How to Create a Digital Estate Plan

Your digital footprint contains valuable assets that need protection after you’re gone. From cryptocurrency wallets to social media accounts, these digital properties require careful planning.

We at Rubino Findley, PLLC see families struggle with accessing deceased loved ones’ digital accounts daily. Digital estate planning prevents these complications and protects your family’s financial future.

What Digital Assets Need Protection

Your online accounts hold an average value of $191,516 according to Businesswire research, yet 76% of Americans have little knowledge about how to protect these assets after death (Bryn Mawr Trust survey). Digital assets include cryptocurrency wallets, online banking accounts, PayPal and Venmo balances, cloud storage files, social media profiles, email accounts, subscription services, and intellectual property from platforms like YouTube or podcasts. Licensed content such as iTunes music, Kindle books, and streaming service accounts cannot transfer to heirs, which makes inventory documentation vital to prevent financial losses.

Financial Risks of Abandoned Digital Accounts

Unmanaged digital accounts create immediate financial damage through continued subscription charges that drain estate funds indefinitely. Cryptocurrency holdings become permanently inaccessible without proper key documentation, and online business accounts may lose valuable customer data or revenue streams. Digital payment accounts like PayPal often freeze funds after death notifications, which requires legal intervention to recover balances. Investment accounts on platforms like Robinhood or Coinbase need specific transfer procedures, and delays cost families thousands in missed opportunities or asset value decline.

Access Barriers Under Florida Law

The Florida Fiduciary Access to Digital Assets Act requires explicit authorization for account access, but most families lack proper documentation. Tech companies maintain strict terms of service that block family access without court orders, which creates expensive legal battles. Email providers delete inactive accounts after specific periods and destroy important communications and financial records permanently. Social media platforms have different policies – Facebook offers memorialization while Twitter may delete accounts, which leaves families without control over digital memories or business assets.

Platform-Specific Challenges

Google allows users to assign an Inactive Account Manager, while Apple has a Legacy Contact feature for account access. However, these built-in tools supplement but do not replace comprehensive legal planning. Each platform maintains unique policies that change frequently, and families must navigate different requirements for each service. Dead man’s switch tools can override estate plan instructions, so consistency across all platforms becomes essential for proper asset management.

The next step involves creating a systematic approach to catalog and secure these valuable digital assets.

How Do You Build Your Digital Asset Inventory

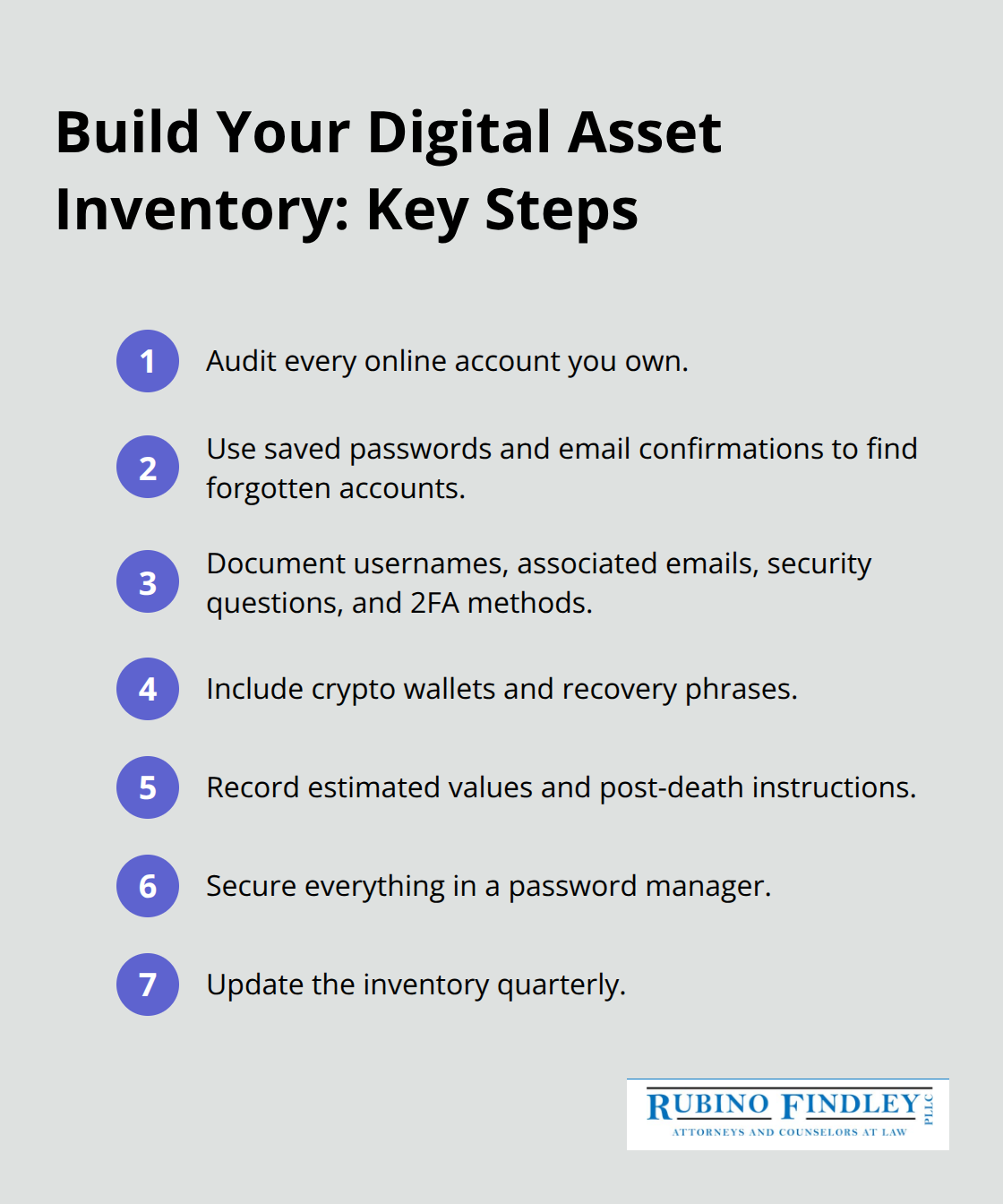

Start with a comprehensive audit of every online account you own. This includes email addresses, bank platforms, investment accounts, social media profiles, cloud storage services, subscription services, and business accounts. Use your browser’s saved passwords feature and check your email for account creation confirmations to identify forgotten accounts. Document each account’s username, associated email address, security questions, and two-factor authentication methods.

Password managers like LastPass or 1Password streamline this process and provide secure storage for credentials. Include cryptocurrency exchanges, digital wallets with their recovery phrases, PayPal and Venmo balances, and intellectual property assets like YouTube channels or podcast platforms.

Secure Documentation Methods

Store access information in encrypted password managers rather than written documents that family members might lose or misplace. Create a master document that lists all accounts with their current status, estimated value, and specific instructions for post-death management. Include recovery phone numbers, backup email addresses, and any physical security keys required for access.

Update this inventory quarterly as you open new accounts or close existing ones. Share the master password or access method with your designated digital executor through a secure method (like a sealed envelope stored with your attorney).

Digital Executor Selection

Select someone tech-savvy who understands online platforms and can navigate complex account recovery processes effectively. Your digital executor should live locally in Palm Beach County to handle time-sensitive matters quickly. This person should differ from your traditional estate executor if that person lacks technical knowledge.

Provide clear written instructions for each type of account, which includes assets to preserve, transfer, or delete permanently. Document your preferences for social media memorialization versus account deletion, and specify how to handle subscription cancellations to prevent ongoing charges against the estate.

Legal Documentation Requirements

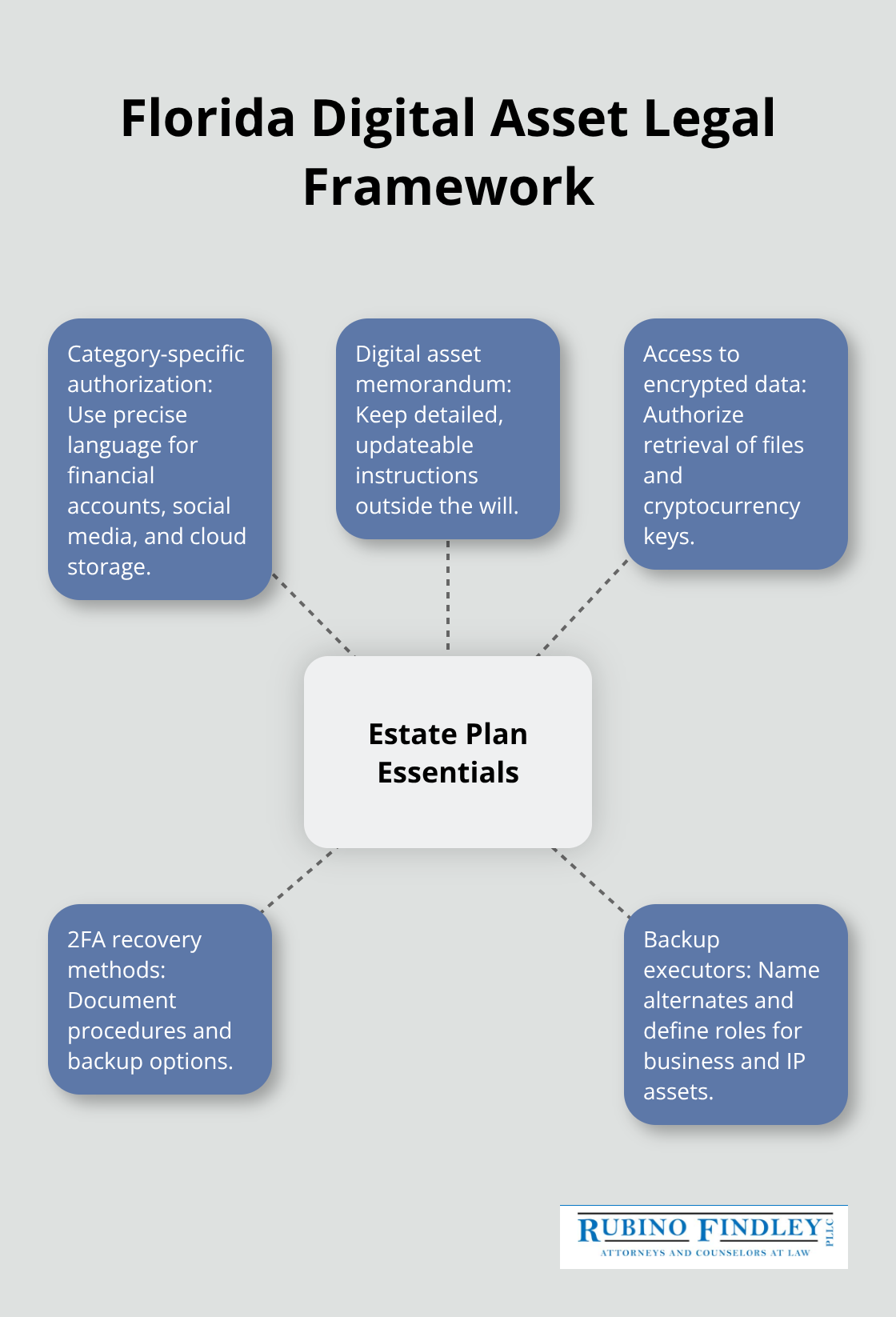

Florida law requires explicit authorization for digital asset access through proper estate documents. Include specific language in your will that grants your digital executor authority to access and manage online accounts. This prevents costly legal battles when tech companies demand court orders for account access.

Work with an estate attorney to draft digital asset provisions that comply with platform terms of service and state regulations. These legal documents must address each category of digital assets separately (financial accounts, social media, cloud storage) to avoid access complications for your family.

What Legal Requirements Apply to Digital Assets in Florida

Florida’s Fiduciary Access to Digital Assets Act mandates specific language in estate documents to grant digital asset access, but most attorneys miss the technical requirements that tech companies actually enforce. The law requires explicit authorization for each category of digital assets – financial accounts need different language than social media or cloud storage. Without precise legal wording, companies like Google and Apple will deny access even with valid death certificates and court orders.

Platform Terms Override State Law

Tech companies maintain terms of service that supersede Florida law in many cases and create access barriers that surprise families. Facebook requires specific legacy contact designation before death, while Twitter may delete accounts regardless of legal documentation. Cryptocurrency exchanges like Coinbase demand multi-step verification processes that can take months to complete. Apple’s Legacy Contact feature only works if activated before death – otherwise, families need court orders that cost thousands in legal fees. Google’s Inactive Account Manager overrides will provisions unless properly coordinated with estate documents.

Annual Policy Changes Create Compliance Challenges

Each platform changes policies annually, so estate plans need regular updates to maintain compliance. Amazon modified its digital content inheritance rules in 2023, while Microsoft updated business account transfer procedures twice in the past year. These changes invalidate existing estate language and force families into expensive legal proceedings. PayPal altered its death notification requirements in 2024, which caught many estate attorneys off guard. Cryptocurrency platforms face new regulatory requirements that affect inheritance procedures monthly.

Strategic Legal Documentation Framework

Estate documents must include platform-specific authorization language rather than generic digital asset clauses that attorneys commonly use. The will should reference a separate digital asset memorandum that contains detailed instructions for each account type (this approach allows updates without will amendments when platforms change policies).

Include specific language that grants authority to access encrypted files, recover cryptocurrency keys, and manage business accounts. Document two-factor authentication recovery methods and designate backup executors in case primary choices become unavailable. The legal framework should address intellectual property transfers, subscription cancellations, and social media memorialization preferences to prevent family disputes.

Final Thoughts

Digital estate planning demands regular attention as technology platforms shift policies and new accounts accumulate throughout your lifetime. Quarterly reviews prevent outdated information from blocking family access when they need it most. Platform updates can invalidate existing legal language, which makes regular consultation with estate attorneys necessary to maintain compliance.

Professional legal guidance protects families from costly court battles and lengthy account recovery processes. We at Rubino Findley, PLLC help Palm Beach County residents create comprehensive estate plans that address both traditional and digital assets. Our team understands Florida’s specific requirements for digital asset access and drafts documents that tech companies actually honor.

Without proper digital estate planning, families face months of legal proceedings to access cryptocurrency wallets, business accounts, and personal files. The average digital asset value of $191,516 (according to Businesswire research) makes this protection essential for financial security. Contact our estate planning attorneys to protect your family from digital asset complications and create a plan that preserves your complete legacy.