How to Choose the Right Estate Planning Package

Estate planning isn’t one-size-fits-all. Your financial situation, family structure, and goals are unique, which means your estate planning package should be too.

At Rubino Findley, PLLC, we help families in Boca Raton and throughout Palm Beach County select the right package for their needs. This guide walks you through the key factors that matter when making this decision.

What Should You Inventory Before Choosing a Package

Start by listing everything you own. This sounds basic, but most people drastically underestimate their assets. Include your home, vehicles, bank accounts, investment portfolios, retirement accounts like 401(k)s and IRAs, life insurance policies, business interests, digital assets like cryptocurrency or online accounts, and personal property with real value.

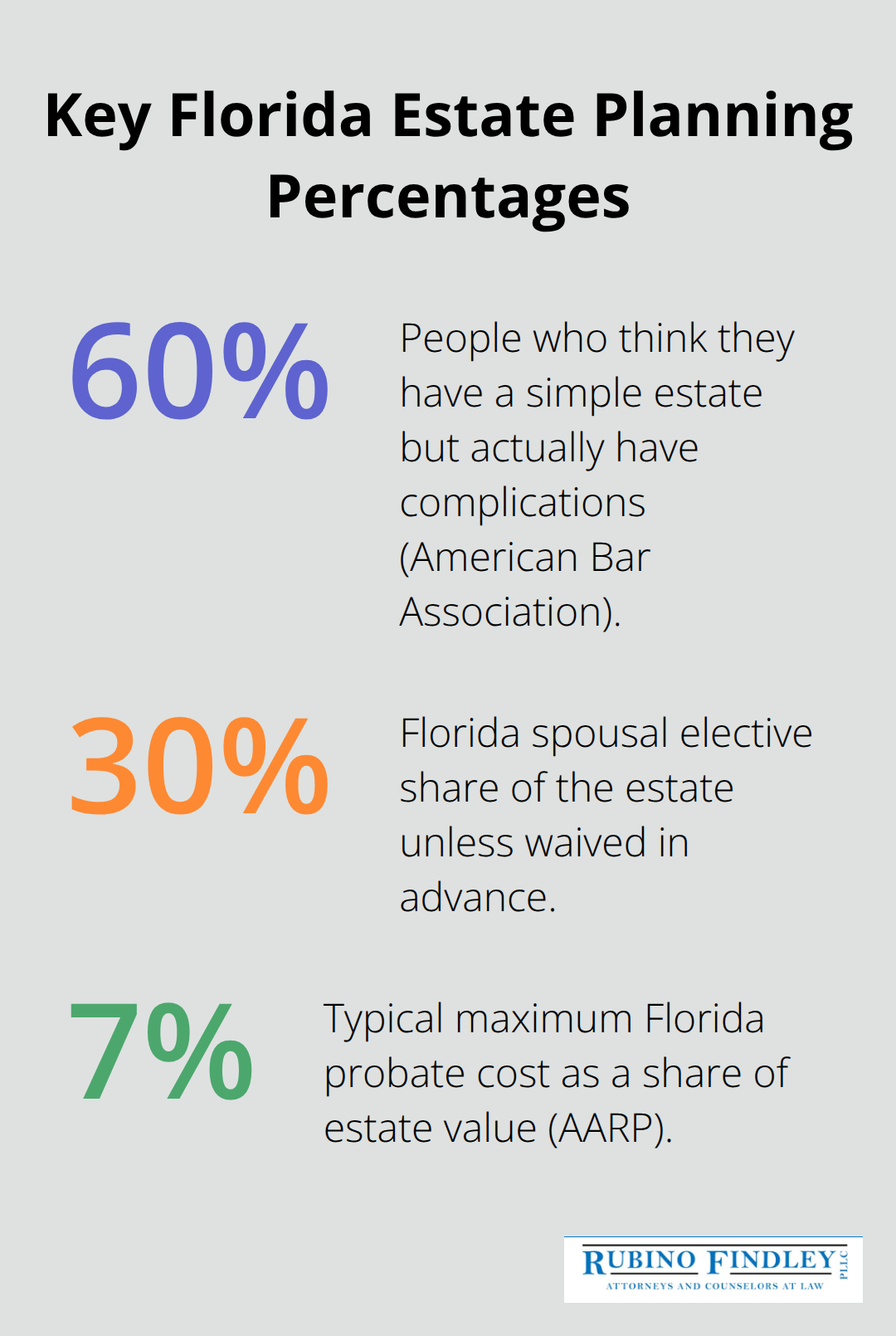

Don’t forget accounts with beneficiary designations-these pass outside probate but still matter for your overall plan. Research from the American Bar Association shows that 60% of people who think they have a simple estate actually have complications they didn’t account for. Once you know what you have, you can determine whether a basic package with a will and power of attorney fits your situation or whether you need trust-based planning to minimize probate. In Florida, probate costs between 3% and 7% of your estate value according to AARP, so understanding your total assets helps you decide if probate avoidance strategies like revocable living trusts or transfer-on-death designations make financial sense for you.

Family Structure Shapes Your Package Choice

Your family situation determines what documents matter most. Single adults with no dependents need different protections than married couples, blended families, or parents with minor children. If you have minor children, you must designate a guardian in your will-without this, a court decides who raises them if both parents die. Parents in blended families face a real risk: without planning, the surviving spouse may inherit most or all of your estate, potentially leaving stepchildren with nothing. Special needs beneficiaries require specialized trusts to preserve eligibility for SSI or Medicaid, governed by federal law under 42 U.S.C. § 1396p(d)(4)(A). If you own a business, your package needs succession planning and possibly buy-sell agreements. Spousal rights in Florida also matter-surviving spouses automatically receive homestead rights and a statutory 30% share of the estate unless waived in advance.

Your Goals Determine Document Complexity

Before selecting a package, write down what you actually want to happen. Do you want to avoid probate entirely, or is speed more important than privacy? Do you want complete control over how your children inherit money, or do you prefer simple outright distribution? Are you concerned about protecting assets from creditors or future lawsuits? Do you want to leave money to charity, and if so, do you want tax benefits from that decision? These questions separate a basic will from a comprehensive plan. If you want to control distributions-say, giving your 25-year-old $10,000 per year instead of a lump sum-you need trust language that a simple will cannot provide. If you’re worried about incapacity from illness or accident, your package must include a durable power of attorney and healthcare surrogate; without these, your family may face costly guardianship proceedings. If you own real estate and want to avoid probate on that property specifically, a Ladybird deed (enhanced life estate deed) might be part of your strategy, allowing you to keep living rights while naming who inherits it.

How Your Answers Shape the Next Decision

The inventory you’ve completed, the family structure you’ve mapped, and the goals you’ve written down now point toward a specific package type. A single person with modest assets and no dependents moves toward a basic package. A married couple with children and a home moves toward something more comprehensive. A business owner or someone with blended family concerns moves toward advanced strategies.

Your answers also reveal whether you need documents beyond the standard will-perhaps a healthcare surrogate, a durable power of attorney, or trust provisions that control how money flows to your heirs. The next section walks you through the actual packages available and how they match these different situations.

Estate Planning Packages That Match Your Situation in Boca Raton

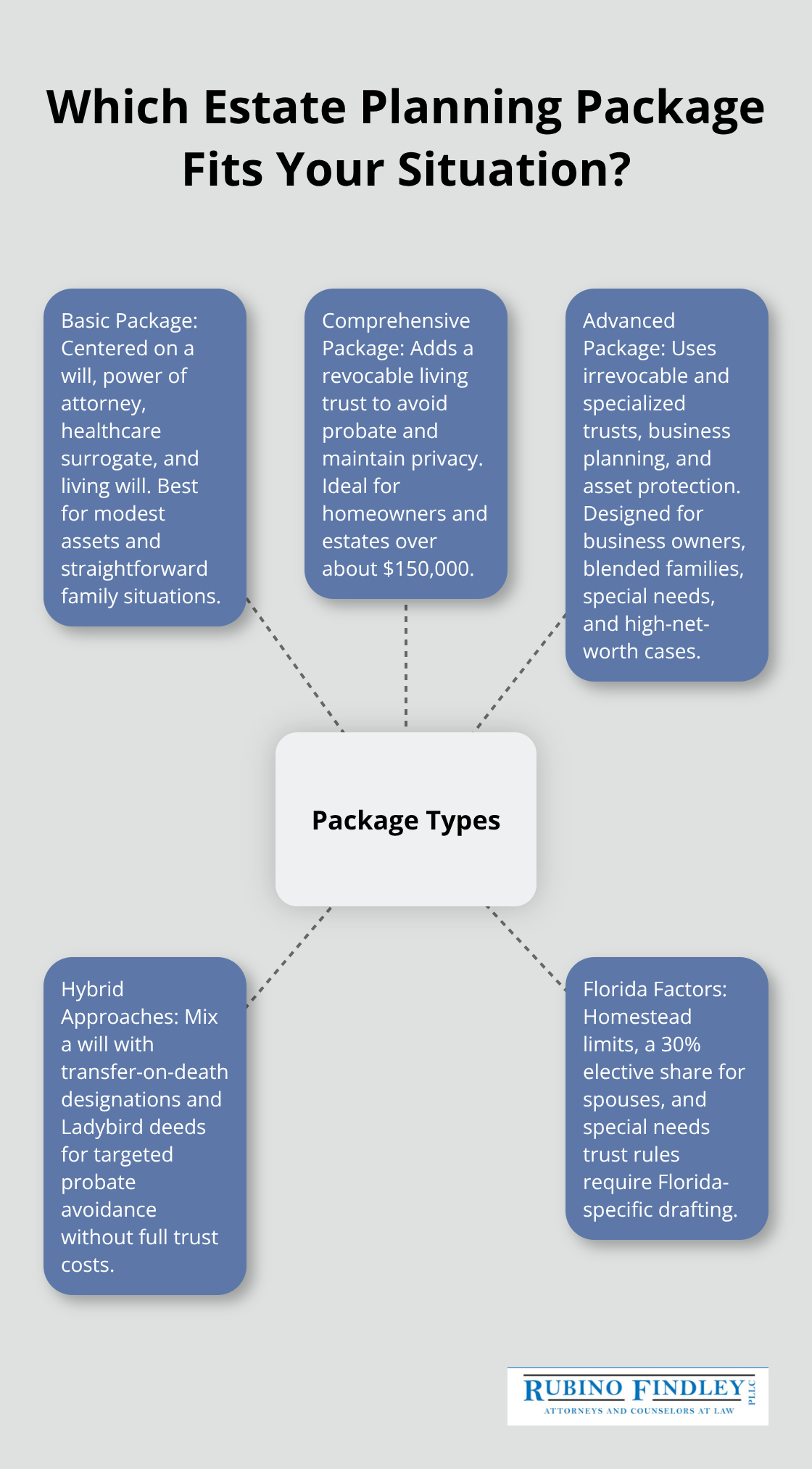

The market offers three main package categories, and your choice depends entirely on what you uncovered in your inventory and goals.

Basic Packages for Straightforward Situations

A basic package centers on a last will and testament, which costs around $795 per person according to typical Florida pricing for complete estate plan packages. This package includes a simple last will to distribute assets and name guardians for minor children, plus a durable power of attorney so someone you trust can handle financial decisions if you cannot, and a health care surrogate to communicate your medical preferences during serious illness. A living will rounds out the basics by specifying your end-of-life wishes. This approach works well if you have modest assets under $100,000, no minor children, and a straightforward family situation. However, probate in Florida typically takes months to over a year and costs 3% to 7% of your estate value according to AARP, meaning a $200,000 estate could lose $6,000 to $14,000 in probate costs alone.

Comprehensive Packages for Homeowners and Families

Comprehensive packages add revocable living trusts and more sophisticated power of attorney language to avoid probate on most assets. These plans work for homeowners, people with retirement accounts, and anyone wanting to keep their affairs private since trust administration stays confidential while probate becomes public record. A revocable living trust lets you transfer property during your lifetime so it passes to heirs outside probate without court involvement. The cost runs higher-typically $1,500 to $3,000-but the probate savings often justify the expense for estates over $150,000. For Floridians specifically, hybrid approaches combine a will, transfer-on-death designations for bank accounts, and Ladybird deeds for real estate, giving you probate avoidance on key assets without the full trust cost. Ladybird deeds let you keep living rights and control while naming who inherits the property automatically, and they won’t affect homestead tax status.

Advanced Packages for Complex Situations

Advanced packages target business owners, blended families with competing interests, people with special needs beneficiaries, and high-net-worth individuals worried about creditor protection. These plans use irrevocable trusts, charitable giving vehicles, and specialized trusts governed by federal law like 42 U.S.C. § 1396p(d)(4)(A) for special needs beneficiaries to preserve SSI and Medicaid eligibility. They also address buy-sell agreements for businesses, asset protection from lawsuits, and multi-generational wealth transfer strategies. These packages cost $3,000 to $10,000 or more because they require customization and coordination with tax professionals. The choice isn’t about spending more money-it’s about matching your actual situation to the documents that prevent costly mistakes. Once you identify which package category fits your needs, the next step involves understanding how an attorney evaluates your specific circumstances and builds a plan tailored to your family’s future.

What Really Matters When Picking Your Package in Boca Raton

Budget Versus True Cost

Your budget sets the ceiling, but your estate’s actual complexity determines what you truly need to spend. A $795 basic package sounds appealing until you realize your modest assets still trigger probate costs of 3% to 7% according to AARP, potentially costing thousands in court fees and delays. The real question isn’t how cheap you can go-it’s whether saving $1,200 upfront costs you $8,000 in probate later. If your estate sits between $100,000 and $300,000, a comprehensive package at $1,500 to $3,000 almost always pays for itself through probate avoidance alone.

High-net-worth individuals and business owners should budget $3,000 to $10,000 or more because the cost of getting specialized trusts or asset protection wrong far exceeds the attorney fees.

Florida Law Creates Specific Complications

Florida law creates specific complications that generic packages miss entirely. Spousal elective share rules mean surviving spouses automatically claim 30% of your estate unless you plan around it, which a basic will cannot address. Homestead protections under Florida Statutes 732.4015 limit how you can devise your primary residence, and the rules differ sharply from other states-a template from another state often creates conflicts. Special needs beneficiaries require trusts complying with 42 U.S.C. § 1396p(d)(4)(A) to preserve SSI and Medicaid eligibility; one wrong word disqualifies them from benefits worth tens of thousands annually. Ladybird deeds, which work brilliantly for Florida probate avoidance on real estate, confuse attorneys unfamiliar with state law. Transfer-on-death designations for bank accounts work in Florida but not everywhere, and mixing them with trust language requires careful coordination.

Estate Complexity Determines Your Real Needs

The complexity of your estate matters most when you own multiple properties across states, operate a business with succession concerns, have minor children with competing interests, or face blended family dynamics where stepchildren might be unintentionally disinherited. An advanced package addresses these intersections; a basic package leaves gaps that create expensive problems later. Your situation may involve overlapping concerns (a business plus a blended family, or multiple properties plus special needs beneficiaries) that demand customized solutions rather than standard forms. The cost of getting these details wrong-through missed tax planning, unintended disinheritance, or asset protection failures-far exceeds the price of a comprehensive plan built for your actual circumstances.

Matching Your Situation to the Right Strategy

Your package must reflect Florida law and your actual circumstances rather than a one-size template that works for nobody. Work with an experienced estate planning attorney who understands how Florida statutes interact with your family structure, asset mix, and goals. An attorney familiar with Boca Raton and Palm Beach County can identify which documents matter for your situation and which ones you can skip without risk. This targeted approach saves money by avoiding unnecessary documents while protecting you from the gaps that generic packages create.

Final Thoughts

The right estate planning package matches your actual situation, not a generic template. You’ve inventoried your assets, mapped your family structure, and identified your goals-that foundation points directly toward whether you need a basic package with a will and power of attorney, a comprehensive plan with trust-based probate avoidance, or advanced strategies for complex circumstances. The cost difference between packages matters far less than the cost of getting your plan wrong, since probate in Florida runs 3% to 7% of your estate value according to AARP.

Working with an attorney in Boca Raton who understands Florida law gives you a real advantage. We at Rubino Findley, PLLC help families throughout Palm Beach County select and build estate plans tailored to their circumstances. An attorney familiar with Florida statutes like the spousal elective share rules, homestead protections, and special needs trust requirements identifies which documents matter for your situation and which ones you can skip-this targeted approach saves money by avoiding unnecessary paperwork while protecting you from the gaps that one-size packages create.

Schedule a consultation to discuss your inventory, family structure, and goals with an attorney who listens and explains options clearly. We offer a free consultation to help you understand what your situation actually requires. Reach out to Rubino Findley, PLLC to learn more about our estate planning services and take the first step toward protecting your family’s future.