Estate Planning Strategies for Retirees in Boca Raton

Retirement brings new financial realities that demand updated legal strategies. Estate planning for retirees becomes more complex as priorities shift from wealth accumulation to preservation and distribution.

We at Rubino Findley, PLLC understand that Boca Raton retirees face unique challenges in protecting their assets and legacy. Florida’s tax advantages create opportunities, but proper planning remains vital for maximizing benefits.

How Do Retirement Financial Priorities Change Estate Planning

Financial Focus Shifts from Growth to Preservation

Retirement fundamentally alters your financial landscape. The accumulation phase ends, and preservation becomes paramount. Only 33% of Americans have a will according to Caring.com, yet retirees face heightened risks that make estate planning non-negotiable. Your investment strategy shifts from aggressive growth to income generation and capital protection. This transition demands immediate estate plan updates because your previous documents may no longer reflect current needs or asset values.

Three Critical Mistakes That Cost Retirees Thousands

Retirees consistently make predictable errors that drain their estates. First, they fail to update beneficiary designations after major life changes (leaving ex-spouses or deceased relatives as beneficiaries). Second, they underestimate long-term care costs, which average $108,405 annually for private rooms in Florida according to Genworth’s Cost of Care Survey. Third, they postpone Medicaid planning until crisis hits, missing the five-year lookback period that protects assets through irrevocable trusts.

Age Creates Legal Urgency That Cannot Wait

Time pressure intensifies estate planning needs after 65. Only 36% of Americans have advance healthcare directives according to the National Hospice and Palliative Care Organization, creating family stress during medical emergencies. Cognitive decline affects 13% of people over 70 (making capacity challenges real threats to your planning timeline). Florida’s probate process takes 6 to 12 months in Palm Beach County, extending to 18 months for complex estates. Waiting increases costs and reduces options for tax-efficient wealth transfer strategies.

These changing priorities require specific legal tools that address retirement realities. The next section examines the essential estate planning documents that protect Boca Raton retirees and their families.

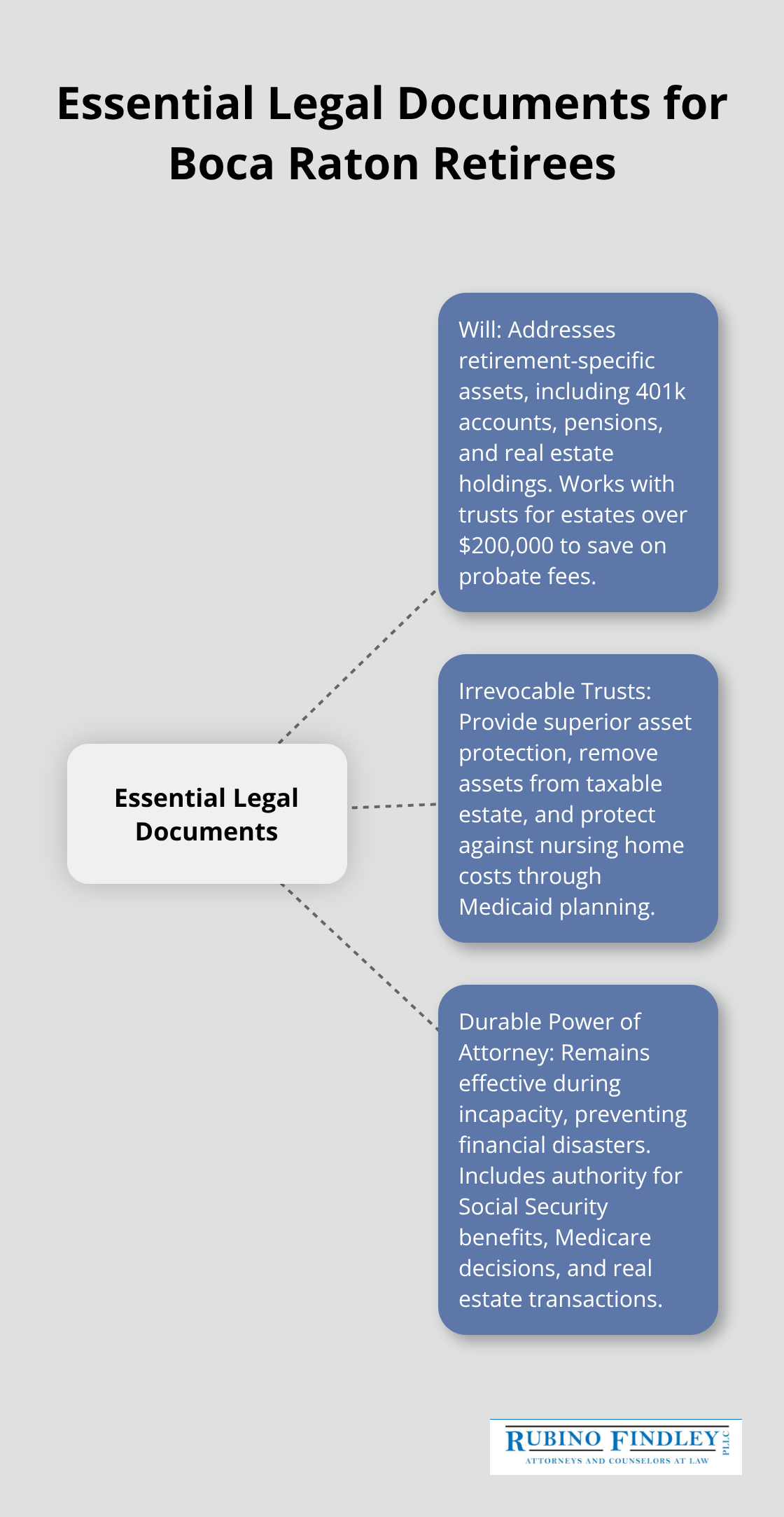

What Legal Documents Do Boca Raton Retirees Need Most

Your Will Must Address Retirement-Specific Assets

Your retirement will contains different assets than your pre-retirement version. Florida’s simplified summary administration applies to estates under $75,000, but most retirees exceed this threshold with 401k accounts, pensions, and real estate holdings. Your will must specifically address retirement account distributions, Social Security survivor benefits, and healthcare directives that weren’t priorities during working years. Probate fees in Florida range from 3% to 7% of total estate value (making revocable living trusts the superior choice for estates over $200,000). Retirees save thousands when they structure wills that work with trusts rather than replace them entirely.

Irrevocable Trusts Provide Superior Asset Protection

Revocable trusts provide probate avoidance but offer zero creditor protection during your lifetime. Irrevocable trusts remove assets from your taxable estate and protect against nursing home costs through Medicaid planning. Florida’s homestead exemption protects primary residences from creditors, but second homes and investment properties remain vulnerable without trust protection. The five-year Medicaid lookback period makes early irrevocable trust funding essential for long-term care planning.

Durable Power of Attorney Prevents Financial Disasters

Financial power of attorney remains effective during incapacity, unlike regular powers that terminate when you need them most. Healthcare power of attorney appointments should name backup agents because 13% of people over 70 develop cognitive decline according to medical research. Your agents need specific authority for Social Security benefits, Medicare decisions, and real estate transactions that standard forms often omit. Palm Beach County courts require detailed documentation for contested guardianship cases (making comprehensive power of attorney documents your best protection against family disputes).

Tax considerations and asset protection strategies become paramount once you establish these foundational documents. Florida offers unique advantages for retirees, but strategic planning maximizes these benefits while protecting your wealth from unexpected costs.

How Can Florida Retirees Maximize Tax Benefits and Protect Assets

Florida Tax Advantages Create Massive Retirement Savings

Florida eliminates state income taxes on retirement distributions, Social Security benefits, and pension payments. This advantage saves retirees thousands annually compared to high-tax states like New York or California. Florida’s homestead exemption protects primary residences from creditors and reduces property taxes for residents over 65. The exemption applies to properties worth up to $50,000 for seniors (creating substantial annual savings). Retirees relocate from northern states specifically to capture these tax benefits while they maintain their lifestyle in Palm Beach County.

Strategic Estate Tax Planning Requires Immediate Action

Federal estate tax exemption stands at $12.92 million per person for 2023, but this drops to $5.49 million in 2026 without Congressional action. Charitable remainder trusts provide lifetime income while they reduce taxable estates and generate immediate tax deductions. Annual gifts of $17,000 per recipient remove assets from taxable estates without gift tax triggers. Irrevocable life insurance trusts remove policy death benefits from estate taxation while they provide liquidity for estate taxes and expenses.

Long-Term Care Costs Devastate Unprepared Estates

Private rooms in Florida nursing homes cost $108,405 annually according to Genworth’s Cost of Care Survey (depleting retirement savings within five years for most families). Medicaid plans through irrevocable trusts protect assets when families implement them before the five-year lookback period begins. Long-term care insurance premiums average $3,500 annually but cover $150 daily benefits, providing 4,000% return on investment during extended care periods. Asset protection strategies must begin immediately because delays until health declines eliminate most protective options and force families into crisis-driven decisions.

Final Thoughts

Estate planning for retirees demands immediate action because delays cost families thousands in taxes and legal fees. You must update your will to reflect retirement assets, then establish irrevocable trusts for Medicaid protection before the five-year lookback period begins. Annual reviews of beneficiary designations prevent costly mistakes, particularly after major life changes like divorce or death of a spouse.

You should update your estate plan every three to five years or after significant events like retirement, health changes, or new grandchildren. Florida’s tax laws change frequently (making regular reviews essential for optimal strategies). Your durable power of attorney needs updates when agents move, become ill, or relationships change.

We at Rubino Findley, PLLC serve clients throughout Palm Beach County with comprehensive estate plans that protect assets and honor wishes. Our team handles wills, trusts, probate administration, and durable power of attorney documents. Contact us for a consultation to discuss your specific needs and develop strategies that maximize Florida’s tax advantages while protecting your legacy for future generations.