Essential Estate Planning Forms You Need

Most people put off estate planning because they don’t know where to start. The truth is, having the right estate planning forms in place protects your family and gives you peace of mind.

At Rubino Findley, PLLC, we help families in Palm Beach County create the documents they need. This guide walks you through the forms that matter most and how to organize them properly.

What Makes a Will Valid and Why Most People Get It Wrong

Florida’s Legal Requirements for a Valid Will

A will is the foundation of estate planning, yet most people either skip it entirely or create one that won’t hold up in court. In Florida, a will must be in writing, witnessed by two people, and notarized to be valid, according to The Florida Bar. The testator must be at least 18 years old and of sound mind. These aren’t suggestions-they’re legal requirements. Skip any of them, and your will becomes worthless when probate arrives.

A self-proving will actually speeds up probate by including acknowledgments and affidavits upfront, so the court doesn’t require testimony later. This matters because probate can take months and cost thousands of dollars even with an uncontested will, according to The Florida Bar.

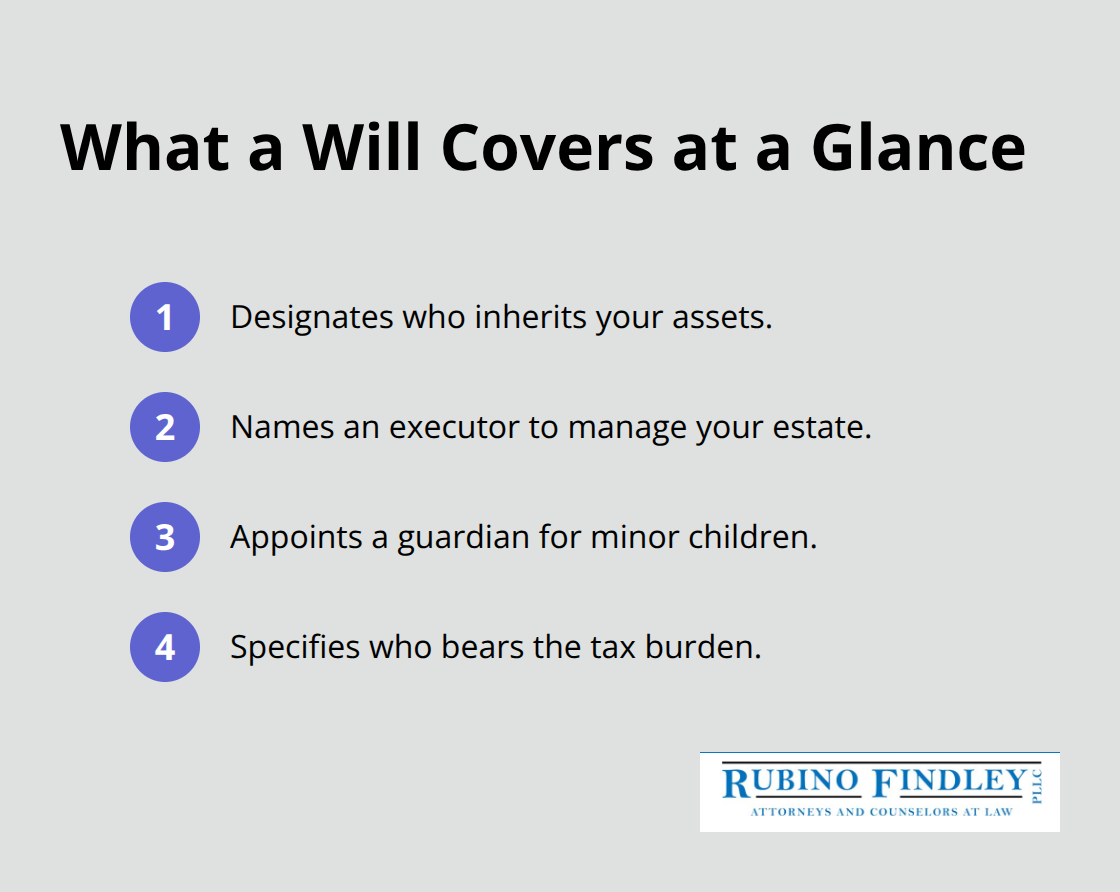

What Your Will Actually Accomplishes

A properly drafted will accomplishes four critical things: it designates who inherits your assets, names an executor to manage your estate, appoints a guardian for minor children, and specifies who bears the tax burden. Without these decisions in writing, Florida’s intestate succession laws decide for you-and they rarely align with what families actually want.

The biggest mistake people make is treating a will as a complete estate plan. A will alone doesn’t avoid probate; it simply directs assets and appoints someone to handle the process. Many people also fail to update their will after major life events like marriage, divorce, or buying property. The Florida Bar emphasizes that a will is revocable and can be changed by a new will or codicil, but writing directly on the will after execution can invalidate it.

How Beneficiary Designations Override Your Will

Another critical error involves ownership titles and beneficiary forms. If property is held jointly with a right of survivorship or if you name beneficiaries on accounts like 401(k)s or life insurance policies, those designations override your will entirely. The person listed as beneficiary receives the asset regardless of what your will says. You could accidentally leave everything to an ex-spouse if you don’t update beneficiary forms after a divorce.

Homestead interests, life estates, and jointly owned property have their own rules and may pass outside the will. These assets require separate attention beyond your will’s language.

Moving Forward With Your Estate Plan

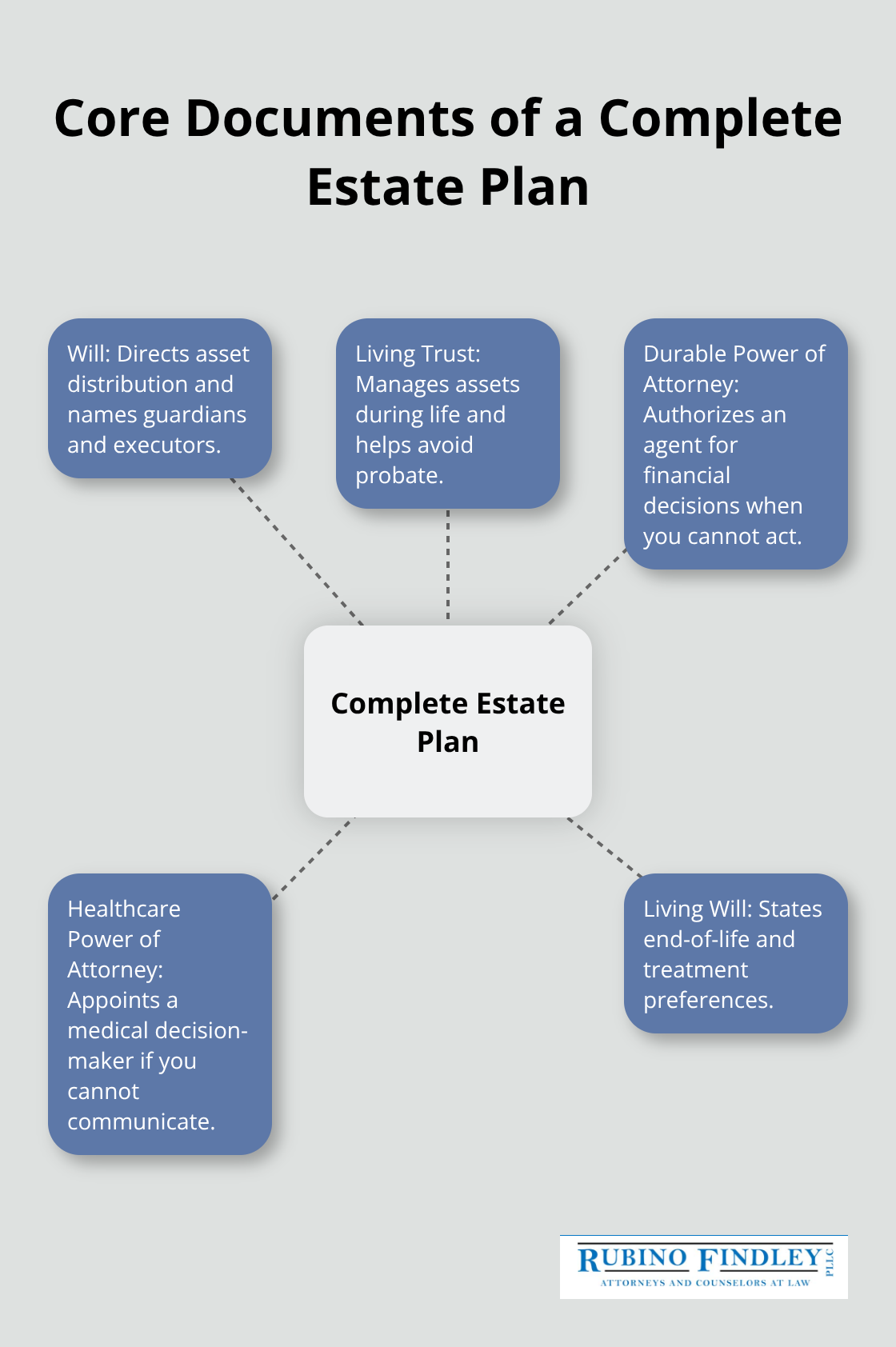

A will handles some of your property, but not all. Understanding which assets pass through your will and which pass outside it determines whether your overall plan actually protects your family. The next section covers living trusts and powers of attorney-the documents that work alongside your will to create a complete estate plan.

Living Trusts and Powers of Attorney

How Living Trusts Work During Your Lifetime

A living trust allows you to control and use your assets while alive and pass them to heirs after death, often helping to avoid probate and maintain privacy. The key difference from a testamentary trust, which is created within your will and only takes effect after death, is that a living trust operates during your lifetime. This matters because probate can take months and cost thousands of dollars even with an uncontested will, according to The Florida Bar. A testamentary trust gives you no control during your life and offers no probate avoidance.

Funding Your Trust Properly

To fund a revocable living trust properly, you must transfer property titles into the trust’s name and designate a successor trustee to manage it after you’re gone. Many people create a trust but fail to fund it, which means their assets still pass through probate anyway. Your house deed, investment accounts, and vehicle titles must actually show the trust as owner for this strategy to work.

The Durable Power of Attorney for Finances

A durable power of attorney for finances, governed by Florida Statutes Chapter 709, must explicitly state it is not terminated by your subsequent incapacity, ensuring your agent can act when you cannot. It must be signed by you, witnessed by two people, and notarized to be valid. The agent’s authority is limited to what is expressly granted in the document, so broad language alone does not automatically grant all powers. If you want to grant specific authorities like creating or modifying trusts or changing beneficiary designations, you must sign or initial next to each enumerated authority listed in the document.

Florida recognizes supported decision-making agreements as an alternative, allowing information sharing and assistance without binding authority to act. Banks and financial institutions have a four-day window to accept or reject a power of attorney for banking transactions and may request affidavits or additional documentation if needed.

Healthcare Decisions and Medical Preferences

A healthcare power of attorney designates someone to make medical decisions if you cannot communicate them yourself, while a living will expresses your care preferences in advance. These documents serve different purposes and both matter equally. The agent is a fiduciary who must act within the scope of authority and in your best interests, maintaining records of all actions taken.

Choosing Your Agent Carefully

These documents become active when executed unless you specify otherwise, so choose a trustworthy agent carefully since Florida no longer recognizes springing powers that activate only upon incapacity. Your agent will have significant responsibility, and selecting the right person protects your interests when you cannot act for yourself. With your financial and healthcare decisions covered, the next step involves organizing all these documents so your family and attorney can locate them quickly when needed.

How to Organize and Store Your Estate Planning Documents

Protecting Your Documents From Loss or Damage

Your estate planning documents hold no value if your family cannot locate them when needed. Store original documents in a safe deposit box at a bank or credit union rather than at home, where fire, theft, or water damage can destroy them. A safe deposit box costs between $25 and $100 annually and provides climate-controlled protection. Banks may freeze access after your death until the estate opens properly, which can delay your family’s immediate retrieval of documents. This limitation makes copies essential elsewhere.

Creating Accessible Copies and Digital Backups

Photocopies or digital scans of every estate planning document should sit in a fireproof safe at home. Digital scans require password protection and storage in a secure cloud service with encryption, not in regular email accounts where security remains weak. The average person under 70 maintains more than 160 digital accounts, so substantial digital assets warrant a digital executor designation in your plan to manage those accounts after your death. Your executor needs quick access to identify which accounts exist and how to close or transfer them.

Building Your Master Document List

A one-page document should list the location of every original document, all bank account numbers, investment account details, insurance policy numbers, and contact information for your executor, healthcare agent, and any trustees. This master list belongs in your safe at home and should reach your executor and healthcare agent in a sealed envelope with clear instructions. Provide a copy to your attorney as well. Include specific details like which safe deposit box holds your originals, the box number, and who holds authorized access. Your family should not have to guess or hire someone to track down your financial information.

Updating Your Plan on Schedule

Review your entire document storage plan every three to five years, or sooner if you move, change banks, or update your plan. Update your master list whenever you create new documents or change trustees, agents, or beneficiaries. Life changes like marriage, divorce, or purchasing property often trigger the need for new estate documents, and your storage system must reflect those updates. Outdated information creates confusion when your family needs answers most.

Final Thoughts

Estate planning forms protect your family from uncertainty and expensive legal battles. Without a will, living trust, powers of attorney, and healthcare directives in place, your loved ones face months of probate proceedings, court costs, and decisions made by strangers rather than people who know your wishes. The documents you create today determine whether your family inherits smoothly or struggles through a complicated process that drains both time and money.

Creating these documents yourself using online templates or generic forms often leads to mistakes that invalidate your plan when your family needs it most. Florida’s legal requirements for wills, trusts, and powers of attorney are specific, and missing even one detail can render your documents worthless. A healthcare power of attorney signed incorrectly won’t hold up when hospitals need to know your medical preferences, and a trust created but never funded leaves your assets passing through probate anyway.

Working with an attorney ensures your estate planning forms meet Florida law and actually accomplish what you intend. We at Rubino Findley, PLLC help families in Palm Beach County create wills, trusts, powers of attorney, and healthcare directives tailored to their specific situations, and we handle the details so your documents work when they matter most. Contact us today to schedule your free consultation and begin building an estate plan that protects what matters most to you.