How to Handle Formal Administration Probate in Florida

Formal administration probate in Florida is a court-supervised process that handles most estates with significant assets or complex circumstances. The process protects creditors, beneficiaries, and heirs while ensuring the estate settles according to Florida law.

At Rubino Findley, PLLC, we guide families through each step of formal administration so nothing falls through the cracks. This guide walks you through what to expect and how to avoid costly mistakes.

What Formal Administration Actually Means

Court Supervision and the Personal Representative

Formal administration is Florida’s court-supervised process for settling most estates with substantial assets or complicated circumstances. Florida law requires an attorney to file the petition-you cannot handle this yourself. The court appoints a personal representative (PR) who gains authority through Letters of Administration, a court order that gives them power to access bank accounts, sell property, and manage estate affairs. This process takes 6 to 18 months on average, though Palm Beach County backlogs can push timelines to 60 to 90 days just to get initial hearings scheduled. The filing fee alone costs $401 under Florida Statute 733.2123, and attorney fees typically range from $3,000 to $8,000 depending on estate complexity and whether disputes emerge.

When Formal Administration Becomes Mandatory

Formal administration becomes mandatory when the estate’s probate assets exceed $75,000, or when the decedent’s will explicitly directs formal administration. If the decedent died less than two years ago and the estate value stays at or below $75,000, summary administration becomes an option instead-a faster, cheaper route that skips many formal requirements. The key difference is court supervision and the appointment of a PR with Letters of Administration. In summary administration, no PR is appointed and no letters are issued, which creates real problems when banks refuse to release funds or the IRS demands information without those letters showing authority.

Protections for All Parties

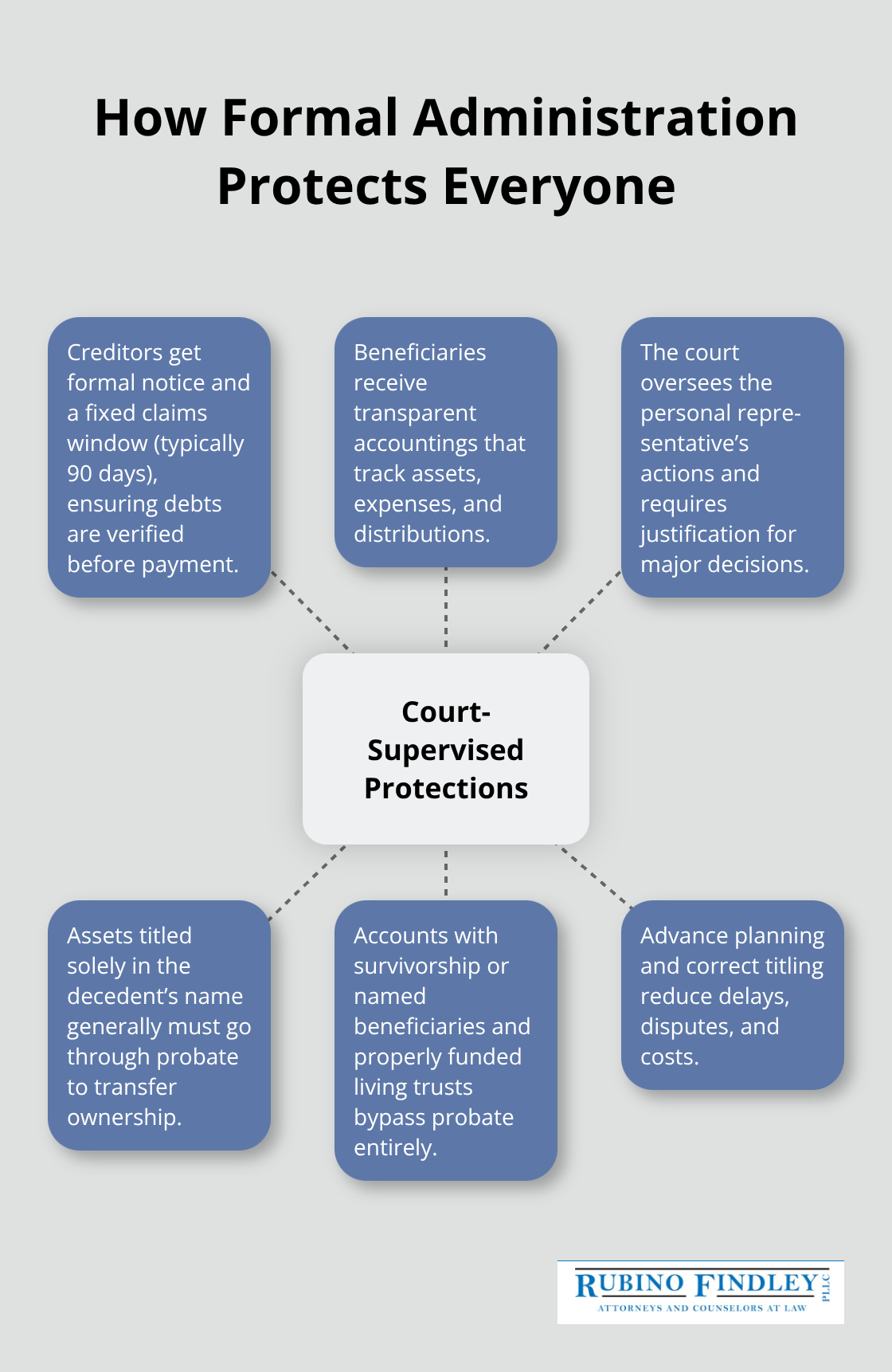

Formal administration protects everyone involved. Creditors receive notice and a deadline to file claims (typically 90 days), beneficiaries receive accountings showing where money went, and the court ensures the PR follows the law.

Assets cannot skip probate if they were titled solely in the decedent’s name without beneficiary designations, payable-on-death clauses, or survivorship language. Joint bank accounts with survivorship, retirement accounts with named beneficiaries, life insurance proceeds, and properly funded living trusts all avoid probate entirely-which is why proper planning before death matters so much.

Required Filings and Court Approval

The PR must file an inventory within 60 days listing all assets with professional appraisals for real estate (typically $300 to $800 per appraisal) and personal property. The PR must publish notice to creditors in a newspaper, arrange for certified mail to known creditors, open a restricted estate bank account, and file detailed accountings before distributing anything to beneficiaries. Will contests happen in roughly 5 to 10 percent of formal probate cases and cost $15,000 to $50,000 in litigation expenses when they do. Asset valuation disputes are common, especially for closely held businesses where appraisals can run $5,000 to $15,000. The court supervises every major decision-selling property worth more than $15,000 requires court approval, and the PR cannot simply hand out money without documented justification. These requirements create friction points where disputes arise and timelines extend, which is why understanding what comes next in the process helps you prepare for the challenges ahead.

Steps From Filing to Final Distribution

Filing Your Petition and Obtaining Letters of Administration

You must submit the original will, a certified death certificate, and the petition to the circuit court clerk along with a $401 filing fee under Florida Statute 733.2123. The court typically schedules your initial hearing 30 to 45 days after filing, though Palm Beach County backlogs often push this to 60 days or longer during peak periods. Once the judge approves your petition, the court issues Letters of Administration-the document that gives your personal representative the legal authority to access bank accounts, manage property, and conduct estate business. Banks will refuse to release funds without it, and the IRS will not respond to inquiries from anyone lacking these letters. Within 10 days of receiving Letters, you must deposit the original will with the clerk if it hasn’t been filed already; no fee applies to this deposit.

Meeting the Critical 60-Day Inventory Deadline

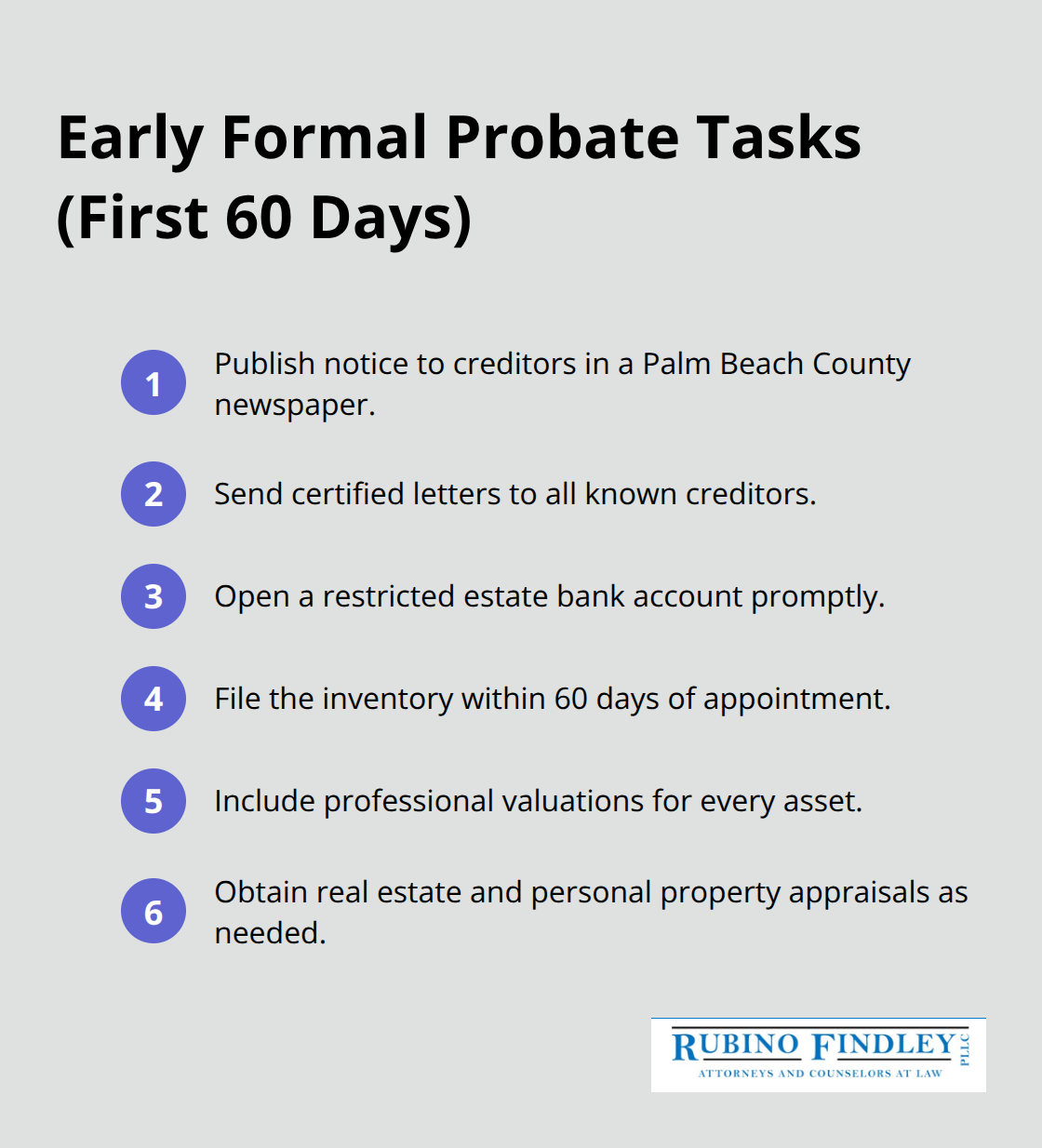

Your PR faces a compressed timeline immediately after appointment. You must publish notice to creditors in a Palm Beach County newspaper, send certified letters to known creditors, and open a restricted estate bank account. The inventory must be filed within 60 days of appointment and must list every asset with professional valuations.

Real estate appraisals typically cost $300 to $800 each, and personal property appraisals for antiques or collectibles can run $500 to $2,000 per item. Missing this deadline creates serious problems-the court can impose sanctions, and beneficiaries may challenge the PR’s authority to continue managing the estate.

Managing Creditor Claims and Verification

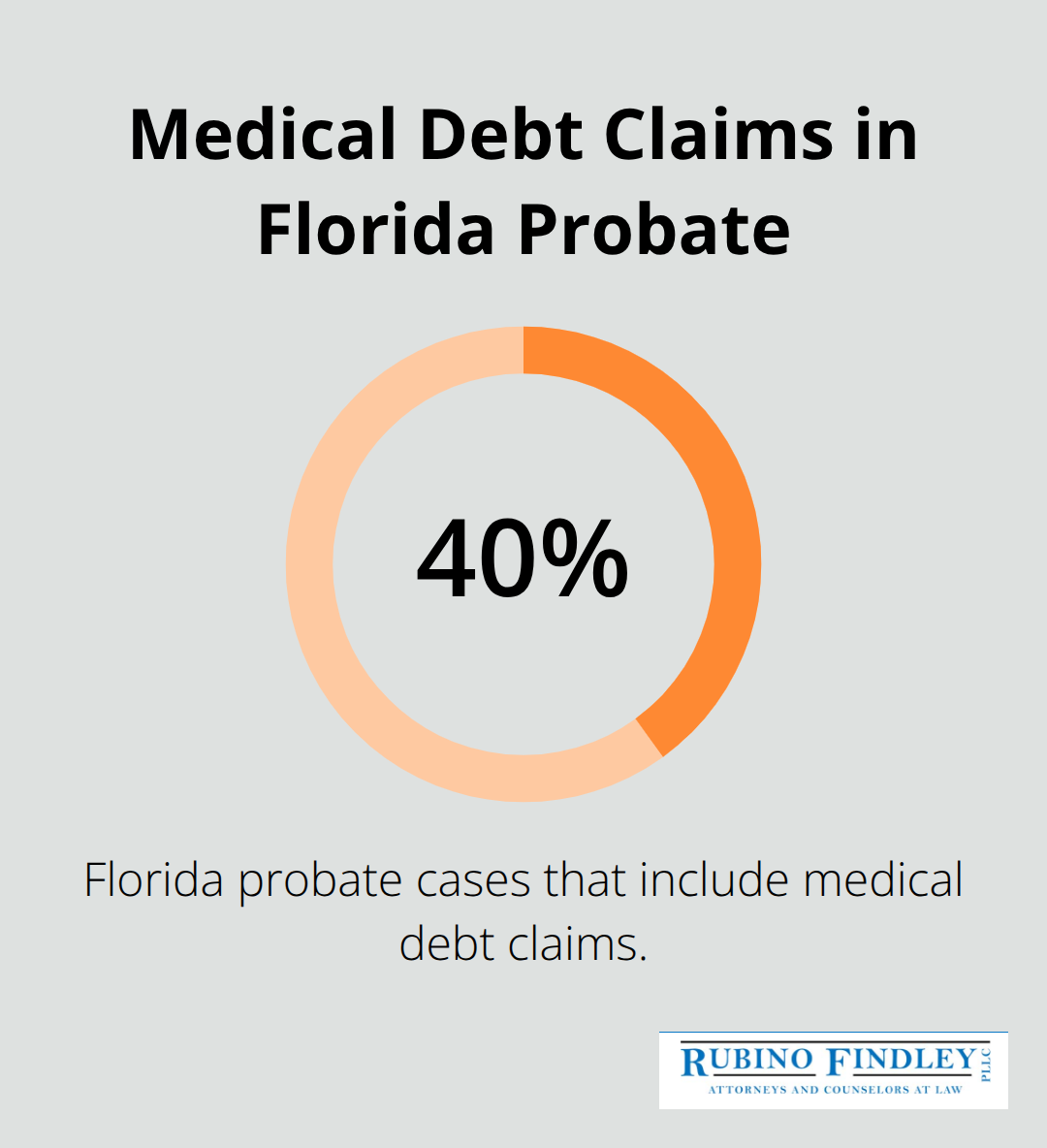

Creditors have 90 days from the publication date to file claims, and this three-month window is critical. Known creditors who receive direct notice have a hard deadline, while unascertainable creditors (those found through publication) have approximately three months. You must review every claim carefully; credit card companies frequently file claims without proper documentation, and life insurance beneficiary disputes happen regularly. Medical debt claims appear in roughly 40 percent of Florida probate cases, so verify that medical expenses are legitimate and not already covered by insurance before you pay them. Challenge questionable claims within the 90-day period to protect estate assets from improper deductions.

Obtaining Court Approval for Asset Sales and Distributions

You must file detailed accountings showing every transaction, asset sale, and creditor payment before you make any distributions to beneficiaries. The court supervises major decisions-selling real property worth more than $15,000 requires court approval, and your PR cannot liquidate assets without documented justification. Prepare final tax returns including Form 1040 for the decedent’s final year, Form 1041 for estate income, and potentially Form 706 for federal estate tax if the estate exceeds current exemption limits. Coordinate with a tax professional or CPA because tax mistakes can trigger IRS penalties and extend the probate timeline significantly. Once all debts, taxes, and creditor claims are paid and the court approves your final accounting, you can distribute remaining assets to beneficiaries according to the will or Florida intestacy law.

Understanding Timeline Variations and Complexity Factors

The entire process typically takes 6 to 18 months, though complex estates with disputes or asset valuation disagreements can stretch to two years or beyond. Will contests happen in roughly 5 to 10 percent of formal probate cases and cost $15,000 to $50,000 in litigation expenses when they do. Asset valuation disputes are common, especially for closely held businesses where appraisals can run $5,000 to $15,000. Each complication-contested claims, business valuations, or beneficiary disagreements-adds months to your timeline and increases costs. The next chapter covers the common challenges that arise during formal administration and practical strategies to avoid them before they derail your estate settlement.

What Derails Formal Probate in Boca Raton and How to Stop It

Missing Deadlines Creates Irreversible Problems

Formal probate fails not because of complex law but because deadlines slip, stakeholders clash, and asset complications snowball. The 60-day inventory deadline triggers court sanctions and opens the door for beneficiaries to challenge the personal representative’s authority to continue if you miss it. The 90-day creditor claims window is equally punishing-let it pass and you forfeit the right to object to questionable claims later, meaning credit card companies file unsupported charges, medical providers inflate bills, and life insurance beneficiary disputes go uncontested. Palm Beach County’s court backlogs mean your hearing might land 60 to 90 days after filing, but your internal deadlines do not shift. Many personal representatives treat these dates as suggestions rather than hard stops, then scramble when the court rejects late filings.

The inventory must include professional appraisals for real estate (typically $300 to $800 per property) and personal property, especially antiques or collectibles ($500 to $2,000 each). Skipping appraisals or submitting rough estimates invites disputes later-beneficiaries challenge low valuations to claim larger distributions, creditors challenge high valuations to justify larger claims, and the entire estate stalls while appraisers revisit their work. Your notice to creditors must appear in a newspaper, not just get mailed; the clerk no longer publishes notices for non-indigent parties, so you arrange publication yourself and file proof with the court. Miss this step and creditors argue they never received proper notice, potentially reopening claims after distributions have already occurred.

Beneficiary Disputes and Valuation Conflicts

Disputes among beneficiaries and heirs explode when the personal representative plays favorites or fails to communicate transparently. Will contests occur in 5 to 10 percent of formal probate cases according to Florida Bar statistics, and litigation costs $15,000 to $50,000 when they do. Asset valuation disagreements are the real culprit though-when a closely held business or rental property must be appraised, heirs often disagree on value because the appraisal directly affects their inheritance. A business valued at $500,000 versus $750,000 changes distributions dramatically, and multiple heirs suddenly demand independent appraisals costing $5,000 to $15,000 each.

Obtain a single, credible appraisal early and share the methodology with beneficiaries before disputes harden. Medical debt claims appear in roughly 40 percent of Florida probate cases, and this is where active verification saves money. A hospital claims $25,000 in medical expenses but insurance covered $18,000-challenge the claim before the 90-day window closes. Credit card issuers file claims without documentation routinely; demand proof of the balance and interest calculation, then object to anything unsupported.

Coordinating Multiple Professionals and Asset Types

Complex estates with investment accounts, rental properties, or business interests require coordination across multiple professionals. A CPA handles tax returns (Form 1040, Form 1041, potentially Form 706), a real estate agent lists properties for sale, a securities broker liquidates investments, and the personal representative must synchronize their actions. Sell real estate at the wrong time and you miss market conditions; liquidate investments in the wrong order and you trigger capital gains taxes unnecessarily; file taxes late and the IRS adds penalties.

Document every decision and share accountings with beneficiaries monthly rather than waiting until the end-interim accountings surface disagreements early when you can still adjust course rather than discovering conflict after final distributions have been made. This proactive approach prevents the cascading problems that turn a straightforward six-month probate into an 18-month nightmare.

Final Thoughts on Formal Administration Probate in Florida

Formal administration probate in Florida demands precision, timing, and knowledge of court procedures that trip up most people handling this alone. The 60-day inventory deadline, the 90-day creditor claims window, and the requirement for court approval on major asset sales are not flexible. Missing any of these creates irreversible consequences-sanctions from the judge, challenges to the personal representative’s authority, or claims that should have been contested slipping through unchallenged.

The real cost of handling formal administration without guidance extends far beyond the filing fee or appraisal expenses. Disputes over asset valuations add months to your timeline, will contests cost $15,000 to $50,000 in litigation expenses, and creditor claims slip past your objection window because you did not know the rules. Beneficiaries clash over business valuations that swing $250,000 in either direction while credit card companies file unsupported claims and medical providers inflate bills.

We at Rubino Findley, PLLC guide families through formal administration so nothing falls through the cracks. Our team handles court filings, coordinates with appraisers and tax professionals, manages creditor claims, and keeps beneficiaries informed at every step. Contact our team in Boca Raton to discuss your formal administration probate situation and explore your options.