Estate Planning 101: What You Need to Know

Most Americans don’t have an estate plan, yet it’s one of the most important financial decisions you’ll make. Without proper planning, your family could face costly delays, taxes, and legal complications.

At Rubino Findley, PLLC, we help families in Boca Raton understand estate planning basics and protect what matters most. This guide walks you through the documents you need, when to start planning, and why getting professional guidance makes all the difference.

What Estate Planning Actually Means

Estate Planning Protects Your Family From Costly Delays

Estate planning is the process of deciding how your assets get managed and transferred after you die or become unable to make decisions. It’s not about being wealthy or old-it’s about protecting your family from unnecessary legal battles and costs. Without a plan in place, Florida law determines who inherits your assets and makes medical decisions for you, which rarely aligns with what you actually want.

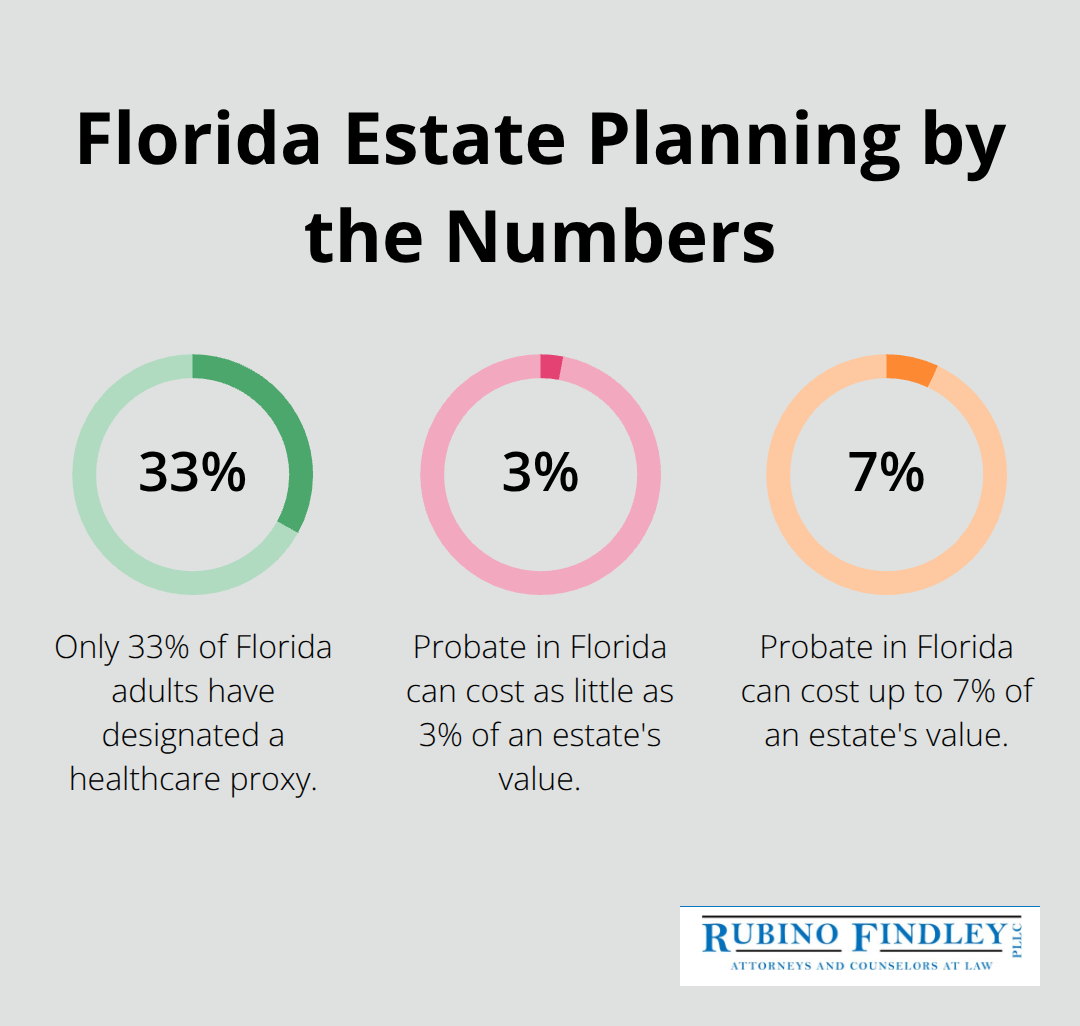

The numbers tell a stark story. Only 33% of Florida adults have designated a healthcare proxy, meaning two-thirds of residents have left critical medical decisions to chance.

Probate costs in Florida run between 3% and 7% of your estate’s value according to AARP, and the process often takes months to over a year to complete. This hits families hard-a private nursing home room in Florida costs about $108,405 per year according to Genworth’s Cost of Care Survey, so unexpected probate fees drain resources that should go to your loved ones.

Estate Planning Isn’t Just for the Wealthy or Elderly

Many people believe estate planning is only for the wealthy or elderly, but that’s simply false. Anyone age 18 and older with assets, minor children, or specific healthcare wishes needs a plan. A single parent with a modest house and a car still needs to name a guardian for their children and specify who handles finances if they’re incapacitated.

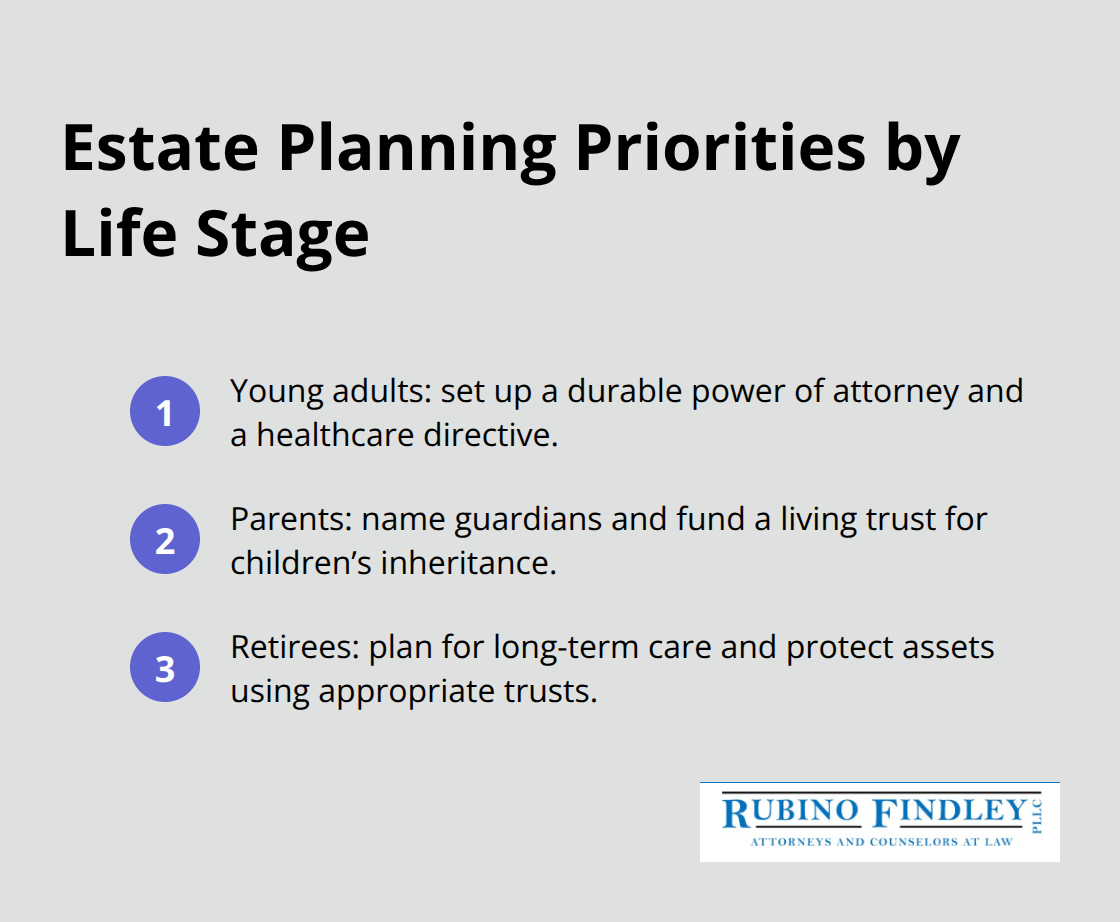

Young adults starting their first job should establish a durable power of attorney and healthcare directive so someone trusted can act if they’re in an accident. Parents need to decide who raises their kids and manages their inheritance, not leave those decisions to a court-appointed guardian. The earlier you plan, the fewer complications your family faces.

Getting Started With Professional Guidance

Working with an experienced estate planning attorney from Rubino Findley, PLLC in Boca Raton helps you understand what documents you actually need and why taking action now prevents chaos later. We help families at every stage establish wills, trusts, probate administration, and durable powers of attorney. Our team serves clients throughout Palm Beach County, Broward County, and Florida.

Understanding what documents you need is the first step toward protecting your family. Let’s look at the specific documents that form the foundation of every solid estate plan.

Building Your Estate Plan’s Foundation

Why a Will Alone Isn’t Enough

A will is the document most people think of first, but it’s actually the weakest link in estate planning on its own. A will tells the court who gets your assets and who raises your minor children, but it does nothing to avoid probate. In Florida, a valid will must be in writing, signed by you, and witnessed by two individuals. Many people create a will through online templates thinking they’ve solved the problem, then die and their family spends thousands in probate fees anyway.

The real power comes from combining a will with a revocable living trust. A living trust transfers your assets outside of probate entirely. When you fund a living trust properly by retitling your real property, bank accounts, and investments into the trust’s name, those assets pass directly to your beneficiaries after death without court involvement. This matters because probate in Florida takes months to over a year and costs between 3% and 7% of your estate’s value according to AARP. For a $500,000 estate, that’s $15,000 to $35,000 in unnecessary fees. A funded living trust eliminates this drain on your family’s inheritance.

The Power of Attorney: Managing Your Finances If You Can’t

Beyond wills and trusts, you need a durable power of attorney for financial decisions and a healthcare directive for medical choices if you become incapacitated. A durable power of attorney lets a trusted person manage your bank accounts, investments, and property if you’re in an accident or hospitalized and unable to act. The word durable matters because it means the document remains effective during your incapacity, unlike a regular power of attorney that expires. Florida no longer recognizes springing powers of attorney, which means your power of attorney takes effect immediately, so choose someone you absolutely trust.

Healthcare Directives: Speaking for You When You Can’t

Your healthcare directive combines a living will and medical power of attorney into one document that tells doctors your end-of-life wishes and names someone to make medical decisions for you. Only 33% of Florida adults have designated a healthcare proxy according to the Florida Hospital Association, which means two-thirds of residents have left critical medical decisions to strangers or the court system. Adding a HIPAA authorization form lets your designated person actually access your medical records and information, something most families overlook.

Bringing It All Together

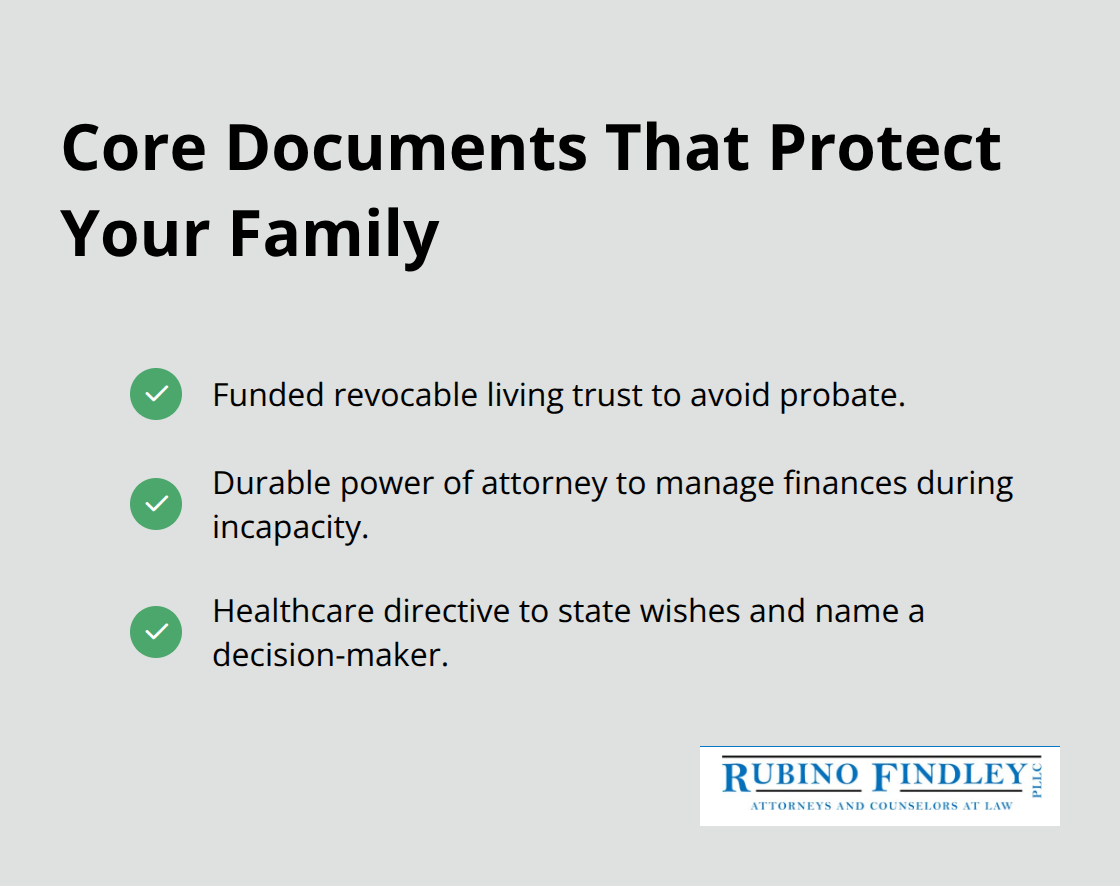

These three documents-a funded living trust, a durable power of attorney, and a healthcare directive-form the complete foundation of an estate plan. When you establish all three documents together, nothing falls through the cracks and your family has clear guidance when they need it most. The next step involves tailoring these documents to your specific situation, which depends on your age, family structure, and financial circumstances.

Estate Planning for Different Life Stages

Young Adults Need Protection From Day One

Accidents don’t wait until you turn forty, yet young adults often dismiss estate planning as something for wealthy retirees. A single car accident or sudden illness can leave your finances in chaos and your family fighting in court over guardianship of your children. At twenty-one, you should establish a durable power of attorney naming someone to manage your bank accounts and pay your bills if you’re hospitalized. At twenty-five with a mortgage or rental lease, add a healthcare directive so doctors know your medical wishes. These documents cost far less than the legal battles your family faces without them.

The American Bar Association found that only 24% of Americans have completed a HIPAA authorization form, meaning most young adults haven’t given anyone permission to access their medical information during emergencies. If you’re self-employed or own any business interest, the stakes climb even higher because without a documented plan, your business may collapse while your family struggles through probate.

Parents With Minor Children Face Urgent Decisions

Your will must name a guardian for your kids if both you and your spouse die, and that decision cannot wait. Courts will not automatically appoint the person you want-they’ll appoint whoever petitions first or whoever the judge deems appropriate, potentially separating siblings or placing children with relatives you wouldn’t choose. A living trust funded with your home, investments, and business interests keeps your children’s inheritance out of probate and gives you control over when they receive money.

Instead of handing a lump sum to an eighteen-year-old, a properly drafted trust lets you specify that distributions happen at ages twenty-five, thirty, and thirty-five, protecting them from poor decisions during early adulthood. You also need a durable power of attorney identifying someone to manage finances if you’re incapacitated, ensuring your mortgage gets paid and your children’s needs are covered while you recover.

Retirees Must Address Long-Term Care Costs

Long-term care costs in Florida run approximately $108,405 annually for a private nursing home room according to Genworth’s Cost of Care Survey, and without planning, these expenses destroy assets meant for your heirs. A Medicaid Asset Protection Trust established at least five years before applying for benefits lets you preserve wealth while qualifying for Medicaid coverage of nursing home costs. Florida’s homestead exemption protects your primary residence from creditors, but you must structure ownership correctly through your estate plan to maximize this protection.

Snowbirds and those with property in multiple states need separate planning for each jurisdiction-a Florida living trust handles your Boca Raton home while another trust addresses property in your home state, preventing complications for your successor trustee and reducing probate exposure in multiple counties.

Final Thoughts

Estate planning basics require three core actions: establish a will or living trust, name someone to handle finances if you become incapacitated, and create a healthcare directive so doctors know your wishes. Without these documents, your family faces probate delays, unexpected costs, and decisions made by strangers instead of people you trust. The earlier you act, the fewer complications your loved ones encounter.

Start your plan by inventorying your assets including your home, bank accounts, investments, and business interests. Identify who you want to inherit each asset and who should raise your children if both parents die. Write down your healthcare preferences and name someone you absolutely trust to make medical decisions if you cannot, then contact Rubino Findley, PLLC in Boca Raton to discuss your specific situation.

Florida residents face unique planning considerations that generic online templates miss entirely. Your homestead property receives creditor protections under Florida law, but only if your estate plan structures ownership correctly, and snowbirds especially need tailored guidance to establish proper domicile and coordinate assets held in different locations. We help clients throughout Palm Beach County and Broward County establish wills, trusts, and durable powers of attorney that protect what matters most.