How to Choose the Right Estate Planning Seminar

Picking the wrong estate planning seminar wastes your time and leaves you with incomplete information about protecting your family’s future.

At Rubino Findley, PLLC, we see people in Boca Raton make costly mistakes by attending sessions that don’t address their specific situation or Florida’s unique laws. This guide shows you exactly what to look for and what to avoid.

What Makes an Estate Planning Seminar Worth Your Time

The Instructor’s Background Shapes Everything

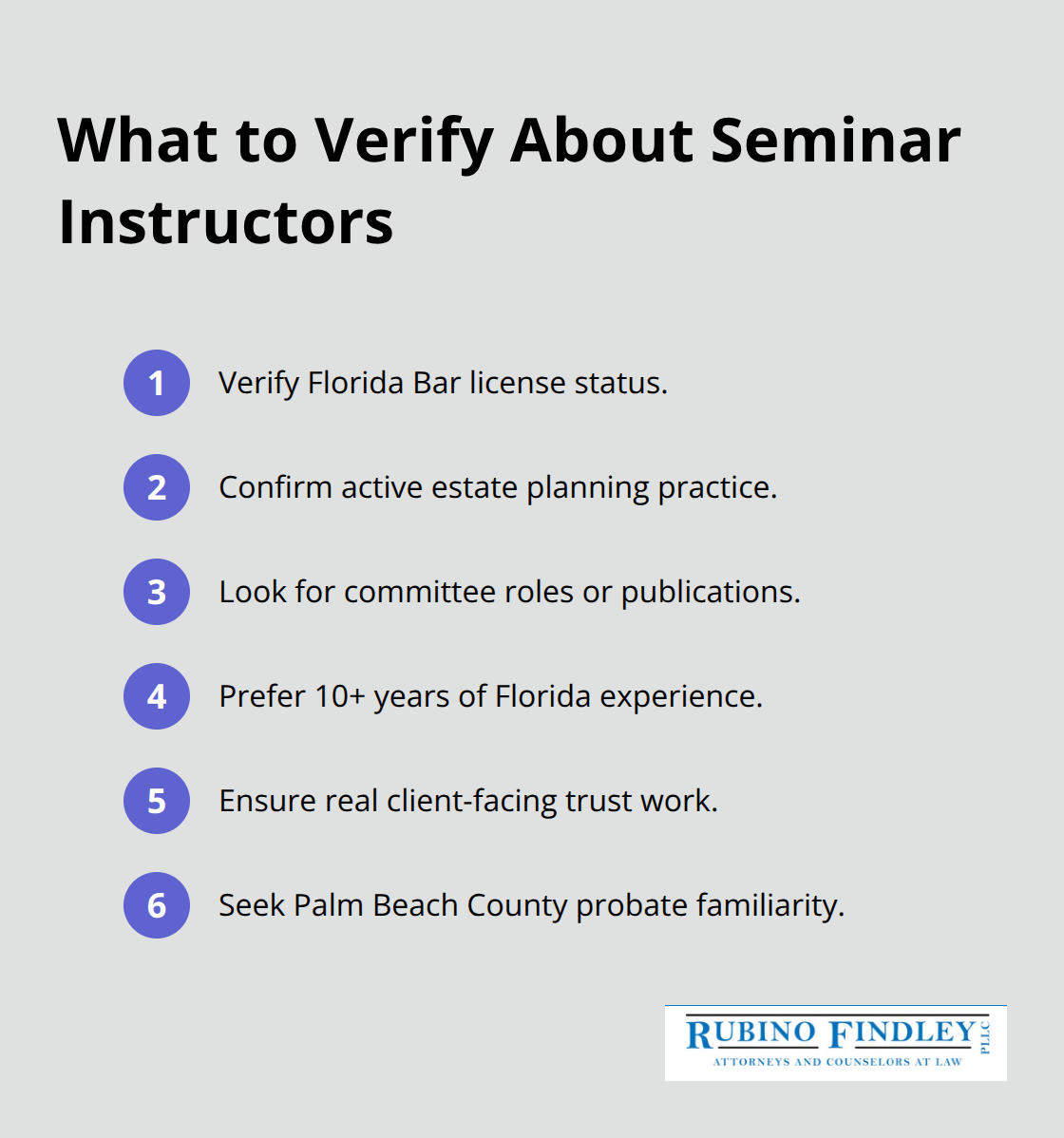

The instructor’s background matters more than you might think. Look for attorneys licensed in Florida who actively practice estate planning, not someone who dabbles in it alongside other practice areas. The Osher Lifelong Learning Institute at Florida Atlantic University requires instructors to have verifiable credentials and institutional affiliations, which signals serious content quality. When you review seminar descriptions, check whether the speaker chairs estate planning committees, advises clients on trust matters, or publishes in the field. These details separate educators who understand real-world planning from those reading from generic slides.

A speaker with 10 years of active practice in Florida estate planning brings specific knowledge about how courts in Palm Beach County handle disputes, which probate timelines actually apply to your situation, and which planning strategies work versus which create problems later.

Content Must Match Your Actual Situation

The seminar content must address your actual concerns, not just general principles. If you own a home, business, or significant investments in Florida, the seminar should explain how Florida’s homestead laws affect your planning, what asset protection strategies make sense for your situation, and how trusts work differently in Florida than other states. Generic seminars that cover wills and trusts for everyone waste your time because they skip the details that matter to you. Check the agenda before you register. Does it mention healthcare directives, power of attorney documents, or probate avoidance? Does it address what happens if you become incapacitated tomorrow, or only what happens after you die?

Format and Materials Determine Your Retention

The format affects what you’ll actually retain and apply. In-person seminars with Q&A sessions let you ask about your specific circumstances, while recorded videos don’t. Some seminars record presentations so you can review complex material later, which helps when estate planning concepts don’t stick the first time. Confirm whether the seminar provides written materials you can take home and reference, not just slides you see once. The best seminars run 60 to 75 minutes of actual content plus 15 minutes for questions, keeping your attention focused without overwhelming you with information overload.

Once you identify a seminar that meets these standards, the next step involves understanding which common mistakes could still derail your planning process.

Mistakes That Derail Your Estate Planning Decisions

Non-Attorney Instructors Leave You Vulnerable to Bad Advice

Attending a seminar led by someone without Florida legal credentials wastes your time and potentially teaches you outdated or incorrect information. Non-attorneys and financial advisors often present estate planning content without understanding how Florida courts actually enforce documents or how state-specific rules affect your plan. Florida’s homestead exemption, for example, operates differently than in other states and directly impacts how you structure property ownership and trust provisions. A financial advisor might recommend a strategy that works in their home state but creates tax problems or probate complications in Florida. Attorneys licensed to practice in Florida and actively handling estate cases know these distinctions because they encounter them daily in their client work. When you evaluate seminar instructors, confirm their bar license status through the Florida Bar website and look for evidence of ongoing estate planning practice, not just credentials from decades ago.

Florida-Specific Content Separates Valuable Seminars from Wasted Time

Generic estate planning content glosses over Florida-specific requirements and your personal circumstances, leaving you unprepared for decisions that matter. Seminars designed for national audiences skip critical details about Palm Beach County probate courts, Florida’s strict requirements for valid wills and trusts, and how local judges interpret estate planning documents. Your situation likely involves specific assets, family dynamics, or business interests that require tailored guidance, not broad principles. A seminar addressing only wills and basic trusts ignores whether you need a revocable living trust to avoid probate, a qualified personal residence trust for tax planning, or specialized structures for business succession. Before you register, contact the seminar organizer directly and ask how the content addresses Florida law and whether instructors discuss local court procedures. Reject any seminar where organizers cannot explain how the material applies specifically to Florida residents.

What Happens When You Skip Personalized Guidance

The gap between seminar content and your actual needs grows wider when you settle for generic information instead of personalized guidance. A seminar might explain what a trust is, but it won’t tell you whether a trust makes sense for your specific assets, family situation, or tax picture. You leave the seminar with general knowledge but no clear path forward for your own planning. This uncertainty often leads people to delay action or make decisions based on incomplete information. The right next step involves working with an attorney who understands both estate planning principles and your unique circumstances-someone who can translate what you learned at a seminar into a concrete plan that protects your family and assets in Florida.

How Rubino Findley, PLLC Translates Seminar Knowledge Into Your Actual Plan

The Gap Between Learning and Action

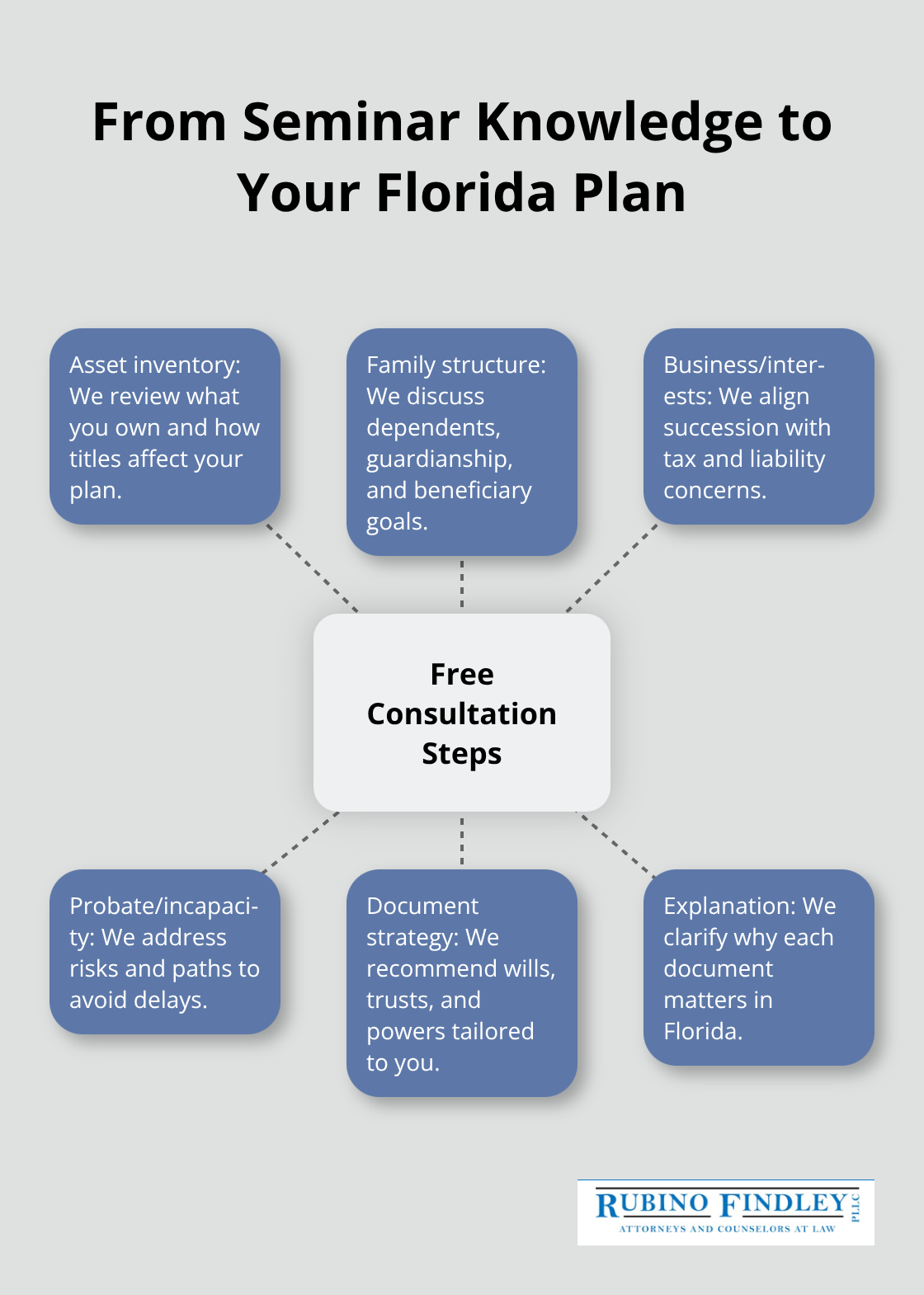

A seminar teaches you what estate planning involves, but it stops short of solving your specific problems. The gap between general knowledge and actionable decisions is where most people get stuck. A free consultation closes that gap through a straightforward process that starts with understanding exactly what you own, who depends on you, and what keeps you awake at night. During this conversation, we listen to your situation without selling anything-we ask about your assets, your family structure, any business interests, and your concerns about probate or incapacity. This conversation reveals whether you need a simple will, a revocable living trust to avoid probate, a durable power of attorney for healthcare decisions, or a more complex structure for asset protection.

Why Seminar Recommendations Don’t Always Fit Your Situation

Many people who attend seminars assume they need what the instructor recommended, but your situation might be entirely different. One client attended a seminar on trusts and thought they needed a complex structure; after a consultation, we determined a straightforward will and healthcare directive solved their actual problem and saved them thousands in unnecessary complexity. Seminars rarely address how Florida’s specific rules apply to your particular assets and family dynamics, which is where the real planning work happens. Courts throughout Palm Beach County and Florida interpret estate planning documents in ways that homemade or seminar-based plans often fail to anticipate.

How Florida Law Shapes Your Actual Plan

If you own a home in Florida, you need to understand how homestead exemptions affect your trust structure and property transfer strategy. If you have minor children, your plan must address guardianship and how assets transfer to them without creating probate delays or tax complications. If you own a business or investment property, succession planning requires coordination with tax strategy and liability protection that a two-hour seminar cannot address. We establish wills, trusts, durable powers of attorney, and other documents tailored to your circumstances and Florida law, then we explain exactly why each document matters for your situation. This transforms what you learned at a seminar into a concrete, written plan your family can actually execute when they need it.

Final Thoughts

Attending the right estate planning seminar gives you knowledge, but knowledge alone doesn’t protect your family. The real work starts when you leave the seminar and face the question of what to do next. Your specific situation requires more than general principles, and the gap between seminar learning and actual protection widens when you delay turning that knowledge into action.

Professional estate planning support translates what you learned into documents tailored to your circumstances and Florida law. An attorney licensed in Florida understands how Palm Beach County courts interpret estate planning documents, how homestead exemptions affect your property, and which strategies actually work versus which create problems later. This knowledge prevents costly mistakes that an estate planning seminar cannot address because seminars focus on broad concepts rather than your unique assets, family structure, and concerns.

Schedule a consultation with Rubino Findley, PLLC to discuss your specific needs and transform what you learned into a concrete plan. We help clients in Palm Beach County establish wills, trusts, durable powers of attorney, and other documents that reflect your actual situation and protect your family from probate complications and uncertainty. Accidents happen without warning, and without proper documents in place, someone other than your loved ones may make decisions about your assets and family.