behalf. The key to effective power of attorney planning is choosing an agent you trust completely and being explicit about which powers you grant them-whether that includes gifting authority, real estate transactions, or business management. When your agent signs documents on your behalf, they should use proper designation (such as “Agent, attorney-in-fact for [your name]”) to avoid personal liability. Your agent’s fiduciary duty also requires them to keep careful records of all transactions and potentially provide you with an accounting of their actions.

Planning Your Power of Attorney Strategy

Selecting the right agent matters more than most people realize. You want someone who understands your financial goals and approach to money, ideally someone willing to follow your lead rather than impose their own preferences. If your first choice becomes unavailable or incapacitated, you should designate successor agents to maintain continuity. Consider whether you want to limit your agent’s authority in specific ways-for example, excluding the ability to change beneficiaries on your accounts or adding a time limit to their powers. These decisions shape how your agent can act and protect your interests during your lifetime and if incapacity occurs.

How Power of Attorney Works During Your Lifetime

Immediate Financial Authority Your Agent Receives

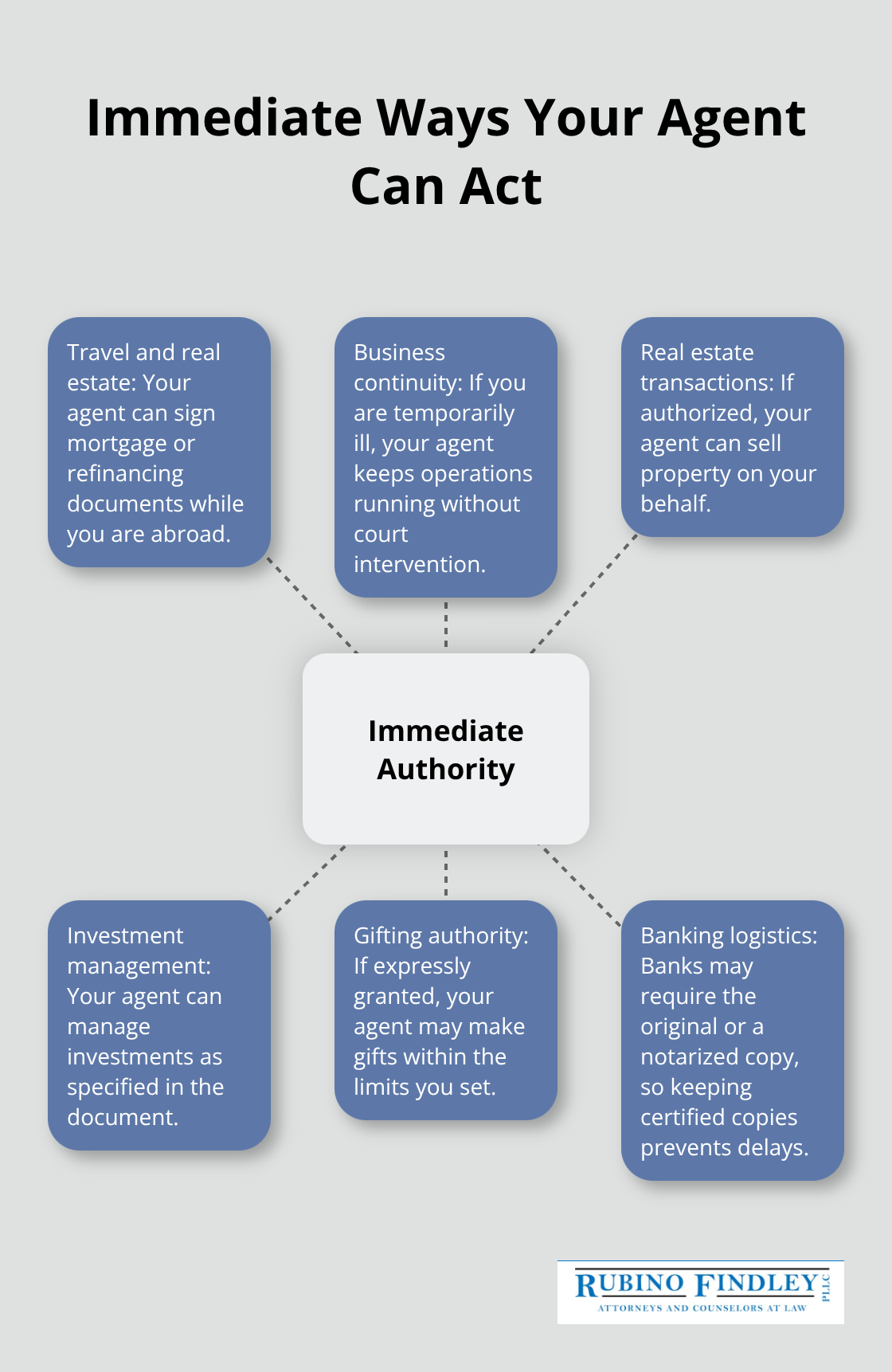

A power of attorney transforms how you handle finances the moment you sign it, giving your chosen agent immediate authority to act on your behalf. This is where the document proves its real value-not in theory, but in everyday situations. When you travel internationally and need to refinance a property, your agent can sign the mortgage documents without you flying home. When you manage a business and become temporarily ill, your financial agent keeps operations running without court intervention.

Florida allows your power of attorney to take effect immediately upon signing under Florida Statutes Chapter 709, meaning your agent can start using these powers right away rather than waiting for a crisis. This immediate effectiveness is why many people in Boca Raton establish their power of attorney years before they might need it-not because they expect incapacity, but because life happens unpredictably. The agent you select must understand exactly which powers you want them to exercise, so clarity in the document matters tremendously. If you want your agent to sell real estate, manage investments, or make gifts, the power of attorney must state this explicitly. Banks and financial institutions often require the agent to present the original or notarized copy of the power of attorney before honoring transactions, so maintaining multiple certified copies in accessible locations prevents delays when your agent needs to act quickly.

Healthcare Decisions Through a Separate Document

Your healthcare agent operates differently than your financial agent, handling medical decisions specifically through a designation of health care surrogate under Florida Statutes 765.204. This agent cannot access your bank accounts or sell your home-they can only make healthcare choices if you cannot communicate your wishes to doctors. This separation of powers protects you because it prevents one person from controlling both your money and your medical care. Many families in Palm Beach County fail to realize that a financial power of attorney does not grant healthcare decision-making authority, so they end up needing two separate documents to cover all scenarios. The healthcare agent’s role activates only when you lack capacity to make medical decisions yourself, giving them authority to discuss treatment options with physicians, approve or refuse medical procedures, and access your health information.

Avoiding Costly Court Intervention

Without a healthcare power of attorney in place, your family faces a difficult situation where doctors cannot discuss your condition with anyone, and major medical decisions require court involvement through guardianship proceedings. According to The Florida Bar, guardianship can take months to establish and costs thousands in legal fees, all while your medical care decisions sit in limbo. A healthcare power of attorney avoids this entirely by giving your agent the legal standing to act immediately. You should name a backup healthcare agent in case your first choice becomes unavailable, ensuring continuity of decision-making without requiring emergency court orders. Communicating your healthcare wishes to your designated agent before a crisis occurs makes their job easier and ensures they understand your values and preferences regarding end-of-life care, organ donation, and other sensitive matters.

Protecting Your Estate During Incapacity

When you become incapacitated without a power of attorney in place, Florida courts may appoint a guardian or conservator to manage your affairs. This court-supervised process removes your ability to choose who controls your finances and healthcare decisions. A durable power of attorney (which remains effective even if you become incapacitated) prevents this outcome by establishing your chosen agent’s authority in advance. Your agent can then manage your property, pay your bills, and handle investments without court approval or ongoing judicial oversight. The fiduciary duty your agent accepts means they must act in your best interests and keep detailed records of all transactions they perform on your behalf.

Coordinating Financial and Healthcare Powers

Your complete power of attorney strategy should address both financial and healthcare needs, with different agents handling each responsibility if you prefer. Some people in Boca Raton name the same trusted person for both roles, while others separate these powers to create additional oversight. The financial agent manages bank accounts, real estate, and investments, while the healthcare agent makes medical decisions and communicates with physicians. This dual-document approach ensures that someone you trust can act immediately in any situation-whether you need property sold, medical treatment approved, or bills paid while you recover from illness or injury. When you work with an estate planning attorney, you can establish both documents together and ensure they work seamlessly with your will and trust.

Power of Attorney Works Alongside Your Estate Plan

How Power of Attorney Fits Into Your Complete Estate Plan

A power of attorney sits at the center of practical estate planning, but most people treat it as separate from wills and trusts when they should work together seamlessly. Your will controls what happens to your assets after you die, your trust manages assets during your lifetime and after death, but your power of attorney handles everything in between-the years when you’re alive but unable to act. This distinction matters enormously because probate, the court process that validates your will and distributes assets, only begins after you die. A durable power of attorney prevents your family from needing court intervention long before probate becomes relevant.

The Cost of Skipping a Power of Attorney

When you become incapacitated without a power of attorney in place, Florida courts must appoint a guardian to manage your finances. According to The Florida Bar, this process costs between $5,000 and $15,000, involves ongoing court supervision, and removes your family’s ability to act quickly. Your power of attorney eliminates this entire problem by authorizing your chosen agent to manage bank accounts, pay bills, refinance property, and handle investments immediately, without any judge’s approval.

The agent operates under fiduciary duty, meaning they must act in your best interests and maintain detailed records of all transactions-protections that guardianship proceedings also require but at a fraction of the cost and complexity.

Funding Your Trust Through Power of Attorney Authority

Your power of attorney also streamlines how assets move into your trust or how your agent implements your broader estate plan during your lifetime. If your estate plan includes a revocable living trust, your power of attorney should explicitly authorize your agent to transfer property into that trust, fund it properly, and maintain continuity if you become unable to manage these tasks yourself. Many families in Boca Raton create a trust but fail to fund it completely, leaving assets in individual names that later require probate anyway-a power of attorney with proper language prevents this gap. Your agent can retitle accounts and property into your trust’s name without court involvement, accomplishing in days what might otherwise require months of probate proceedings after your death.

Coordinating Your Documents for Maximum Protection

The Florida Bar recommends coordinating your power of attorney with your will and trust so all three documents work toward the same goals. This coordination means your agent understands not just what they can do, but how their actions support your overall estate plan and protect your family from unnecessary legal costs. When you work with an estate planning attorney to establish these documents together, you create a comprehensive strategy that addresses incapacity, death, and everything in between. Your agent can implement your estate plan during your lifetime, transfer assets into trusts, and ensure your wishes take effect immediately rather than waiting for court approval or probate proceedings.

Final Thoughts

A power of attorney in estate planning protects your family from financial chaos and medical uncertainty during the years when you’re alive but unable to act. Without this document, your family faces court intervention, thousands in legal fees, and months of delays when decisions need to happen immediately. With one in place, your chosen agent can pay bills, sell property, manage investments, and make medical choices without any judge’s approval.

For Boca Raton residents, the next step is straightforward: review your current estate plan and ask whether you have a durable financial power of attorney and a healthcare power of attorney in place. If you created these documents years ago, they may need updating to reflect changes in Florida law or your family circumstances. If you lack them entirely, establishing them now prevents problems later.

We at Rubino Findley, PLLC help clients throughout Palm Beach County create comprehensive estate plans that include wills, trusts, and durable powers of attorney working together. Schedule your free consultation with Rubino Findley, PLLC to take control of your power of attorney estate planning and protect your family’s interests today.