How to Create Your Own Estate Plan at Home

Many people put off estate planning because they think it’s too expensive or complicated. DIY estate planning might seem like a quick solution, but it often creates more problems than it solves.

At Rubino Findley, PLLC, we’ve seen families struggle with poorly drafted documents that don’t hold up in court or miss critical tax savings. This guide walks you through what DIY estate planning involves and when you really need professional help.

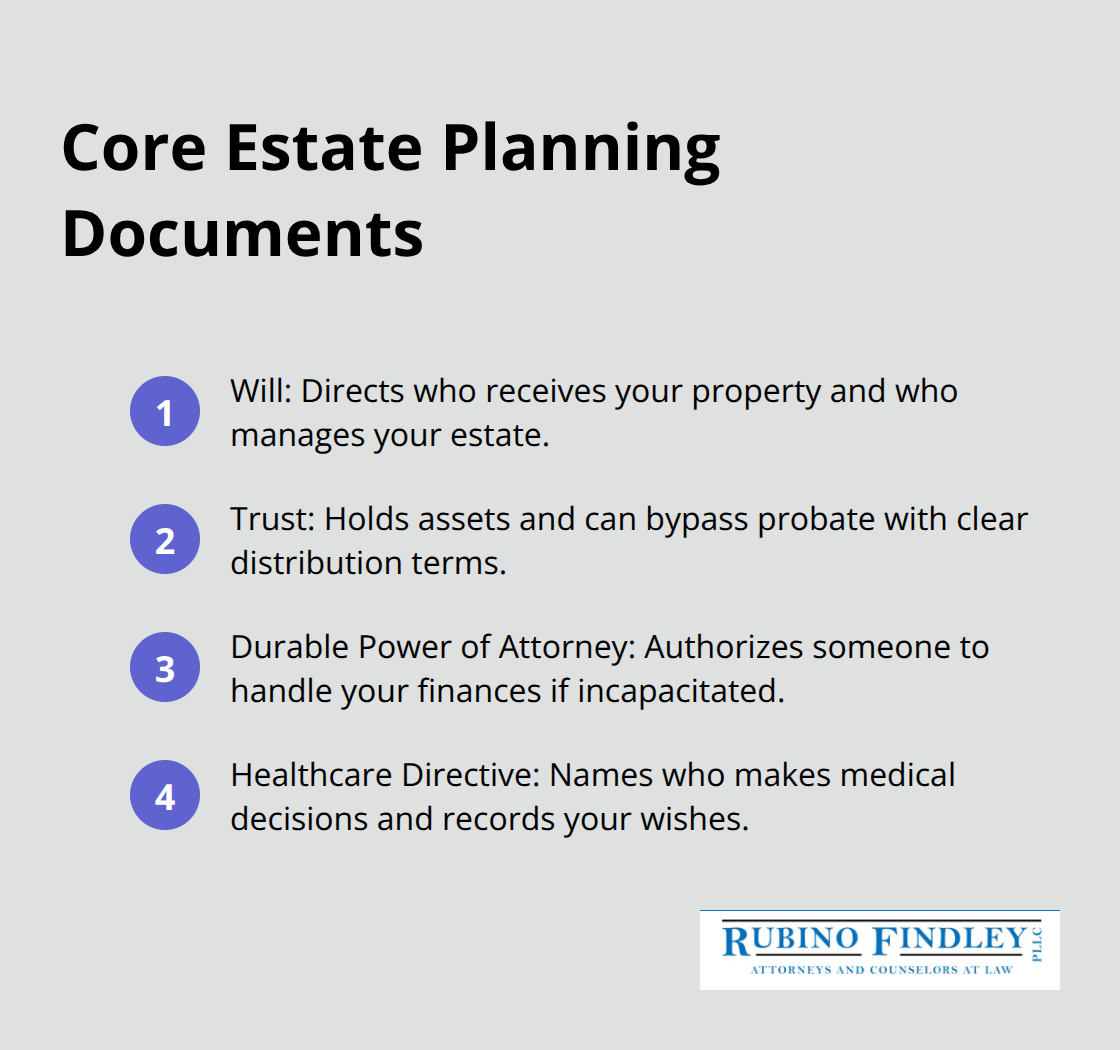

What Actually Goes Into an Estate Plan

The Core Documents You Need

An estate plan isn’t a single document-it’s a collection of legal instruments that work together to protect your assets and direct your wishes. A will specifies who receives your property and who manages your estate after you die. A trust holds your assets and distributes them according to your instructions, often bypassing probate entirely. A durable power of attorney names someone to handle your finances if you become incapacitated. A healthcare directive designates who makes medical decisions for you.

Without these pieces in place, Florida law decides who inherits your assets and who manages your affairs-which rarely matches what families actually want. The problem with DIY approaches is that people either create incomplete documents or fail to execute them properly, rendering them invalid.

Why Execution Matters in Florida

State-specific requirements make DIY estate planning dangerous. Florida requires witnesses to sign your will in specific ways; mistakes here invalidate the entire document. A will that doesn’t meet Florida’s execution standards holds no legal weight, leaving your family to navigate probate without your guidance. Your digital assets-bank accounts, social media, cryptocurrency-may become inaccessible to your family if you haven’t documented them properly. Medical decisions fall to whoever the hospital deems appropriate, not necessarily your spouse or closest relative.

Who Needs an Estate Plan

Everyone needs an estate plan, regardless of age or wealth level. The American Bar Association reports that roughly 60% of American adults don’t have a will, yet accidents and illnesses don’t discriminate by age or net worth. If you die without a plan, your minor children could end up in state custody while courts determine guardianship.

Tax implications compound the problem-a poorly structured plan can cost your heirs tens of thousands in unnecessary estate taxes that proper planning could have avoided entirely.

The gap between what you want and what the law provides grows wider without proper documentation. This is where the difference between a DIY document and a legally sound plan becomes impossible to ignore.

What You Actually Need to Start

Inventory Your Assets and Liabilities

Creating a DIY estate plan requires brutally honest self-assessment about your financial situation and your family’s needs. List everything you own: real estate, bank accounts, investment portfolios, retirement accounts, life insurance policies, vehicles, and business interests. The Federal Reserve’s 2023 Survey of Consumer Finances found that the median American household holds assets across multiple account types, yet most people cannot accurately state their total net worth within 10 percent.

Write down the approximate value of each asset and note where the account information lives. Then list your debts: mortgages, credit cards, personal loans, and any business obligations. This inventory becomes your roadmap, but skipping it guarantees your DIY plan will be incomplete.

Choose Your Executor and Trustee

Next, decide who actually has the capability and willingness to manage your affairs. Your spouse might seem like the obvious choice, but what if they predecease you or become incapacitated themselves? You need a primary executor and at least one successor. Florida probate courts reject executors regularly because people appointed someone without considering whether that person lives in state, understands financial management, or can handle family conflict.

A professional trustee costs money but eliminates drama. If you choose a family member, have a direct conversation about whether they want the job before naming them. This step separates plans that work from plans that create conflict.

Draft Documents That Meet Florida Requirements

Then comes the hardest part: drafting documents that actually reflect Florida law. Most DIY wills fail because people copy templates that don’t address Florida-specific execution requirements or miss critical provisions like testamentary trusts for minor children. Without proper language around digital asset access, your family loses passwords and cannot retrieve accounts worth thousands.

Healthcare directives created from generic online forms often lack the specificity hospitals require, leaving your family fighting with medical staff about your wishes. The cost difference between a fifty-dollar online template and a properly drafted estate plan from an attorney in Boca Raton amounts to a few hundred dollars, yet the consequences of cutting corners affect your family for decades.

These gaps in DIY documents create the exact problems that proper legal planning prevents-which is why the next section examines what happens when those gaps become real.

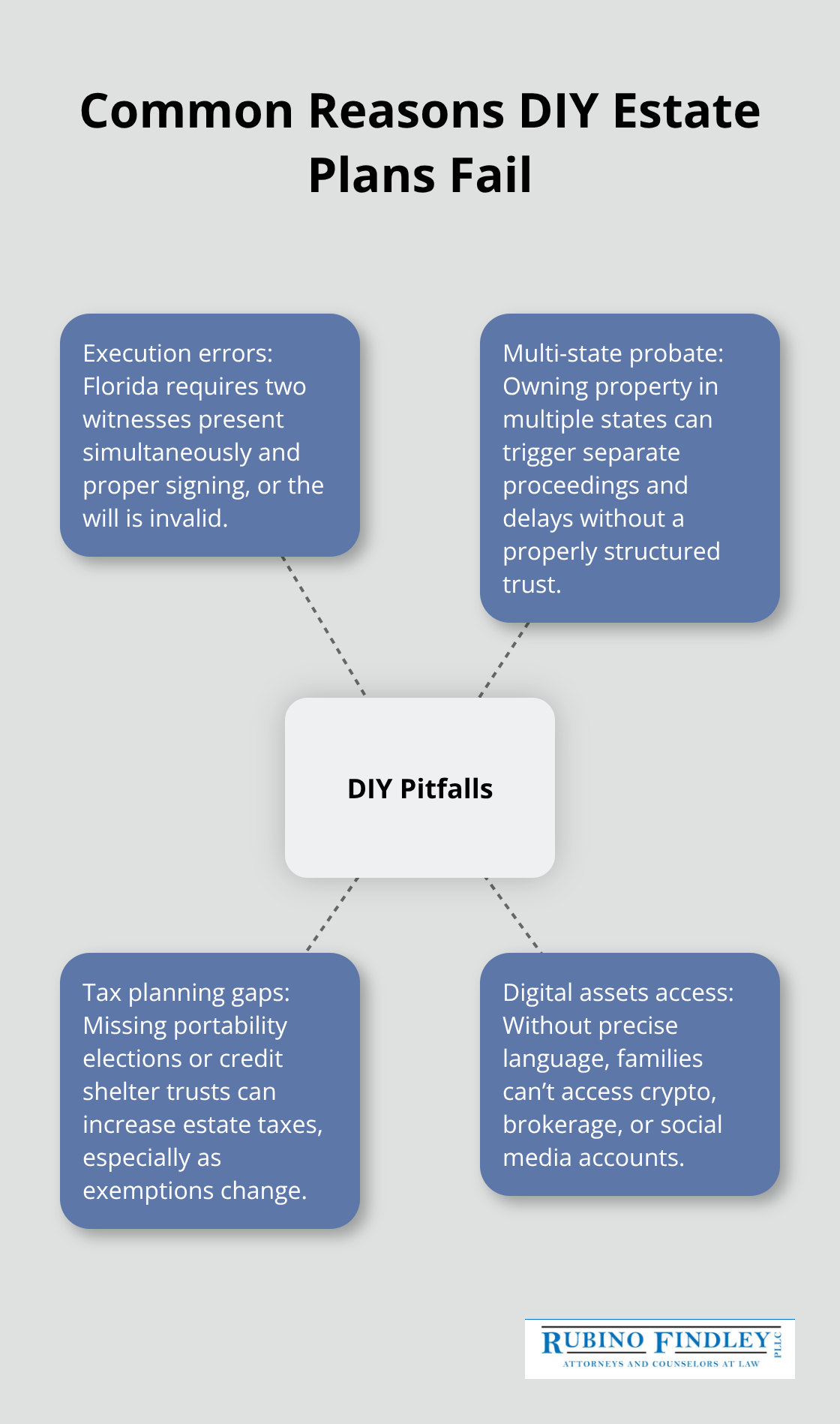

Why DIY Estate Plans Fail in Court

Execution Problems That Invalidate Your Will

Florida courts reject DIY wills regularly because homemade documents miss state-specific execution requirements. Florida Statute 732.502 requires two witnesses present simultaneously while you sign, and both witnesses must sign in your presence and each other’s presence. Most online templates fail to explain this requirement clearly, leading people to have witnesses sign separately or at different times, which invalidates the entire will. The Florida Bar reports that improper execution accounts for roughly 40 percent of will contests they observe. A single mistake in how you sign your document renders it worthless in probate court, leaving your family without the guidance you intended to provide.

Multi-State Property and Probate Complications

If you own real property in multiple states, a poorly drafted will creates probate proceedings in each state where you own land, multiplying legal costs and delays for your family. A trust drafted by an attorney avoids this multi-state probate nightmare, but DIY trust documents frequently contain language so vague that banks and financial institutions refuse to recognize them. Your family then waits months unable to access accounts or transfer property titles.

The complexity compounds when you hold real estate in Florida and another state-courts in both jurisdictions may claim authority over your estate, creating expensive legal battles that proper planning prevents entirely.

Tax Liability and Asset Protection Failures

Tax implications destroy the financial protection DIY plans promise. The IRS allows each person an estate tax exemption of 13.61 million dollars in 2024, but this exemption disappears after 2025 unless Congress acts. A married couple with a combined estate over 27 million dollars faces catastrophic tax liability without proper planning, yet most DIY wills contain zero language addressing portability elections or credit shelter trusts that could save hundreds of thousands in taxes. Even smaller estates suffer from poor planning. If you fail to properly title assets in a trust’s name, those assets go through probate anyway, costing your family thousands in court fees and attorney costs when a properly structured plan would have avoided probate entirely.

Digital Assets Left Inaccessible

DIY plans rarely address cryptocurrency wallets, online brokerage accounts, or social media accounts, leaving your family unable to access or liquidate these assets without court intervention. Your family cannot retrieve passwords or account information from generic online templates. Banks and financial institutions require specific language and documentation before they release digital assets to heirs, and most DIY documents lack this precision. Without proper planning, accounts worth thousands remain frozen while your family navigates probate courts trying to prove their right to access what you left behind.

Final Thoughts

DIY estate planning saves money upfront but costs your family far more later. We at Rubino Findley, PLLC have watched families spend thousands correcting mistakes that proper planning would have prevented entirely. A customized estate plan addresses your specific situation, not some generic template’s assumptions about your life. Palm Beach County families often have unique circumstances-multi-state property, blended families, business interests, or significant digital assets-that require tailored solutions, not one-size-fits-all documents.

Proper legal documentation and execution matter more than most people realize. Florida’s execution requirements are strict, and courts reject poorly drafted wills regularly. When you work with us, we handle the technical details that make the difference between a plan that works and one that fails in probate court. We prepare your healthcare directives with the specific language hospitals require, structure your trust to properly title your assets and avoid probate, and cover digital accounts your family needs to access through your power of attorney.

The real value lies in the peace of mind that comes from knowing your wishes will actually be honored. Your family won’t fight over your intentions or spend months in probate court trying to figure out what you wanted. Contact Rubino Findley, PLLC in Boca Raton to schedule your free consultation and discuss your estate planning needs-we serve families throughout Palm Beach County and Florida.