How LLCs Affect Your Estate Planning Strategy in Boca Raton

At Rubino Findley, PLLC, we understand the importance of protecting your assets and securing your family’s future. LLC and estate planning strategies can work together to provide robust protection for your wealth in Boca Raton.

This blog post explores how Limited Liability Companies (LLCs) can enhance your estate planning efforts, offering unique benefits for asset protection and tax optimization. We’ll dive into the specifics of Florida LLC laws and their impact on your estate planning goals.

What Are LLCs and How Do They Enhance Estate Planning?

The Basics of LLCs

Limited Liability Companies (LLCs) serve as powerful tools for estate planning in Boca Raton. These business structures combine the liability protection of corporations with the tax benefits of partnerships, making them ideal for asset safeguarding and wealth transfer streamlining.

An LLC is a flexible business entity that protects owners (called members) from personal liability for business debts. This means your personal assets, like your home or savings, remain safe from business creditors. In Florida, LLCs have gained popularity since the repeal of the corporate income tax in 1996 and the intangible tax in 2006.

Asset Protection Benefits

One of the key advantages of LLCs in estate planning is the charging order protection. If a member faces personal creditors, these creditors can only receive a charging order against the LLC interest. This limits them to distributions (if and when they occur), but prevents them from seizing the underlying assets or forcing a business sale.

Estate Planning Integration

LLCs play a significant role in comprehensive estate planning strategies. They facilitate the gifting of business interests to family members, potentially reducing estate taxes. For example, you can gift LLC interests to children or grandchildren over time, using annual gift tax exclusions ($17,000 per recipient as of 2023).

LLCs can streamline family asset management by centralizing control, simplifying gifting processes, and providing a framework for succession planning. This proves particularly valuable for family businesses in Boca Raton aiming to preserve wealth across generations.

Tax Advantages

LLCs offer substantial tax benefits that complement estate planning goals. As pass-through entities, they avoid double taxation. Moreover, the IRS often allows discounts on LLC interest valuations due to lack of marketability and control. These discounts can effectively double the utility of gift tax exemptions, though adhering to legal formalities remains essential to withstand potential IRS challenges.

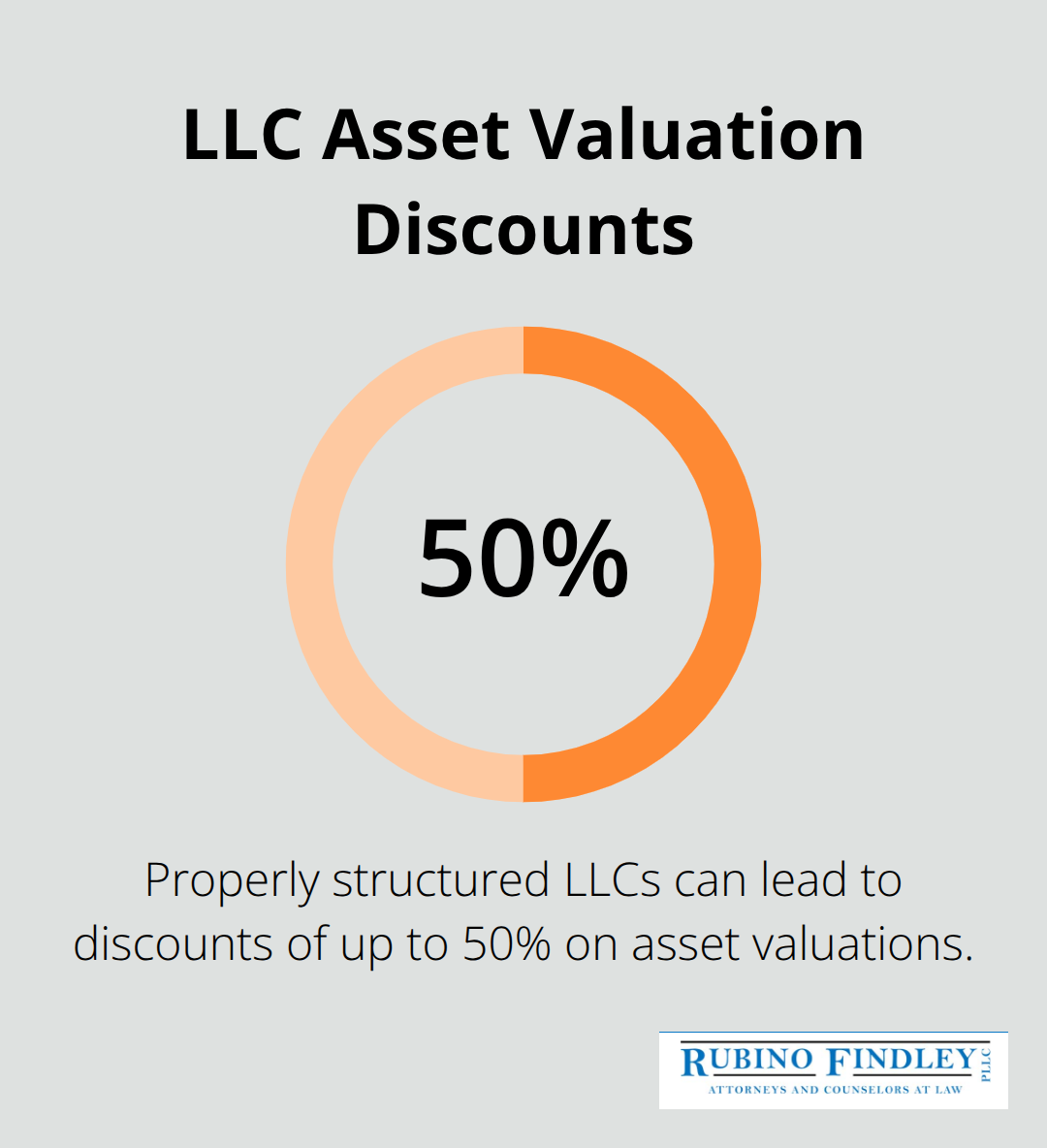

Properly structured LLCs can lead to discounts of up to 40-50% on asset valuations (depending on various factors), significantly impacting overall estate planning strategies. However, this requires careful planning and documentation.

Flexibility and Control

LLCs provide flexibility in management structure and ownership allocation. This allows for creative estate planning solutions, such as establishing different classes of membership interests with varying rights and responsibilities. Such flexibility can help tailor the distribution of assets and control among family members according to your specific wishes and family dynamics.

As we move forward, let’s explore how Florida’s specific LLC laws impact estate planning strategies in Boca Raton.

How Florida Law Protects Your Assets Through LLCs

The Power of Florida’s Charging Order Protection

Florida’s LLC laws offer robust asset protection benefits for estate planning in Boca Raton. These laws create a strong shield between personal and business assets, making LLCs an essential tool for comprehensive wealth protection strategies.

Florida law provides exceptional protection for LLC members through the charging order mechanism. If a creditor obtains a judgment against an LLC member, their only recourse is a charging order. This limits the creditor to receiving distributions from the LLC, if and when they occur. The creditor cannot force a sale of LLC assets or seize the member’s ownership interest.

This protection is particularly strong in Florida, where courts have consistently upheld the charging order as the exclusive remedy for creditors. In a 2010 Florida Supreme Court case (Olmstead v. Federal Trade Commission), the court affirmed this protection for multi-member LLCs. While single-member LLCs initially faced some uncertainty, subsequent legislative changes in 2011 extended similar protections to them as well.

Separating Personal and Business Liabilities

LLCs create a legal separation between personal and business assets. This separation protects personal wealth from business-related risks. For example, if your Boca Raton real estate investment LLC faces a lawsuit, your personal assets like your home, car, or personal bank accounts remain protected.

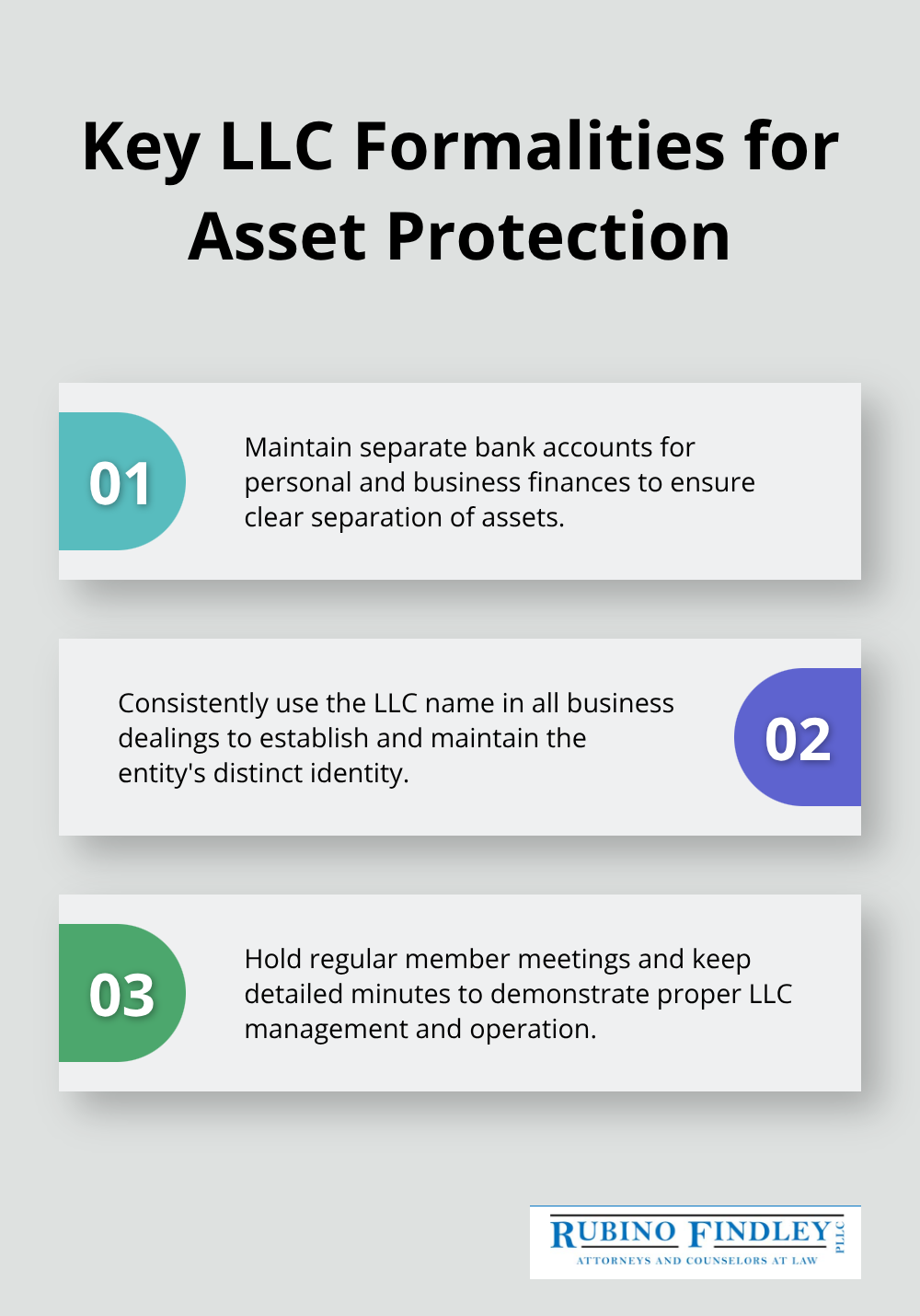

To maintain this protection, it’s critical to observe proper LLC formalities. This includes:

- Maintaining separate bank accounts for personal and business finances

- Consistently using the LLC name in business dealings

- Holding regular member meetings and keeping minutes

- Avoiding commingling of personal and business funds

Failure to adhere to these practices can lead to “piercing the corporate veil,” potentially exposing personal assets to business liabilities.

Shielding Business Assets from Personal Creditors

Florida’s LLC laws also work in reverse, protecting business assets from personal creditors of LLC members. This proves particularly valuable for estate planning, as it ensures that personal financial issues don’t jeopardize the family business or investment assets.

For instance, if an LLC member faces personal bankruptcy, creditors cannot directly access the LLC’s assets. They are limited to the charging order remedy, which often proves unattractive to creditors due to its limited scope.

Maximizing Asset Protection through Strategic LLC Structuring

To fully leverage the powerful protections offered by Florida LLC laws, it’s important to structure your LLCs strategically. This involves careful consideration of ownership structure, operating agreements, and asset allocation. A well-structured LLC can provide multiple layers of protection, safeguarding both personal and business assets from various types of creditors.

The next chapter will explore the tax implications of using LLCs in your estate planning strategy, further highlighting the benefits of these versatile entities in wealth preservation and transfer.

How LLCs Reduce Your Tax Burden

Pass-Through Taxation: A Primary Advantage

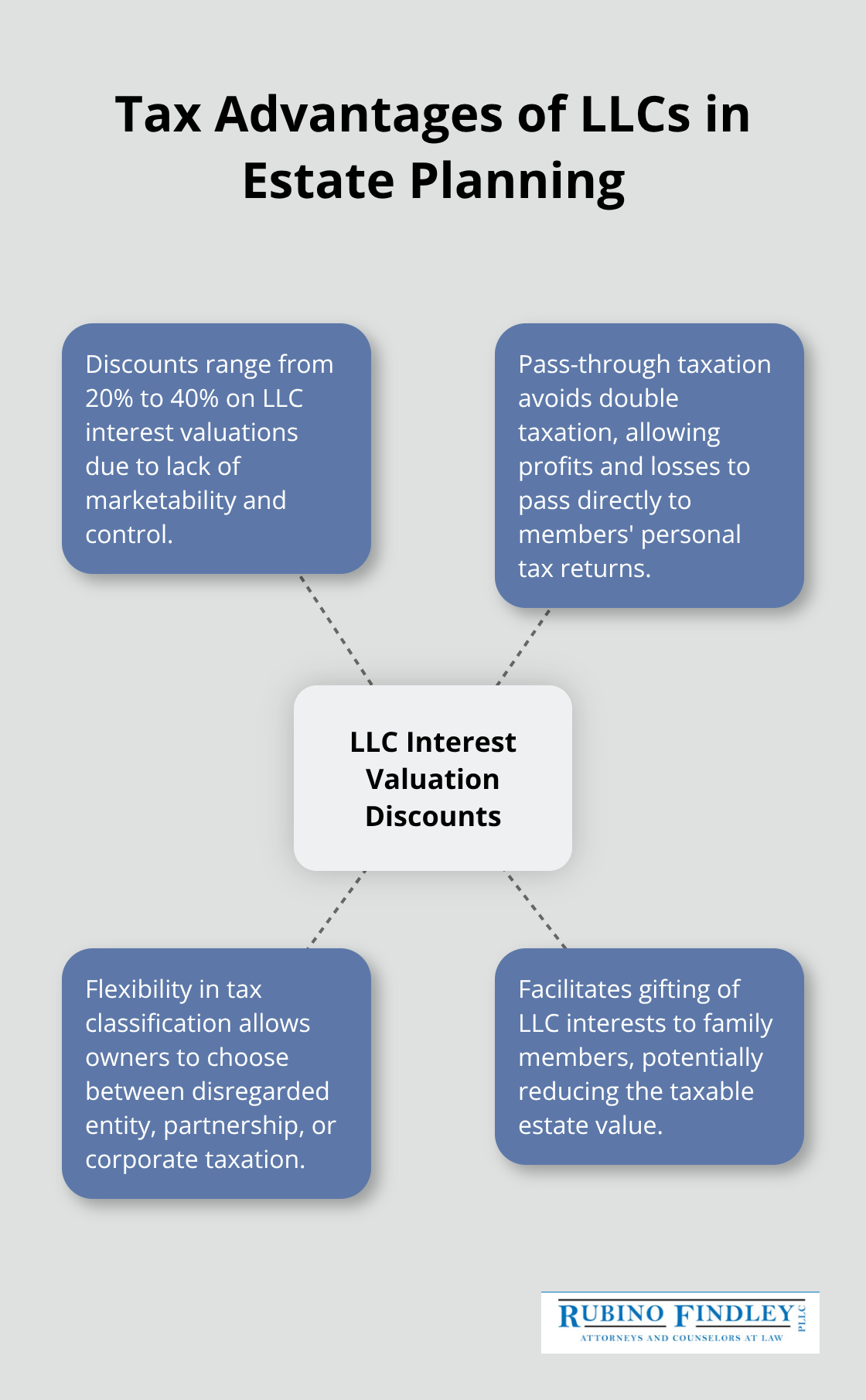

LLCs offer significant tax advantages that enhance estate planning strategies in Boca Raton. The primary benefit is pass-through taxation. Unlike corporations, which face double taxation, LLCs allow profits and losses to pass directly to the members’ personal tax returns. This results in substantial tax savings.

For instance, if a Boca Raton real estate investment LLC generates $100,000 in profit, that income is reported on the owner’s personal tax return. The owner pays taxes at their individual rate, avoiding the corporate tax rate (which can reach 21% at the federal level).

Tax Classification Flexibility

LLCs have the unique ability to choose their tax classification. Single-member LLCs are treated as disregarded entities for tax purposes by default, while multi-member LLCs are taxed as partnerships. However, LLCs can elect to be taxed as corporations (either C-corps or S-corps) if it proves advantageous.

This flexibility allows owners to optimize their tax strategy based on specific circumstances. For example, electing S-corp status can help reduce self-employment taxes for LLC members who actively participate in the business.

Estate Tax Minimization Strategies

LLCs play a key role in minimizing estate taxes. The current federal estate tax exemption is $12.92 million per individual (as of 2023), but this will decrease in 2026 without congressional intervention. While Florida has no state estate tax, federal estate taxes can still impact high-net-worth individuals.

An effective strategy involves using LLCs to facilitate gifting. Owners can gift LLC interests to family members over time, utilizing the annual gift tax exclusion ($17,000 per recipient in 2023). This allows wealth transfer while potentially reducing the value of the taxable estate.

The IRS often allows discounts on LLC interest valuations due to lack of marketability and control. These discounts can range from 20% to 40%, effectively allowing more wealth transfer while using less of the lifetime gift tax exemption.

Basis Step-Up Considerations

When planning an estate, it’s important to consider the basis step-up rules. Assets inherited through an estate receive a step-up in basis to their fair market value at the date of death. This can significantly reduce capital gains taxes if the heirs later sell the assets.

LLCs can be structured to take advantage of this rule. For instance, owners might retain highly appreciated assets within the LLC until death, allowing heirs to benefit from the step-up in basis.

Professional Guidance for Tax Optimization

Understanding these complex tax implications is essential for maximizing the benefits of LLCs in estate planning. Working with experienced professionals who understand both LLC structures and estate planning helps navigate these waters effectively and create a strategy tailored to unique situations and goals. Business owners can minimize tax burdens through careful estate planning and the strategic use of LLCs.

Final Thoughts

LLCs offer powerful benefits for estate planning in Boca Raton. These entities provide asset protection, tax advantages, and flexibility in wealth transfer. Florida’s strong LLC laws allow individuals to shield personal assets from business liabilities and protect business interests from personal creditors.

The complexities of LLC formation and integration into estate planning strategies require professional guidance. Nuances of Florida law, tax implications, and estate planning considerations demand experience to navigate effectively. Working with experienced professionals ensures that your LLC structure aligns with your overall estate planning goals and complies with legal requirements.

Rubino Findley, PLLC understands the intricacies of LLC and estate planning strategies. Our team can guide you through the process of establishing LLCs, creating wills and trusts, and ensuring your estate plan aligns with your wishes. Estate planning is an ongoing process, and regular reviews help adapt to changing laws, personal circumstances, and financial situations (including LLC structures).