Estate Planning for the Elderly in Boca Raton Key Considerations

Estate planning for the elderly in Boca Raton requires careful consideration of unique needs and challenges. As we age, our priorities shift, and our estate plans must adapt accordingly.

At Rubino Findley, PLLC, we understand the importance of tailoring estate planning strategies for seniors in our community. This guide explores key aspects of estate planning for the elderly, including essential documents, healthcare directives, and navigating probate in Palm Beach County.

Unique Estate Planning Needs for Seniors in Boca Raton

Seniors in Boca Raton face distinct challenges when it comes to estate planning. The warm climate and vibrant community make it an attractive retirement destination, but it also means that estate planning needs are often more complex.

Healthcare Directives and Long-Term Care Planning

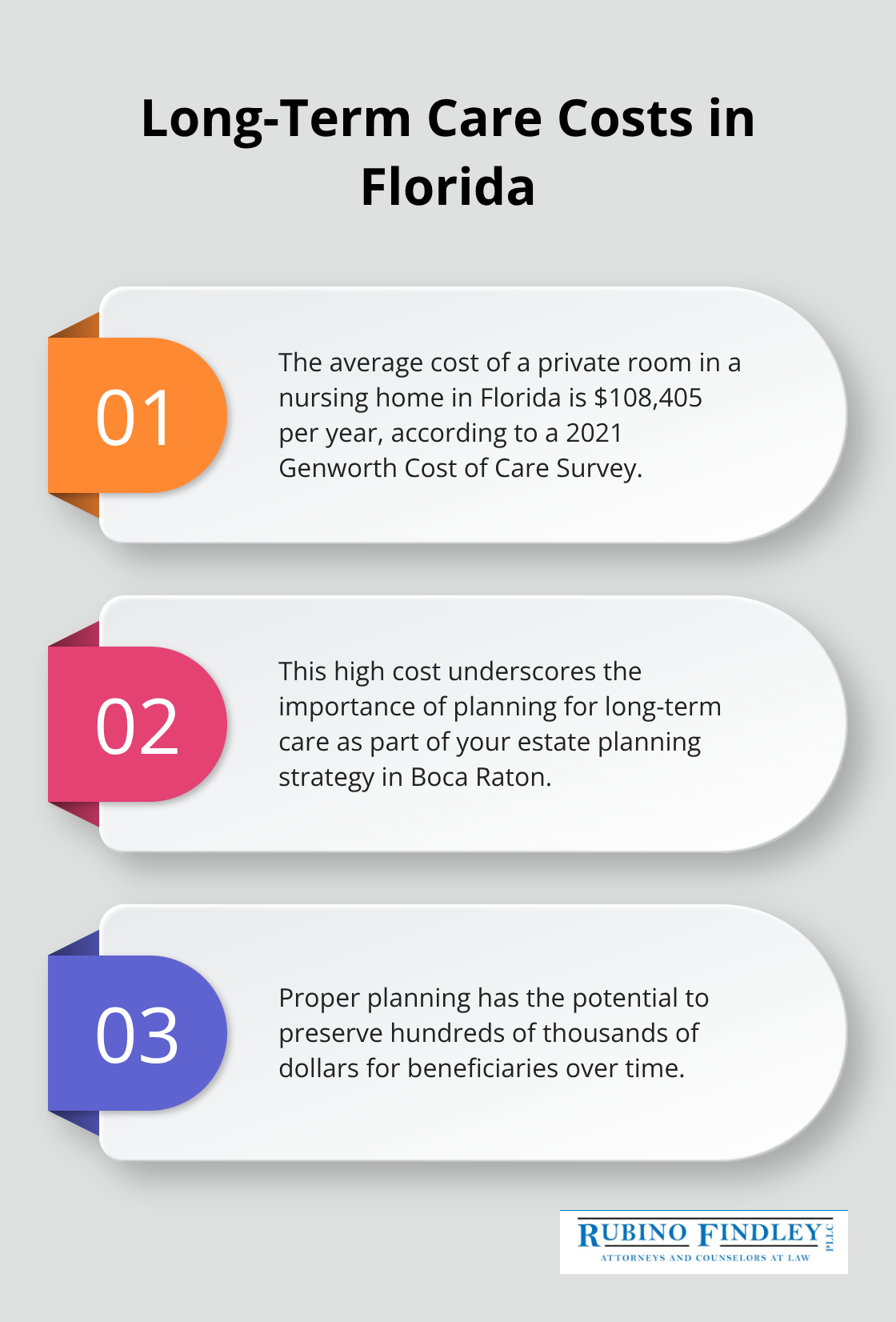

One of the most pressing concerns for seniors is healthcare. In Florida, the average cost of a private room in a nursing home is $108,405 per year (according to a 2021 Genworth Cost of Care Survey). This staggering figure underscores the importance of planning for long-term care.

Comprehensive healthcare directives are essential for seniors in Boca Raton. These documents outline medical preferences and designate someone to make decisions if the individual becomes unable to do so. It’s not just about end-of-life care; it’s about maintaining control over healthcare decisions at any stage.

Long-term care insurance is another consideration. While it can be expensive, it may save an estate significant sums in the long run. Proper planning has the potential to preserve hundreds of thousands of dollars for beneficiaries.

Asset Protection Strategies

Florida’s homestead exemption is a powerful tool for asset protection. It shields the primary residence from creditors, making it a cornerstone of many estate plans in Boca Raton. However, it’s not a catch-all solution.

For seniors with significant assets, irrevocable trusts often provide additional protection. These trusts can safeguard assets from creditors and may help with Medicaid planning. It’s a complex area of law, but when implemented correctly, it can provide substantial benefits.

Considerations for Beneficiaries and Inheritance

Seniors in Boca Raton often have unique family situations that require careful planning. Blended families, for instance, may need special provisions to ensure all children receive fair treatment.

There’s also an increasing trend of seniors wanting to leave money to grandchildren for education. A 529 plan can serve as an excellent vehicle for this purpose, offering tax advantages while helping with college costs.

For those with charitable inclinations, a charitable remainder trust can provide income during their lifetime while benefiting their chosen charity after passing. This strategy can offer tax benefits and create a lasting legacy.

Estate planning for seniors in Boca Raton isn’t one-size-fits-all. It requires a nuanced approach that considers health, assets, and family dynamics. With thoughtful planning, seniors can protect their assets, provide for their loved ones, and ensure respect for their wishes.

As we move forward, let’s examine the essential estate planning documents that every senior should consider. These legal instruments form the foundation of a comprehensive estate plan and provide clarity and direction for your loved ones.

Essential Estate Planning Documents for Seniors in Boca Raton

Estate planning for seniors in Boca Raton requires several key documents that form the foundation of a comprehensive plan. These documents ensure that your wishes are respected and your assets are protected.

Last Will and Testament: The Foundation

A last will and testament outlines how you want your assets distributed after your death. In Florida, a valid will must be signed by the testator and two witnesses. Without a will, your assets will be distributed according to Florida’s intestacy laws, which may not align with your wishes.

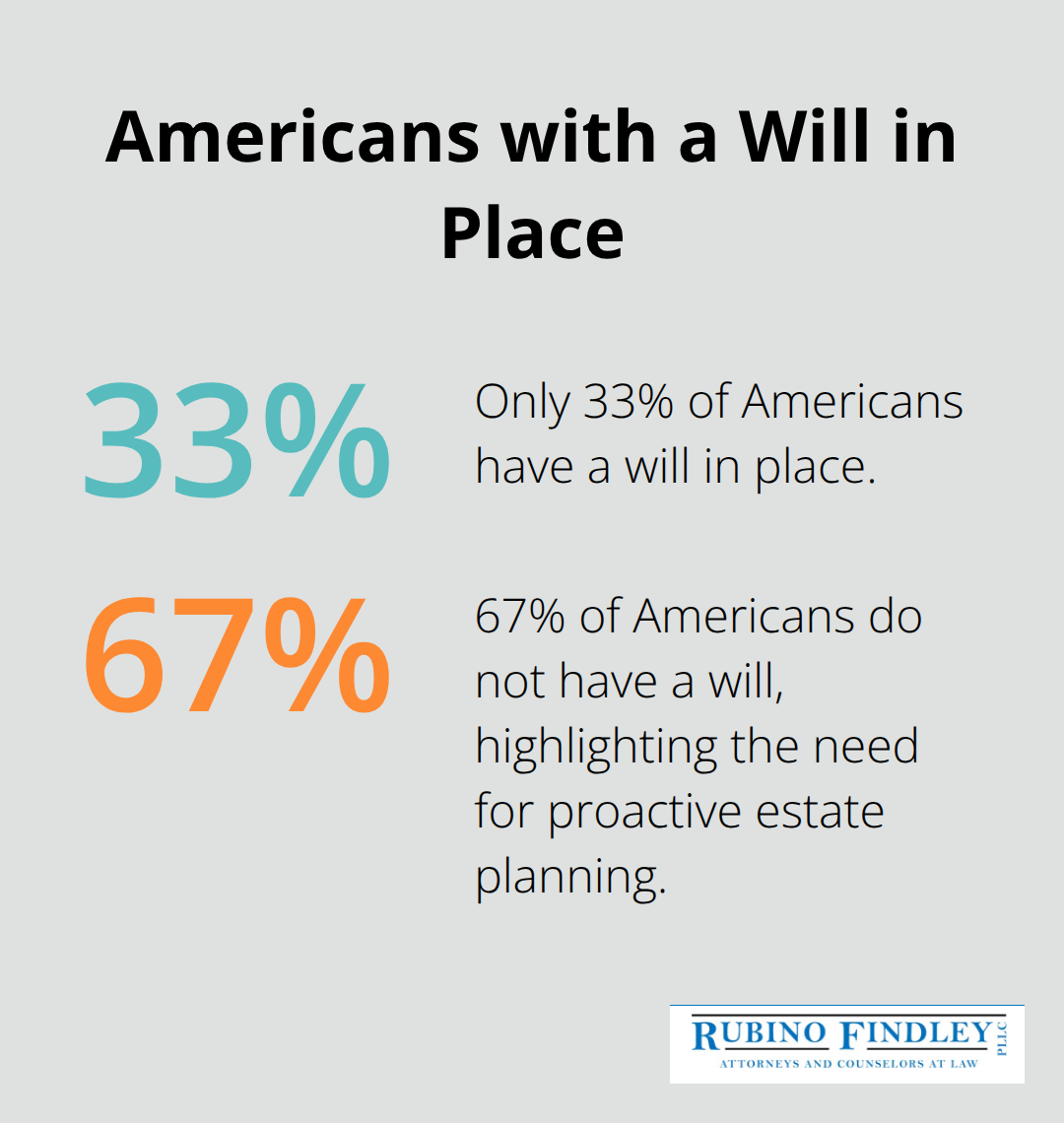

A well-crafted will helps avoid family disputes and preserves your legacy. It’s particularly important for blended families or those with complex asset structures. A study by Caring.com found that only 33% of Americans have a will in place, highlighting the need for more proactive estate planning, especially among seniors.

Durable Power of Attorney: Financial Protection

A durable power of attorney (DPOA) allows you to appoint someone to manage your financial affairs if you become incapacitated. This document remains in effect even if you lose mental capacity, unlike a standard power of attorney.

In Florida, a DPOA can be effective immediately or only upon incapacity. It’s important to choose a trustworthy individual and clearly define their powers. A DPOA can cover a wide range of financial decisions (from paying bills to managing investments).

Advance Healthcare Directives: Medical Decision-Making

Advance healthcare directives consist of two main documents: a living will and a healthcare proxy (also known as a healthcare power of attorney). These documents work together to ensure your medical wishes are respected if you’re unable to communicate them yourself.

A living will outlines your preferences for end-of-life care, such as whether you want to be kept on life support. A healthcare proxy designates someone to make medical decisions on your behalf. The National Hospice and Palliative Care Organization reports that only about 36% of Americans have advance directives in place, leaving many families struggling with difficult decisions during critical times.

Revocable Living Trust: Flexibility and Privacy

A revocable living trust allows you to transfer assets into a trust during your lifetime, which you can continue to manage. Upon your death, these assets transfer to your beneficiaries without going through probate.

The benefits of a revocable living trust include:

- Privacy: Unlike a will, a trust is not a public document.

- Flexibility: You can change or revoke the trust during your lifetime.

- Probate avoidance: Assets in the trust bypass the probate process, saving time and money.

In Florida, where probate can be costly and time-consuming, a revocable living trust can be particularly beneficial. Probate costs can range from 3% to 7% of the total estate value, making trusts an attractive option for many seniors.

These essential documents provide the framework for a comprehensive estate plan. However, estate planning doesn’t stop with document creation. The next step involves understanding how to navigate probate and estate administration in Palm Beach County, which can significantly impact the execution of your estate plan.

How Probate Works in Palm Beach County

Understanding the Probate Process

Probate in Palm Beach County involves several steps for estates valued over $75,000 (excluding exempt assets like homestead property). The process typically lasts 6 to 12 months but can extend to 18 months or more for complex estates.

The probate journey begins when someone files a petition with the circuit court within 10 days of the decedent’s death. The court then appoints a personal representative to manage the estate. This representative must notify creditors, who have 3 months from the date of publication to file claims against the estate. This timeline affects how quickly assets can be distributed to beneficiaries.

Strategies to Reduce Probate Impact

Several methods can minimize the impact of probate:

- Beneficiary Designations: Assets like life insurance policies, retirement accounts, and certain bank accounts can pass directly to beneficiaries, avoiding probate entirely.

- Revocable Living Trusts: Assets held in trust are not subject to probate, potentially saving thousands in court costs and attorney fees. A study by the American Association of Retired Persons (AARP) found that probate fees can consume up to 5% of an estate’s value.

- Summary Administration: Florida offers this simplified probate process for estates valued under $75,000 or when the decedent has been dead for more than two years. It can significantly reduce time and costs associated with probate.

The Personal Representative’s Role

The personal representative plays a key role in the probate process. Their responsibilities include:

- Inventorying the estate’s assets

- Paying valid creditor claims

- Filing tax returns

- Distributing assets to beneficiaries

Choosing the right personal representative is important. They should be trustworthy, organized, and capable of handling complex financial matters. In Palm Beach County, the personal representative must be either a Florida resident or a close relative of the decedent.

We at Rubino Findley, PLLC often advise clients to name a backup personal representative in their will. This can prevent delays if the primary choice cannot or will not serve.

Navigating Probate Challenges

Probate can present various challenges, especially in complex estates. Common issues include:

- Disputes among beneficiaries

- Creditor claims against the estate

- Locating and valuing assets

- Interpreting unclear will provisions

An experienced probate attorney can help navigate these challenges and ensure a smooth probate process. They can also advise on strategies to minimize probate costs and delays, tailored to your specific situation.

Final Thoughts

Estate planning for the elderly in Boca Raton requires careful consideration of unique challenges. A comprehensive plan includes essential documents such as wills, powers of attorney, and healthcare directives. These tools protect assets, respect wishes, and provide clarity for families during difficult times.

The probate process in Palm Beach County can impact estates significantly. Strategies to minimize probate effects can save time and money for beneficiaries. Selecting the right personal representative plays a key role in managing the estate efficiently.

We at Rubino Findley, PLLC offer guidance for elderly estate planning (tailored to individual needs). Our team creates wills, trusts, and other vital documents to secure your legacy. Schedule a consultation today to start crafting a plan that aligns with your goals and protects your loved ones.