How to Adapt Estate Planning Software for Your Needs

Estate planning software can save you time and money, but only if you configure it properly for your situation. Most people buy the wrong tool or fail to adapt estate planning software to match their actual needs and goals.

At Rubino Findley, PLLC, we help families in Boca Raton navigate these decisions. This guide walks you through selecting software that fits your life, then customizing it to protect what matters most.

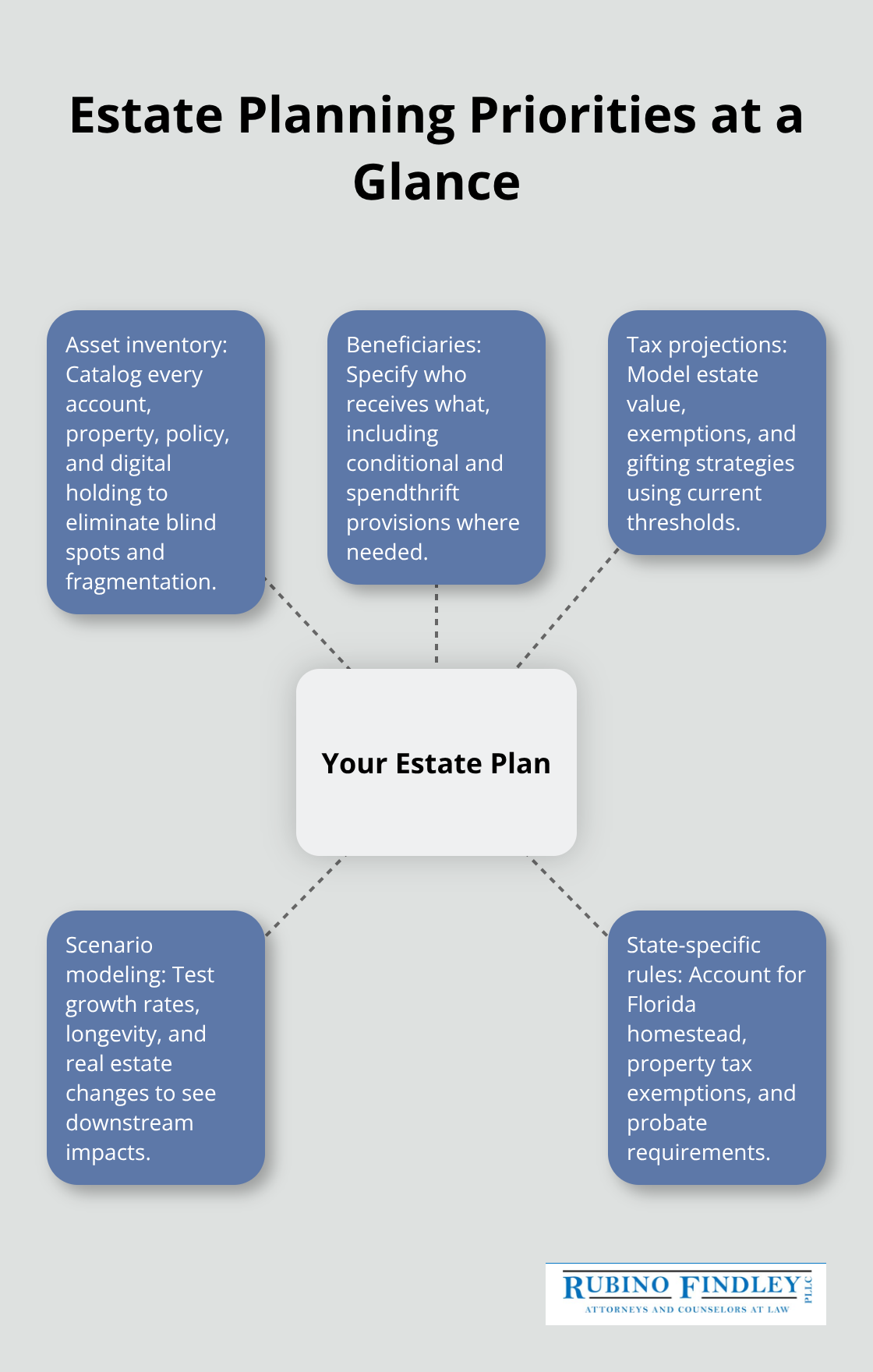

Understanding Your Estate Planning Goals

Before any estate planning software can work for you, you need a complete picture of what you own. Most people significantly underestimate their assets. They think of their house and maybe a retirement account, then stop. That incomplete view leads to software configurations that miss major pieces of your financial life.

What Assets Do You Actually Own?

Start by listing everything: bank accounts, investment accounts, retirement plans like 401(k)s and IRAs, real estate, vehicles, life insurance policies, and business interests. Include digital assets too-cryptocurrency, online accounts, and intellectual property. The IRS reported that the average American household has assets spread across at least five different institutions, which means your estate plan must account for fragmentation. Pull recent statements from your financial institutions rather than guessing.

This matters because tax planning strategies differ dramatically based on your total estate value. If your combined assets exceed $13.61 million in 2024, you face federal estate tax considerations that software must handle correctly. If you fall under that threshold, your planning priorities shift entirely.

Who Actually Inherits What Matters More Than You Think

Deciding who inherits your property forces you to make explicit choices instead of letting state law decide. Without a will or trust, Florida intestacy laws determine distribution, which rarely matches what families want. The state prioritizes spouses and direct descendants in a fixed order that ignores stepchildren, unmarried partners, and charitable causes you care about. Your estate planning software must reflect your actual wishes, not default legal rules. Write down specifically which assets go to which people, and be realistic about family dynamics. If you have adult children from different relationships, a blended family, or significant age gaps between beneficiaries, your software configuration must handle complexity. Consider whether certain beneficiaries need protection-a spendthrift trust provision prevents a financially irresponsible heir from depleting an inheritance quickly. Your software should support these conditional arrangements without forcing you into generic templates.

Tax Efficiency Requires Actual Numbers, Not Wishes

Tax minimization sounds appealing until you realize it requires specific strategies tied to your exact financial situation. Florida has no state income tax, which is valuable, but federal taxes still apply to large estates. If you’re married, portability rules allow your surviving spouse to use unused estate tax exemptions, potentially doubling your tax-free threshold. If you’re unmarried or have substantial assets, lifetime gifting strategies, charitable remainder trusts, or irrevocable life insurance trusts might reduce future tax burdens. None of these strategies work without precise calculations based on your actual asset values, growth projections, and family circumstances. Software that offers advanced tax analysis helps you model scenarios before you commit to a plan. Run the numbers: what happens to your estate if the market grows 5 percent annually? What if real estate values increase? What if you live another 20 years versus 40 years? Your software should answer these questions with data, not assumptions. Tax law changes frequently; the software you select must receive regular updates to stay compliant. Palm Beach County residents especially benefit from planning that accounts for Florida’s unique property tax exemptions and homestead protections, which reduce taxable estate values if configured properly in your documents.

Now that you understand your assets, beneficiaries, and tax situation, the next step involves selecting software that actually supports these specific needs rather than forcing you into a one-size-fits-all mold.

Evaluating Estate Planning Software Options

The wrong estate planning software wastes months of your time and produces documents that miss critical details. You need to evaluate platforms on what they actually deliver, not marketing promises.

Test Software Against Your Specific Situation

Start by testing whether the software handles the specific documents your situation requires. If you have a blended family, the platform must support multiple trust structures and conditional inheritance rules without forcing you into generic templates. If you own a business, it needs to handle succession planning and entity transfers. If you have minor children, guardianship designations and special needs provisions must work seamlessly. WealthCounsel offers modular products covering estate planning, elder law, business succession, and firearms planning across different practice areas, which means you can select tools matched to your actual complexity rather than overpaying for features you don’t need.

Before committing to software, run a test scenario through the platform. Create a sample estate plan that mirrors your situation and see whether the tool produces documents that feel complete and accurate. Many platforms offer free trials ranging from 7 to 14 days, which gives you enough time to configure a basic plan and assess workflow. Actually generate documents and review them for accuracy and comprehensiveness rather than just clicking through the interface.

Assess User Interface and Ease of Use

User experience matters more than most people realize because poor interface design forces you to spend hours learning software instead of building your plan. Holistiplan, which serves over 8,000 financial planners, emphasizes cloud-based accessibility that works across devices and browsers, eliminating the need to purchase specialized hardware or software licenses for each team member. A platform that adapts to how you work saves time and reduces frustration.

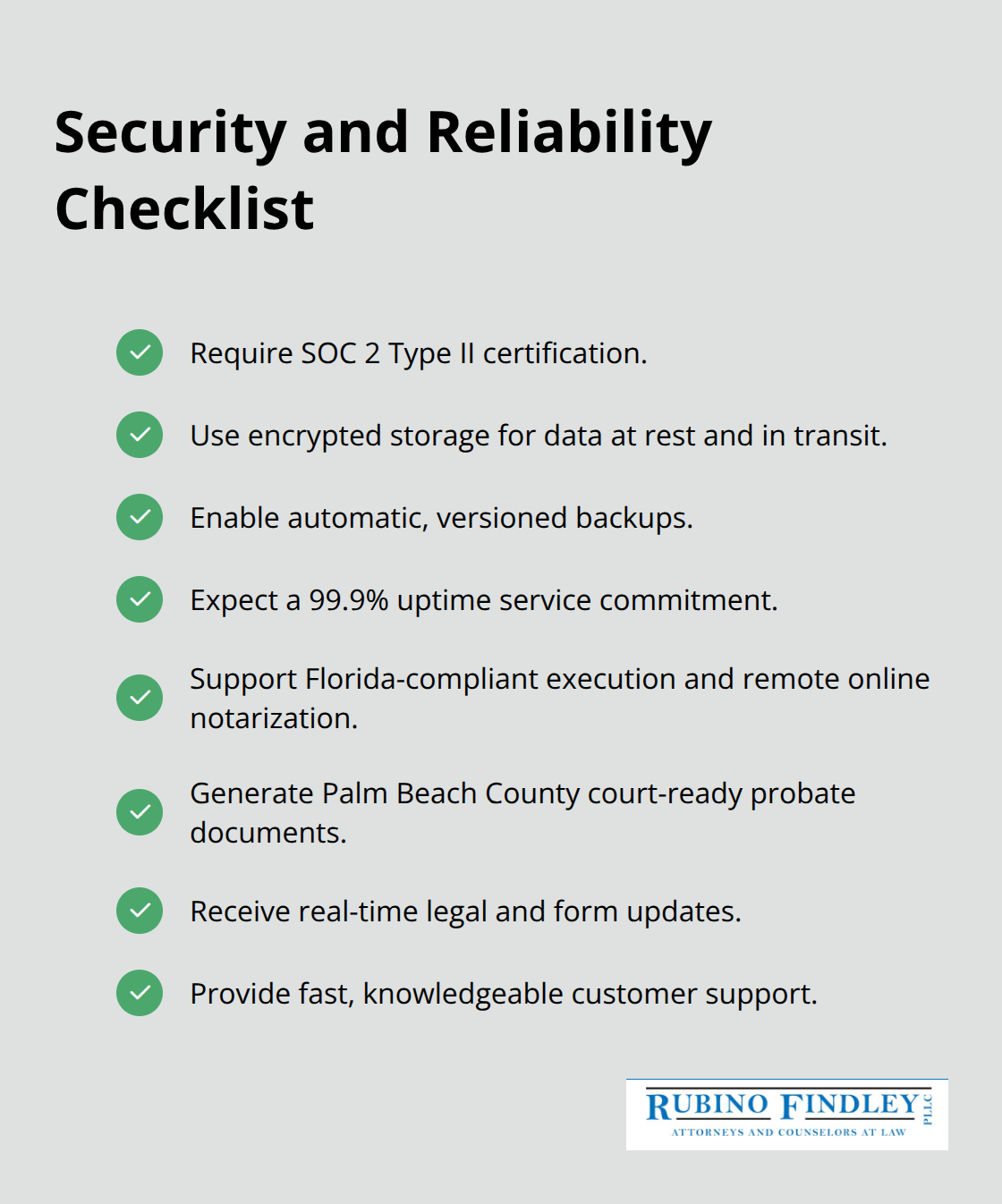

Review Security and Data Protection Standards

Security cannot be an afterthought when storing sensitive financial information and personal documents. Look for platforms with SOC 2 Type II certification, which verifies that the vendor has implemented rigorous controls for data protection, access management, and system availability. A 99.9% uptime commitment matters because you cannot afford downtime when managing time-sensitive estate documents.

Check whether the platform provides encrypted storage, automatic backups, and compliance with state-specific regulations. Florida residents should confirm that software meets state requirements for document execution and notarization, particularly if you plan to handle remote online notarization through the platform. Palm Beach County courts require specific formatting and compliance standards for probate documents, so your software must generate court-ready paperwork without manual corrections.

Real-time updates from courts and regulatory bodies keep your forms current as laws change, preventing you from using outdated templates that could create legal vulnerabilities. Test the vendor’s customer support responsiveness by contacting them during your trial period with questions about your specific situation. Quick response times and knowledgeable technical support indicate whether the company will stand behind you when you need help most.

Once you’ve selected software that meets your security and usability standards, the next step involves configuring it to reflect your actual family structure, assets, and wishes rather than accepting default settings that rarely match individual circumstances.

Customizing Your Estate Plan Within Software Platforms

Most people configure estate planning software with default settings and generic beneficiary structures, then wonder why their plan fails to protect what actually matters. Software platforms offer flexibility that generic templates never will, but only if you take time to build your configuration around your specific circumstances rather than accepting preset options.

Import Your Complete Asset List

Start by importing your complete asset list into the software’s asset tracking section. Platforms like WealthCounsel organize assets across categories including bank accounts, investment portfolios, real estate, business interests, and personal property, which forces you to confront fragmentation head-on. As you input each asset, the software calculates your total estate value automatically and flags whether you exceed the federal estate tax exemption threshold of $13.61 million in 2024. This calculation determines whether your documents need tax-minimization provisions or whether simpler structures suffice.

Configure Your Beneficiary Structure With Precision

Next, configure your beneficiary structure with precision instead of accepting the software’s default assumption that your spouse receives everything and your children split the remainder. Specify exact percentages or dollar amounts for each beneficiary, then use the software’s conditional logic to handle complexity. If you have a minor child, direct the software to hold their inheritance in a trust until age 25 rather than distributing assets outright at age 18.

If you have a beneficiary with substance abuse issues or financial irresponsibility, activate spendthrift trust provisions that prevent them from accessing principal while allowing trustee discretion for distributions. The software should display asset distribution visuals that show how your plan allocates real estate, investment accounts, and personal property across beneficiaries, making it obvious whether your configuration matches your intentions.

Review Beneficiary Designations on Financial Accounts

Update your plan at minimum annually, particularly if your asset values shift significantly or your family structure changes. Software platforms that receive real-time updates from courts and regulatory bodies keep your documents compliant as tax laws change, but you must still review your beneficiary designations on retirement accounts and life insurance policies because these documents override your will entirely. The IRS reports that misaligned beneficiary designations cause more estate disputes than any other single error, yet most people never review these after initial setup.

Set a calendar reminder to review your configuration each January and after major life events like marriage, divorce, the birth of children, or significant asset purchases. If your estate value crosses the federal tax exemption threshold due to market gains or inheritance, your software configuration may require restructuring to incorporate irrevocable life insurance trusts or charitable remainder trusts that your initial plan lacked.

Know When to Consult an Attorney

Do not assume that software alone handles the complexity of your situation, particularly if you own a business, have significant real estate holdings, or face potential estate tax exposure. When you work with an experienced estate planning attorney from Rubino Findley, PLLC in Boca Raton, we help you navigate these updates and ensure your software configuration stays aligned with both your wishes and current law.

Final Thoughts

Selecting and configuring estate planning software requires deliberate choices at every step. You must understand your complete financial picture, identify your actual beneficiaries and their needs, and calculate tax implications based on real numbers rather than assumptions. Then you evaluate platforms against your specific situation, test their functionality during free trials, and verify their security standards before storing sensitive documents.

The software you select should handle your documents without forcing you into templates designed for someone else’s life. If you own a business, manage significant real estate, or face potential estate tax exposure, software alone cannot navigate that complexity. An experienced estate planning attorney helps you bridge the gap between what software can automate and what requires personalized legal judgment, and we at Rubino Findley, PLLC in Boca Raton work with families throughout Palm Beach County to adapt estate planning software to your specific circumstances.

Whether you need a straightforward will or a complex trust arrangement with multiple conditions and protections, our team guides you through the process and ensures your documents reflect your actual wishes. Contact Rubino Findley, PLLC to schedule your free consultation and take action on your estate plan today.