Essential Questions for Comprehensive Estate Planning in Boca Raton

Estate planning is a vital process for protecting your assets and ensuring your wishes are carried out. At Rubino Findley, PLLC, we understand the importance of asking the right questions when creating a comprehensive estate plan.

Our questionnaire for estate planning covers all essential aspects, from asset distribution to healthcare decisions. This guide will walk you through the key components and considerations specific to Boca Raton residents, helping you create a robust plan tailored to your unique needs.

Key Components of Estate Planning in Boca Raton

Estate planning in Boca Raton involves several critical elements that work together to protect your assets and ensure your wishes are carried out. We focus on four main components that form the foundation of a solid estate plan.

Wills and Trusts: The Cornerstones of Asset Distribution

Wills and trusts are fundamental to any estate plan. A will outlines how you want your assets distributed after your death. In Florida, a valid will must be in writing, signed by you (the testator), and witnessed by two individuals. Trusts offer more flexibility and privacy. They can help you avoid probate, potentially saving your estate up to 5% in fees (according to AARP).

Power of Attorney: Protecting Your Interests

A power of attorney (POA) allows someone you trust to make decisions on your behalf if you become incapacitated. Different types of POAs exist, including financial and healthcare. In Florida, a durable power of attorney remains in effect even if you become incapacitated, making it particularly important.

Healthcare Directives: Respecting Your Medical Wishes

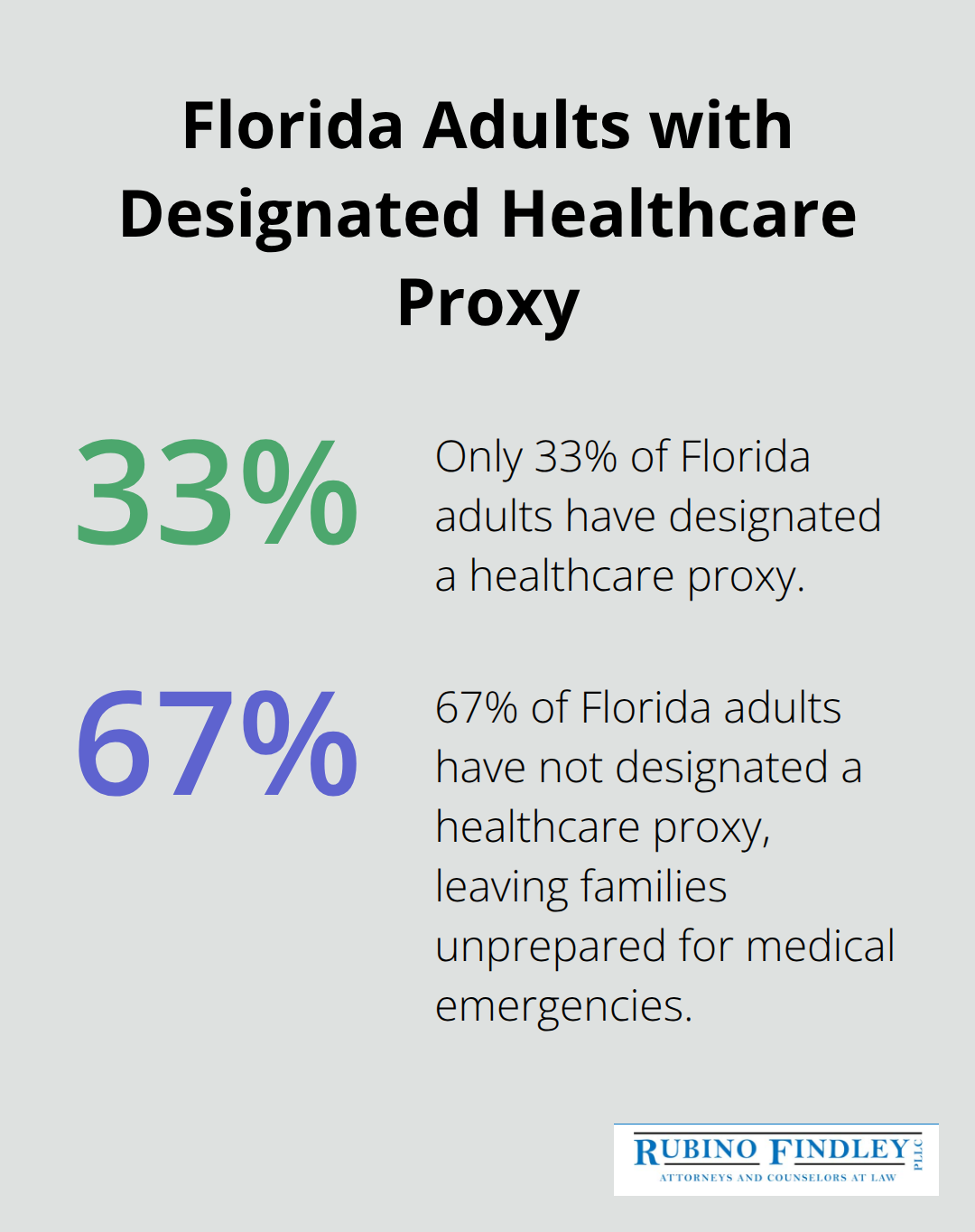

Healthcare directives (including living wills and healthcare proxies) articulate your medical wishes. Only 33% of Florida adults have designated a healthcare proxy, leaving many families unprepared for medical emergencies. A living will specifies your end-of-life care preferences, while a healthcare proxy names someone to make medical decisions for you if you’re unable to do so.

Beneficiary Designations: The Often Overlooked Element

Beneficiary designations on accounts like life insurance policies and retirement accounts are crucial. These designations typically override instructions in your will, so it’s essential to keep them up-to-date. Review and update your beneficiaries regularly, especially after major life events (such as marriage, divorce, or the birth of a child).

Each of these components plays a vital role in creating a comprehensive estate plan. As we move forward, we’ll explore the important questions you should ask during the estate planning process to ensure all your bases are covered.

Key Questions for Effective Estate Planning

Estate planning requires important decisions about your assets, healthcare, and legacy. We’ve identified several key questions to guide you through this process, ensuring a comprehensive plan tailored to your unique situation.

Who Will Inherit Your Assets?

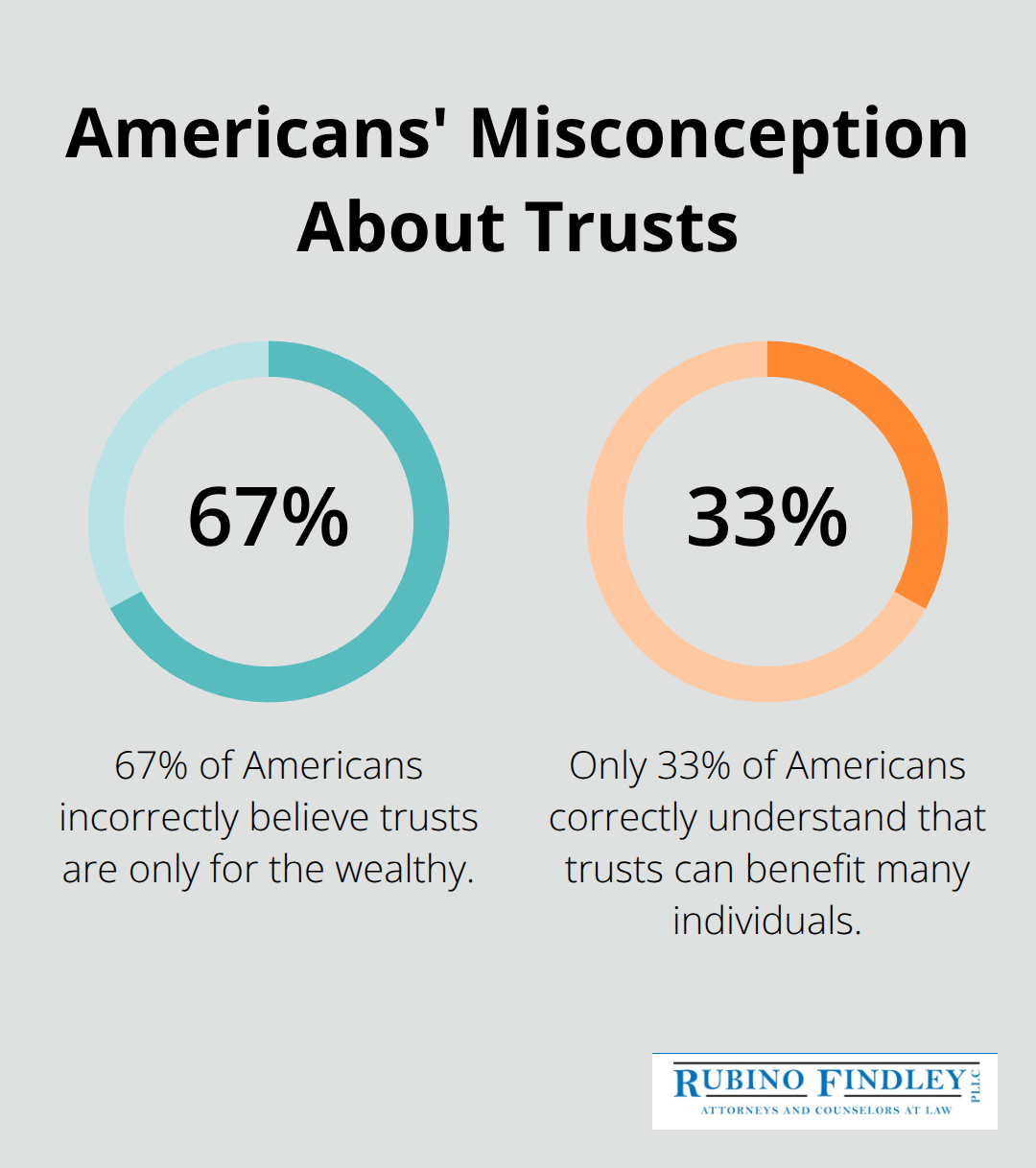

Asset distribution forms the foundation of estate planning. Consider not just immediate family, but also friends, charities, or other beneficiaries. Be specific about who receives what, including sentimental items. A clear plan reduces potential conflicts among heirs. A 2022 Wealth Counsel survey revealed that 67% of Americans incorrectly believe trusts are only for the wealthy. In reality, trusts can benefit many individuals, offering control over asset distribution and potentially avoiding probate.

How Will You Handle Incapacity?

Planning for incapacity often gets overlooked. Designate a trusted individual to manage your affairs if you become unable to do so. This involves creating a durable power of attorney for financial matters and a healthcare proxy for medical decisions. The Florida Hospital Association reported in 2021 that only 33% of Florida adults have designated a healthcare proxy (leaving many families unprepared for medical emergencies).

What Are Your Healthcare Preferences?

Clearly articulate your healthcare wishes. This includes creating a living will that specifies your end-of-life care preferences. The Florida Agency for Health Care Administration reports that only 29% of Floridians have a living will. Additionally, complete a HIPAA authorization form, allowing designated individuals access to your medical information. The American Bar Association notes that only 24% of Americans have completed this important form.

How Will You Minimize Estate Taxes?

While Florida doesn’t have a state estate tax, federal estate taxes may apply to larger estates. Try to implement strategies to minimize these taxes, such as gifting assets during your lifetime or establishing certain types of trusts. Consult with a tax professional to understand the implications for your specific situation.

How Will You Provide for Minor Children or Dependents?

If you have minor children or dependents, your estate plan should address their care and financial support. Name guardians for minor children and consider setting up trusts to manage assets for their benefit. This ensures their well-being and financial security if something happens to you.

Estate planning isn’t just about distributing assets; it’s about ensuring your wishes are respected in all aspects of your life. As we move forward, we’ll explore unique considerations for Boca Raton residents that can impact your estate planning decisions.

Navigating Boca Raton’s Unique Estate Planning Landscape

Estate planning in Boca Raton presents distinct challenges and opportunities. Florida’s laws, the snowbird lifestyle, and the need for robust asset protection all influence the creation of an effective estate plan. This chapter explores these factors and provides practical insights to help you navigate this complex landscape.

Florida’s Homestead Exemption: A Powerful Tool

Florida’s homestead exemption stands as a cornerstone of asset protection for Boca Raton residents. This law shields your primary residence from creditors (with some exceptions). The exemption applies to an unlimited value for up to half an acre in a municipality or 160 acres in unincorporated areas. To leverage this protection, your estate plan should clearly designate your Florida home as your primary residence.

Snowbird Considerations: Dual State Planning

Many Boca Raton residents split their time between Florida and another state. This dual residency complicates estate planning. Establishing Florida as your domicile becomes essential to benefit from its favorable tax laws. Steps to solidify your Florida residency include:

- Obtaining a Florida driver’s license

- Registering to vote in Florida

- Spending at least 183 days per year in the state

Your estate plan should address assets in both states, potentially using separate wills or trusts for each jurisdiction.

Asset Protection Strategies for High Net Worth Individuals

Boca Raton attracts many high net worth individuals, making asset protection a top priority. The establishment of an irrevocable trust can shield assets from creditors. Florida’s laws favor self-settled asset protection trusts. Another strategy involves taking advantage of Florida’s tenancy by the entirety law, which protects jointly owned marital property from individual creditors.

Long-Term Care Planning: Protecting Your Future

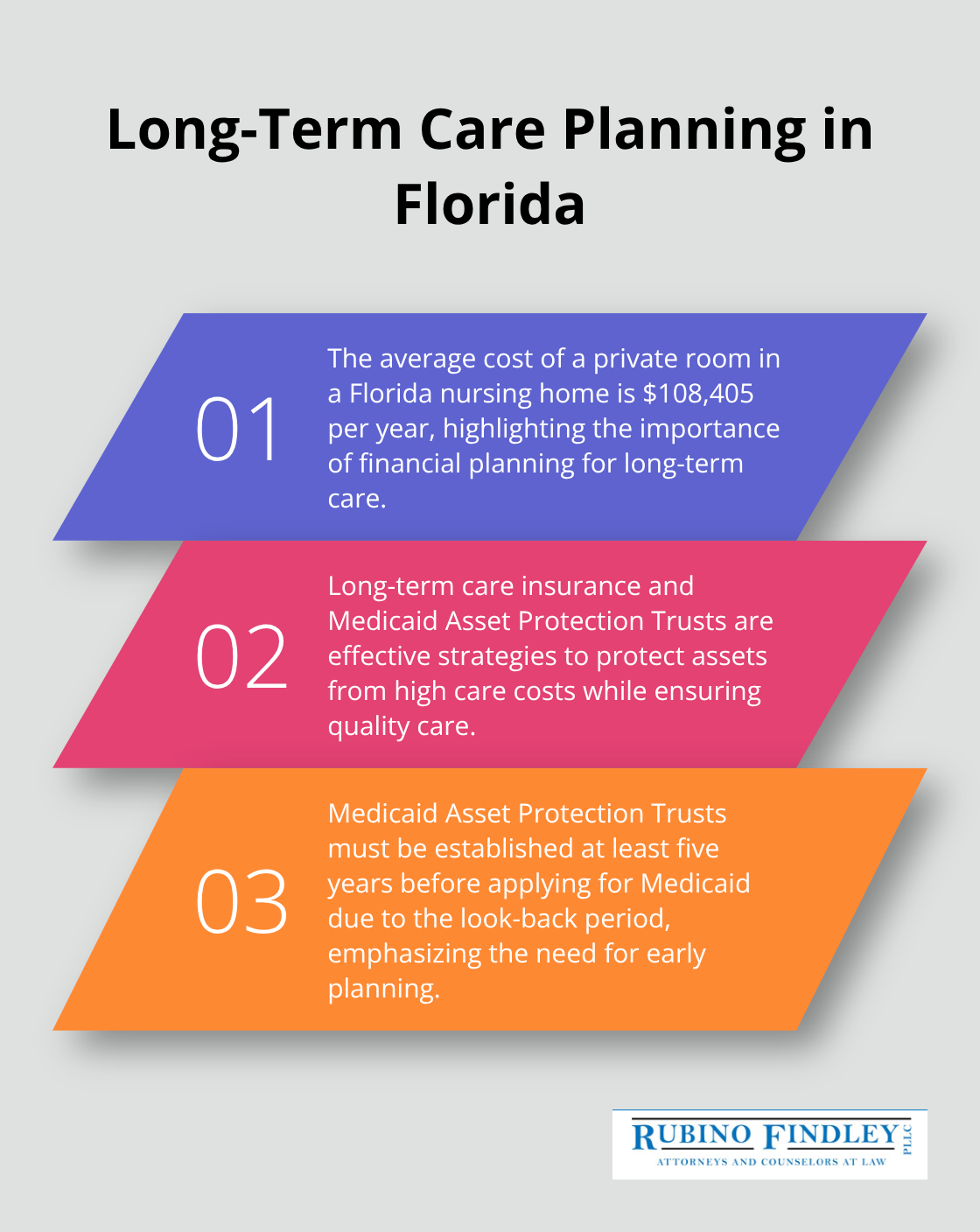

With Florida’s aging population, long-term care planning becomes a critical component of estate planning in Boca Raton. The average cost of a private room in a Florida nursing home reaches $108,405 per year (according to Genworth’s 2021 Cost of Care Survey). To protect your assets from these high costs, consider long-term care insurance or a Medicaid Asset Protection Trust. These trusts can help you qualify for Medicaid while preserving assets for your heirs. However, you must establish them at least five years before applying for Medicaid due to the look-back period.

Estate planning in Boca Raton requires a nuanced approach that accounts for Florida’s unique laws and lifestyle factors. Addressing these considerations head-on allows you to create a robust plan that protects your assets and ensures the execution of your wishes.

Final Thoughts

Estate planning in Boca Raton requires careful consideration of unique factors. Our questionnaire for estate planning addresses key components like wills, trusts, powers of attorney, and healthcare directives. It guides you through important decisions about asset distribution, incapacity planning, and long-term care.

Boca Raton’s estate planning landscape includes specific considerations such as Florida’s homestead exemption and snowbird lifestyle. Asset protection strategies and long-term care planning take on increased importance in our community. These factors highlight the value of local knowledge in creating a comprehensive estate plan.

Rubino Findley, PLLC can help you navigate the complexities of estate planning in Palm Beach County. Our team assists clients with wills, trusts, probate administration, and durable powers of attorney. Contact us for a free consultation to discuss your unique needs and start building a secure future for yourself and your loved ones.