Estate Planning for Business Owners in Boca Raton What to Consider

Estate planning for business owners is a complex but essential process. At Rubino Findley, PLLC, we understand the unique challenges faced by Boca Raton entrepreneurs when it comes to protecting their legacy.

This guide outlines key considerations for estate planning business strategies, including succession planning, tax implications, and legal structures. By addressing these critical aspects, business owners can safeguard their assets and ensure a smooth transition for their companies.

Essential Components of Business Estate Planning

Estate planning for business owners involves several critical elements that extend beyond personal asset protection. At Rubino Findley, PLLC, we recognize the significance of these components and their impact on your business’s future.

Succession Planning: Securing Your Business’s Future

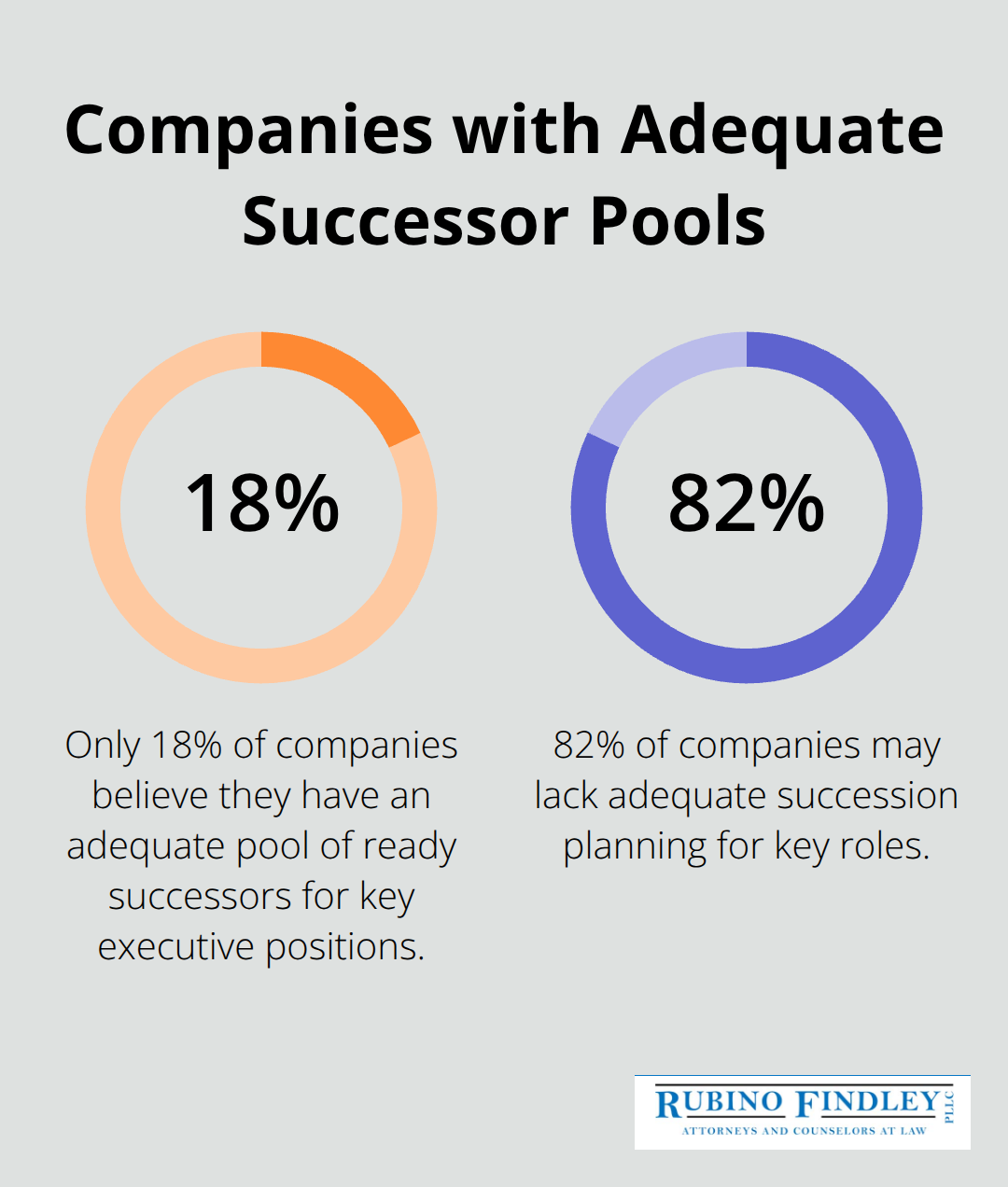

Succession planning forms the foundation of business estate planning. It encompasses more than just determining who takes over; it focuses on how your business will flourish after your departure. A 2019 survey by the National Association of Corporate Directors revealed that only 18% of companies believed they had an adequate pool of ready successors for key executive positions. This statistic highlights the urgent need for proactive planning.

To initiate the process, you should:

- Identify potential successors within your company or family

- Develop a training program to prepare them for leadership roles

- Create a timeline for the transition (which may occur gradually over several years)

Buy-Sell Agreements: Protecting Ownership Interests

Buy-sell agreements play a vital role for businesses with multiple owners. These legally binding contracts outline the procedures for handling an owner’s share of the business in the event of their death, disability, or departure. The absence of such an agreement could lead to significant disruption or even dissolution of your business.

When you draft a buy-sell agreement, consider these factors:

- Triggering events (death, disability, retirement)

- Valuation methods for the business

- Funding mechanisms for the buyout

Insurance: Safeguarding Against the Unexpected

Life insurance and key person insurance serve essential functions in business estate planning. Life insurance can provide the necessary funds for a buy-sell agreement, ensuring that remaining owners can purchase the deceased owner’s share without financial strain.

Key person insurance protects the business if a crucial employee or owner dies unexpectedly. The death benefit can help cover lost revenue, recruitment costs, and other expenses associated with the loss of a key individual.

Asset Protection: Shielding Your Business and Personal Wealth

Effective asset protection strategies are indispensable for business owners. These strategies can help safeguard your personal assets from business liabilities and vice versa. You should consider establishing separate legal entities for different aspects of your business operations. This approach can limit liability exposure and protect your personal wealth.

Additionally, explore the benefits of trusts in your estate plan. Certain types of trusts can provide asset protection while allowing you to maintain control over your business interests during your lifetime.

As we move forward to discuss tax considerations in business estate planning, it’s important to note that these components work together to create a comprehensive strategy. The next section will explore how tax implications can significantly impact your estate plan and the steps you can take to minimize the tax burden on your business assets.

How Business Owners Can Minimize Tax Burdens

Estate planning for business owners requires navigation through complex tax considerations. Understanding these implications proves essential for wealth preservation and smooth asset transition.

Federal Estate Tax Implications

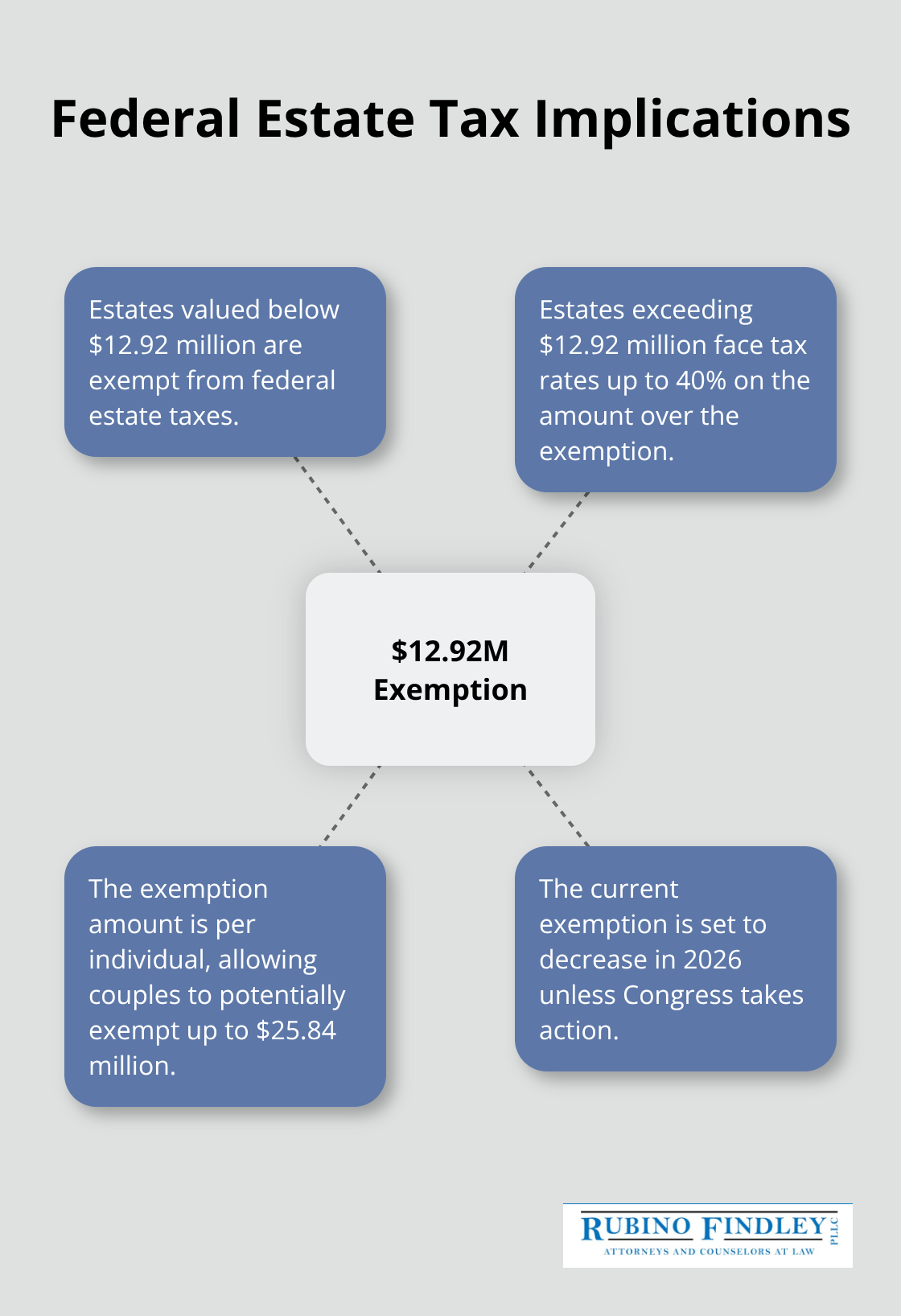

The federal estate tax can significantly impact business asset transfer. As of 2023, the federal estate tax exemption stands at $12.92 million per individual. Estates valued below this threshold avoid federal estate taxes. However, estates exceeding this amount face tax rates up to 40%.

This exemption will decrease in 2026 unless Congress acts. This potential change highlights the need for proactive planning. Business owners should review and update their estate plans regularly to account for these shifting thresholds.

Florida-Specific Tax Considerations

Florida offers tax advantages for business owners in estate planning. The state imposes no estate tax, which can provide significant savings compared to other states. Florida also lacks a state income tax, benefiting certain business structures and inheritance plans.

However, Florida residents remain subject to federal estate taxes. Property or business interests in other states may also incur those states’ estate or inheritance taxes.

Strategies to Reduce Tax Burdens

Business owners can employ several strategies to minimize the tax impact on their estates:

- Gifting: Annual gifts up to $17,000 per recipient (as of 2023) are exempt from gift taxes. This strategy transfers wealth over time effectively.

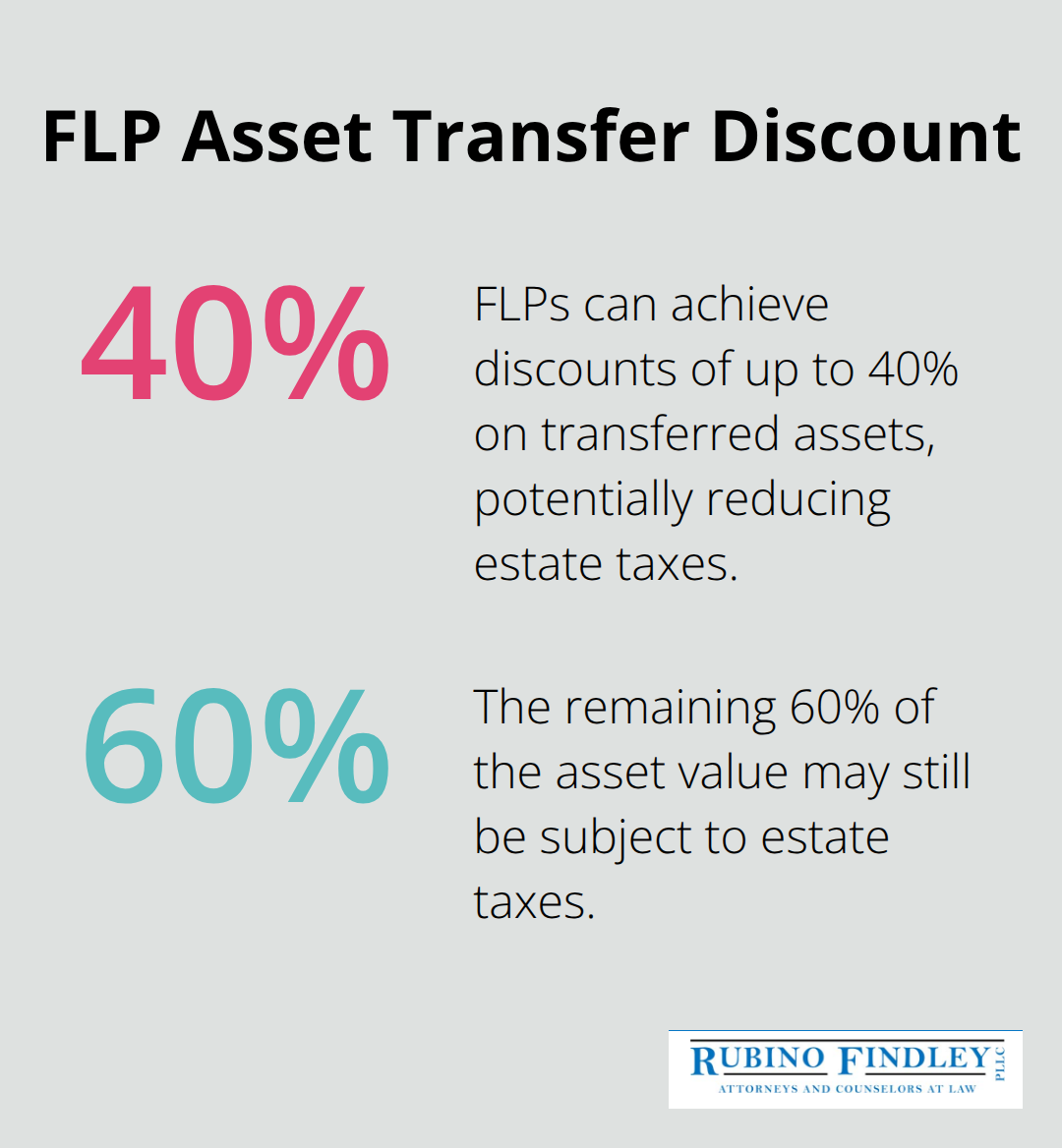

- Family Limited Partnerships (FLPs): These structures help reduce the taxable value of business interests while maintaining control.

- Irrevocable Life Insurance Trusts (ILITs): These trusts can own life insurance policies, keeping the proceeds out of the taxable estate.

- Charitable Remainder Trusts: These trusts support charitable causes while potentially reducing estate tax liability.

- Grantor Retained Annuity Trusts (GRATs): These trusts effectively transfer appreciating assets with minimal gift tax consequences.

The Importance of Professional Guidance

Tax laws are complex and subject to change. Regular reviews and updates to estate plans ensure they remain effective and compliant with current regulations. Working with experienced professionals helps navigate these complexities and make informed decisions about business and personal legacy.

The next section will explore the legal structures and tools available for business estate planning, providing a comprehensive view of the options at your disposal.

Legal Tools for Protecting Your Business Legacy

Estate planning for business owners extends beyond personal assets. It requires strategic use of legal structures and tools to protect business interests and ensure smooth transitions. We at Rubino Findley, PLLC help Boca Raton business owners navigate these complex legal options.

LLCs and FLPs: Powerful Asset Protection Tools

Limited Liability Companies (LLCs) and Family Limited Partnerships (FLPs) serve as powerful tools for business estate planning. LLCs offer personal asset protection and tax flexibility. They prove especially useful for real estate holdings or businesses with multiple owners.

FLPs allow you to transfer business interests to family members while maintaining control. This structure can potentially reduce estate taxes by applying valuation discounts. A 2021 study by the American Bar Association found that FLPs could achieve discounts of up to 40% on transferred assets.

When you set up these entities, consider:

- Your business’s specific needs

- Your long-term succession goals

- The tax implications of each structure

Trusts: Tailored Protection for Business Assets

Trusts play a key role in safeguarding business assets. Revocable living trusts allow for seamless management of your business if you become incapacitated. Irrevocable trusts can provide asset protection and potential tax benefits.

For instance, a Grantor Retained Annuity Trust (GRAT) can transfer business interests to beneficiaries with minimal gift tax consequences. This strategy has gained popularity among business owners, with the IRS reporting a 73% increase in GRAT filings between 2012 and 2016.

When you consider trusts, work with an experienced attorney to select the right type for your situation. Each trust serves a specific purpose and comes with its own set of rules and tax implications.

Critical Documents for Business Continuity

Powers of attorney and healthcare directives prove essential for business owners. A durable power of attorney ensures someone can manage your business affairs if you’re unable to do so. Without this document, your business could face operational challenges or even court intervention.

Healthcare directives (including living wills and healthcare proxies) outline your medical preferences. These documents can prevent disputes among family members and ensure respect for your wishes.

A 2019 Caring.com survey revealed that only 18% of people aged 18-34 have these important documents in place. Don’t leave your business vulnerable – prioritize the creation of these essential legal tools.

Final Thoughts

Estate planning for business owners in Boca Raton demands strategic planning and professional guidance. The complexities of legal structures, tax implications, and succession strategies require expert navigation. A well-crafted plan ensures smooth transitions, minimizes tax burdens, and provides peace of mind for you and your family.

We urge Boca Raton business owners to take action now to secure their business’s future. The first step involves assessing your current situation, identifying your goals, and seeking professional advice. Estate planning is an ongoing process that requires regular reviews and updates as your business and personal circumstances evolve.

At Rubino Findley, PLLC, we help business owners navigate the complexities of estate planning (including wills, trusts, and probate administration). Our team works with you to create a tailored estate plan that aligns with your business goals and personal wishes. Don’t leave your business’s future to chance – take the first step towards comprehensive estate planning today.