How to Create Special Needs Estate Planning That Works

Families with special needs members face unique challenges that standard estate plans simply don’t address. A missed detail or wrong decision can leave your loved one vulnerable when you’re no longer able to provide care.

Special needs estate planning requires specific tools and strategies designed to protect your child or family member while preserving their government benefits. At Rubino Findley, PLLC, we help families in Palm Beach County, Florida build plans that actually work for their situation.

What Makes Special Needs Planning Different

Special needs estate planning addresses a reality that standard wills and trusts ignore: your loved one receives government benefits like SSI and Medicaid that could disappear if they inherit money directly. Federal law caps SSI resource limits at $2,000, and Medicaid has similar thresholds. A straightforward inheritance pushes most beneficiaries over these limits immediately, disqualifying them from benefits and forcing them to spend down assets on care costs that public programs would otherwise cover.

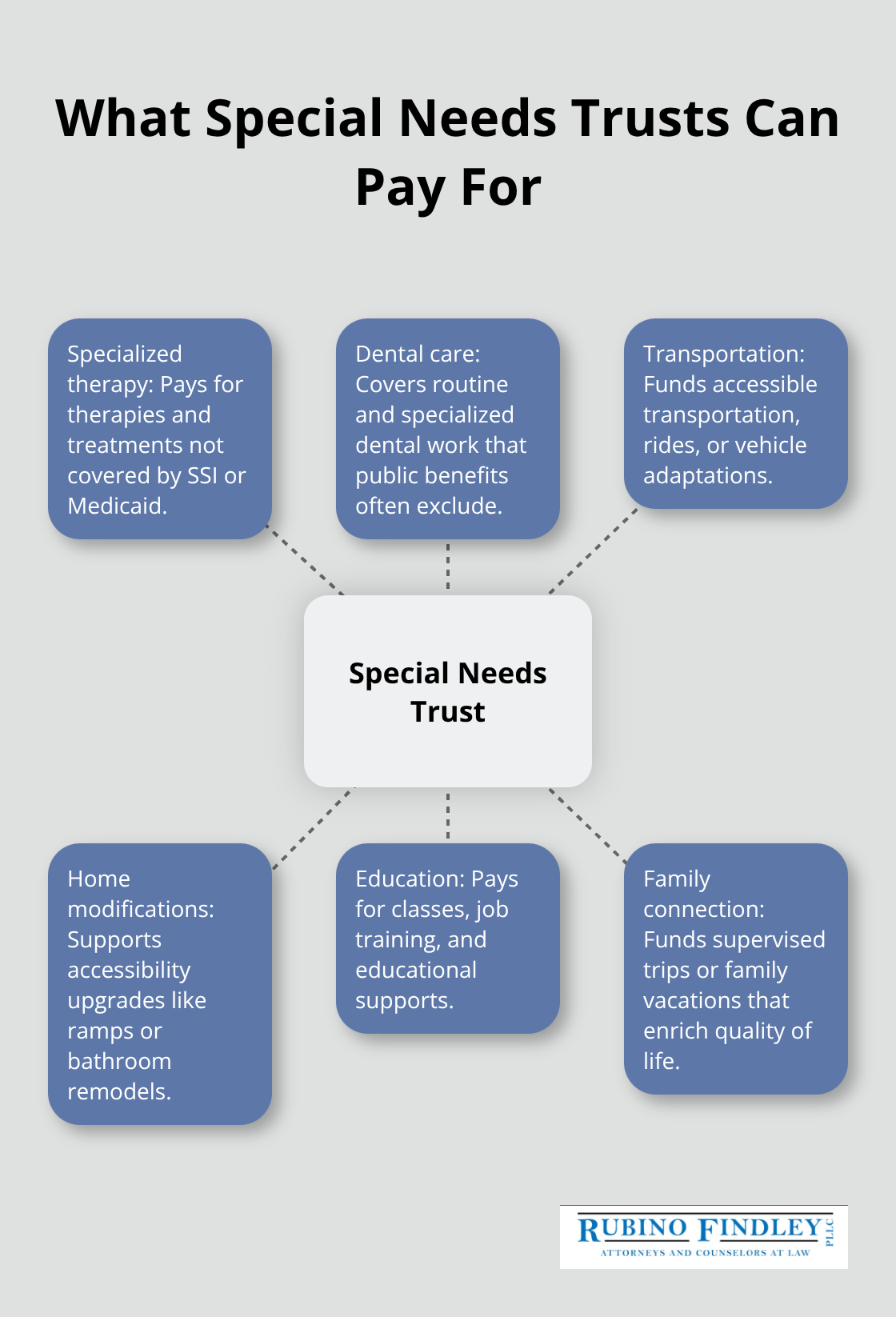

This outcome is not a minor inconvenience-it fundamentally changes the quality of life for someone with a disability. Special needs planning uses trusts structured specifically to hold assets on behalf of your family member without triggering benefit loss. The trustee controls distributions, paying for needs that government programs don’t cover: specialized therapy, dental work, transportation, home modifications, education, or family vacations.

The Legal Framework in Florida

Florida Statutes 732.2025(8) recognizes supplemental needs trusts as a legitimate planning tool, giving families a legal framework to work within. Your plan must also account for who makes decisions if you cannot-both financial decisions through a durable power of attorney and healthcare decisions through a healthcare directive. Standard estate plans typically name a single successor or assume adult children will manage affairs.

Special needs situations demand clearer succession planning because a trustee must understand both the beneficiary’s disability and the intricate rules governing government benefits. Many families discover too late that their chosen trustee lacks knowledge about SSI resource limits or Medicaid planning, leading to accidental disqualifications that take months to remedy.

Why Leaving Assets Directly Fails

Passing assets directly to a child with special needs through a will or joint account sounds straightforward but creates a financial crisis. The beneficiary receives a lump sum and immediately loses eligibility for means-tested benefits. SSI stops. Medicaid stops. Suddenly your family member must use their inheritance to pay for nursing home care, personal attendants, medications, and other expenses that Medicaid previously covered.

A $150,000 inheritance disappears within two to three years in a nursing facility, leaving nothing for supplemental needs. Special needs trusts prevent this by keeping assets titled in the trust’s name, not the beneficiary’s. Distributions come from the trustee, who pays vendors and service providers directly rather than handing money to your family member. This structure preserves benefit eligibility while extending asset longevity substantially-sometimes by decades.

Moving Forward With Your Plan

The difference between a standard estate plan and a special needs plan comes down to structure and knowledge. Your trustee needs training on benefit rules, your documents must reflect your family’s specific situation, and your assets must be titled correctly from the start. Without these elements in place, even well-intentioned plans fail to protect your loved one.

Key Documents and Tools for Special Needs Planning

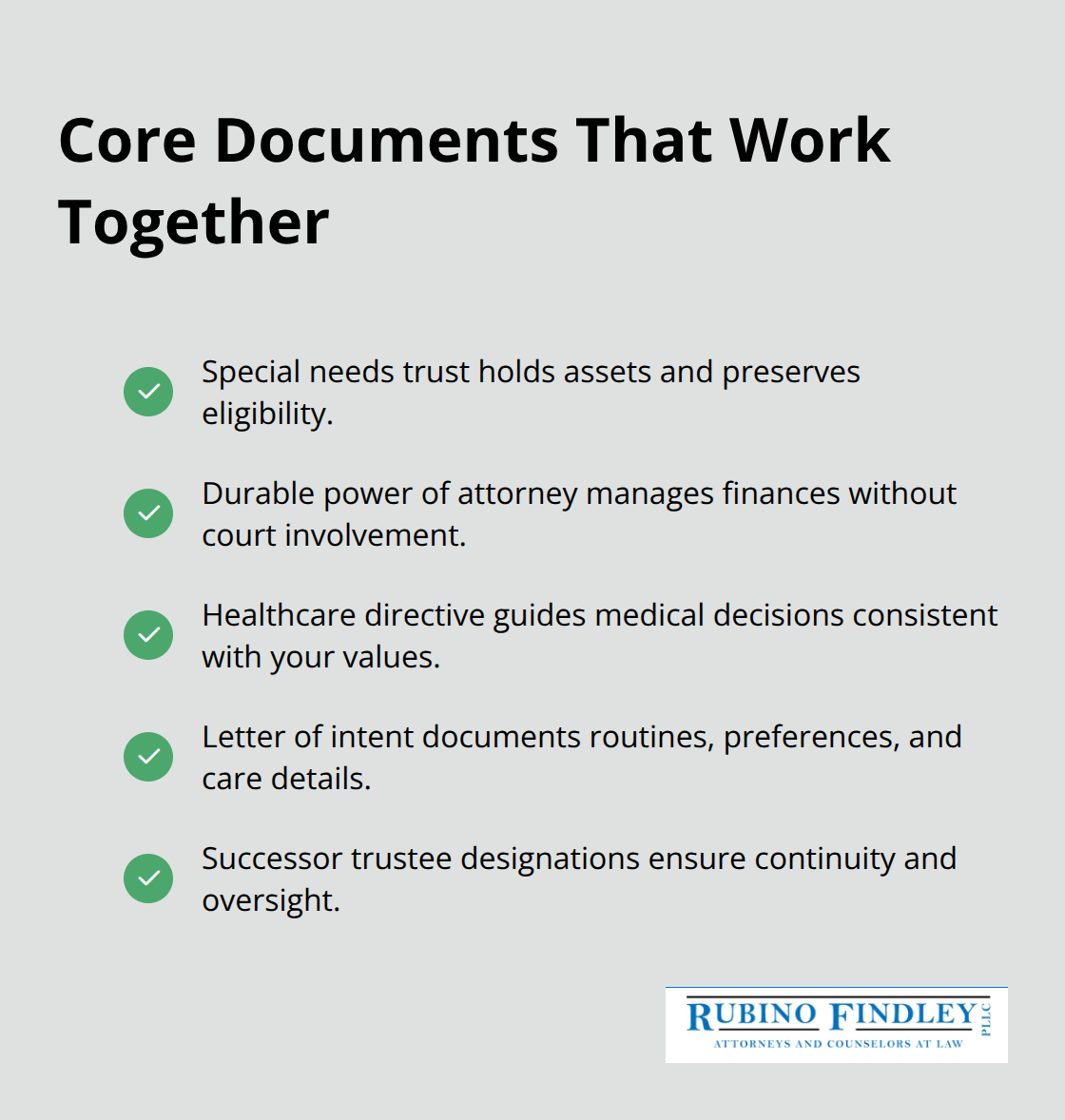

A special needs trust forms the foundation of your plan, but it cannot stand alone. The trust holds assets and preserves benefit eligibility, yet it requires supporting documents to function properly when you are no longer able to manage affairs. Florida law recognizes supplemental needs trusts under Statutes 732.2025(8), but that legal framework only works if your trustee knows how to operate within benefit rules and if your other documents align with the trust structure. Many families create a trust without establishing clear successor trustees, which leaves the plan incomplete. Your trustee needs a detailed letter of intent describing your family member’s routines, preferences, medical history, and daily care needs. Without this information, even a capable trustee struggles to make decisions that reflect your loved one’s best interests.

Additionally, you need a durable power of attorney for financial decisions and a separate healthcare directive so that someone can manage medical choices if you become incapacitated. These three documents work together: the trust holds and protects assets, the financial power of attorney ensures bills get paid and accounts stay managed, and the healthcare directive guarantees your family member receives medical decisions aligned with your values.

Choosing the Right Trustee Structure

Your trustee selection matters more than most families realize. A professional trustee such as a bank or attorney understands SSI resource limits, Medicaid spend-down rules, and the mechanics of benefit preservation. Individual trustees like a sibling or adult child may love your family member but lack knowledge about the complex regulations governing government benefits. A co-trustee arrangement pairs a family member who knows your loved one with a professional trustee who understands benefit rules. This prevents costly mistakes. Many families appoint a single successor trustee without backup, creating a crisis if that person becomes unable or unwilling to serve. Your plan should name at least two successor trustees in order of preference. Consider adding a trust protector-a separate person empowered to remove a trustee who acts against your family member’s interests. This layer of oversight prevents self-dealing and ensures the trustee remains accountable.

Guardianship and Decision-Making Authority

Guardianship and conservatorship serve different purposes than trusts and create ongoing obligations. A guardianship gives someone legal authority to make personal and healthcare decisions for an adult who cannot make them independently. A conservatorship handles financial decisions. Many families assume guardianship is necessary when it may not be. If your family member can express preferences and understand basic decisions, a healthcare directive and financial power of attorney may provide sufficient authority without the expense and court involvement of guardianship. Guardianship requires ongoing court filings, annual accountings, and periodic reviews. Conservatorships involve similar reporting requirements. These tools exist for genuine incapacity, but overusing them strips your family member of decision-making rights unnecessarily. A durable power of attorney activated during your lifetime or at your death provides financial management without court involvement. A healthcare directive allows your designated person to make medical choices. Together, these documents accomplish what guardianship does with less restriction and lower cost. If your family member has significant capacity, this approach preserves their autonomy while ensuring decisions get made properly.

Aligning Your Documents With Benefit Rules

Your durable power of attorney and healthcare directive must work in tandem with your special needs trust, not against it. A poorly drafted power of attorney might authorize someone to transfer assets directly to your family member-an action that would trigger immediate benefit loss. Your healthcare directive should name someone who understands your family member’s disability and can coordinate medical decisions with the trustee’s financial choices. These documents should reference the special needs trust and confirm that the designated agent will not take actions that jeopardize benefit eligibility. Many families overlook this alignment, creating conflicts between documents that undermine the entire plan. Your attorney should review all documents together to verify they support the same goals and protect your loved one consistently.

Planning for Incapacity and Succession

Your documents must address what happens if you become incapacitated before your death. A financial power of attorney with discretionary non-support distributions allows someone to manage your affairs and potentially fund the special needs trust during your lifetime if needed. This prevents a gap in planning if you suffer a stroke, accident, or illness that leaves you unable to make decisions. Your healthcare directive should name someone who can communicate your wishes to medical providers and coordinate with your financial agent. Succession planning extends beyond your death-your trustee needs clear instructions about what happens if they cannot continue serving. Your plan should identify backup trustees, explain how to remove a trustee who fails to perform, and provide the successor with all necessary information to step in smoothly. Without this structure, your family member faces uncertainty at the exact moment they need stability most.

The documents you establish now determine whether your family member receives coordinated, benefit-preserving care or faces a chaotic transition that threatens their financial security and quality of life. Your next step involves identifying which assets should fund the trust and how to structure those contributions to maximize protection.

Common Mistakes Families Make in Special Needs Planning

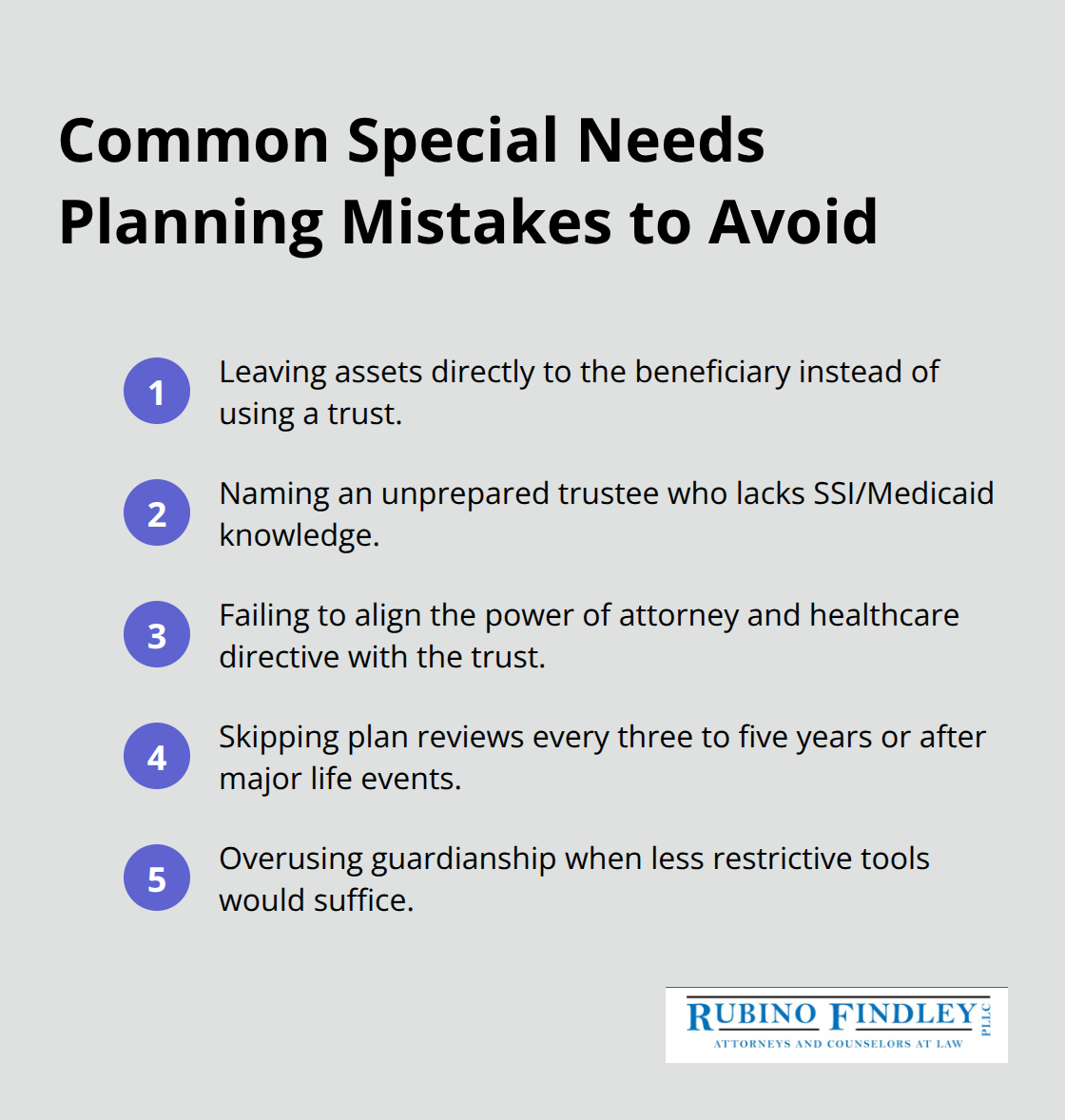

Most families with special needs members create a plan and then never revisit it. Life changes-your child ages, government benefit rules shift, family circumstances evolve, tax laws update-yet the documents drafted five or ten years ago remain untouched. An outdated plan becomes a liability. If your special needs trust was created before 2014, it may not account for ABLE accounts, a tool that allows people with disabilities to hold up to $20,000 per year in tax-free savings without losing SSI or Medicaid eligibility. Your trustee might not know ABLE accounts exist, missing an opportunity to stretch resources further. Similarly, if your plan predates recent changes to Medicaid rules in Florida, your trustee may make distributions that inadvertently trigger benefit loss. We at Rubino Findley, PLLC recommend reviewing your special needs plan every three to five years, or immediately after major life events like a diagnosis, inheritance, job change, or shift in your family member’s condition. A plan review costs far less than fixing mistakes that have already disqualified your loved one from benefits.

The Danger of Direct Inheritance

Leaving assets directly to a beneficiary with special needs remains the single most destructive mistake families make. A parent dies and leaves $100,000 to their adult child with autism in a standard will. The child receives a lump sum, loses SSI immediately, loses Medicaid within months, and must spend the inheritance on nursing home care at roughly $6,000 to $8,000 per month in Florida-money that would have been covered by Medicaid. Within two years, the inheritance is gone. Families sometimes justify this approach by thinking their child will inherit other assets from multiple relatives, so direct inheritance seems fair. Fairness between siblings matters, but not at the cost of your disabled family member’s financial security. A special needs trust allows you to benefit your child while preserving their government benefits, and you can adjust asset division among your other children through other mechanisms-perhaps giving them a larger share of retirement accounts or real estate, or equalizing distributions through life insurance. The documents must explicitly direct assets into the trust, not to the beneficiary directly. Many wills contain language like “leaves all property to my children equally,” which triggers direct inheritance unless you establish a trust beforehand and fund it properly. Your attorney must draft language that funnels your estate into the special needs trust for your disabled child’s benefit.

Selecting Trustees Without Proper Preparation

Naming successor trustees and guardians requires honest assessment of your family’s actual capabilities. Many parents name their oldest child as successor trustee without considering whether that person understands SSI resource limits, can manage complex financial decisions, or has the time and temperament to serve. Your successor trustee will make distribution decisions affecting your family member’s quality of life for potentially decades. If the successor trustee lacks knowledge about benefit rules, they will make mistakes. One trustee distributed $3,000 to a beneficiary for a vehicle purchase, unaware that SSI counts gifts as income and suspends benefits for months. That mistake cost the family far more in lost benefits than the vehicle was worth. A co-trustee structure-pairing a capable family member with a professional trustee or attorney-prevents these errors. Your family member’s sibling might handle day-to-day decisions about activities and preferences while a professional manages distributions and benefit compliance. If you cannot afford a professional co-trustee, at minimum provide your successor trustee with detailed written guidance about benefit rules, contact information for a benefits counselor, and clear instructions about which distributions are safe and which create risk. Your letter of intent should include specific dollar amounts and categories of permissible spending.

Failing to Clarify Decision-Making Authority

Your plan requires clarity about who decides what happens when circumstances change. If your family member’s disability worsens and they need nursing home care, who decides whether to pursue Medicaid planning? If a medical opportunity arises that costs $15,000 and isn’t covered by insurance, who authorizes the expense? If your family member receives a settlement from an injury claim, who ensures it funds the special needs trust rather than going directly to them? Without explicit answers, your successor trustee and healthcare agent may disagree, or one person may make unilateral decisions that harm your family member. Your documents should address healthcare decisions separately from financial decisions, naming people suited to each role. Your healthcare agent should understand your family member’s medical history and preferences. Your trustee should understand finances and benefit rules. These roles sometimes overlap, but clarity about primary responsibility prevents conflicts. A trust protector-a person empowered to oversee the trustee’s decisions-adds another layer of accountability. If your successor trustee makes a distribution that jeopardizes benefits, the trust protector can intervene. This structure sounds complex, but it prevents the chaos that erupts when decisions fall through gaps or get made by people unprepared for the responsibility.

Final Thoughts

Special needs estate planning cannot wait. Every day you delay increases the risk that your family member faces financial chaos if something happens to you. A parent dies without a plan in place, and suddenly a sibling must navigate SSI rules, Medicaid eligibility, and trustee responsibilities with no guidance. The cost of fixing mistakes after the fact-lost benefits, disqualifications, legal fees to restore eligibility-far exceeds the cost of planning now.

The documents you establish today determine whether your loved one receives coordinated care that preserves their benefits or faces a crisis that threatens their security. A special needs trust, properly funded and managed, extends resources across decades. A trustee trained in benefit rules prevents costly errors. A succession plan ensures continuity when circumstances change.

We at Rubino Findley, PLLC help families in Palm Beach County, Florida build special needs estate plans tailored to their situation. Contact Rubino Findley, PLLC to schedule a free consultation and discuss which tools and strategies fit your family’s needs.