How to Find the Right Probate Administration Attorney

Probate administration involves complex legal procedures that many families handle incorrectly, leading to costly delays and family conflict. The right probate administration attorney guides you through Florida’s requirements and protects your family’s interests.

At Rubino Findley, PLLC, we’ve helped countless families in Palm Beach County navigate this process smoothly. This guide shows you what to look for in an attorney and how to avoid the mistakes that derail estates.

What Matters Most When Hiring a Probate Attorney

Experience Handling Real Cases

The attorney you choose will guide your family through months of legal work, court filings, and financial decisions. This decision deserves serious attention. Too many families hire the first attorney they find and regret it later when costs spiral or deadlines slip. Florida probate law is detailed and unforgiving-missing a filing deadline or miscommunicating with the court can restart the entire process.

You need someone who knows the Palm Beach County courts, understands Florida Statutes 733, 735.201, and 735.301, and has handled cases similar to yours. Ask any candidate how many probate cases they’ve closed in the last three years and what complexity levels they handled. If they dodge the question or quote a vague total, move on. An attorney who closes 40 to 50 cases annually across multiple complexity levels has real depth; someone who closes five or ten cases annually likely lacks the pattern recognition that saves time and money.

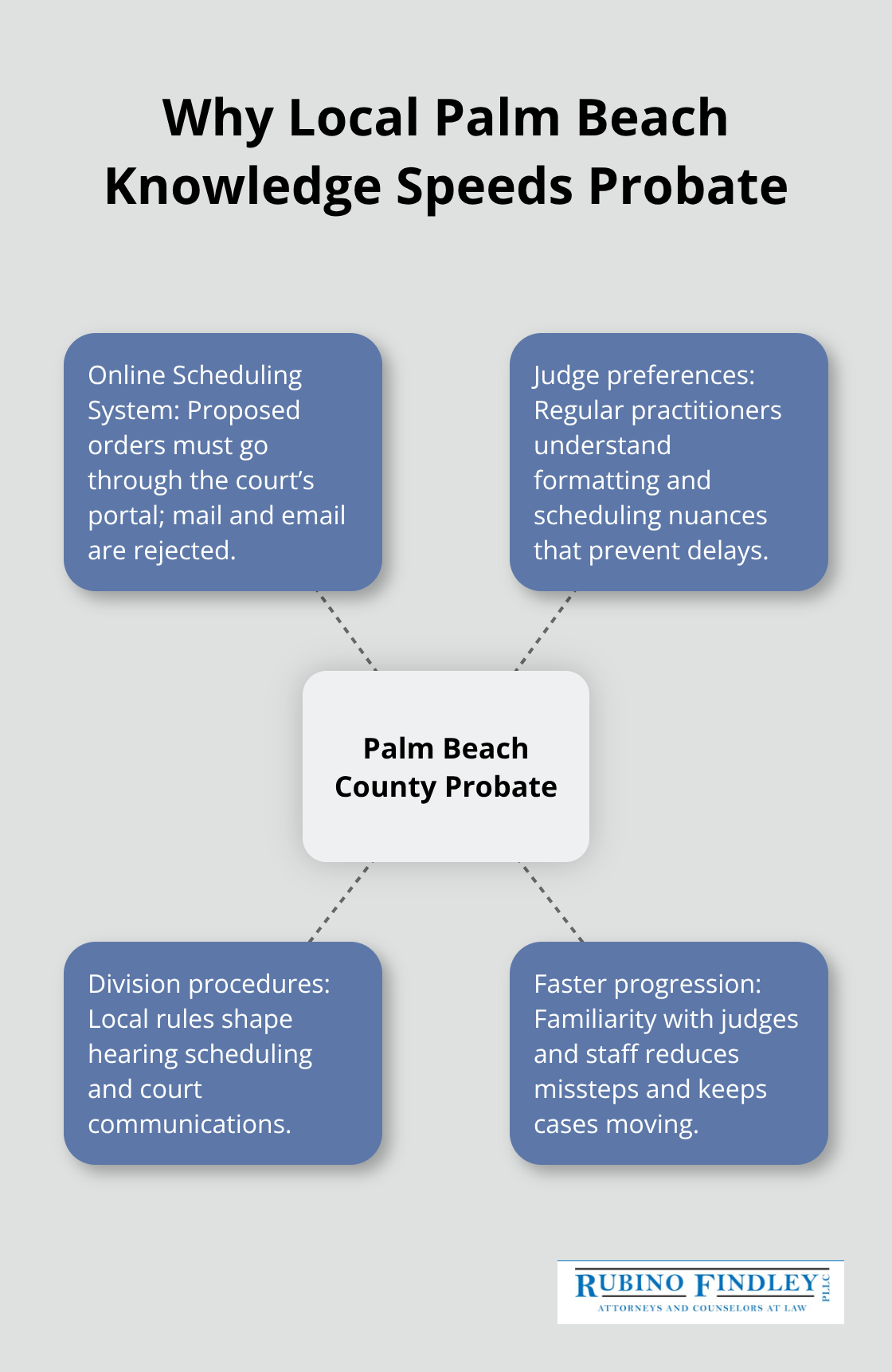

Local Knowledge in Palm Beach County

Experience in Florida probate matters more than national credentials. Probate procedures vary significantly by state, and Palm Beach County has its own local rules through the 15th Judicial Circuit. The court uses an Online Scheduling System for submitting proposed orders-mail and email are rejected. Judges have individual preferences and hearing schedules documented on the Divisions page of the 15th Judicial Circuit’s website.

An attorney who regularly appears before your assigned judge understands what works and what delays cases. Ask whether the candidate has handled probate in your specific county and whether they know the judges and staff. Local familiarity translates directly to faster case progression and fewer costly missteps.

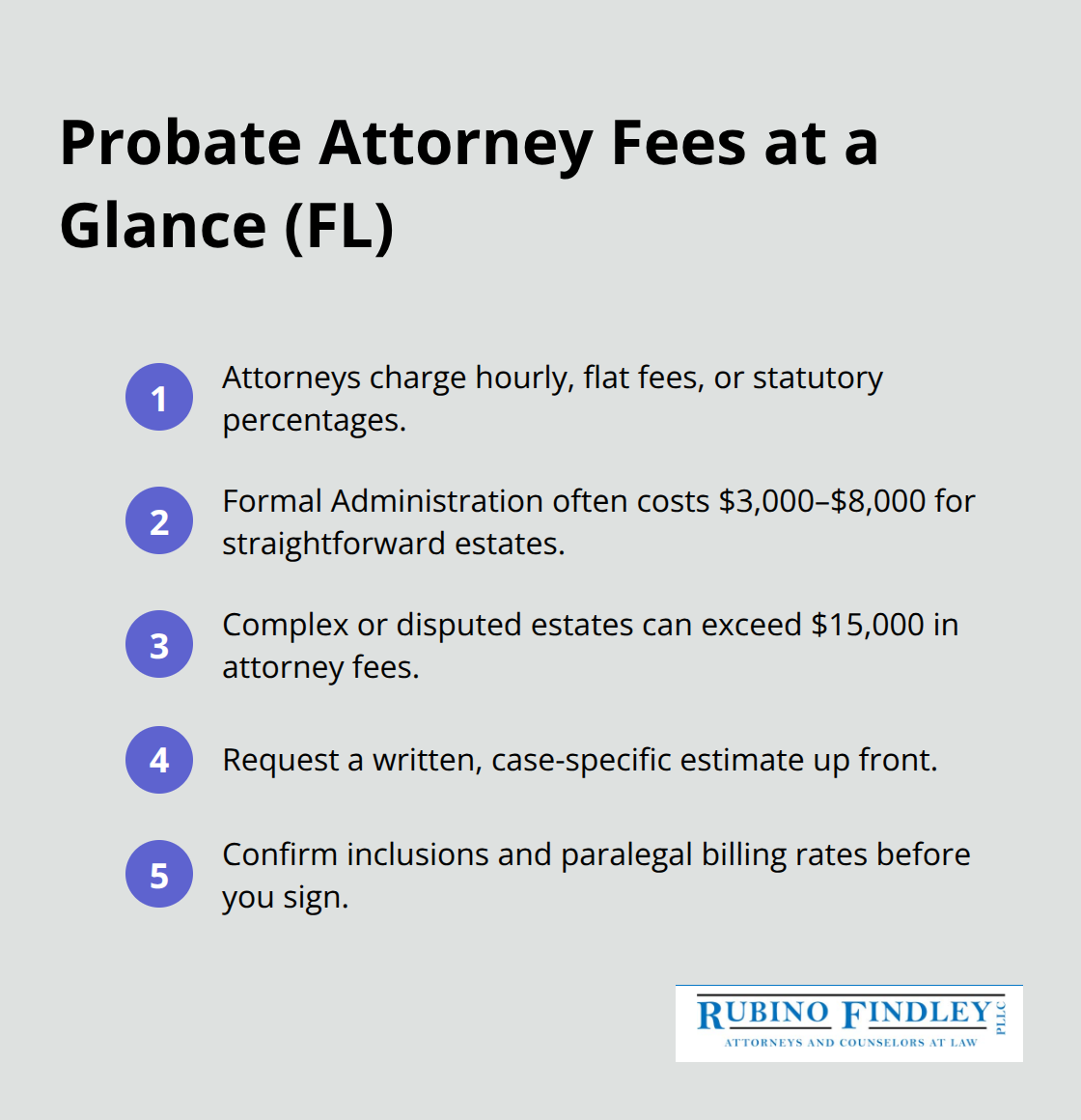

Fee Structure and Transparency

On fees, demand clarity before signing anything. Florida probate attorneys typically charge hourly rates, flat fees, or statutory percentages depending on the case type. Formal Administration cases often run $3,000 to $8,000 in attorney fees for straightforward estates, while complex cases with disputes or substantial assets can exceed $15,000.

Request a written estimate based on your specific situation, not a generic range. Confirm what’s included-does the attorney handle tax filings for the estate, court filing fees, and publication costs, or do you pay those separately? Will paralegals handle routine work at lower rates, or does the attorney bill for everything? Transparent attorneys provide a step-by-step fee breakdown and explain how they bill for different tasks.

Communication and Responsiveness

Probate takes six to eight months in Florida, and you’ll need updates on court deadlines, creditor claims, and asset transfers. Some attorneys communicate quarterly; others respond within 48 hours. During your initial consultation, ask how often you’ll receive updates and through what channel.

Ask for a reference from a client whose case closed in the last year-not a polished testimonial, but someone willing to discuss real experiences and outcomes. If an attorney won’t provide references or seems dismissive about communication expectations, that’s a red flag. The attorney you select will shape your family’s experience throughout the entire probate process, making responsiveness and openness essential qualities.

Mistakes That Derail Probate Cases in Boca Raton

Missing Court Deadlines Restarts Everything

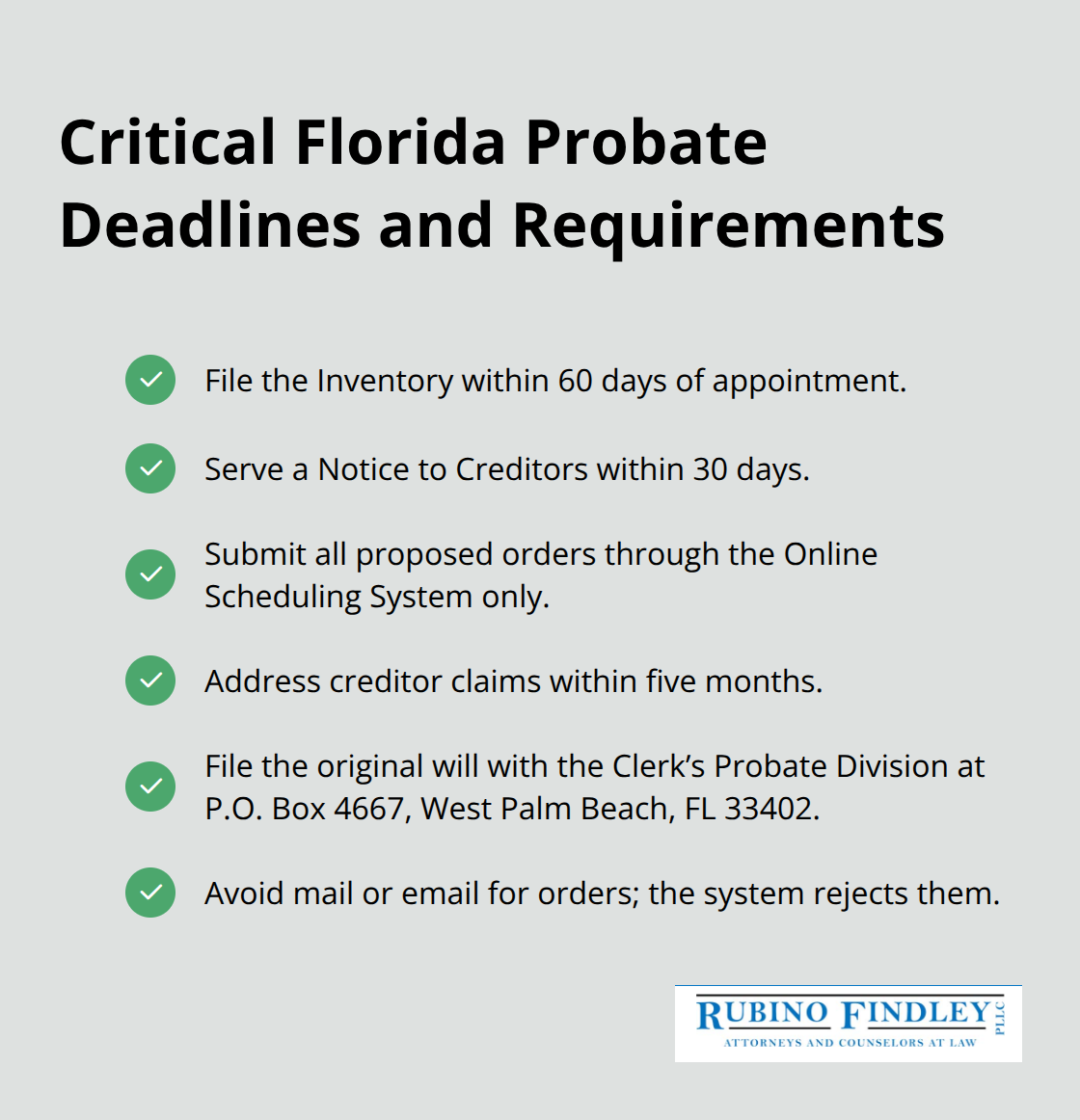

Missing court deadlines in Florida probate is not a minor administrative slip-it restarts the entire process. Florida Statute 733 requires specific filings within strict timeframes: the personal representative must file an Inventory within 60 days of appointment, serve creditors with a Notice to Creditors within 30 days, and submit all proposed orders through the 15th Judicial Circuit’s Online Scheduling System. The system rejects mail and email submissions entirely. One attorney who files through the wrong channel causes the court to reject the order, costing weeks of delay and additional legal fees. Creditor claims must be addressed within five months, or the estate remains open longer than necessary. The original will must be filed with the Clerk’s Probate Division at P.O. Box 4667, West Palm Beach, FL 33402-not electronically.

Mishandling these procedural details transforms a six-month case into a nine-month or longer ordeal.

Commingling Assets Destroys Credibility

Estate assets during probate must be held in a separate account in the personal representative’s name, not commingled with personal funds. When assets sit in the wrong account or remain invested without proper documentation, creditors question the estate’s solvency and beneficiaries lose trust in the process. Tax filings for the deceased and the estate cannot be skipped; the IRS requires final individual returns and estate tax returns if the estate exceeds $13,610 in gross income for 2024. Failing to file these returns triggers penalties and interest that reduce what beneficiaries receive. An attorney who handles tax coordination prevents these costly oversights.

Inadequate Notice Creates Legal Disputes

Beneficiaries and creditors must receive proper notice under Florida law, yet families often skip notification or provide incomplete information. Florida Statute 731.110 requires that creditors receive written notice within 30 days of the personal representative’s appointment, and beneficiaries must be informed of their rights and the probate timeline. When notice is inadequate or delayed, creditors file claims late and beneficiaries challenge distributions. The Clerk does not publish Notices of Action or Notices to Creditors for non-indigent parties; you must arrange publication with a newspaper and file proof of publication with the Clerk. Families who attempt probate without legal guidance often overlook this requirement entirely.

Local Rules Vary Significantly

Palm Beach County uses the 15th Judicial Circuit’s local procedures, which differ from other Florida counties. These variations affect how you submit orders, schedule hearings, and communicate with the court. An attorney in Boca Raton navigates these local rules, ensures all parties receive proper notice, and prevents disputes that extend probate timelines by months. Understanding which mistakes matter most in your specific jurisdiction separates a smooth probate from one that spirals into conflict and expense.

How Probino Findley, PLLC Handles Probate Administration in Boca Raton

Navigating Court Procedures and Local Requirements

The 15th Judicial Circuit requires proposed orders submitted through its Online Scheduling System only-mail and email face outright rejection. Missing this single procedural requirement forces resubmission, delaying distributions by weeks. Palm Beach County courts operate under specific local rules that differ from other Florida counties. These variations affect how you submit orders, schedule hearings, and communicate with the court. The original will must arrive at the Clerk’s Probate Division (P.O. Box 4667, West Palm Beach, FL 33402) complete and accurate on the first attempt. Attorneys who work regularly in Palm Beach County know which judges prefer certain formatting, which staff members handle specific case types, and how to schedule hearings efficiently.

Managing Notifications and Creditor Claims

The Clerk does not publish Notices of Action or Notices to Creditors for you-you must arrange newspaper publication and file proof with the court. Florida Statute 731.110 requires creditors receive written notice within 30 days of appointment, and beneficiaries must understand their rights and the probate timeline. When notice is incomplete or delayed, creditors file late claims and beneficiaries challenge distributions, extending the process from six months to nine months or longer. Proper notification from the start prevents these costly complications.

Preventing Asset Mismanagement and Tax Problems

Estate funds must sit in a separate account in the personal representative’s name, never commingled with personal money. When assets remain in the wrong account or lack proper documentation, creditors question the estate’s solvency and beneficiaries lose trust in the process. Tax filings for the deceased and the estate cannot be skipped-the IRS requires final individual returns and estate tax returns if the estate exceeds $13,610 in gross income for 2024. Missing these deadlines triggers penalties and interest that reduce what beneficiaries receive. Proper tax coordination prevents this costly oversight.

Resolving Beneficiary Disputes Before They Escalate

Disputes between beneficiaries consume time and money that should go toward settling the estate. When one heir questions the personal representative’s actions or disagrees with asset valuations, the case stalls. Mediation of these disagreements before they escalate to litigation saves substantial costs-litigation itself runs $10,000 to $25,000 or more depending on complexity. Early intervention prevents disputes from spiraling into expensive court battles that drain the estate and damage family relationships.

Final Thoughts

Probate administration without legal guidance leaves your family vulnerable to costly mistakes, missed deadlines, and family conflict. A single procedural error in Palm Beach County can restart the entire process, adding months and thousands of dollars in unnecessary costs. Missing a court filing deadline, commingling estate assets, or failing to notify creditors properly transforms a straightforward six-month case into a prolonged legal battle that drains the estate and damages family relationships.

A probate administration attorney protects your family from the procedural complexities that trip up families attempting to navigate probate alone. Florida Statutes 733, 735.201, and 735.301 contain specific requirements that vary by case type and jurisdiction, and the 15th Judicial Circuit’s Online Scheduling System rejects mail and email submissions entirely. Creditors must receive notice within 30 days, the original will must reach the Clerk’s Probate Division at the correct address, and tax filings cannot be skipped without triggering IRS penalties.

We at Rubino Findley, PLLC help families in Palm Beach County navigate probate administration with clarity and efficiency. Our team handles court filings, creditor notifications, asset management, and tax coordination so your family can focus on healing rather than legal procedures. Contact us to schedule your free consultation and learn how a probate administration attorney can protect your family’s interests.