How to Navigate Probate Independent Administration

Probate independent administration offers Florida families a streamlined path through estate settlement. This process reduces court oversight and speeds up asset distribution compared to supervised administration.

We at Rubino Findley, PLLC see many Palm Beach County families benefit from this approach. Understanding the requirements and steps can save months of delays and reduce legal costs significantly.

What Makes Independent Administration Different

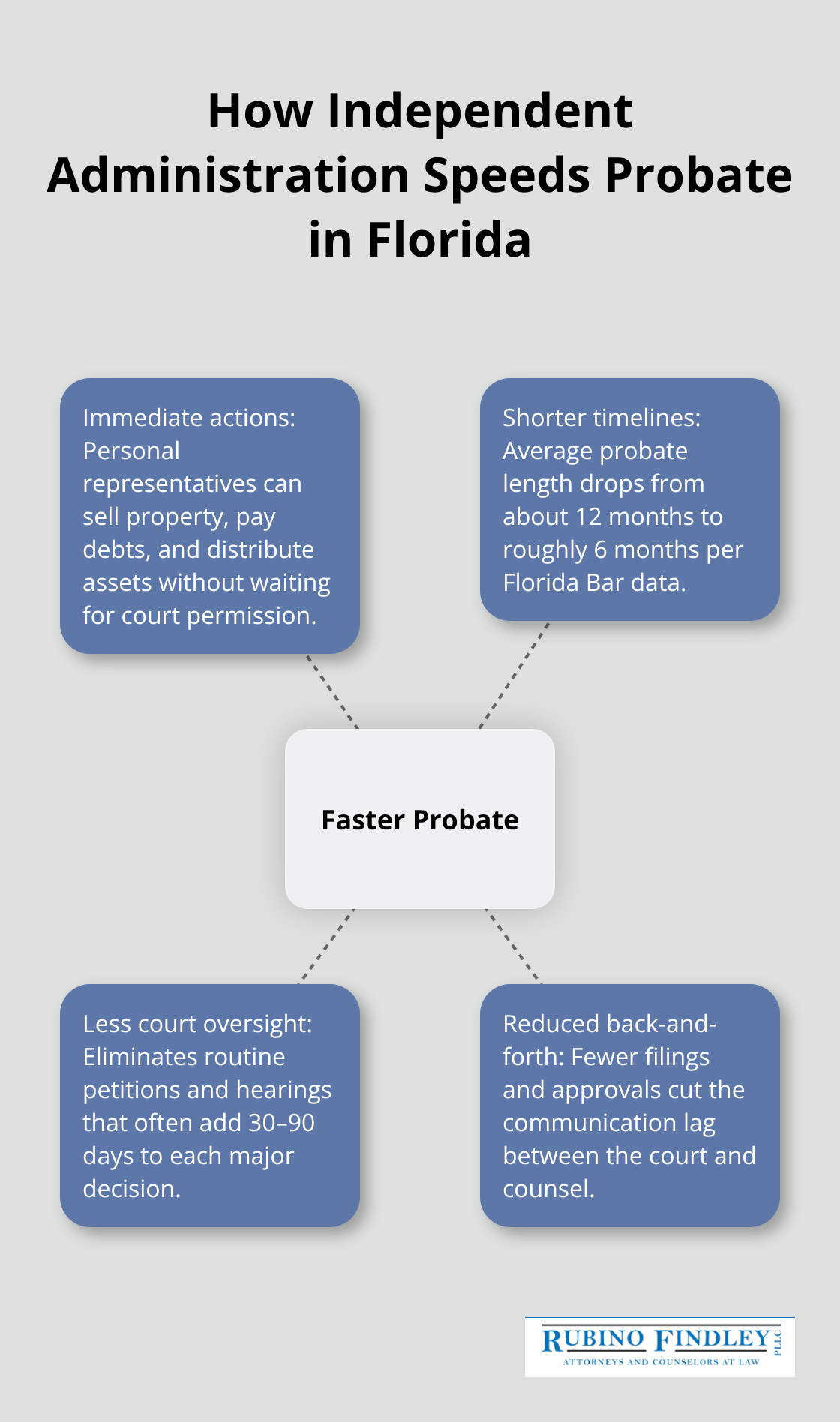

Independent administration operates without constant court supervision, while supervised administration requires court approval for nearly every action the personal representative takes. In supervised probate, the personal representative must petition the court before they sell property, pay debts, or make distributions to beneficiaries. This creates delays of 30 to 90 days for each major decision.

How Independent Administration Accelerates the Process

Independent administration allows the personal representative to handle these tasks immediately. This approach cuts the average probate timeline from 12 months to 6 months according to Florida Bar data. The personal representative can act on estate matters without court permission, which eliminates the back-and-forth communication that slows supervised cases.

When Florida Law Permits Independent Administration

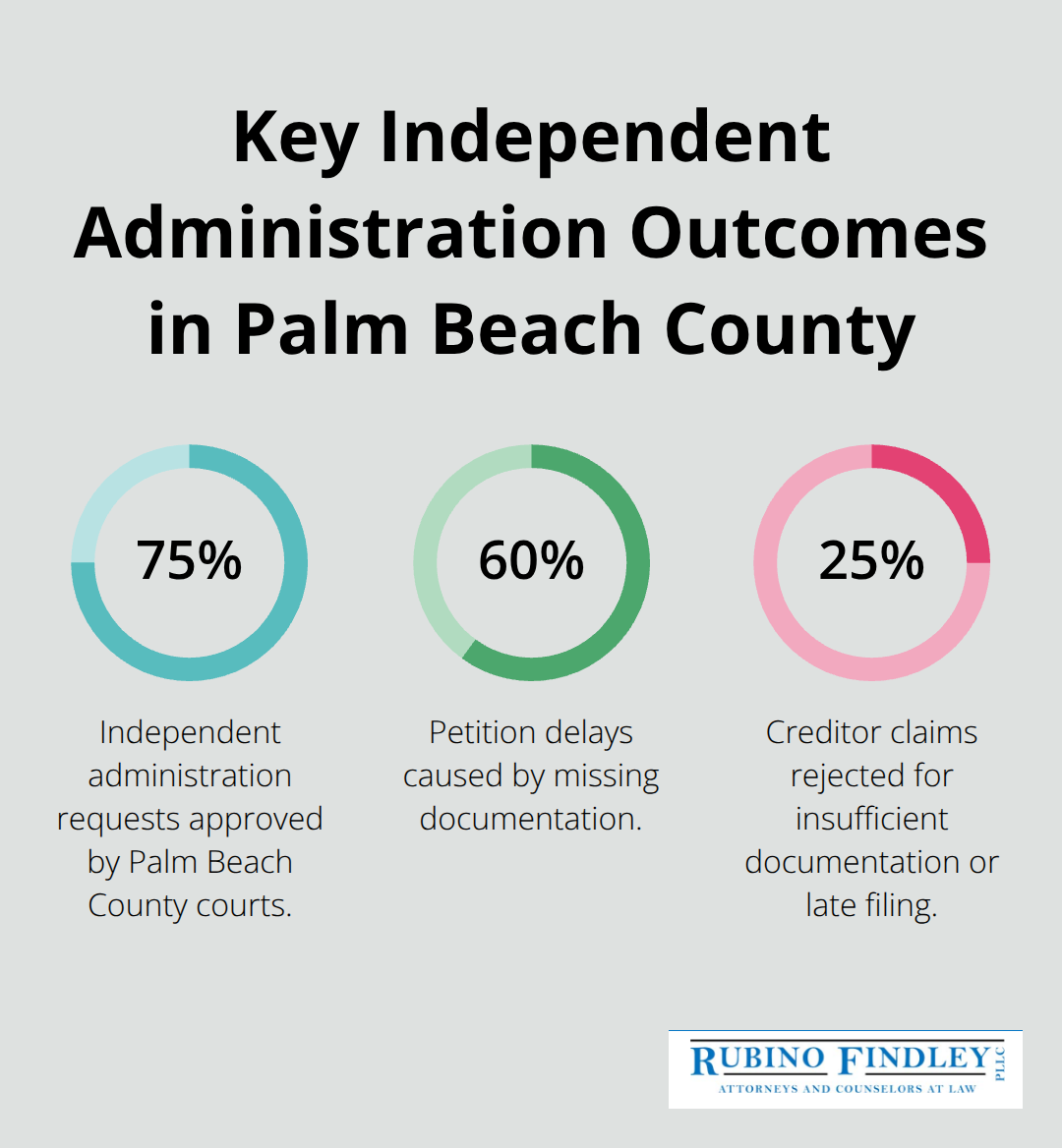

Florida Statutes Section 733.701 allows independent administration when the will authorizes it or when all beneficiaries and creditors consent in written form. The decedent must have been a Florida resident at death, and no objections can be pending against the personal representative. Palm Beach County courts approve roughly 75% of independent administration requests (with most denials from family disputes or incomplete documentation). The personal representative must still qualify under Florida law and cannot have felony convictions or conflicts of interest with beneficiaries.

Financial Benefits of Independent Administration

Independent administration reduces legal fees by 40% to 60% compared to supervised probate because fewer court appearances are required. The personal representative can sell real estate without court approval, pay legitimate debts immediately, and distribute assets once the creditor claim period expires. This flexibility prevents asset depreciation and reduces costs for real estate and business interests.

Timeline Advantages in Palm Beach County

Most independent administrations in Palm Beach County close within 6 to 8 months, while supervised cases often extend beyond 18 months due to court delays and required waiting periods between actions. This efficiency becomes particularly valuable when the estate includes time-sensitive assets or when beneficiaries need quick access to funds.

The next step involves understanding the specific requirements and procedures for filing your petition with the Palm Beach County Court system.

Steps to Obtain Independent Administration

Palm Beach County requires precise documentation and strategic timing for independent administration filings. The process starts when you submit Form 12.200(a) Petition for Administration to the Palm Beach County Probate Court at 205 North Dixie Highway in West Palm Beach. This petition must include the original will, certified death certificate, and a complete list of interested persons with their addresses. The court charges $401 for estates under $75,000 and $401 plus additional fees for larger estates (according to Palm Beach County Clerk records). Most attorneys recommend you file within 30 days of death to prevent complications with creditor claims and asset preservation.

Documentation Requirements

The court demands specific forms beyond the basic petition. Form 12.285 Application for Appointment as Personal Representative establishes your legal authority, while Form 12.200(b) Notice of Administration alerts all beneficiaries and creditors. You must provide a detailed inventory of assets with Form 12.285, which includes bank statements, property deeds, and investment account records from the date of death. Palm Beach County requires notarized signatures on all documents and certified copies of out-of-state property records. Missing documentation causes 60% of petition delays according to Florida Bar statistics, so you should compile everything before you file.

Court Review Process

Palm Beach County typically schedules hearings within 14 to 21 days after you file if no objections arise. The judge reviews your qualifications, examines the will’s validity, and confirms that independent administration requirements are met under Florida Statutes Section 733.701. Letters of Administration are issued immediately after approval, which grants you authority to manage estate assets. The entire approval process takes 3 to 5 weeks for straightforward cases, but contested matters can extend this timeline to 6 months or longer.

Authority and Next Steps

Once the court approves your petition, you receive full authority to sell assets, pay debts, and distribute property without additional court permission. This authority comes with significant responsibilities that require careful attention to Florida probate law and proper asset management procedures.

Managing Your Duties as Independent Personal Representative

Your first responsibility involves creating a comprehensive inventory within 60 days of receiving Letters of Administration. Florida Statutes Section 733.604 requires you to list every asset with fair market values as of the death date, including bank accounts, real estate, vehicles, jewelry, and personal property. Palm Beach County accepts professional appraisals for real estate and valuable items, but you can value household goods yourself unless they exceed $1,000 individually. The Florida Bar reports that 40% of probate delays stem from incomplete or inaccurate inventories, so you must account for every item the decedent owned.

Handling Creditor Claims and Estate Expenses

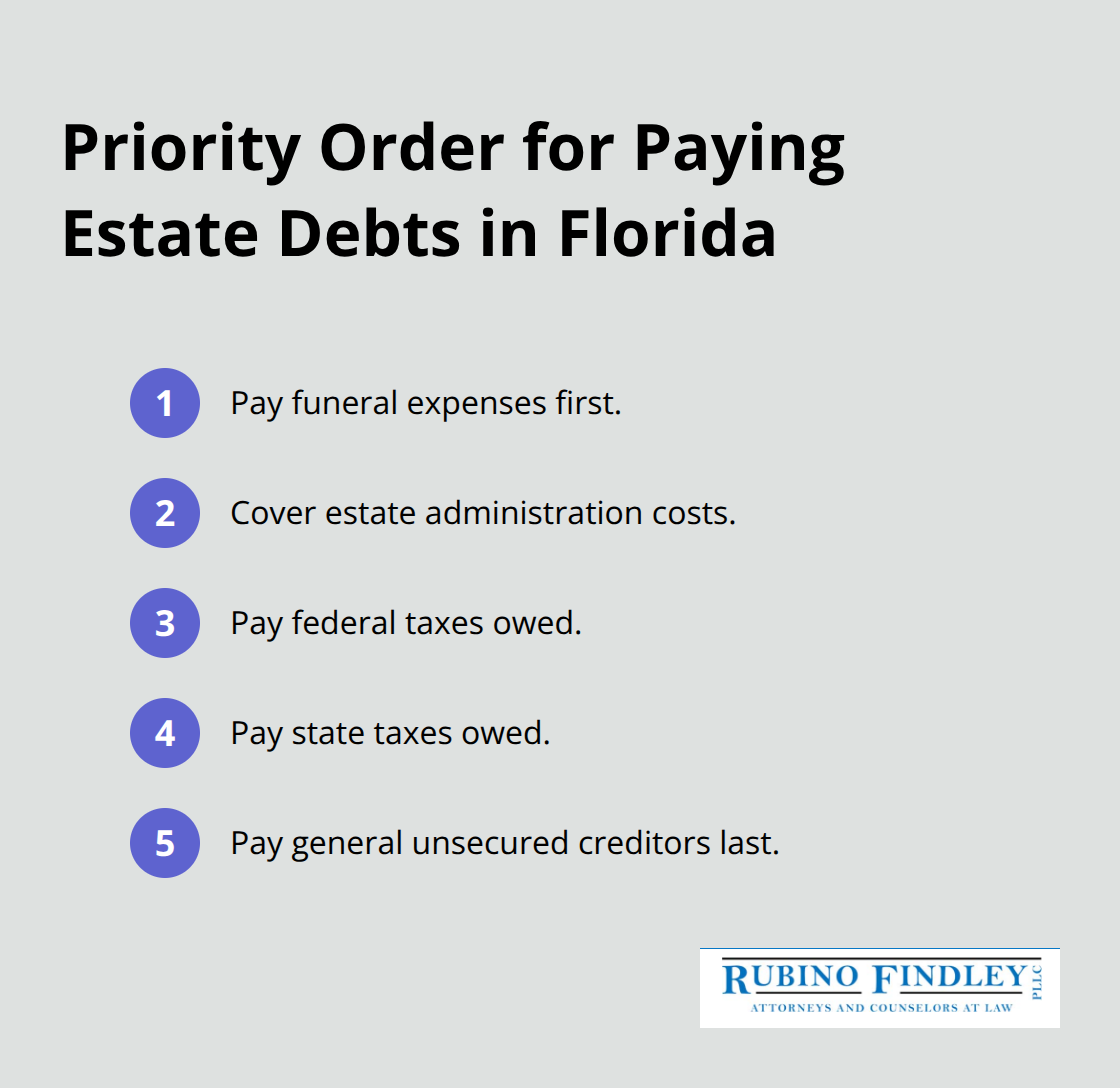

You have 90 days from your appointment to publish a Notice to Creditors in a Palm Beach County newspaper, which starts a three-month deadline for creditor claims under Florida Statutes Section 733.2121. Known creditors receive direct written notice and have 30 days or three months from publication to file claims (whichever is later). You pay valid debts in this order: funeral expenses, estate administration costs, federal taxes, state taxes, then general creditors. Florida courts reject 25% of creditor claims for insufficient documentation or late filing, according to Florida Bar statistics.

You can negotiate payment amounts and reject invalid claims, but disputed claims require court resolution.

Asset Distribution and Final Accounting

After the creditor claim period expires and all debts are paid, you distribute assets according to the will or Florida intestacy laws. You must obtain signed receipts from each beneficiary that acknowledge their distribution, which protects you from future claims. Florida law requires a final accounting that details all income, expenses, and distributions during your administration. Most Palm Beach County independent administrations close within 180 days after creditor claims expire (provided you maintain detailed records and communicate regularly with beneficiaries about the process timeline).

Final Thoughts

Probate independent administration delivers substantial advantages for Palm Beach County families. This streamlined approach reduces legal costs by 40% to 60% while cutting probate timelines from 12 months to 6 months. The process eliminates constant court supervision and allows personal representatives to sell assets, pay debts, and distribute property without judicial approval delays.

Independent administration demands careful attention to Florida probate law and precise documentation. Personal representatives face significant responsibilities that include asset inventory, creditor notification, and proper distribution procedures. Mistakes in these areas can lead to personal liability and costly delays (which often extend cases beyond the typical 6-month timeline).

We at Rubino Findley, PLLC help clients navigate the petition process and manage their duties as personal representatives in Palm Beach County. Our team assists families with probate independent administration while also providing estate planning services to help avoid probate entirely. Contact Rubino Findley, PLLC today for your free consultation to discuss your probate administration needs.