How to Handle Estate Planning Administration Effectively

Estate administration involves managing a deceased person’s assets, paying obligations, and distributing what remains to beneficiaries. Many families struggle with this process because they lack clear guidance on what needs to happen and when.

At Rubino Findley, PLLC, we’ve seen how poor planning during estate administration creates unnecessary stress and expense for families in Palm Beach County. This guide walks you through the common pitfalls, the essential steps, and why professional support makes a real difference.

What Mistakes Derail Estate Administration

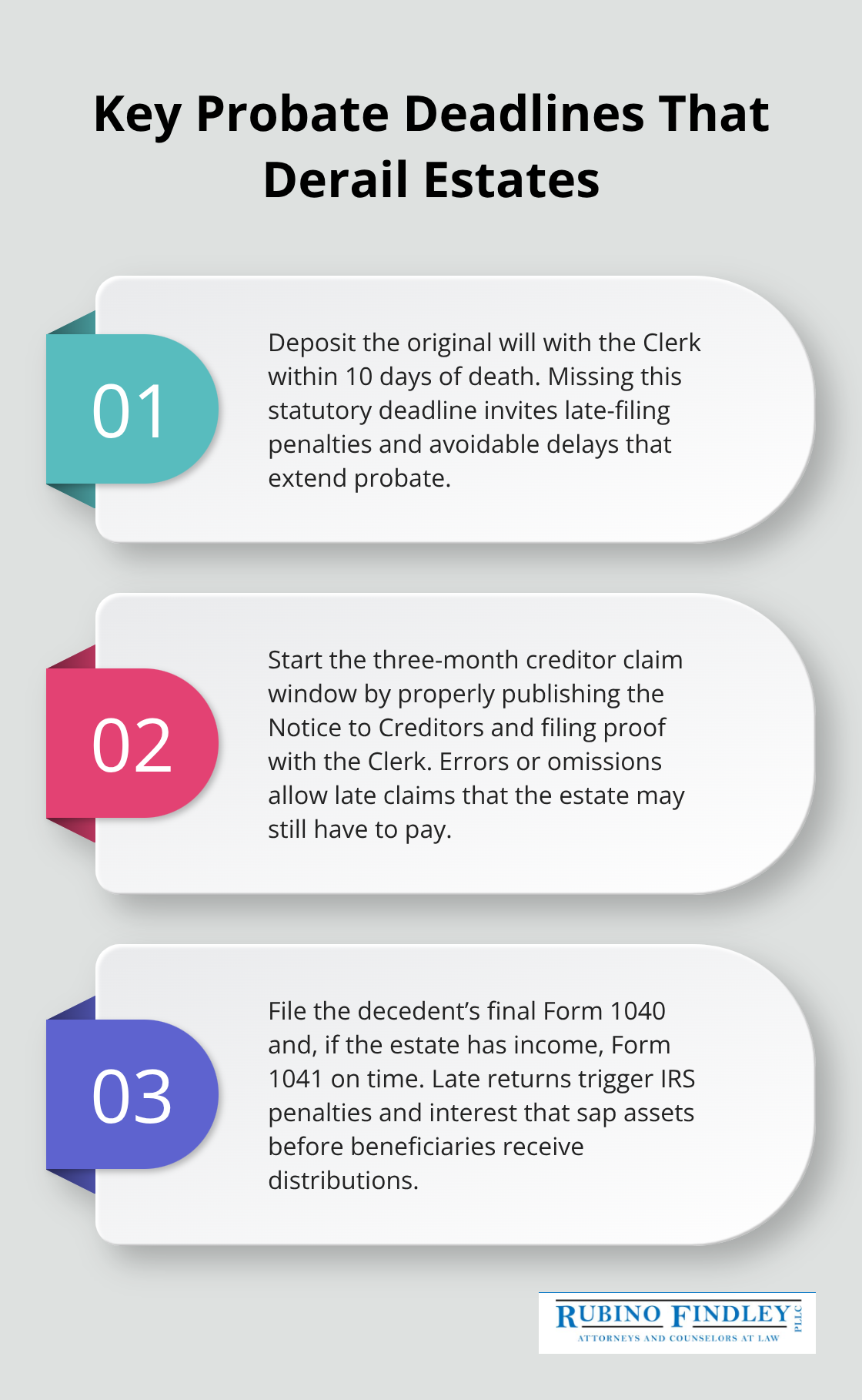

Missing Critical Filing Deadlines

Timing failures during estate administration cost families thousands in unnecessary fees and court delays. Florida law requires the original will deposited with the Clerk within 10 days of death, yet personal representatives miss this deadline regularly, triggering late-filing penalties and complications that extend probate timelines.

The three-month creditor claim period begins only after the Notice to Creditors publishes in a newspaper of general circulation, and many families arrange publication incorrectly or fail to file proof of publication with the Clerk entirely. When these notices go out late or incompletely, creditors file claims outside the window, forcing the estate to pay debts that should have been barred.

Tax filing deadlines create even steeper consequences. The decedent’s final Form 1040 must be filed, and if the estate generates income, Form 1041 becomes mandatory. Failure to file these returns on time triggers IRS penalties and interest that deplete estate assets before beneficiaries receive anything.

Commingling Funds and Skipping Asset Valuations

Personal representatives often treat estate accounts like personal accounts, which creates serious problems. Funds deposited in the Court Registry during probate must stay segregated and documented; commingling estate money with personal funds invites accusations of theft and triggers surcharge liability where the personal representative personally reimburses the estate.

Many families also fail to obtain a valuation date for assets. Assets are valued as of the decedent’s date of death or the alternate valuation date, and skipping this step means overpaying estate taxes or distributing assets at incorrect values. This oversight (which happens more often than it should) directly harms both the estate and beneficiaries.

Breaking Communication with Beneficiaries

Personal representatives who ignore beneficiaries or provide no updates about the estate’s status generate resentment and legal challenges that drag probate into years rather than months. Florida law doesn’t require frequent updates, but families who receive no information assume mismanagement is occurring, even when administration is proceeding normally.

Transparent communication about asset inventory, creditor claims, tax filings, and distribution timelines prevents disputes that transform a routine probate into contentious litigation. Beneficiaries who understand what’s happening and why (and when they’ll receive their distributions) rarely challenge the administration process. Those kept in the dark almost always do.

These three categories of mistakes-timing failures, asset mismanagement, and communication breakdowns-account for most of the problems we see in estate administration. Understanding what goes wrong is the first step toward handling administration correctly, which means knowing exactly what steps you need to take and in what order.

The Three Phases of Estate Administration in Boca Raton

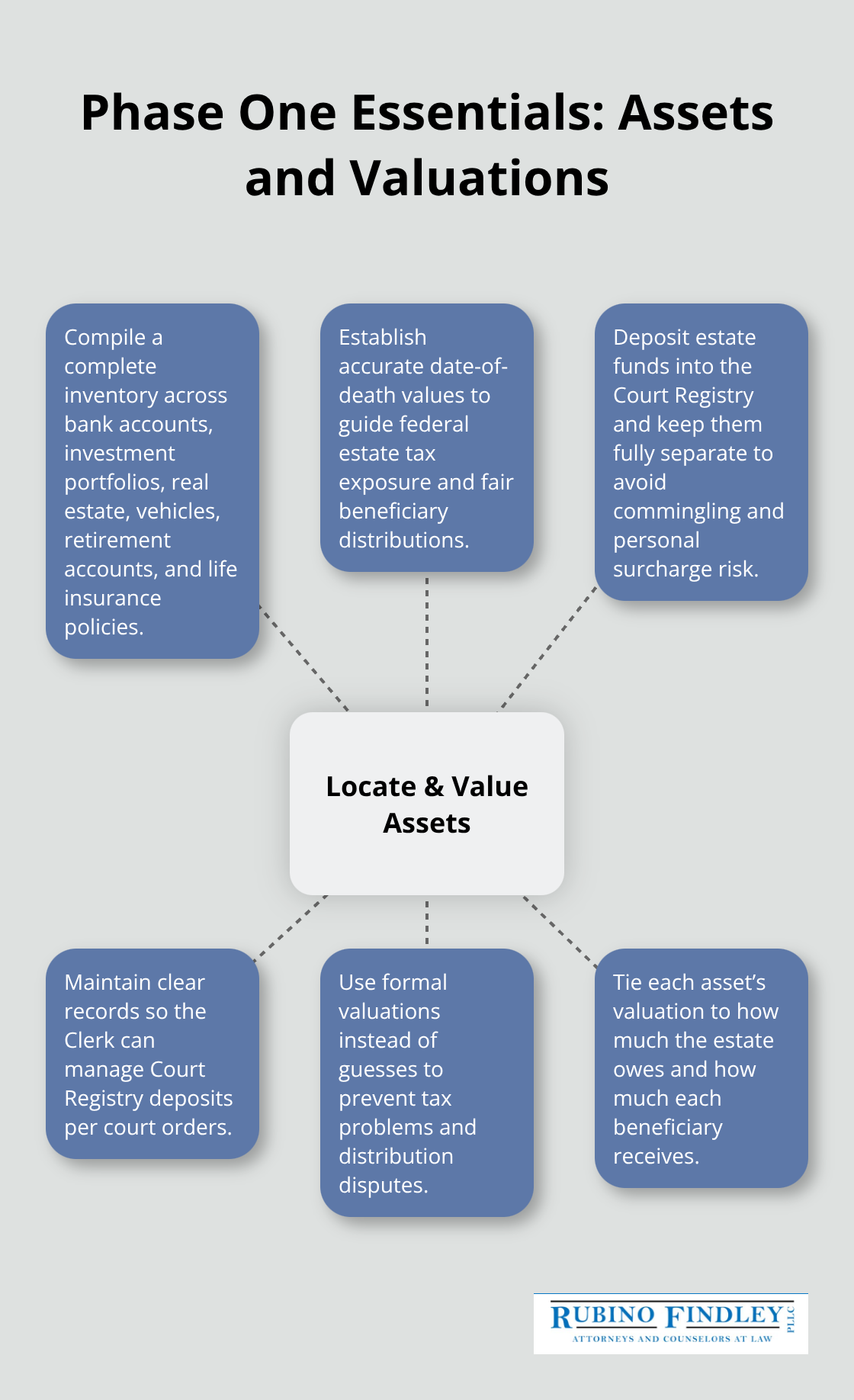

Phase One: Locating and Valuing Assets

Estate administration in Florida follows a predictable sequence, and staying on track with each phase prevents the delays and disputes that derail many families. The first phase involves locating every asset the decedent owned-bank accounts, investment portfolios, real estate, vehicles, retirement accounts, and life insurance policies. Personal representatives must obtain a comprehensive asset list and determine the date-of-death value for each item, since assets are valued as of the decedent’s death date for tax and distribution purposes.

This valuation step directly affects how much federal estate tax the estate owes and how much each beneficiary receives. Many families skip formal valuations and rely on guesses, which creates tax exposure and distribution disputes later. Once assets are identified and valued, the personal representative deposits estate funds into the Court Registry if probate is open, keeping funds completely separate from personal accounts. The Court Registry holds these funds until the estate closes, and the Clerk manages them according to court orders.

This segregation prevents the personal representative from facing surcharge liability-personal liability for mixing estate money with personal funds.

Phase Two: Paying Debts and Taxes

The second phase addresses what the estate owes: creditor claims, taxes, and administration expenses must be paid before any beneficiary receives a distribution. Florida law gives creditors three months from the date the Notice to Creditors publishes in a newspaper of general circulation to file claims against the estate. The personal representative must publish this notice correctly and file proof of publication with the Clerk, or creditors can file claims outside the window and the estate must pay them anyway.

Tax obligations include the decedent’s final Form 1040, estate income tax on Form 1041 if the estate generates income, and potentially federal Form 706 estate tax returns if the gross estate exceeds the federal exemption threshold (13.61 million in 2024). The IRS imposes penalties and interest for late filings, so these deadlines are non-negotiable. Once debts and taxes are paid and all creditor claims are resolved, the estate moves into its final phase.

Phase Three: Distributing Assets and Closing the Estate

The personal representative distributes remaining assets to beneficiaries according to the will or Florida intestate succession laws. The personal representative files a final accounting with the court, and once the judge approves the accounting and all distributions are complete, the estate closes. Simple probate typically takes five to six months after Letters of Administration issue, though complex estates with disputes or significant tax issues extend far longer.

Understanding these three phases helps personal representatives stay organized and avoid the timing failures that create unnecessary delays. Each phase has specific deadlines and requirements, and missing even one can trigger penalties, extended probate timelines, and family conflict. Professional guidance helps personal representatives navigate these phases without costly mistakes.

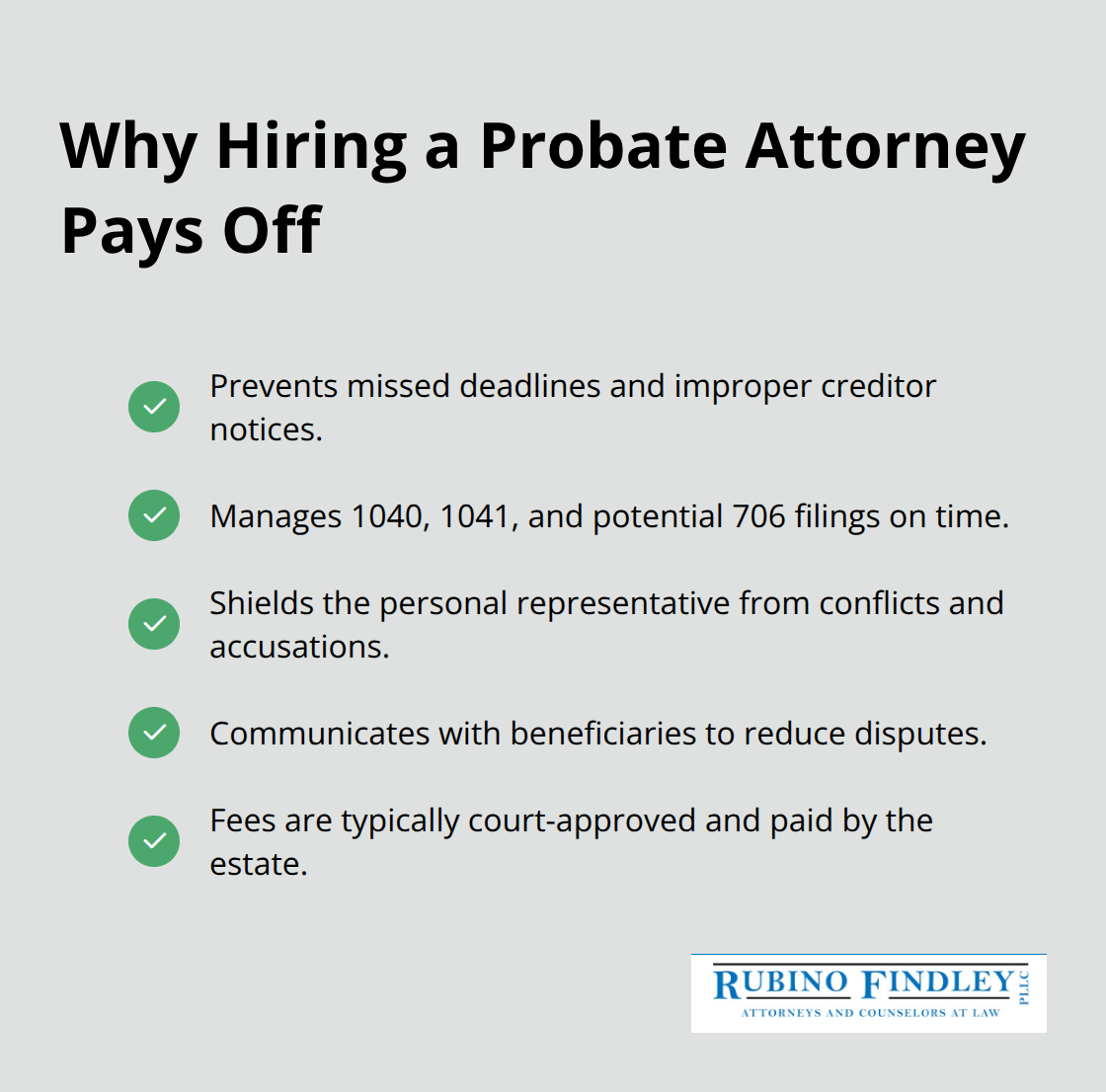

Why You Need an Attorney for Estate Administration in Boca Raton

The Cost of Going It Alone

Personal representatives who attempt estate administration without legal guidance make costly mistakes that haunt families for years. The math is simple: hiring an attorney costs far less than fixing the errors that emerge when someone without probate knowledge manages the process alone. Florida probate law spans multiple statutes and rules, and a single misstep-missing a filing deadline, publishing notice to creditors incorrectly, or failing to obtain proper asset valuations-triggers penalties, extends probate timelines by months, or exposes the personal representative to personal liability. An experienced attorney handles these technical requirements and prevents the delays that turn a routine five-to-six-month administration into a drawn-out nightmare.

Protection Through Professional Counsel

An attorney serves as a buffer between beneficiaries and the personal representative, absorbing complaints and disputes before they escalate into litigation. When beneficiaries grow impatient or suspicious about asset management, an attorney’s presence and documentation provide credibility and protection. The personal representative’s attorney is not automatically the attorney for beneficiaries, so the personal representative has independent counsel focused solely on protecting their interests and the estate’s interests. This separation prevents conflicts of interest and keeps administration moving forward without the personal representative facing accusations of bias or impropriety.

Reducing Family Conflict

Family conflict during estate administration almost always stems from poor communication, unclear financial decisions, or perceived mismanagement of assets. An attorney reduces these conflicts by establishing clear procedures, documenting decisions, and communicating with beneficiaries on behalf of the personal representative. When disputes do arise-and they do in many estates-the attorney knows whether the personal representative has acted properly under Florida law or whether a beneficiary’s complaint has merit. This knowledge prevents unnecessary concessions and protects the estate from paying claims that should be rejected.

Recovering Attorney Costs from the Estate

The cost of hiring an attorney is recoverable from the estate in most cases, so the personal representative does not pay out of pocket. Court approval of reasonable attorney fees is standard practice in Florida probate, and these fees are paid before beneficiaries receive distributions, making professional legal guidance an estate expense rather than a personal burden.

Final Thoughts

Estate administration requires attention to detail, strict adherence to Florida law, and clear communication with beneficiaries. The mistakes outlined earlier-missing filing deadlines, mismanaging assets, and failing to keep beneficiaries informed-are entirely preventable when you follow the three-phase process and stay organized throughout probate. Simple estates close within five to six months, but only when the personal representative understands what needs to happen and when.

Professional legal guidance transforms estate administration from a source of family stress into a manageable process. An attorney handles the technical requirements that trip up most personal representatives, publishes notices correctly, manages creditor claims, and ensures tax filings meet IRS deadlines. The personal representative’s attorney also serves as a neutral party between beneficiaries and the estate, reducing conflict and protecting everyone’s interests (attorney fees are paid from estate assets in most cases, making professional counsel an estate expense rather than a personal burden).

At Rubino Findley, PLLC, we help families in Palm Beach County navigate estate administration and probate litigation. We also work with clients on the front end through estate planning administration-establishing wills, trusts, and durable powers of attorney before a crisis forces families into probate court. Contact Rubino Findley, PLLC in Boca Raton to schedule your free consultation and learn how we can help protect your family’s future.