Estate Planning Template: Your Complete Guide

Most people put off estate planning because they think it’s only for the wealthy or elderly. The truth is that without a solid plan, your family could face years of legal battles, unexpected taxes, and confusion about your wishes.

We at Rubino Findley, PLLC help families in Palm Beach County create an estate planning template that protects what matters most. This guide walks you through the documents you need, the mistakes to avoid, and why professional guidance makes all the difference.

Why Estate Planning Matters Now

Probate Costs Your Family Time and Money

Estate planning isn’t something you handle when you’re retired or wealthy-it’s something you need the moment you have assets worth protecting or people depending on you. Without a plan in place, your family faces a difficult reality: probate court will decide how your assets are distributed, and state law will determine who raises your children if something happens to you. Probate in Florida costs thousands of dollars and takes months to complete, eating into the inheritance your family receives. According to Florida Statute 735.201, even smaller estates under $75,000 can qualify for Summary Administration, but that still requires court involvement and attorney fees. The real problem is that probate delays your family’s access to funds during a time when they need money most-for funeral expenses, living costs, and childcare.

Incapacity Planning Protects Your Family from Court Control

The second reason to plan now is incapacity. If you’re in an accident or become seriously ill tomorrow, Florida law won’t automatically let your spouse or adult children access your bank accounts, pay your mortgage, or make medical decisions on your behalf. Without a Durable Power of Attorney and Healthcare Surrogate designation in place, your family will need to go to court to get guardianship-a lengthy and expensive process that gives a judge control over your life instead of the people you trust.

Life Doesn’t Wait for the Right Time

Life happens unexpectedly: car accidents, sudden illness, and unexpected death don’t wait for the right time. Families who avoid years of legal headaches and financial loss are the ones who act before crisis strikes. Starting your estate plan today-whether you’re 25 or 65-protects your family from uncertainty and gives you control over what happens to your life, your money, and your children if you can’t make those decisions yourself. An experienced estate planning attorney from Rubino Findley, PLLC in Boca Raton can help you establish the documents your family needs (wills, trusts, powers of attorney, and healthcare directives) tailored to your specific situation and Florida law.

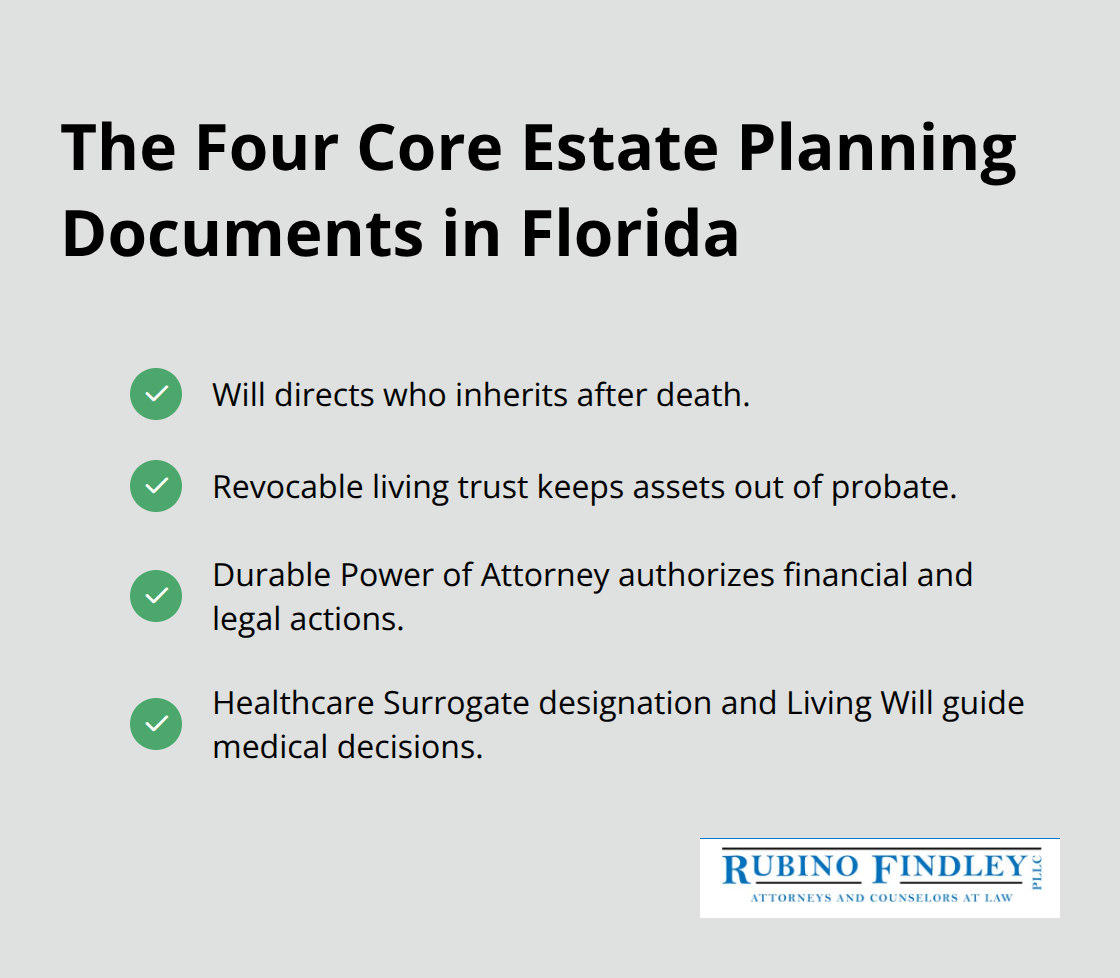

The Four Documents That Actually Protect Your Family

A will alone won’t protect your family from probate or give them access to your accounts if you become incapacitated. That’s why a complete estate plan in Florida requires multiple documents working together.

Why a Will Isn’t Enough

A will directs asset distribution after death but still requires probate court involvement, which in Florida costs thousands of dollars and delays your family’s access to funds for months. According to Florida Statute 732.901, your original will must be filed with the Clerk’s Office within 10 days of death, but that filing triggers the probate process unless you’ve used other tools to bypass it. The will itself cannot prevent court delays or protect your family during incapacity-it only addresses what happens after you die.

Revocable Living Trusts Keep Assets Out of Probate

A revocable living trust holds your assets during your lifetime and transfers them to beneficiaries outside probate when you die, avoiding court delays and keeping your family’s financial details private. The trust must be funded properly (meaning assets are retitled in the trust’s name), or it won’t take effect as intended. This single document accomplishes what a will cannot: it removes your assets from the probate process entirely and gives your family immediate access to funds without court involvement.

Durable Power of Attorney Prevents Court Guardianship

A Durable Power of Attorney names someone you trust to handle your financial and legal matters if you become unable to do so. Unlike a springing power (which Florida generally doesn’t recognize), it takes effect immediately upon signing. Without this document, your family must petition the court for guardianship, which costs money, takes time, and gives a judge control over your life instead of the people you trust.

Healthcare Documents Complete Your Protection

A Healthcare Surrogate designation and Living Will record your medical treatment preferences and name someone to make healthcare decisions if you can’t. These two documents ensure your family knows exactly what you want and has the legal authority to act on your behalf without court intervention.

These four documents-will, trust, durable power of attorney, and healthcare directive-form the foundation of a plan that protects your family from legal complications, delays, and uncertainty. Once you understand what each document does, the next step is identifying which mistakes most families make when they create these documents without professional guidance.

Where Estate Plans Fall Apart

Outdated Documents Cost Your Family Thousands

Most families create an estate plan and then never touch it again, which is exactly why their plan fails when they need it most. Life changes constantly-marriages, divorces, children, grandchildren, career changes, home purchases-but the documents sitting in a drawer do not adjust automatically. According to Florida Statute 732.4015, a surviving spouse has elective rights that must be exercised within six months of death, and those rights depend entirely on what your documents actually say at that moment. If you created a will ten years ago naming your ex-spouse as executor or your original beneficiaries, that outdated document controls what happens to your estate, not your current wishes.

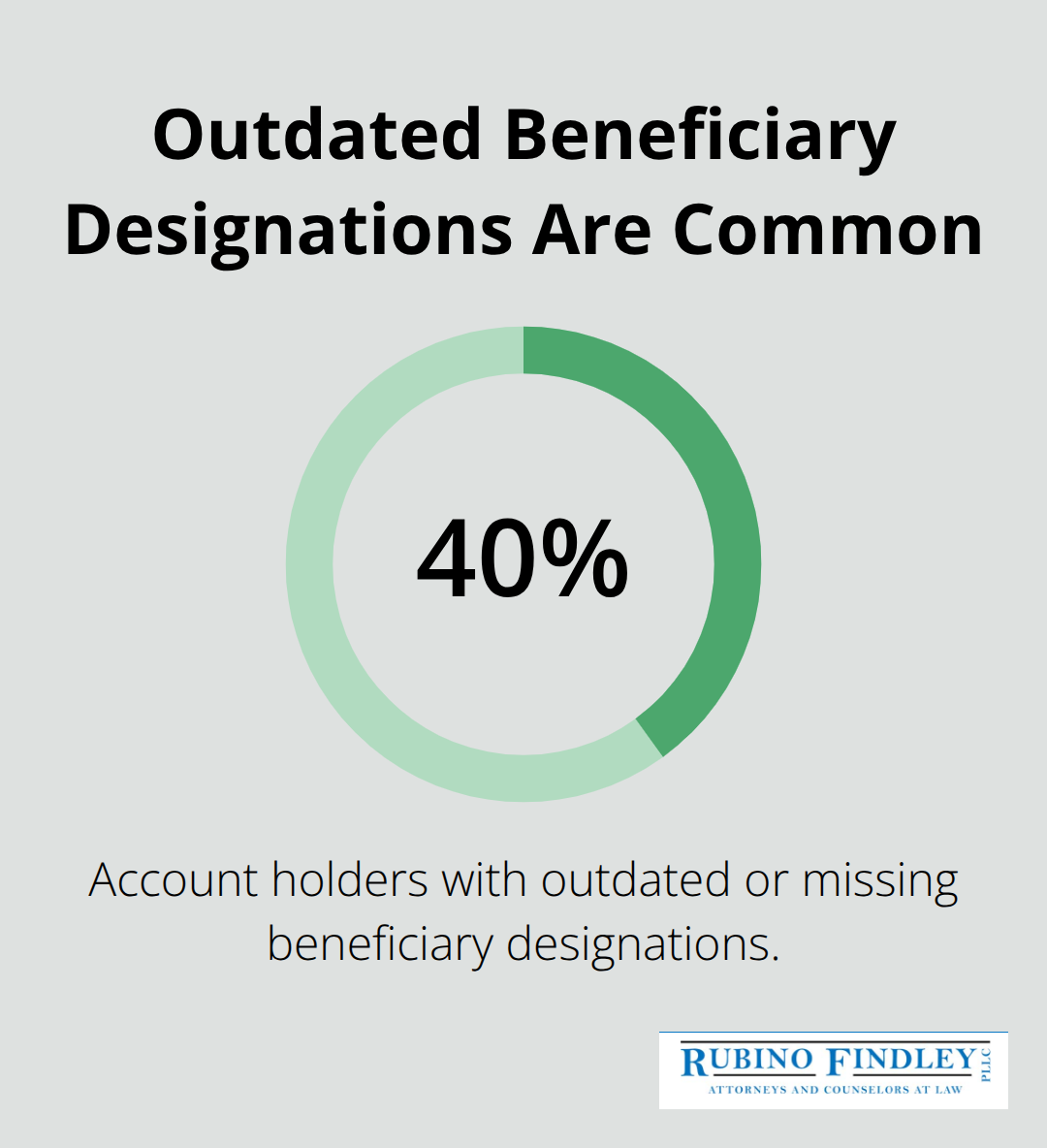

Beneficiary Designations Override Your Will

The same problem hits beneficiary designations on retirement accounts and life insurance policies, which override your will completely. A Fidelity study found that roughly 40% of account holders have outdated or missing beneficiary designations, meaning their assets bypass the people they intended to receive them.

If you named your ex-spouse as beneficiary on a $500,000 life insurance policy and forgot to update it after divorce, your ex receives the money-not your children or current spouse. That single mistake costs your family hundreds of thousands of dollars.

Blended Families Face Unintended Disinheritance

Major life events like remarriage, especially in blended families, demand immediate document review because without explicit distribution instructions in your trust or will, state law may give your new spouse rights to assets you intended for your children from a previous relationship. Your current documents may not reflect your actual wishes about who inherits what.

Digital Assets Disappear Without a Plan

Your online bank accounts, investment portfolios, cryptocurrency wallets, social media profiles, email accounts, and subscription services hold real value and personal information, yet most people never tell anyone where these accounts exist or how to access them. When someone dies, their family often cannot access these assets because they do not know the passwords or even which accounts exist. Worse, many financial institutions require a court order before releasing digital assets to heirs, which means probate delays extend to your online accounts.

You should maintain a comprehensive inventory of all digital assets-including usernames, passwords stored securely, account locations, and instructions for what should happen to each account-and store this list somewhere your executor can find it. Consider using a password manager like 1Password or Bitwarden that your executor can access after your death, or create a separate secure document stored with your estate planning attorney. Some people use digital asset services like Legacy Locker or Everplans specifically designed to catalog and transfer online accounts to heirs. Without this planning, your family may lose access to substantial funds, fail to close accounts that incur ongoing charges, or miss time-sensitive actions like claiming cryptocurrency or transferring domain names. The practical step here is simple: write down every digital account you own, note whether it has monetary value, and decide what should happen to it after you die-then share that information with your executor or attorney.

Final Thoughts

Creating an estate planning template on your own might seem like a way to save money, but the mistakes that follow cost your family far more than professional guidance ever would. When you work with an attorney from Rubino Findley, PLLC, you receive documents drafted correctly the first time, tailored to Florida law and your specific situation rather than generic forms that miss critical details about your assets, family structure, or wishes. An attorney catches problems that DIY templates miss-they ensure your trust receives proper funding so it actually works, your beneficiary designations align with your overall plan, and your documents reflect current Florida statutes.

An attorney asks the questions you might not think to ask: What happens to your business if you die? How do you protect a child who struggles with money management? Should your spouse receive everything, or do you want to preserve assets for your children from a previous relationship? These conversations shape a plan that actually protects your family instead of creating confusion when they need clarity most. Working with an attorney also gives you peace of mind-you know your family won’t face unnecessary probate delays, your children’s guardianship is decided by you rather than a judge, and your medical wishes are documented and legally binding.

We at Rubino Findley, PLLC help families in Palm Beach County create estate plans that work. Schedule your free consultation and let us help you establish the wills, trusts, powers of attorney, and healthcare directives your family needs.