Typical Estate Planning Fees: What to Expect

Estate planning doesn’t have to be expensive, but many people avoid it because they don’t understand typical estate planning fees. The cost varies widely depending on your situation, location, and what documents you actually need.

At Rubino Findley, PLLC, we help families in Palm Beach County understand exactly what they’ll pay and why. This guide breaks down the real numbers so you can plan your estate without surprises.

What Drives Estate Planning Costs

Estate Complexity and Asset Structure

Your estate planning bill depends on three major factors that work together to determine what you’ll actually pay. The size and complexity of your assets matter significantly-someone with a single home, a checking account, and basic beneficiaries will pay far less than someone managing rental properties, investment portfolios, and business interests. If you own property in multiple states, costs climb because you need additional documents to avoid probate in each jurisdiction.

A revocable living trust in Florida typically costs $1,000–$3,000 when your situation is straightforward, but specialized structures like irrevocable trusts or special needs trusts run $2,000–$5,000 or more due to their complexity.

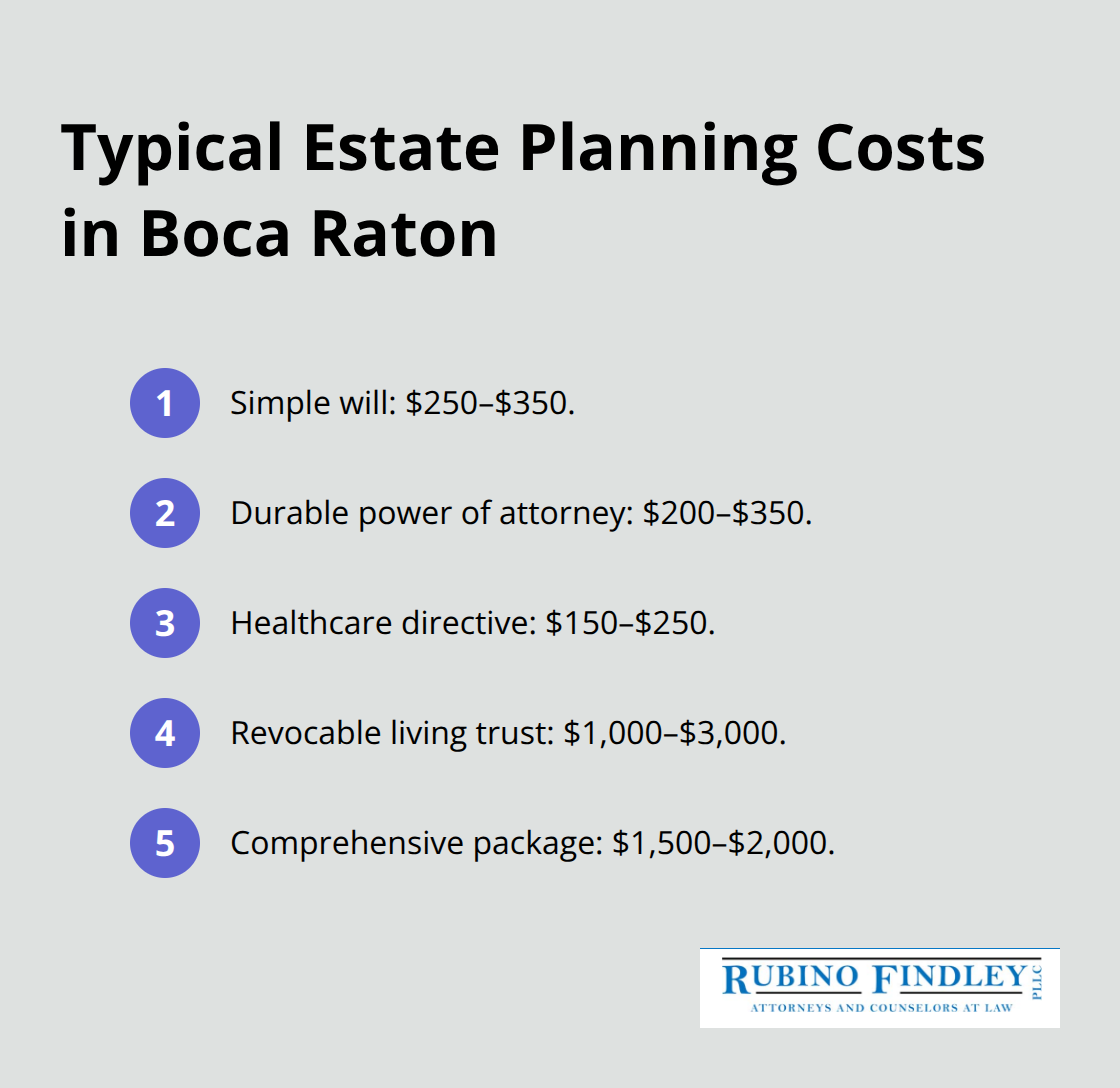

Document Types and Package Options

The type of documents you need shifts your bill considerably. A simple will alone costs $250–$350 in Boca Raton, while a durable power of attorney adds $200–$350, and a healthcare directive runs $150–$250. Most people benefit from bundling these documents together-a comprehensive package combining a will, living trust, power of attorney, and healthcare directives costs roughly $1,500–$2,000 and delivers better value than purchasing each separately.

Location and Attorney Rates

Attorney rates in Boca Raton typically range $250–$350 per hour, with flat-fee packages common for standard services. Geographic variations exist-larger metropolitan areas tend toward higher rates, but the real cost driver is attorney quality and Florida law experience, not zip code. When you meet with an attorney, come prepared with a complete list of assets, debts, property deeds, and account information; this preparation reduces billable hours and keeps your final bill lower.

Understanding these three factors positions you to evaluate fee structures that attorneys in your area actually use.

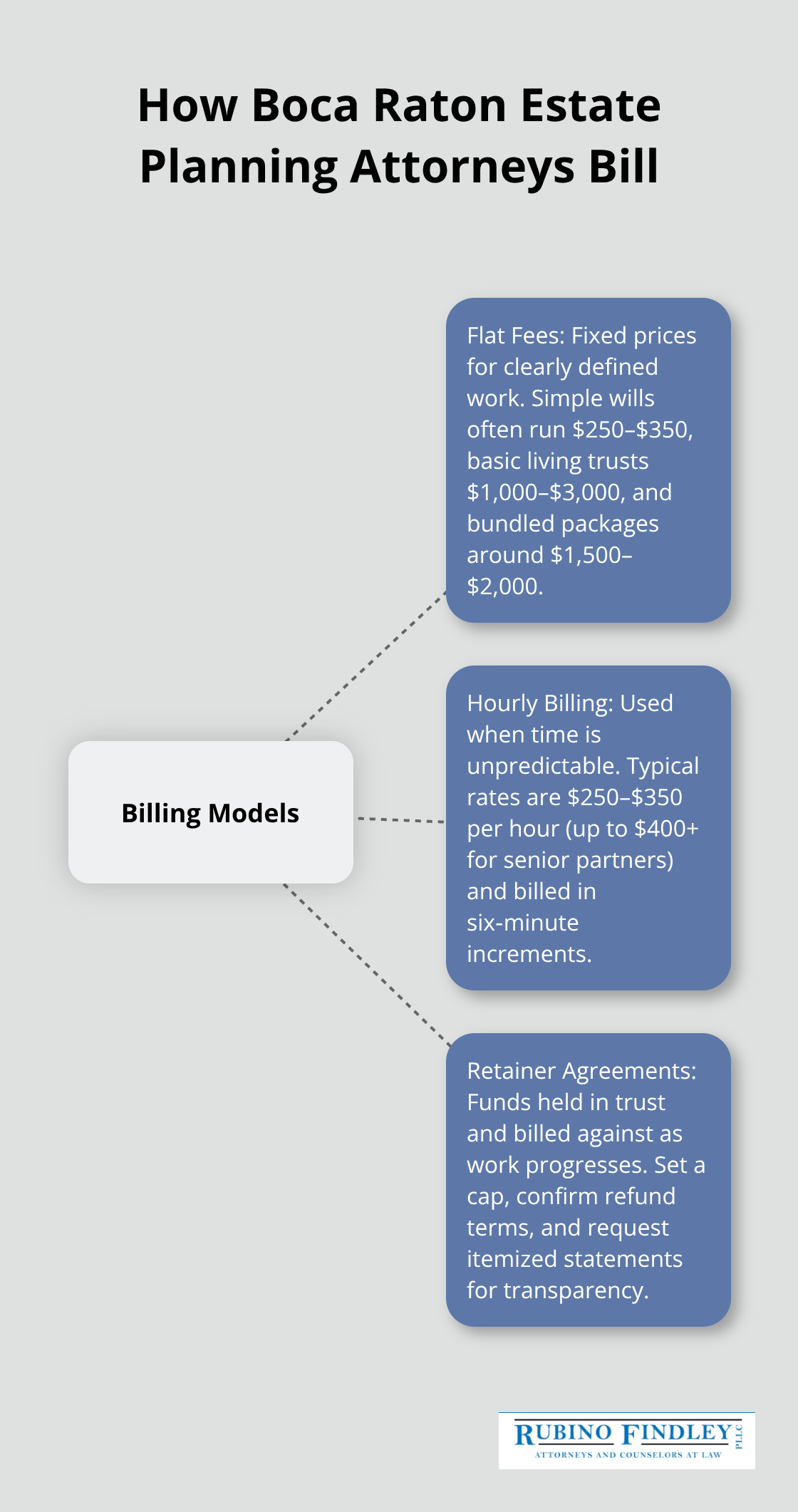

How Attorneys in Boca Raton Bill for Estate Planning

Flat Fees for Straightforward Work

Attorneys in Boca Raton use three main billing models, and understanding which one applies to your situation prevents sticker shock. Flat fees dominate for straightforward work-a simple will costs $250–$350, a basic living trust runs $1,000–$3,000, and bundled packages combining a will, trust, power of attorney, and healthcare directive cost around $1,500–$2,000. These fixed prices work because the scope is clear and the attorney knows exactly how many hours the work requires. You know your total cost before signing the engagement letter, which eliminates surprises. Many firms in Boca Raton now offer flat-fee packages specifically because clients value cost certainty, and these packages almost always deliver better value than purchasing documents separately.

Hourly Billing for Complex Situations

Hourly billing enters the picture when your estate involves complications that make time unpredictable. Attorneys in Boca Raton charge $250–$350 per hour for standard estate planning work, though rates can reach $400 or higher for senior partners handling intricate tax issues or multi-state property situations. According to The Florida Bar, a basic will typically requires 3–5 hours of attorney time, while complex estates with trusts and tax planning can consume 10–20 hours or more. You bill in six-minute increments, so every phone call, document review, and revision adds up. This model protects you when the scope shifts unexpectedly, but it also means your final bill remains uncertain until the work concludes.

Retainer Agreements and Cost Control

Retainer agreements sit between flat fees and hourly billing-the attorney holds money in a trust account and bills against it as work progresses. This structure protects both sides: you have a cost ceiling if you set a retainer cap, and the attorney has guaranteed payment. Never accept a nonrefundable retainer without a clear written explanation of what you’re paying for upfront; The Florida Bar warns that nonrefundable retainers are earned immediately and may not be held in trust, which creates risk if the attorney underestimates the work.

Ask upfront whether unused retainer funds get refunded and request an itemized bill showing exactly how hours were spent.

Preparation Reduces Your Bill

Before meeting with any attorney in Boca Raton, prepare a complete asset inventory, list of debts, property deeds, and account information. This single step can cut billable hours by 30–40 percent and is the fastest way to lower your total cost without sacrificing quality. Organized clients move through the process faster, which means attorneys spend less time hunting for information and more time on actual planning work. Your preparation directly translates to savings on your final invoice.

The billing model you choose shapes not only what you pay but also how much control you maintain over costs. Once you understand these three approaches, you’re ready to evaluate what documents your specific situation actually requires.

What Estate Planning Actually Protects

A proper estate plan stops guesswork and prevents your family from facing costly legal battles when they should be grieving. Without one, Florida intestacy laws dictate who inherits your assets, courts decide guardianship for minor children, and probate costs drain $2,000–$6,000 from your estate before your heirs see a dime. The documents you invest in now become instructions that eliminate uncertainty and reduce the time your family spends in court. When you work with an experienced estate planning attorney in Boca Raton, you establish wills, trusts, durable powers of attorney, and healthcare directives that address exactly what happens to your property, accounts, and family decisions. This isn’t theoretical protection-it’s concrete legal machinery that functions when you cannot.

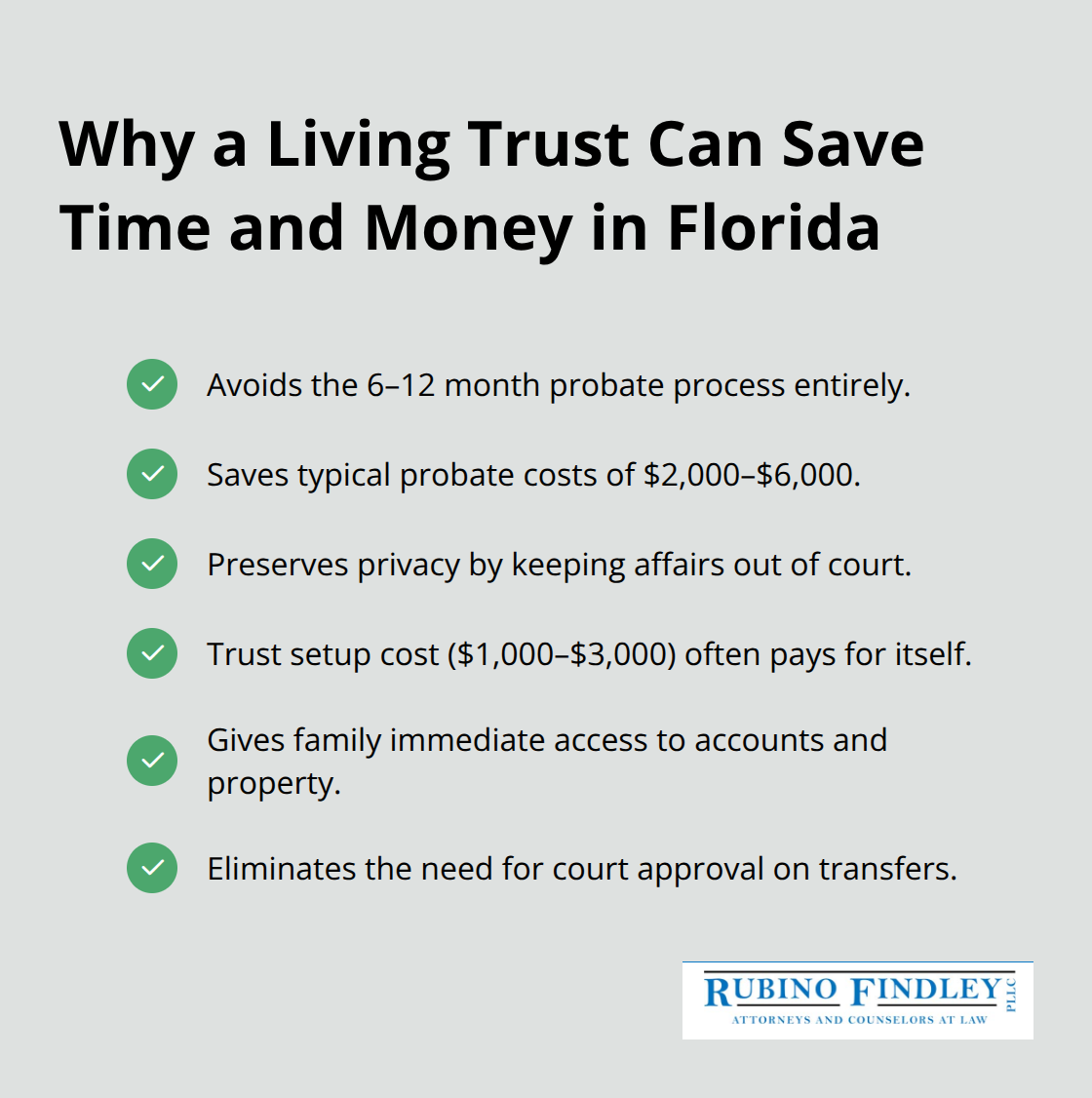

Avoid Probate Delays and Expense

A revocable living trust sidesteps probate entirely, which means your family avoids the 6–12 month court process and keeps more money in the estate. Probate in Florida typically costs $2,000–$6,000 depending on estate size and complexity, but a properly funded trust eliminates those fees and keeps your affairs private. The upfront cost of a living trust ($1,000–$3,000) pays for itself the moment probate is avoided. Your family gains immediate access to accounts and property without waiting for court approval, and they don’t inherit a legal nightmare alongside their inheritance.

A durable power of attorney ($200–$350) and healthcare directive ($150–$250) handle decisions if you become incapacitated before death, preventing family conflict and court intervention for medical or financial matters. These documents work together to protect your interests across every scenario life presents.

Clear Decisions Prevent Family Disputes

Documented instructions eliminate the worst-case scenario where family members disagree about your wishes and end up in litigation. Disputes over who inherits what, who manages the estate, or who should have made healthcare decisions cost families thousands in legal fees and emotional damage. A written estate plan with specific language about asset distribution, guardianship for minor children, and end-of-life preferences removes ambiguity.

Your children know exactly what you wanted, your executor knows their responsibilities, and your healthcare agents know your medical values. This clarity protects relationships that matter far more than the money itself-siblings don’t fight over interpretations when your intentions are spelled out in legal documents. Experienced estate planning attorneys in Boca Raton understand how to draft language that withstands challenges and reflects your actual values.

Final Thoughts

Estate planning costs vary based on your assets, the documents you need, and where you live, but the investment protects far more than money. A simple will runs $250–$350, while a comprehensive package with trust, power of attorney, and healthcare directives costs $1,500–$2,000. These typical estate planning fees remain modest compared to the $2,000–$6,000 your family could lose to probate without proper planning.

Working with an attorney in Boca Raton matters because Florida law has specific requirements for valid wills, trusts, and powers of attorney. An attorney ensures your documents meet those requirements, reflect your actual intentions, and hold up if challenged. You also gain someone who identifies tax-saving opportunities and structures your plan around your unique situation rather than forcing you into a template.

Start your estate plan by gathering your asset list, property deeds, account information, and beneficiary preferences, then schedule a consultation with our team. We at Rubino Findley, PLLC help families throughout Palm Beach County establish wills, trusts, durable powers of attorney, and healthcare directives that actually work when needed.