Estate Planning for Married Couples: A Complete Guide

Marriage brings shared dreams and combined assets. Without proper planning, your spouse and children could face unnecessary delays, taxes, and legal complications if something happens to you.

Estate planning for married couples isn’t about being pessimistic-it’s about protecting what you’ve built together. At Rubino Findley, PLLC, we help couples in Boca Raton create clear plans that reflect their wishes and safeguard their family’s future.

Why Married Couples Need Estate Planning

State Law Decides Your Family’s Future Without a Plan

Without an estate plan, state law decides what happens to your assets and who raises your children if both spouses die. In Florida, intestacy laws distribute your property according to a formula that may not match your wishes. If you have minor children and no designated guardians, the court appoints someone to raise them-possibly a relative you wouldn’t have chosen. Your spouse doesn’t automatically inherit everything either. Under Florida law, if you die without a will or trust, your spouse receives only a portion of your estate while your children receive the remainder, creating unnecessary complexity and potential family conflict.

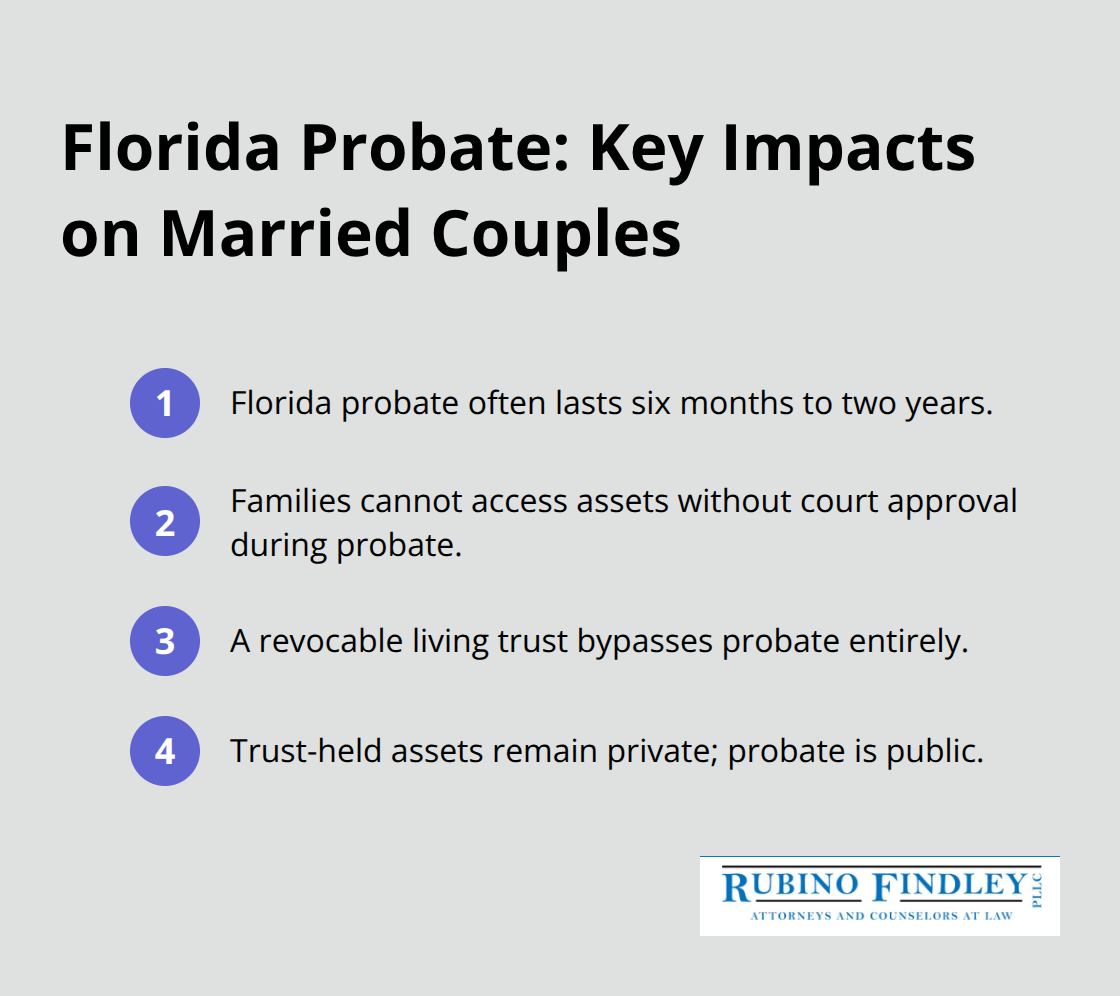

Probate Delays Cost Time and Money

Probate in Florida typically takes six months to two years, depending on estate complexity. During this time, your family cannot access assets to pay bills, maintain property, or cover living expenses without court approval. A revocable living trust bypasses probate entirely, allowing your spouse immediate access to funds and property. Your assets remain private when held in a trust, whereas probate proceedings become public record.

This privacy matters, especially for couples with significant wealth or blended families.

Beneficiary Designations Create Hidden Problems

Without proper beneficiary designations on retirement accounts and life insurance policies, these assets may pass through probate or go to unintended recipients, triggering unnecessary taxes and delays. A coordinated estate plan aligns beneficiary designations with your overall strategy. For married couples with blended families, significant assets, or complex financial situations, the stakes are even higher.

Incapacity Planning Protects Your Spouse

A properly structured plan (using trusts, powers of attorney, and healthcare directives) gives your spouse authority to manage finances and medical decisions if you become incapacitated, avoiding costly guardianship proceedings. Without these documents in place, your spouse may face court intervention to make decisions on your behalf. This is why married couples in Palm Beach County need a clear plan in place before a crisis occurs.

An experienced estate planning attorney from Rubino Findley, PLLC in Boca Raton can help you establish the documents and strategies that address these real risks and protect what you’ve built together. The next section covers the specific documents that form the foundation of a strong estate plan.

Key Estate Planning Documents for Married Couples

Start With a Revocable Living Trust

A revocable living trust forms the foundation of modern estate planning for married couples. Unlike a will, which only takes effect after death and must pass through probate, a revocable living trust operates during your lifetime and transfers assets outside the probate system entirely. Florida law allows you to fund a revocable trust with bank accounts, real estate, investment accounts, and personal property. Your spouse can access these assets immediately after your death without court involvement. The trust also provides instructions for what happens if you become incapacitated, giving your spouse the authority to manage finances without a guardianship proceeding.

Catch Assets With a Pour-Over Will

A pour-over will works alongside your trust to catch any assets you forgot to transfer into the trust during your lifetime. This document ensures nothing falls through the cracks when you pass away. For married couples with children, your will also serves another critical function: designating guardians. Without this document, Florida courts decide who raises your children if both spouses die, which may not align with your preferences.

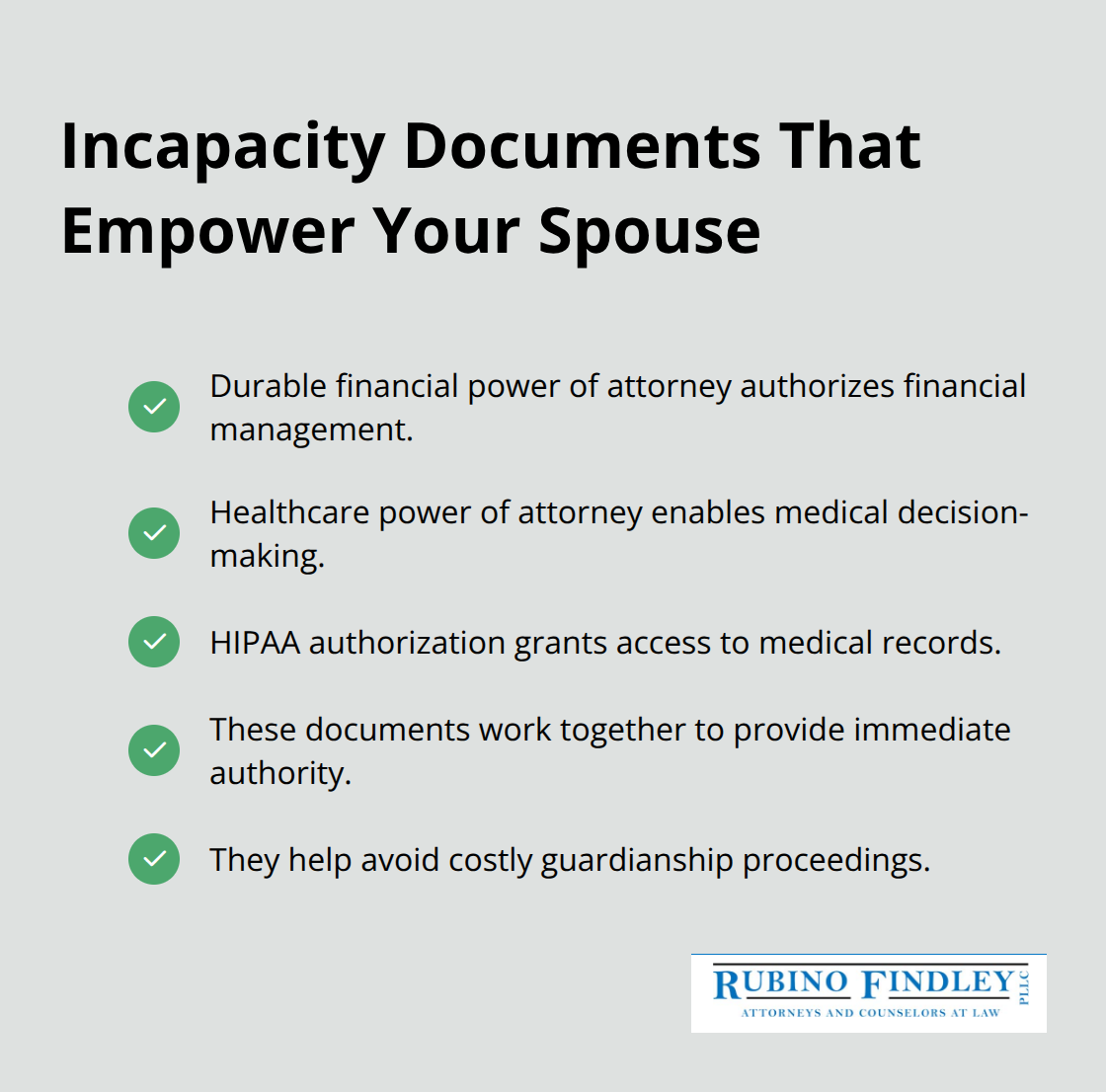

Authorize Your Spouse During Incapacity

A durable financial power of attorney and healthcare power of attorney round out your essential documents. The financial power of attorney authorizes your spouse to manage bank accounts, pay bills, and handle investments if you become unable to do so. This step avoids expensive and time-consuming guardianship court proceedings. A healthcare power of attorney gives your spouse authority to make medical decisions on your behalf if you cannot communicate your wishes. A HIPAA authorization allows your spouse to access your medical records and information. These three documents work together to ensure your spouse has immediate authority during any incapacity without waiting for court approval.

Align Beneficiary Designations With Your Plan

Married couples in Palm Beach County should review beneficiary designations on retirement accounts and life insurance policies to verify they align with your overall estate plan. These designations override what’s written in your will or trust, so misaligned designations can redirect assets away from your intended heirs. Coordinating all these documents creates one cohesive strategy rather than separate pieces that work against each other. The next section addresses common mistakes that married couples make when they fail to keep these documents current and aligned with their changing circumstances.

Common Estate Planning Mistakes Married Couples Make

Outdated Documents Destroy Your Plan

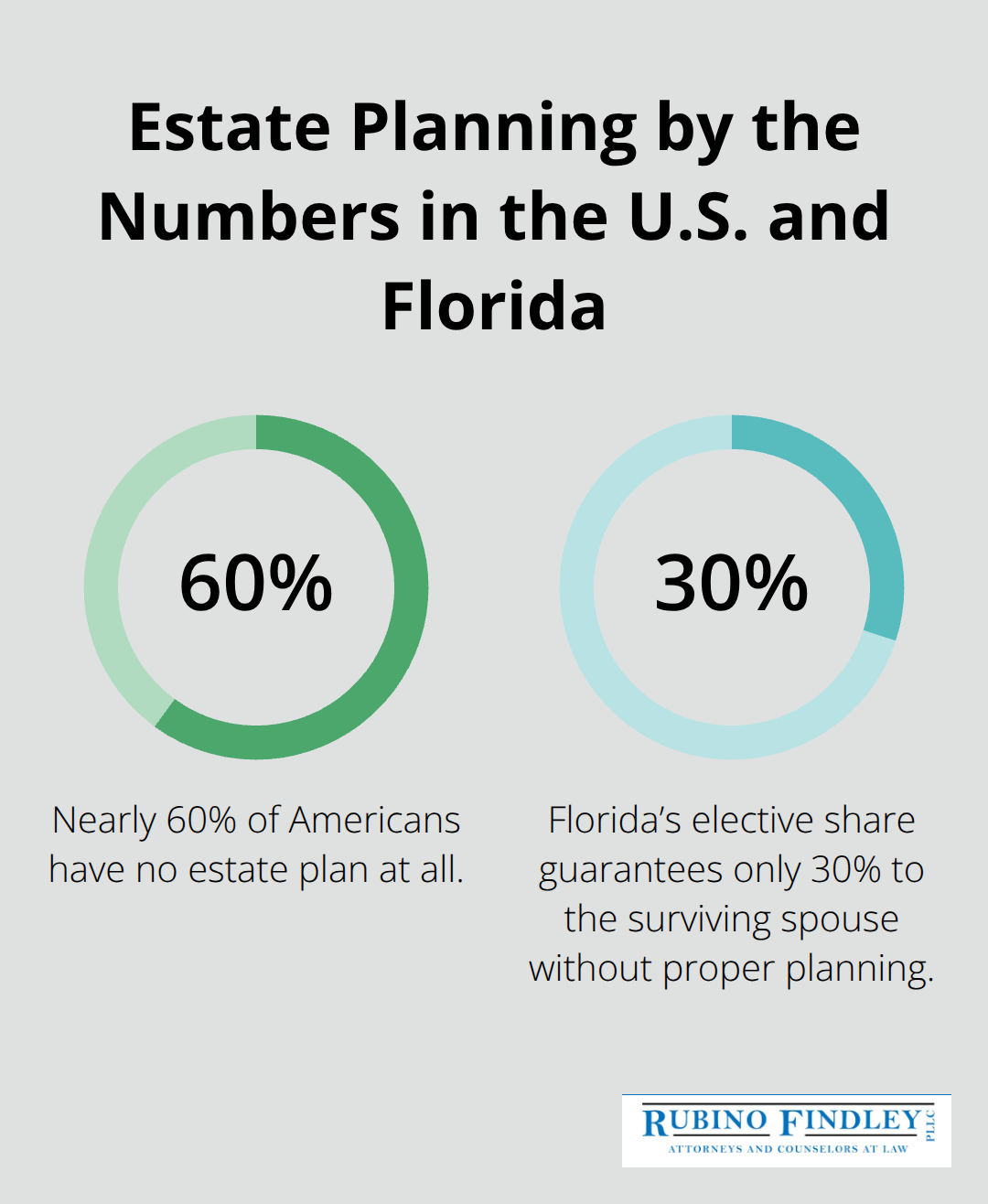

Most married couples create an estate plan and then ignore it. Life happens-you get promoted, inherit money, buy a second home, have children, or experience a major financial shift. Meanwhile, your estate plan sits in a drawer growing outdated. According to the American Academy of Estate Planners and Councils, nearly 60% of Americans have no estate plan at all, and of those who do, the vast majority fail to update their documents within five years.

For married couples, this negligence creates real problems. If you named your spouse as beneficiary on a life insurance policy ten years ago but never updated it after a divorce and remarriage, that outdated designation controls where the money goes, regardless of what your current will says. Your ex-spouse could receive hundreds of thousands of dollars while your current spouse receives nothing.

Beneficiary Designations Override Everything Else

Life insurance, retirement accounts, and payable-on-death accounts bypass your will entirely and go directly to whoever you named years ago. Florida law treats these designations as contracts that override everything else in your estate plan. Many couples also assume their spouse automatically inherits everything, but Florida Statute § 732.201 actually guarantees your surviving spouse only 30% of your elective estate if you die without proper planning. The remaining 70% goes to your children or other heirs according to state law, creating exactly the kind of family conflict and legal complexity that estate planning should prevent.

A revocable living trust solves this problem because it operates outside the statutory formulas and gives you complete control over distributions.

Tax Planning Gaps Leave Heirs With Unnecessary Bills

The most expensive mistake married couples make is overlooking tax planning. Florida has no state estate tax, but federal estate taxes apply to estates exceeding $13.61 million in 2024, and this threshold decreases each year. If you and your spouse have significant assets, a poorly structured plan could leave your heirs paying unnecessary federal taxes.

A Qualified Terminable Interest Property trust (QTIP trust) lets you provide for your surviving spouse during life while directing assets to your children from a previous marriage, avoiding both unnecessary taxes and family disputes. Without this structure, your surviving spouse might inherit everything, leaving nothing for your adult children, or your spouse might receive too little.

Update Your Plan on Schedule

The solution is straightforward: review your entire estate plan every two to five years or immediately after major life events like marriage, divorce, the birth of children, significant asset changes, or relocation. Schedule time with an experienced estate planning attorney from Rubino Findley, PLLC in Boca Raton to verify that all beneficiary designations align with your current wishes and that your trust and will work together as one cohesive plan. This coordination prevents the disasters that destroy families and waste assets on unnecessary probate and taxes.

Final Thoughts

Estate planning for married couples requires five essential steps: identify your goals, inventory your assets, designate beneficiaries and trustees, create the necessary documents, and update your plan regularly. Your revocable living trust, pour-over will, powers of attorney, and healthcare directives form the foundation of protection. Beneficiary designations on retirement accounts and life insurance must align with these documents, or they override your intentions entirely.

Working with an experienced estate planning attorney from Rubino Findley, PLLC in Boca Raton gives your family real protection. We help couples throughout Palm Beach County establish wills, trusts, and durable powers of attorney tailored to your specific situation. Our team understands Florida law and the unique challenges married couples face, especially those with blended families or significant assets.

The next step is straightforward: reach out to schedule your free consultation. Bring your asset inventory and a list of your goals for your spouse and children, and we will review your current situation, identify gaps in your protection, and explain exactly what documents you need. Estate planning is never too early to start.