How to Master Estate Planning and Asset Protection

Most adults put off estate planning because they think it’s only for the wealthy or elderly. The truth is that without a solid plan, your family could face years of legal battles, unexpected taxes, and costly probate proceedings.

At Rubino Findley, PLLC, we’ve seen firsthand how estate planning and asset protection can save families thousands of dollars and prevent unnecessary conflict. This guide walks you through the documents you need, the mistakes to avoid, and how to get started protecting what matters most.

Why Estate Planning Matters for Every Adult

Probate Drains Your Estate and Delays Your Family’s Inheritance

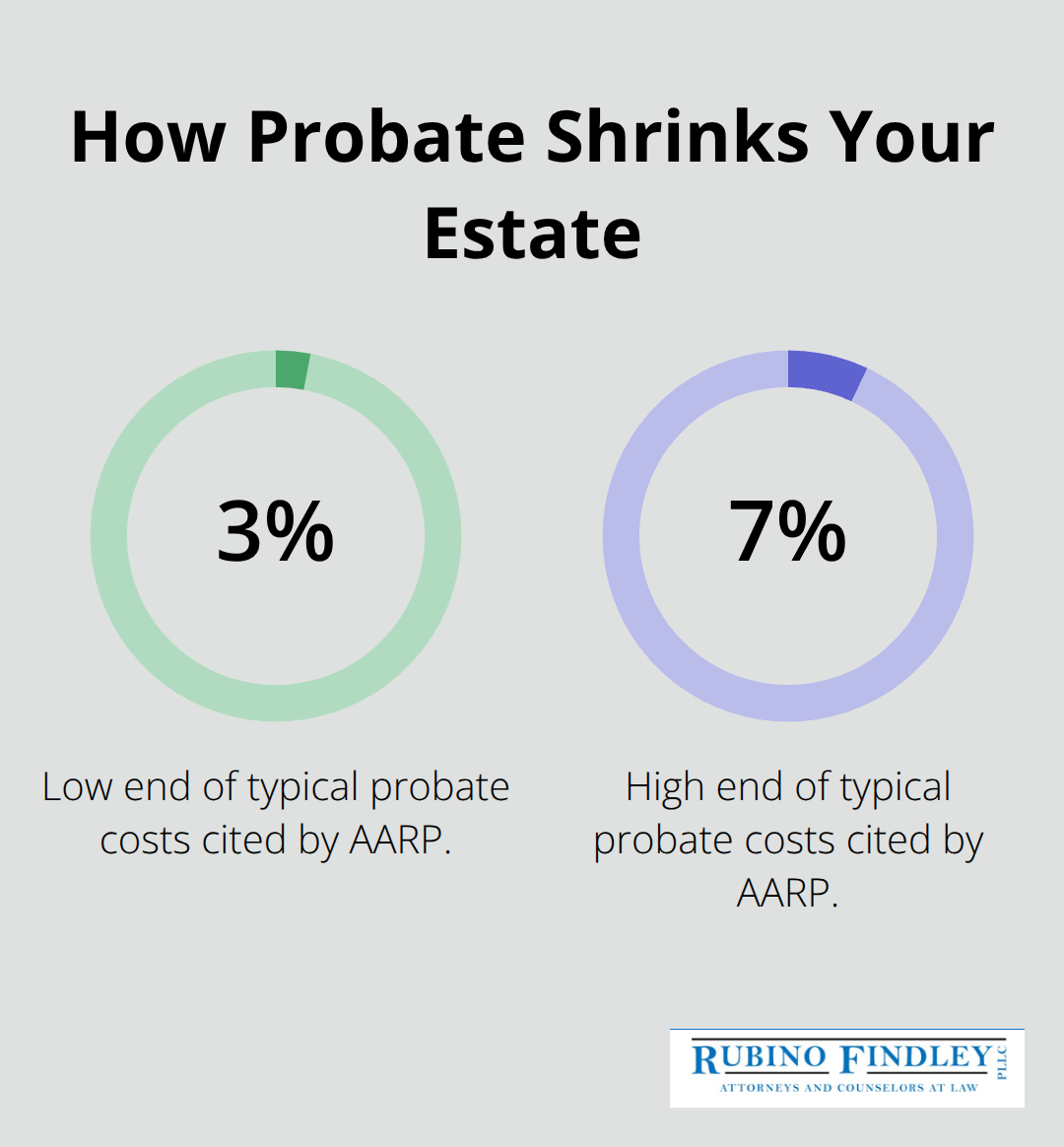

Probate costs money and time that most families cannot afford to waste. According to AARP, probate typically consumes 3 to 7 percent of an estate’s value, and the process often stretches from several months to over a year. For a $500,000 estate, that means $15,000 to $35,000 disappears into court fees, attorney costs, and administrative expenses before your beneficiaries see a single dollar.

Without proper planning, your family loses control of how assets transfer. Florida intestacy laws take over, meaning the state decides who gets what, regardless of your actual wishes. A surviving spouse might receive only a life estate in your home rather than full ownership. Adult children from a previous relationship could be completely shut out. Minor children end up in court-appointed guardianships instead of with the caregiver you would have chosen.

The emotional toll compounds the financial damage. Families spend years resolving disputes that a simple trust could have prevented entirely.

Asset Protection Requires Action Before Crisis Strikes

Most people assume asset protection is something to consider after a lawsuit appears. That’s backwards. Creditors, lawsuits, and long-term care costs can obliterate decades of savings if your assets sit unprotected in your personal name.

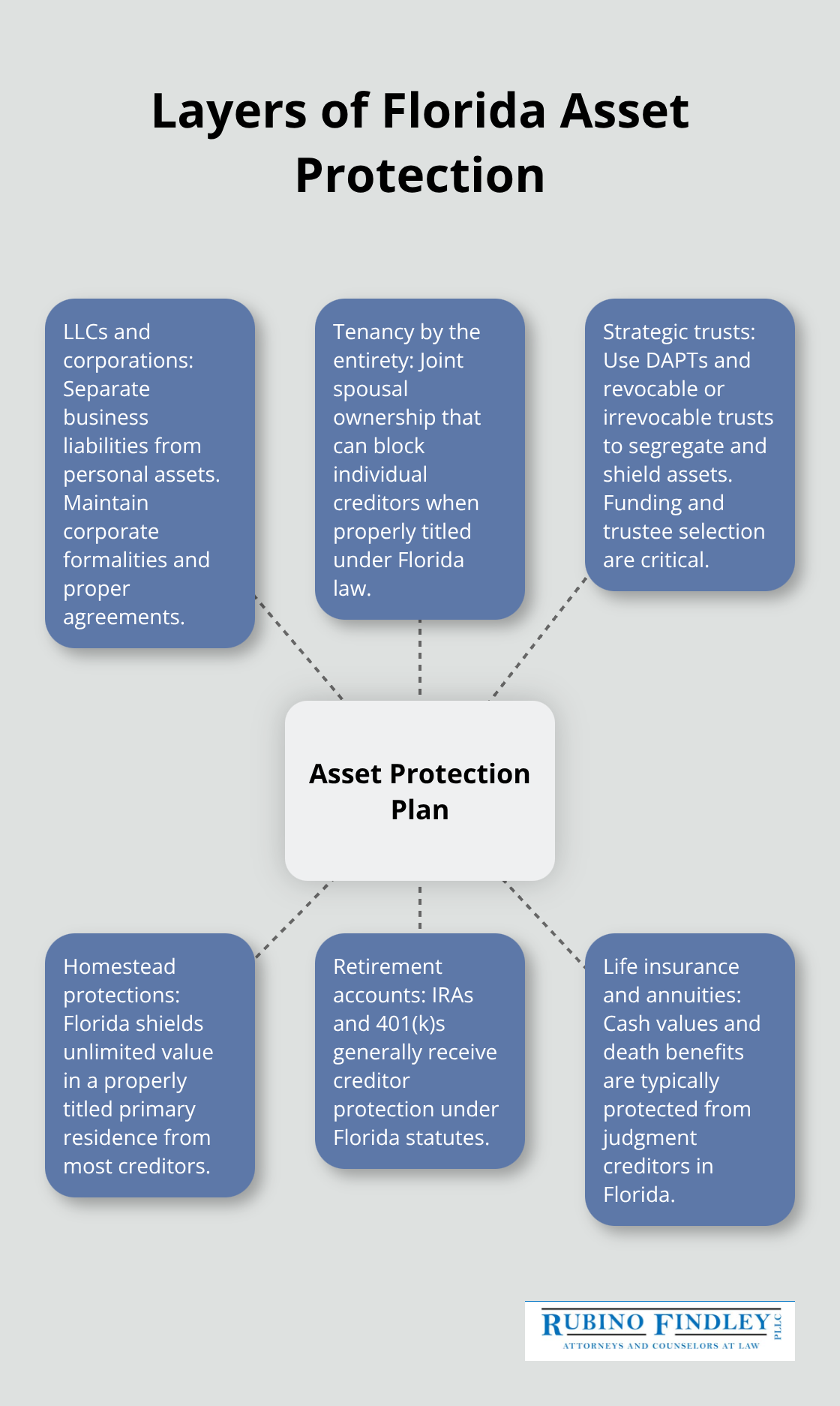

Florida offers strong homestead protections that shield unlimited value in your primary residence from most creditors, but only if the property is properly titled. Retirement accounts like IRAs and 401(k)s receive creditor protection under Florida law, yet many people keep substantial wealth outside these accounts. A Domestic Asset Protection Trust, or DAPT, is an irrevocable structure that allows you to fund it with assets while still retaining some control, creating a legal fortress that creditors cannot easily penetrate.

Life insurance and annuities provide additional layers because their cash values and death benefits are typically protected from judgment creditors in Florida. Real estate investors and high-income earners face particular risk-a single lawsuit can wipe out a lifetime of building wealth unless multiple protection tools work together.

The strongest plans use a multi-layered approach: proper entity structuring through LLCs or corporations for business assets, tenancy by the entirety for spousal property ownership, and strategic trust arrangements that keep assets moving forward while shielding them from threats. These interconnected strategies work far better than any single tool standing alone.

What Happens When You Do Nothing

Without a solid plan in place, your family faces unnecessary legal complexity and financial loss. The state controls your estate distribution, your assets flow through expensive probate proceedings, and your loved ones spend months or years settling matters that proper documentation would have resolved in weeks. Your children may end up in guardianships you never would have chosen, and your spouse might lose control of the family home.

The documents you need-wills, trusts, powers of attorney, and healthcare directives-form the foundation that prevents these outcomes. Each serves a specific purpose, and together they create a comprehensive shield for your family and your wealth.

The Documents That Actually Protect Your Family

Wills Alone Leave Your Estate Vulnerable to Probate

A will alone fails to protect your family. Many people believe that signing a will covers their estate planning needs, but a will only controls what happens after you die-it says nothing about who makes decisions if you become incapacitated, and it guarantees your estate enters probate. According to AARP, probate in Florida typically costs 3 to 7 percent of estate value, which means a $750,000 estate loses $22,500 to $52,500 in unnecessary expenses before your beneficiaries receive anything. Your family also loses privacy-probate documents become public record, while trust distributions remain confidential.

Revocable Living Trusts Transfer Assets Without Probate Delays

A revocable living trust transfers assets outside probate while you retain full control during your lifetime, allowing your beneficiaries to inherit property in weeks instead of months or years. When you fund a trust properly by retitling assets into the trust’s name, those assets bypass probate entirely and transfer directly to your beneficiaries. Many people create trusts but never fund them, leaving assets in personal names where they still face probate delays. The trust itself is merely a set of instructions; the funding is what makes it work.

Powers of Attorney and Healthcare Directives Handle Incapacity

A durable power of attorney and healthcare directives address the gaps a will cannot cover. If you suffer a stroke, accident, or sudden illness, a durable power of attorney names someone to manage your financial accounts, pay bills, and handle business matters without requiring a court-supervised guardianship-a process that costs thousands of dollars and strips you of privacy and control. Healthcare directives (including a living will and healthcare surrogate designation) let your family make medical decisions aligned with your values rather than leaving doctors and courts to guess your intentions.

Beneficiary Designations Must Align With Your Overall Plan

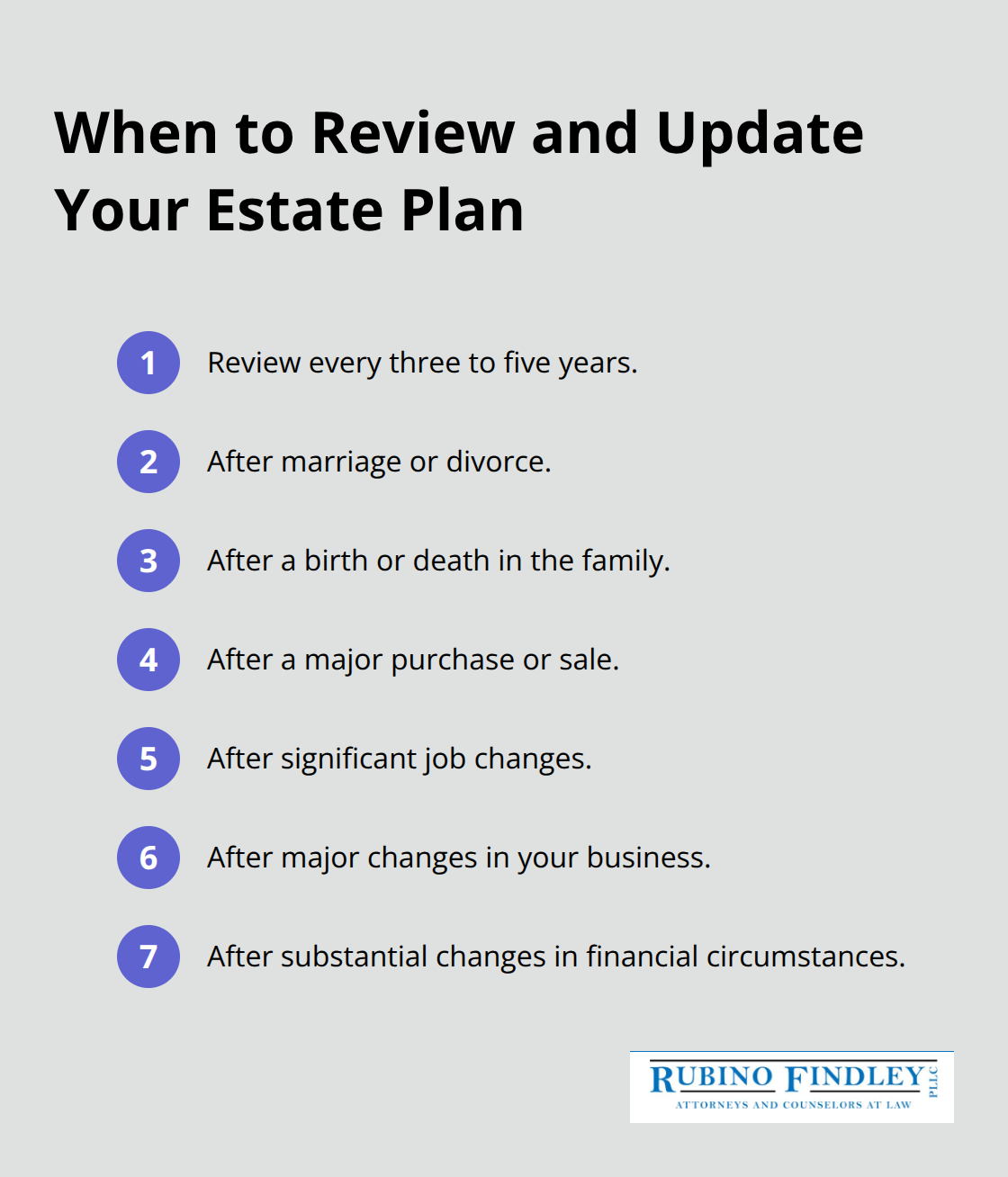

Beneficiary designations on retirement accounts, life insurance, and bank accounts transfer those assets directly to named beneficiaries outside probate, but they must match your overall plan or they can accidentally override your trust or create unintended tax consequences. If your will leaves everything to your children but your life insurance still names your ex-spouse as beneficiary, the insurance proceeds go to your ex regardless of what your will says. You should review beneficiary designations every three to five years to prevent these costly mistakes.

Coordinate All Documents Into One Cohesive Strategy

These documents work best when they function as a coordinated system rather than conflicting instructions that create confusion and litigation for your family. An experienced estate planning attorney from Rubino Findley, PLLC in Boca Raton can help you establish wills, trusts, powers of attorney, and healthcare directives that work together seamlessly. We serve clients throughout Palm Beach County and Florida, ensuring your documents align with your goals and Florida law. The right combination of these tools creates the comprehensive protection your family needs, but the wrong approach-or documents that contradict each other-can undermine your entire plan and leave your loved ones facing the very problems you sought to prevent.

Common Estate Planning Mistakes That Cost Families Thousands

Life Changes Demand Document Updates

Your estate plan is not a set-it-and-forget-it document. Life shifts constantly-marriages, divorces, births, deaths, job changes, major purchases, and financial circumstances all require your plan to evolve. Many people create solid documents but never update them, which means their plan no longer reflects reality. A will or trust drafted ten years ago naming an ex-spouse as executor or trustee creates disasters that proper maintenance would have prevented. Florida law allows you to review and update documents every three to five years, and you should do it after any significant life event. If you married or divorced, had children or grandchildren, acquired substantial new assets, or experienced major changes in your business, your documents need revision.

An outdated beneficiary designation is equally dangerous. If your life insurance still names someone from a previous relationship as beneficiary, those proceeds bypass your trust and go directly to that person, regardless of what your will or trust intends. Schedule a comprehensive review after major transitions to catch these contradictions before they harm your family.

The Wrong Trustee Undermines Everything

Choosing the wrong person to manage your estate creates ongoing problems that money cannot fix. Your executor, trustee, and healthcare surrogate must be organized, reliable, and capable of handling complex financial decisions under emotional stress. Many people name a trusted family member without considering whether that person actually wants the responsibility, understands financial management, or has the bandwidth to handle it.

A trustee must track accounts, file tax returns, manage investments, and communicate with beneficiaries-tasks that demand competence and attention to detail. If your designated trustee lacks these skills or becomes unwilling to serve, your family faces delays, poor decision-making, or costly court intervention to remove and replace them. Some families benefit from naming a corporate trustee or professional fiduciary alongside a family member, creating a team approach where personal relationships are preserved but professional management ensures proper administration.

Tax Planning Gaps Leave Beneficiaries With Unexpected Bills

Tax planning gaps represent another critical mistake that catches families off guard. Many people focus only on probate avoidance and ignore the tax implications of how assets transfer. Inherited retirement accounts, appreciated real estate, and investment portfolios all trigger tax consequences that proper structuring can minimize significantly.

A 2025 basic exclusion amount of $13.61 million per individual means married couples can shelter over $27 million from federal estate taxes, yet many families fail to use these tools strategically. If your estate exceeds these thresholds or you anticipate changes in tax law, your plan must address income tax consequences on inherited assets and potential state-level taxes. Without coordinated planning, beneficiaries inherit assets that trigger substantial tax bills they never anticipated, reducing the wealth you intended to pass forward.

Final Thoughts

Estate planning and asset protection demand your attention today, not years from now when a crisis forces your hand. The longer you postpone these decisions, the greater the risk that your family will face probate delays, unexpected taxes, and legal complications that proper planning would have prevented. Every day without a solid plan leaves your loved ones vulnerable to outcomes you would never choose for them.

You do not need to be wealthy or elderly to benefit from wills, trusts, powers of attorney, and healthcare directives. These documents protect families of all sizes and financial situations by ensuring your wishes are honored and your assets transfer efficiently to the people you care about most. We at Rubino Findley, PLLC in Boca Raton can help you create the legal structures that protect what matters most throughout Palm Beach County and Florida.

Contact Rubino Findley, PLLC to schedule your free consultation and take the first step toward protecting your family and your legacy.