Estate Planning for LLC Owners in Boca Raton What You Need to Know

LLC owners in Palm Beach County face complex challenges when planning their estates. Business interests create unique complications that traditional estate planning doesn’t address.

We at Rubino Findley, PLLC see how estate planning for LLC owners requires careful attention to succession, tax implications, and asset protection. Most business owners make costly mistakes by treating their LLC interests like simple personal assets.

Why LLC Ownership Complicates Your Estate Plan

LLC ownership creates three major roadblocks that traditional estate planning cannot handle. Unlike simple personal assets, business interests involve multiple parties, complex valuations, and tax consequences that catch most owners off guard.

Succession Plans Fall Apart Without Clear Documentation

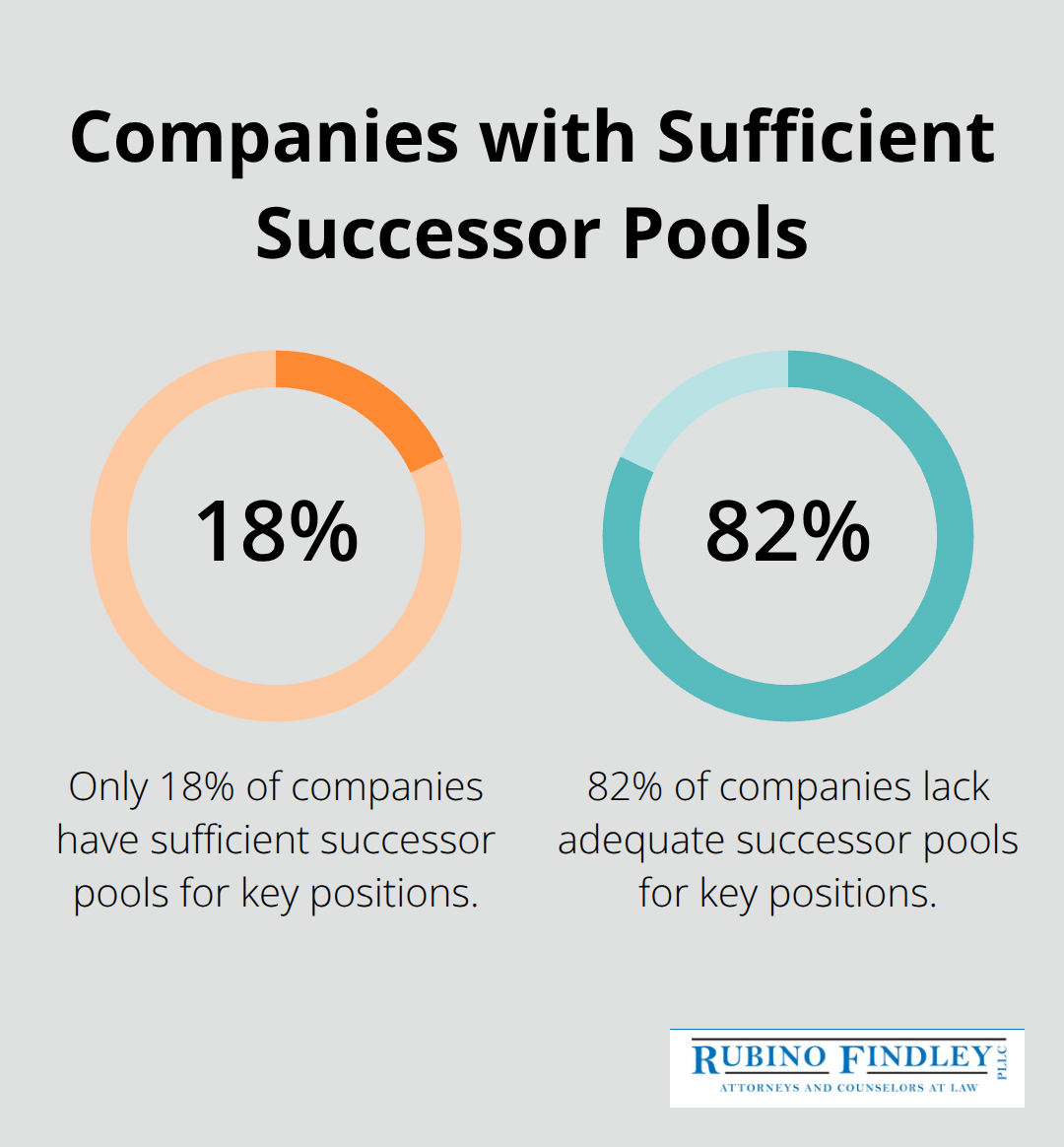

Operating agreements often lack clear succession language. Families scramble when an owner dies or becomes incapacitated. The National Association of Corporate Directors found that only 18% of companies have sufficient successor pools for key positions.

Florida LLCs face additional complications because membership interests do not automatically transfer like other assets. Without proper documentation, your LLC could face lengthy probate proceedings that freeze business operations for months. Multi-member LLCs create even bigger headaches when members disagree about new partners or family members.

Tax Consequences Blindside Families

LLC interests trigger complex tax situations that personal assets do not face. The federal estate tax exemption sits at $12.92 million per individual in 2023, but LLC valuations can push estates over this threshold unexpectedly.

Inherited LLC interests receive a step-up in basis to fair market value at death, but only if owners structure them properly beforehand. Florida’s lack of state estate tax helps, but federal obligations remain significant. Gift tax opportunities exist with the annual $17,000 exclusion per recipient (2023), yet most owners miss these chances to reduce their taxable estates while alive.

Business Valuations Create Costly Disputes

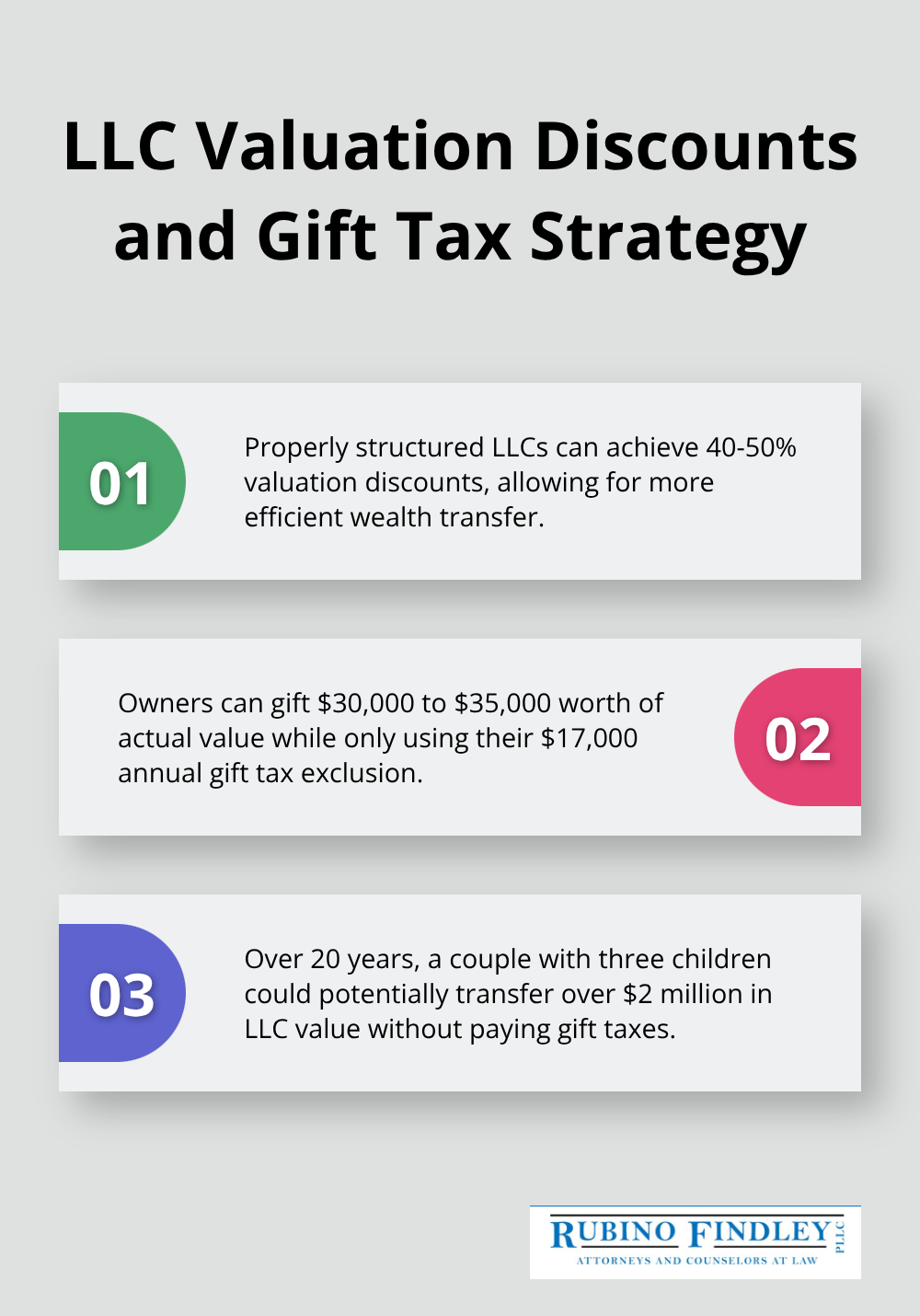

Courts require professional appraisals to determine fair market value for LLC interests. Unlike publicly traded stocks, LLC membership interests lack clear market prices. Properly structured LLCs can achieve 40-50% valuation discounts through minority interest and marketability restrictions, but these require advance planning.

Courts scrutinize aggressive discounts, which makes conservative approaches safer for estate planning purposes. Valuation disputes between family members and the IRS can drag on for years. These conflicts create additional costs and stress during already difficult times.

These complications make proper estate planning tools absolutely necessary for LLC owners who want to protect their business and family interests.

What Tools Actually Protect LLC Owners

LLC owners need three powerful estate planning tools that work together to prevent business disruption and family conflicts. These tools address the specific complications that arise when business interests meet estate planning requirements.

Operating Agreements Must Include Death and Incapacity Triggers

Your operating agreement controls what happens to LLC membership interests when you die or become incapacitated. Florida courts require clear documentation to avoid probate delays that can freeze business operations for months.

Smart operating agreements include automatic transfer provisions that move your interest directly to beneficiaries without court intervention. The agreement should specify voting rights for surviving family members and establish management succession protocols.

Multi-member LLCs need buy-out formulas and payment terms to prevent disputes between your family and business partners. Without these provisions, your LLC faces potential dissolution or costly litigation between surviving members.

Buy-Sell Agreements Lock In Fair Transfer Terms

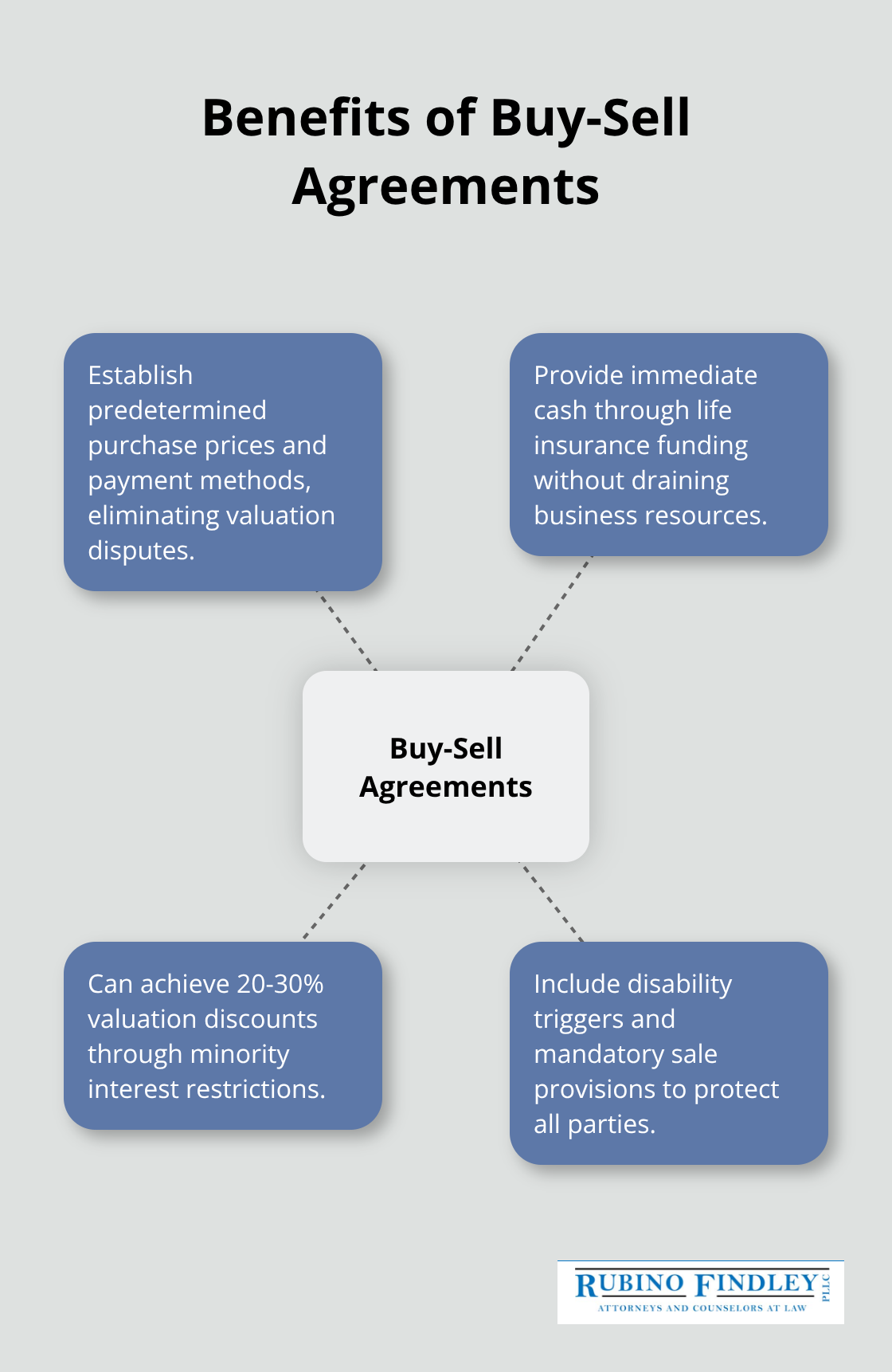

Buy-sell agreements funded with life insurance prevent financial chaos when an owner dies unexpectedly. These agreements establish predetermined purchase prices and payment methods that eliminate valuation disputes.

Life insurance provides immediate cash to surviving partners or family members without draining business resources. The agreement should include disability triggers and mandatory sale provisions to protect all parties.

Properly structured buy-sell agreements can achieve 20-30% valuation discounts through minority interest restrictions. Annual valuation updates keep purchase prices realistic and prevent conflicts (Florida LLCs benefit from charging order protection that limits creditor access to membership interests).

Revocable Living Trusts Bypass Probate Completely

Revocable living trusts hold LLC membership interests and transfer them immediately upon death without probate court involvement. Florida probate proceedings can tie up business assets for six months to two years, creating cash flow problems and operational disruptions.

Trusts maintain privacy since probate records become public documents that expose business details to competitors. The trust should name successor trustees who understand business operations and can make management decisions during incapacity periods.

Assignment of membership interest agreements officially transfer ownership from individual names to the trust. Trusts work best when combined with updated operating agreements that recognize trust ownership and management authority.

Despite having these tools in place, many LLC owners still make critical mistakes that undermine their estate plans and put their businesses at risk.

Where Do LLC Owners Go Wrong

LLC owners consistently make three devastating mistakes that destroy their estate plans and create unnecessary chaos for their families. These errors happen so frequently that the same patterns repeat across Palm Beach County businesses year after year.

Outdated Operating Agreements Create Legal Nightmares

Most LLC owners sign their operating agreement once and never touch it again. Florida law changes, business partnerships evolve, and family situations shift, but the operating agreement stays frozen in time.

When death or incapacity strikes, families discover that their 10-year-old operating agreement contradicts current estate planning documents or fails to address new business partners. Multi-member LLCs face even worse problems when outdated agreements lack clear buy-out procedures or valuation methods.

Courts then step in to resolve disputes, which can take years and cost tens of thousands in legal fees. Smart LLC owners review their operating agreements every two years and update them immediately after major life changes like marriage, divorce, or new business partnerships.

Tax Benefits Slip Away Without Action

LLC owners waste massive tax opportunities when they fail to gift membership interests during their lifetimes. The annual gift tax exclusion allows transfers of $17,000 per recipient in 2023, but most owners never use this strategy.

Properly structured LLCs can achieve 40-50% valuation discounts, which means owners can gift $30,000 to $35,000 worth of actual value while only using their $17,000 annual exclusion. Over 20 years, a couple with three children could transfer over $2 million in LLC value without paying gift taxes (Florida’s lack of state estate tax makes this strategy even more powerful).

Management Succession Plans Remain Incomplete

LLC owners focus on ownership transfer but ignore management succession completely. When the primary owner dies or becomes incapacitated, nobody knows how to run daily operations or make critical business decisions.

Operating agreements should name specific successors for management roles and establish clear decision-making authority during transition periods. Without these provisions, businesses can collapse within months as employees, vendors, and customers lose confidence in leadership stability.

Final Thoughts

Estate planning for LLC owners demands professional guidance that goes far beyond basic will preparation. The complex intersection of business law, tax regulations, and succession plans creates traps that can destroy both your business and family wealth. Most business owners underestimate these complications until it’s too late.

We at Rubino Findley, PLLC help clients in Palm Beach County navigate these complexities while avoiding the costly mistakes that plague most business owners. Professional guidance prevents outdated operating agreements from creating legal nightmares and structures gift strategies that maximize tax benefits. Attorneys create management succession plans that keep operations running smoothly during transitions (proper estate planning for LLC owners requires this level of attention to detail).

Your next step involves scheduling a consultation to review your current estate plan and LLC structure. Rubino Findley, PLLC offers consultations to help you understand how proper planning protects your business and family interests. Time works against unprepared LLC owners, and every day without proper estate planning puts your business at risk of probate delays, tax penalties, and family disputes.