How to Avoid Probate in Boca Raton Simple and Effective Strategies

Probate proceedings in Florida can drain your estate for months or even years while your family waits for asset distribution. The average probate case in Palm Beach County takes 8-12 months and costs 3-5% of the estate’s total value.

Learning how to avoid probate in Boca Raton protects your loved ones from unnecessary delays and expenses. We at Rubino Findley, PLLC help families implement proven strategies that keep assets out of probate court entirely.

Why Florida Probate Creates Problems for Your Family

Probate in Florida transforms your final wishes into a lengthy court-supervised process that puts your family’s financial future on hold. When you die with assets in your individual name, Florida Statute 731.201 requires these assets to pass through probate court before they reach your beneficiaries. This legal requirement applies to real estate, bank accounts, investment portfolios, and business interests titled solely in your name.

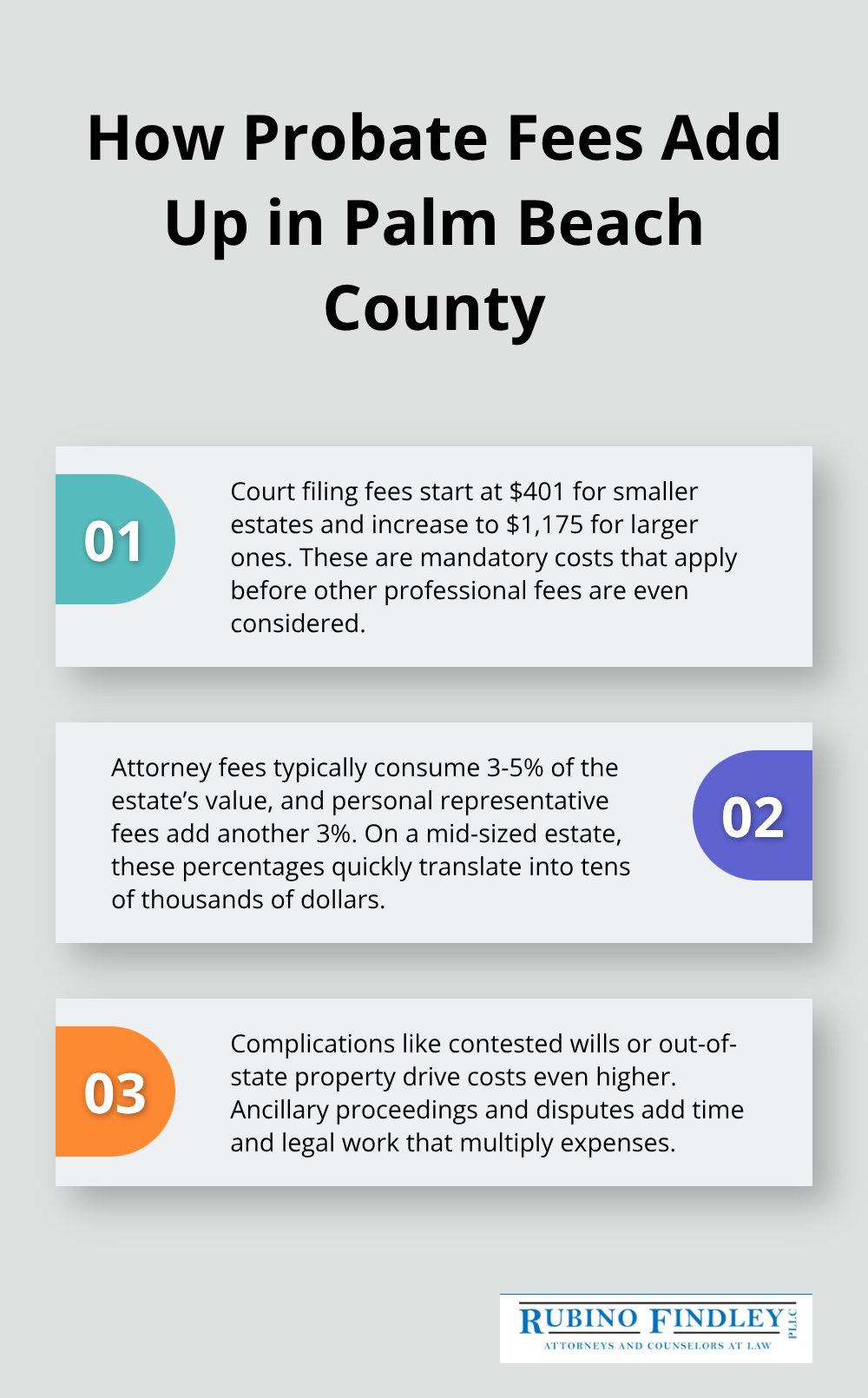

The Financial Drain of Florida Probate

The numbers tell a harsh story about probate costs in Palm Beach County. Court filing fees alone start at $401 for estates under $100,000, then jump to $1,175 for larger estates according to Florida Statute 28.222. Attorney fees typically consume 3-5% of your estate’s value, while personal representative fees add another 3%. A $500,000 estate can lose $30,000-50,000 to probate expenses before your family receives anything. These costs multiply when complications arise, such as contested wills or out-of-state property that requires ancillary probate proceedings.

Your Private Affairs Become Public Records

Florida’s probate system strips away your family’s privacy and makes your estate details public record. Your will, asset inventory, creditor claims, and family disputes become accessible to anyone through the clerk’s office. This exposure puts your beneficiaries at risk for financial predators and creates lasting embarrassment for family conflicts that play out in court documents. Your business relationships, personal debts, and family dynamics become permanently archived in public files that follow your family for years.

Time Delays That Hurt Your Family

Florida probate proceedings typically take 8-12 months in Palm Beach County, but complex estates can stretch beyond two years. Your family cannot access most assets during this waiting period (except for limited family allowances under Florida Statute 732.403). Bills continue to accumulate, mortgages require payment, and your loved ones face financial hardship while courts process paperwork. These delays become particularly devastating when your family depends on your income or needs immediate access to funds for medical expenses or education costs. Florida probate proceedings can tie up business assets for six months to two years, creating cash flow problems and operational disruptions.

Fortunately, several proven strategies can help you bypass these probate problems entirely and protect your family’s financial security.

Estate Planning Tools to Bypass Probate

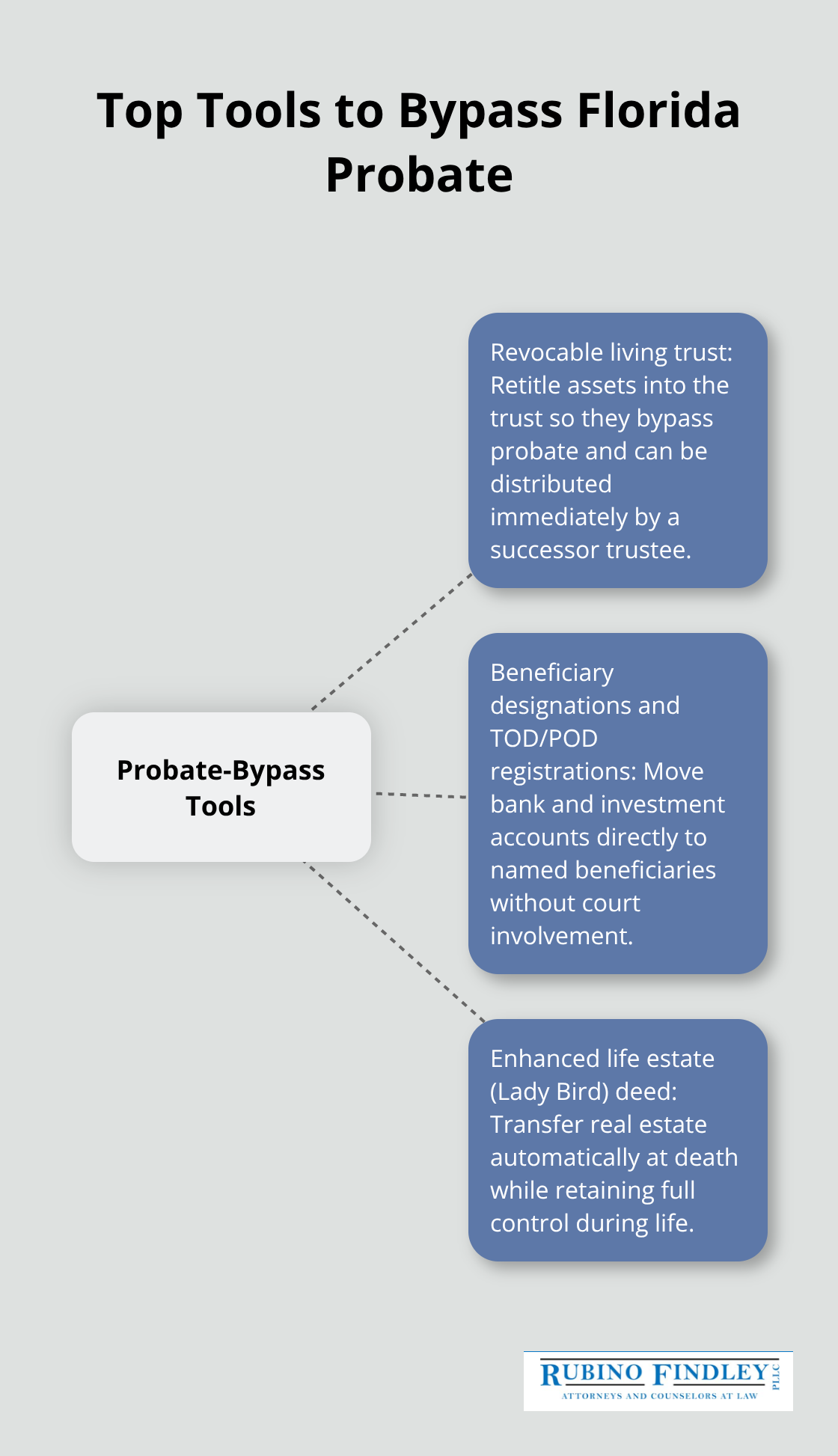

Revocable living trusts stand as the most powerful weapon against Florida probate proceedings and allow you to transfer virtually any asset outside the court system. When you establish a trust and properly fund it by retitling your assets into the trust’s name, those assets bypass probate entirely upon your death. Your successor trustee can distribute assets to beneficiaries immediately without court approval or the 8-12 month wait that devastates families. Florida Statute 736 governs these trusts and requires no attorney for ongoing management (though proper setup demands legal guidance to avoid costly mistakes).

Direct Beneficiary Transfers Save Time and Money

Joint ownership with rights of survivorship and beneficiary designations create automatic asset transfers that eliminate probate requirements completely. Bank accounts with payable-on-death designations transfer immediately to named beneficiaries who simply present a death certificate and identification to claim funds. Investment accounts use transfer-on-death registrations under Florida Statute 711.50 and allow stocks and bonds to pass directly to beneficiaries without any court involvement. Life insurance policies and retirement accounts like 401(k)s and IRAs bypass probate automatically when current beneficiaries are designated, but outdated beneficiary forms can force these assets into probate unnecessarily.

Enhanced Life Estate Deeds Protect Real Estate

Florida homeowners can use enhanced life estate deeds (commonly called Lady Bird deeds) to transfer real estate automatically while they retain complete control during their lifetime. These deeds allow you to sell, mortgage, or modify the property without beneficiary consent, but transfer ownership immediately upon death without probate proceedings. Unlike traditional life estate deeds, enhanced versions protect your homestead exemption and Medicaid eligibility while they avoid the gift tax consequences that plague other real estate transfer methods. Palm Beach County records show these deeds save families $15,000-25,000 in probate costs for typical residential properties.

However, even the most carefully crafted probate avoidance strategies can fail when common implementation mistakes occur.

Common Probate Avoidance Mistakes to Watch Out For

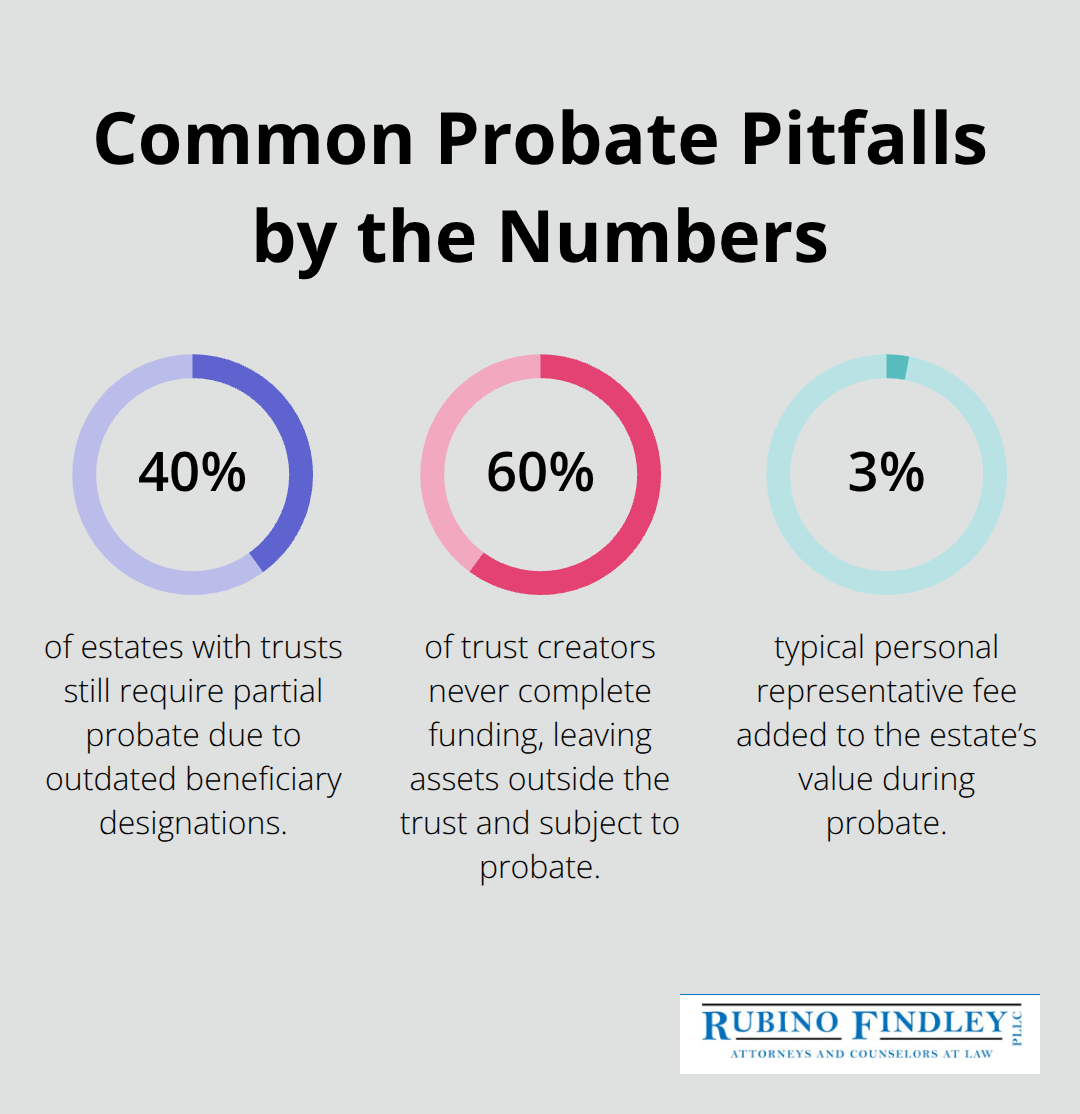

Even perfectly designed probate avoidance strategies collapse when families make three critical implementation errors that force assets back into the court system. Florida Statute 732.507 shows that 40% of estates with trusts still require partial probate because beneficiary designations weren’t updated after major life events like marriage, divorce, or death of a beneficiary. When your ex-spouse remains listed as the beneficiary on your 401(k) worth $300,000, that money goes to them regardless of your will or trust provisions.

Life insurance companies pay benefits to whoever appears on their beneficiary forms, not who you intended to inherit. Families lose substantial assets because someone forgot to update a single bank account designation after their child died or their marriage ended.

Trust Funding Failures Create Expensive Court Battles

The most devastating mistake involves creating a trust but failing to transfer assets into it properly. Florida trust law requires assets to be retitled in the trust’s name to avoid probate, but 60% of trust creators never complete this process according to Palm Beach County probate records. Your house remains in your individual name, your investment accounts keep your Social Security number, and your business interests stay in your personal capacity. When you die, these unfunded assets march straight into probate court despite your expensive trust documents. Estates worth $500,000 routinely pay $25,000-40,000 in probate costs because the trust held only $50,000 while major assets remained outside.

Small Asset Oversights Trigger Full Probate Proceedings

Florida’s probate system doesn’t distinguish between forgotten accounts and major real estate holdings when determining probate requirements. A $2,000 savings account left in your individual name can force your entire estate through formal probate under Florida Statute 735.201, even when you properly planned for larger assets. Personal property like jewelry, artwork, and collectibles frequently get overlooked in trust transfers creating probate requirements that consume thousands in legal fees. Digital assets including cryptocurrency wallets, online business accounts, and social media properties also need specific attention since standard beneficiary designations don’t apply to these modern assets.

Final Thoughts

Proactive probate planning saves your family thousands of dollars and months of court delays while it protects your privacy from public scrutiny. The strategies outlined above work when you implement them correctly, but small mistakes can force your entire estate through Florida’s expensive probate system. Professional legal guidance becomes necessary when your estate includes business interests, out-of-state property, or complex family situations that involve blended families or special needs beneficiaries.

We at Rubino Findley, PLLC help Palm Beach County families implement comprehensive probate avoidance strategies that protect assets and streamline transfers to loved ones. Our team works with clients to establish trusts, update beneficiary designations, and transfer property titles properly. We focus on practical solutions that prevent costly probate proceedings while they preserve your family’s financial security.

Action now prevents your family from facing financial hardship during their time of grief. Every month you delay estate planning increases the risk that Florida probate laws will control your asset distribution instead of your wishes. Understanding how to avoid probate in Boca Raton requires knowledge of both the available tools and proper implementation techniques that keep your wealth in your family’s hands where it belongs (rather than in court proceedings).