High Net Worth Estate Planning in Boca Raton Protecting Your Assets

High net worth estate planning requires sophisticated strategies that go far beyond basic wills and trusts. Wealthy individuals face unique challenges including complex tax implications, asset protection needs, and privacy concerns.

We at Rubino Findley, PLLC understand that protecting substantial wealth demands careful planning and advanced legal structures. The stakes are simply too high to leave your legacy to chance.

What Makes High Net Worth Estate Planning So Complex

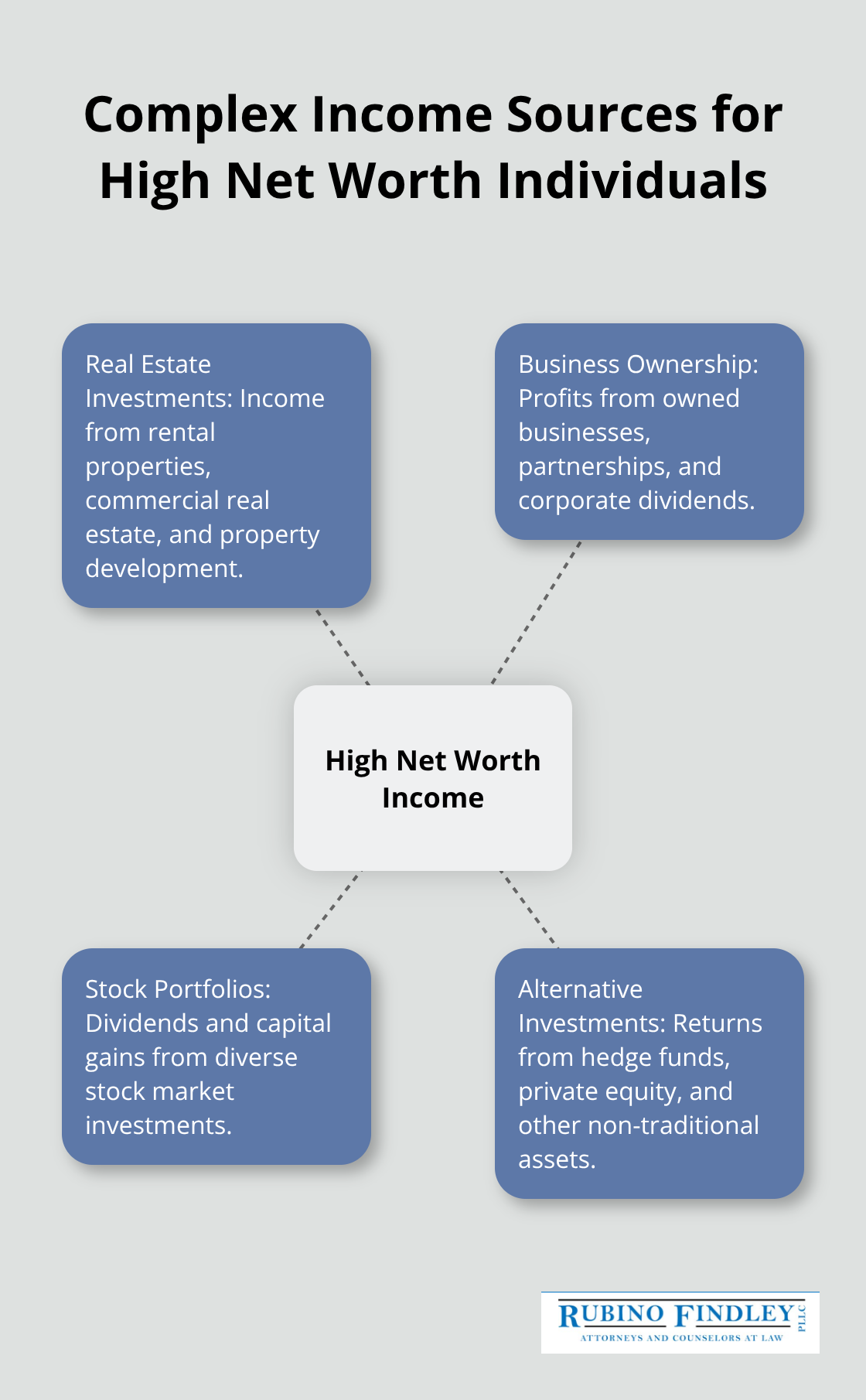

Wealthy individuals in Palm Beach County face three primary obstacles that make traditional estate planning inadequate. Multiple income streams from real estate investments, business ownership, stock portfolios, and alternative investments create intricate tax scenarios that require advanced planning strategies. The IRS reports that individuals with assets that exceed $5 million typically have income from at least four different sources, each with distinct tax implications and timing requirements.

Federal Estate Tax Realities

The 2024 federal estate tax exemption stands at $13.61 million per individual, but this protection disappears in 2026 when exemptions revert to approximately $7 million unless Congress acts. Estates that exceed these thresholds face a punishing 40% tax rate. Florida residents benefit from no state estate tax, yet many maintain properties or business interests in states like New York or California that impose their own estate taxes at $1 million. The Tax Foundation found that 12 states currently levy estate taxes, which creates additional compliance burdens for multi-state asset holders.

Asset Protection and Privacy Challenges

High net worth families become targets for frivolous lawsuits and creditor claims. Public probate records expose family wealth details and create security risks and unwanted attention. Florida’s homestead exemption protects primary residences from creditors without value limits, but investment properties and liquid assets remain vulnerable. Properly structured irrevocable trusts and limited liability companies provide protection, yet many wealthy individuals delay implementation until threats emerge (which reduces their effectiveness significantly).

Complex Business and Investment Structures

Wealthy families often hold assets through multiple entities including family limited partnerships, LLCs, and various trust structures. Each entity requires separate tax filings and compliance obligations. The complexity multiplies when business interests span multiple states or include international components. These sophisticated structures demand ongoing management and periodic restructuring to maintain their effectiveness and adapt to changing tax laws.

Which Tools Protect Wealth Most Effectively

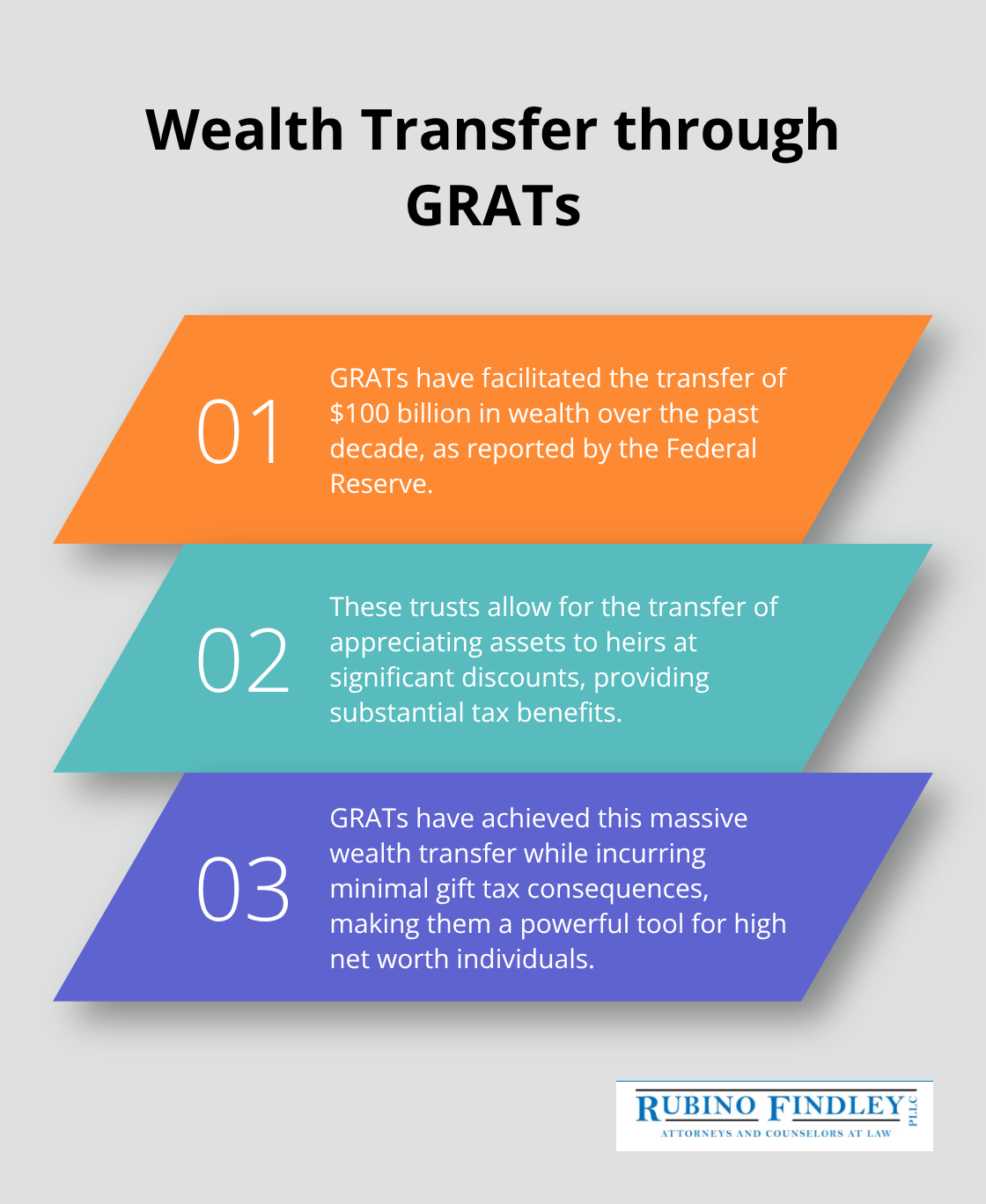

Irrevocable trusts form the cornerstone of sophisticated asset protection for high net worth families in Palm Beach County. These structures remove assets from your taxable estate while they provide creditor protection that revocable trusts cannot match. Grantor Retained Annuity Trusts allow you to transfer assets that appreciate to heirs at steep discounts while you retain income streams for predetermined periods. The Federal Reserve reports that families who use GRATs have successfully transferred $100 billion in wealth over the past decade with minimal gift tax consequences.

Advanced Trust Strategies for Maximum Protection

Qualified Personal Residence Trusts reduce estate taxes on primary residences by 20-50% according to IRS valuation tables (which makes them particularly valuable for Boca Raton properties that have appreciated significantly). These trusts work best when property values continue to rise after the trust creation. Dynasty trusts provide perpetual wealth transfer benefits in states that have abolished the rule against perpetuities, allowing wealth to pass through multiple generations without estate tax consequences.

Tax-Efficient Wealth Transfer Methods

Annual gift limits for 2024 allow $18,000 per recipient without they trigger gift taxes, but wealthy families should maximize the $13.61 million lifetime exemption before it potentially drops in 2026. Generation-skipping trusts bypass estate taxes at your children’s level and direct wealth to grandchildren while they provide income to intermediate generations. These trusts carry their own $13.61 million exemption, which effectively doubles your tax-free transfer capacity. Family limited partnerships offer additional advantages because they allow discounted valuations of 20-40% for minority interests that you gift to children.

Business Succession Strategies That Preserve Value

Family businesses require immediate succession plans to avoid forced sales that fund estate taxes. Installment sales to children or key employees spread tax burdens over multiple years while they maintain family control. Employee Stock Ownership Plans provide tax-deferred proceeds when you sell to employees, with sellers who potentially avoid capital gains taxes entirely through reinvestment strategies. The Small Business Administration found that only 30% of family businesses survive to the second generation (primarily due to inadequate succession plans rather than business failures).

These sophisticated tools require careful implementation and ongoing management, yet many wealthy families make critical errors that undermine their effectiveness.

What Fatal Errors Destroy Estate Plans

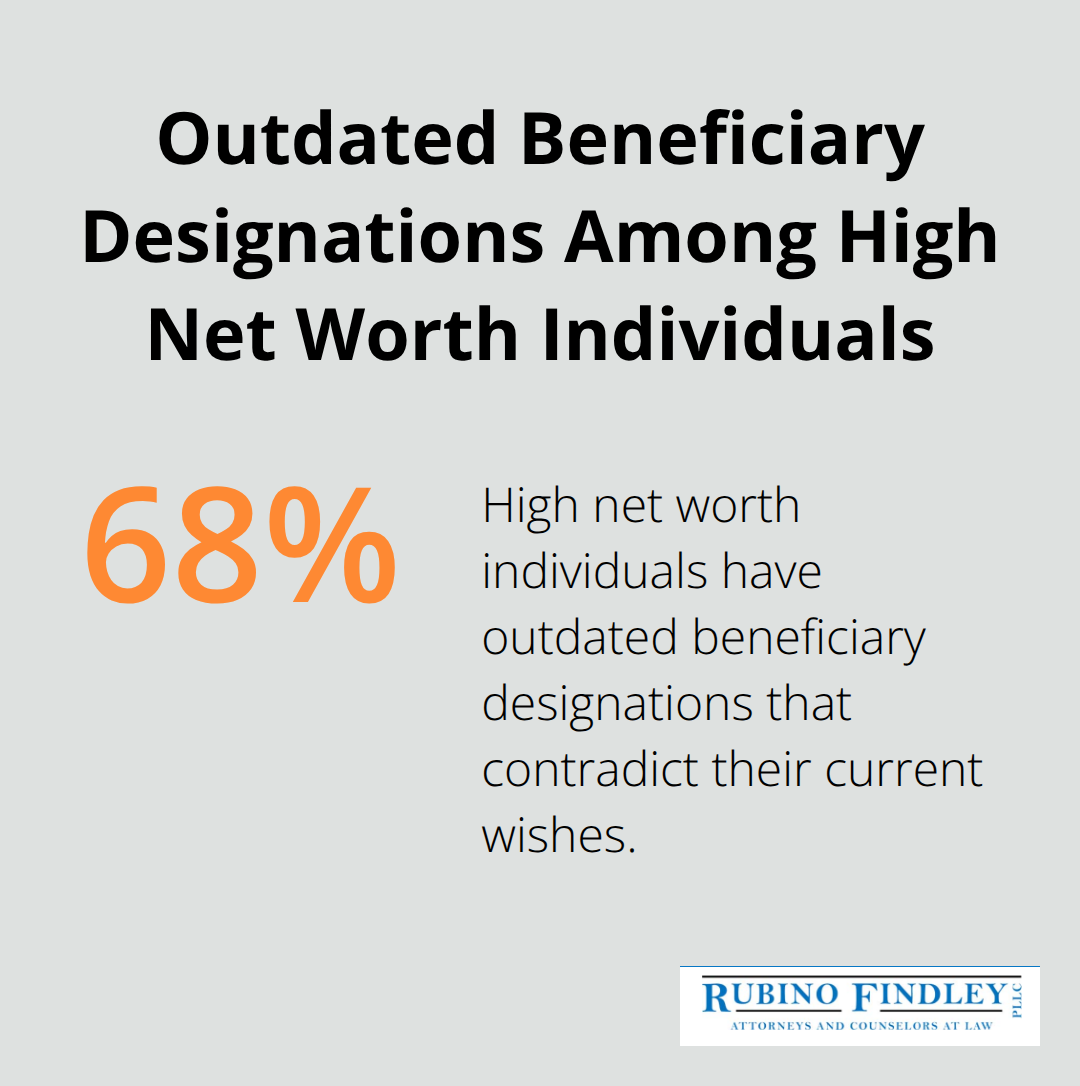

Wealthy families routinely sabotage their own estate plans through three devastating mistakes that cost millions in unnecessary taxes and legal fees. The most destructive error involves failure to update plans after divorces, remarriages, or business sales. Estate Planning Council data shows that 68% of high net worth individuals have outdated beneficiary designations that contradict their current wishes. A divorced spouse who remains the beneficiary on a $2 million life insurance policy will receive those funds regardless of what your will states. Business owners who sell companies often forget to update trusts that held those assets, which leaves beneficiaries with worthless interests instead of cash proceeds.

State Tax Traps That Catch Florida Newcomers

Florida newcomers create immediate tax advantages, but many wealthy individuals fail to properly establish domicile and maintain ties to high-tax states that continue to claim them as residents. New York aggressively audits former residents and collected $1.2 billion from disputed domicile cases in 2023 according to the Department of Taxation. You must spend more than 183 days annually in Florida, change voter registration, obtain Florida driver’s licenses, and move primary bank accounts to establish clear domicile. Country club memberships or investment advisors in former states provide ammunition for tax authorities to challenge your residency change.

Incapacity Plans That Devastate Families

High net worth individuals consistently underestimate incapacity risks and fail to create comprehensive management structures for their complex affairs. The Alzheimer’s Association reports that 11% of adults over 65 develop dementia, yet only 23% of wealthy families have detailed incapacity plans beyond basic powers of attorney. Complex investment portfolios, multiple business interests, and family foundations require sophisticated management that generic documents cannot address (courts will appoint guardians who may lack the knowledge to manage sophisticated wealth structures effectively). Corporate trustees and family governance structures must be established before incapacity strikes.

Digital Asset Oversights

Modern wealth includes substantial digital components that traditional estate plans ignore completely. Cryptocurrency holdings, online business accounts, and digital investment platforms require specific access provisions and succession plans. The Federal Trade Commission found that families lose access to $2.7 billion annually in digital assets due to inadequate estate plans. Password managers and two-factor authentication systems create additional barriers that executors cannot overcome without proper documentation and legal authority.

Final Thoughts

High net worth estate planning demands sophisticated legal guidance that generic online templates cannot provide. The complex interplay between federal tax laws, Florida statutes, and asset protection strategies requires attorneys who understand the nuances of substantial wealth management. Mistakes in document drafts or strategy selection cost families millions in unnecessary taxes and expose assets to creditor claims.

Florida’s favorable tax environment makes proactive plans even more valuable for wealthy families. The absence of state income and estate taxes creates opportunities that other states cannot match, but only when plans are properly structured and maintained (regular reviews become essential as tax laws evolve and family circumstances change). Wealthy individuals who delay action face reduced options and higher costs.

We at Rubino Findley, PLLC help high net worth families throughout Palm Beach County navigate these complex challenges. Our team creates comprehensive estate plans that protect your wealth and honor your wishes through wills, trusts, and durable powers of attorney. Contact Rubino Findley, PLLC today to schedule your free consultation and take the first step toward your family’s financial security.