How to Combine Estate Planning and Wealth Management

Most wealthy families in Boca Raton treat estate planning and wealth management as separate activities. This approach costs them millions in unnecessary taxes and missed opportunities.

We at Rubino Findley, PLLC see clients lose 30-40% of their wealth through poor coordination between these two critical areas. Smart integration can save your family substantial money while protecting your legacy.

Why Estate Planning and Wealth Management Must Work Together

Estate planning and wealth management share the same foundation: they protect your assets and maximize their value for your family. Most Palm Beach County families miss this connection and pay dearly for it.

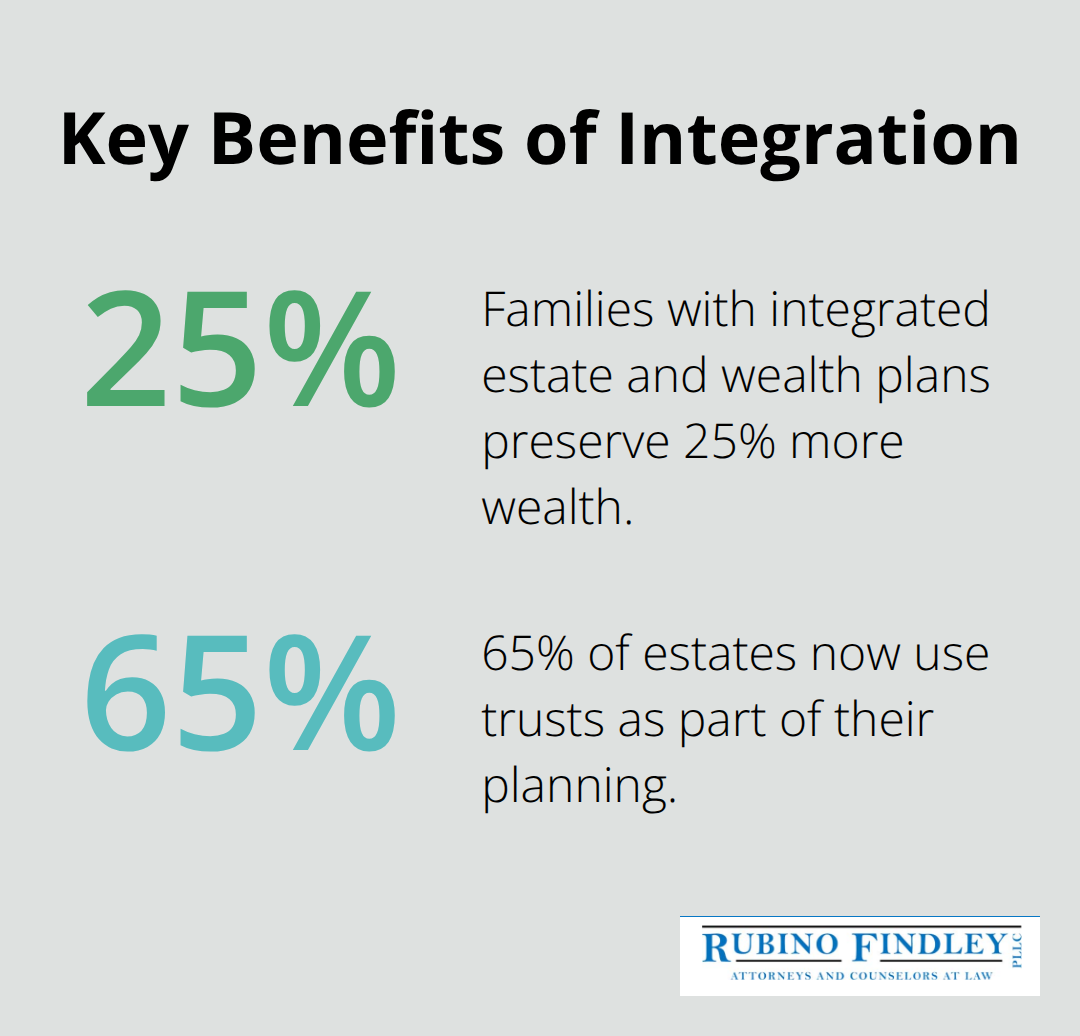

AARP data shows that poor coordination between these strategies costs families 3% to 7% of their estate’s total value in unnecessary fees and taxes. The American Bar Association reports that families with integrated plans preserve 25% more wealth than those who treat these areas separately.

Estate Planning Protects Assets During Your Lifetime

Estate planning tools like revocable living trusts and durable powers of attorney protect your wealth while you’re alive, not just after death. A revocable trust shields your assets from probate court interference if you become incapacitated. This saves your family thousands in legal fees.

Florida probate proceedings can consume up to $50,000 in attorney fees for modest estates. Power of attorney documents prevent costly guardianship proceedings that average $15,000 annually in Florida courts. These tools work with your wealth management strategy to maintain asset growth even during health crises.

Tax Coordination Creates Substantial Savings

Coordinated plans create powerful tax advantages that separate strategies cannot achieve. Irrevocable trusts remove assets from your taxable estate while they allow continued investment growth through professional wealth management.

The federal estate tax exemption stands at $12.92 million per person in 2023, but Florida’s lack of state estate tax makes integrated plans even more valuable for residents. Strategic gifts combined with trust structures can transfer $34,000 annually per recipient without tax consequences (double that for married couples). Wealthy individuals who use coordinated strategies typically save 15-20% more in total taxes than those who manage wealth and estates separately.

These tax benefits become even more powerful when you implement specific trust structures and wealth transfer techniques.

Key Strategies for Integrated Planning

Revocable living trusts form the backbone of integrated wealth and estate plans for high-net-worth families. These trusts allow you to maintain complete control over your assets while alive, then seamlessly transfer wealth to beneficiaries without probate delays. Current data shows that 65% of estates now use trusts, and families save an average of $75,000 in probate costs per estate.

Generation-skipping trusts take this protection further by moving assets two generations down, which avoids estate taxes at your children’s level. Irrevocable life insurance trusts remove life insurance proceeds from your taxable estate while they provide liquidity for estate taxes. Dynasty trusts can preserve wealth for multiple generations by staying outside estate tax calculations indefinitely.

Advanced Gift and Transfer Methods

Annual gift strategies combined with sophisticated valuation discounts create powerful wealth transfer opportunities. The 2023 annual gift exclusion allows $17,000 per recipient, but grantor retained annuity trusts can transfer assets at minimal gift tax cost. Qualified personal residence trusts let you transfer your primary residence at a significant discount while you retain occupancy rights.

Family limited partnerships provide 20-30% valuation discounts on transferred assets while they maintain family control. Charitable remainder trusts generate immediate tax deductions while they provide lifetime income streams (making them attractive for philanthropic families).

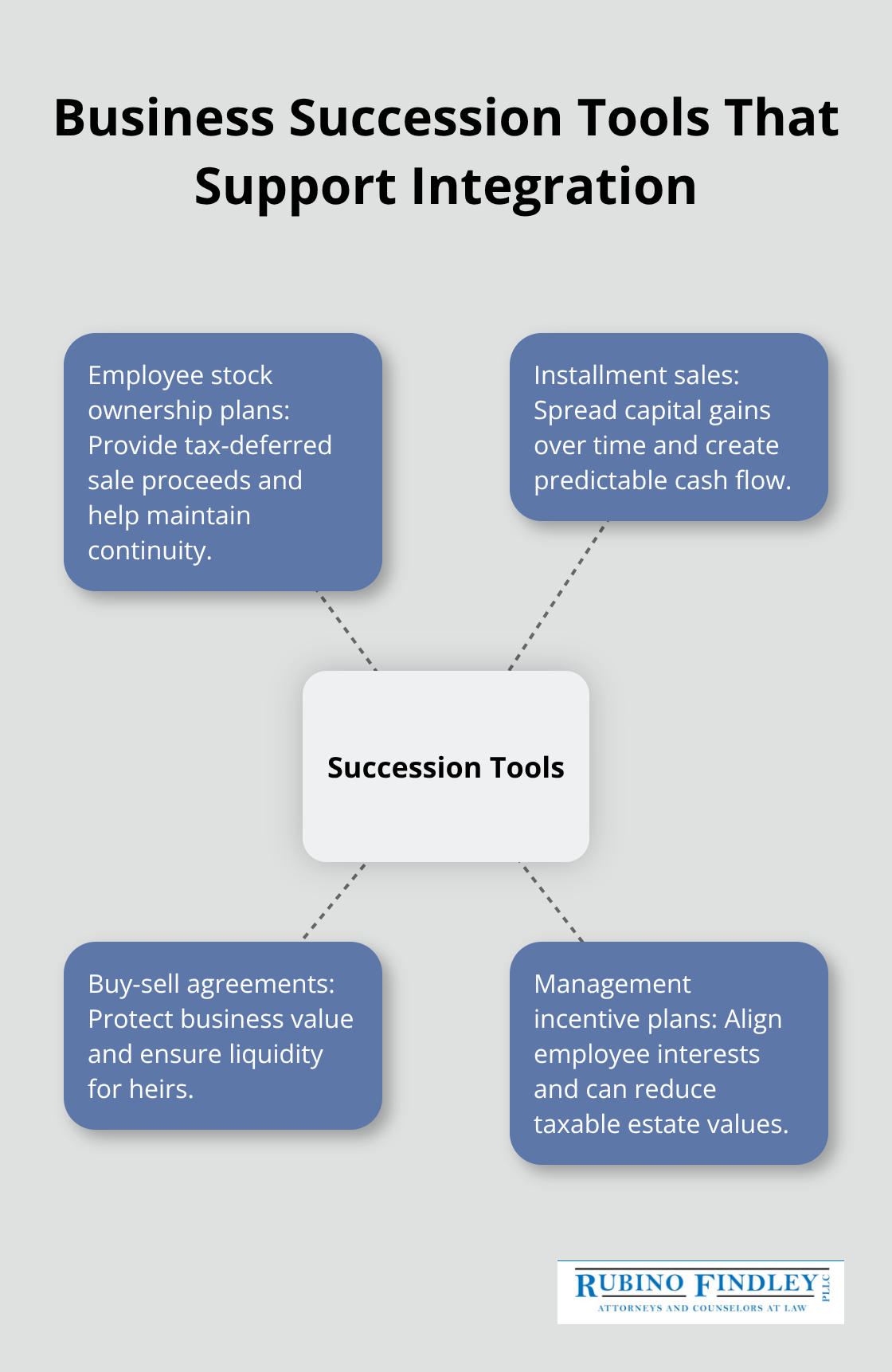

Business Succession Integration

Business owners face unique challenges that require coordinated plans between wealth management and estate strategies. Employee stock ownership plans provide tax-deferred sale proceeds while they maintain business continuity. Installment sales to family members or management teams spread tax obligations over multiple years while they generate steady income.

Buy-sell agreements funded with life insurance protect both business value and family liquidity needs. Management incentive plans align employee interests with long-term business growth while they reduce estate values (particularly effective for family businesses).

These advanced strategies work best when professional teams coordinate their implementation across all aspects of your financial life.

How Do You Build an Effective Professional Team

Most wealthy Palm Beach County families work with multiple professionals but fail to coordinate their efforts. This fragmented approach costs families an average of $250,000 in missed tax savings and duplicated fees according to the National Association of Estate Planners. Smart families create unified teams where estate attorneys, financial advisors, and tax professionals communicate regularly and share common objectives.

Estate Attorneys Drive Tax Strategy Coordination

Your estate planning attorney should lead tax strategy discussions with your financial advisor and CPA. Estate attorneys understand how trust structures affect investment decisions and can guide asset allocation choices that optimize both growth and tax efficiency. Quarterly meetings between all professionals help review portfolio performance against estate plan objectives.

Financial advisors who understand trust taxation can recommend investments that generate tax-preferred income for beneficiaries. CPAs must model tax implications before you implement any wealth transfer strategies. Families who establish these coordination protocols save 15-20% more in combined fees and taxes than those who use siloed professionals.

Tax Professionals Join Plans from Day One

Include your CPA in initial estate planning meetings rather than consult them afterward. Tax professionals can identify opportunities for income shifts and generation-skipping strategies that estate attorneys might miss. They should review all trust documents before you sign to optimize tax elections and accounting methods.

Smart families also engage tax professionals to prepare projections that show how different estate structures affect lifetime and transfer taxes. This upfront involvement prevents costly restructuring later and often identifies additional savings worth tens of thousands annually.

Financial Advisors Must Understand Estate Structures

Your financial advisor needs deep knowledge of how trusts operate and how different investment strategies affect estate plan goals. Advisors should coordinate with estate attorneys before they make major portfolio changes that could trigger unintended tax consequences. They must understand the difference between income and principal distributions from trusts (which affects investment allocation decisions).

The best financial advisors participate in estate planning meetings and help structure investments that support your wealth transfer objectives while they maintain appropriate risk levels for your timeline and goals. High net worth individuals particularly benefit from advisors who understand complex estate structures and can coordinate effectively with legal professionals.

Final Thoughts

Families who integrate estate planning and wealth management strategies preserve significantly more wealth across generations than those who treat these areas separately. The data shows clear advantages: 25% better wealth preservation, 15-20% tax savings, and elimination of costly coordination gaps that drain family resources. Smart families take action now rather than wait for major life changes to force decisions.

Your integrated approach requires three immediate steps. First, inventory all assets including real estate, business interests, and financial accounts. Second, review existing estate documents and investment strategies for coordination gaps (this reveals missed opportunities worth thousands annually). Third, assemble a unified professional team that communicates regularly about your objectives.

Professional guidance becomes essential because integrated planning involves complex legal structures, tax implications, and investment decisions that affect multiple generations. The cost of poor coordination far exceeds the investment in proper planning. Contact our estate planning team today to begin building your integrated wealth and estate strategy.