Integrating Wealth Management and Estate Planning

Wealth management and estate planning work best when they function as a unified strategy rather than separate financial activities. Many Palm Beach County families miss significant opportunities by treating these areas independently.

At Rubino Findley, PLLC, we see how coordinated planning protects assets more effectively and reduces tax burdens. The right approach can save families thousands while building stronger financial foundations for future generations.

How Wealth Management Decisions Shape Your Estate Plan

Your investment choices today directly determine what your beneficiaries will inherit tomorrow. When families make wealth management decisions without estate planning considerations, they often face substantial tax consequences that could have been avoided. The Williams Group found that 70% of wealthy families lose their wealth by the second generation, primarily due to poor coordination between these financial areas.

Investment Strategies That Create Estate Tax Problems

Traditional investment approaches often ignore estate tax consequences. High-net-worth individuals who concentrate wealth in taxable accounts face federal estate tax thresholds, while Florida residents benefit from no state estate tax but still encounter federal obligations. Asset allocation decisions made purely for growth can trigger significant tax events when assets transfer to heirs.

Tax-inefficient investments like actively managed mutual funds generate tax liabilities that reduce the wealth available for transfer. Direct indexing strategies allow for tax-loss harvesting that benefits both current wealth accumulation and future estate transfers.

Tax Coordination Prevents Costly Mistakes

Coordinated planning prevents double taxation scenarios that devastate family wealth. Retirement account distributions can push estates into higher tax brackets, while life insurance proceeds may become taxable if structured incorrectly. Strategic lifetime gifts reduce estate size while utilizing annual exclusions ($18,000 per recipient in 2024).

Charitable remainder trusts provide immediate tax deductions while they generate income streams, which reduces overall estate tax exposure. Business owners who fail to coordinate succession plans with wealth management often face liquidity crises when estate taxes come due.

The High Cost of Separate Management

Families who manage these areas independently typically lose 15-30% more wealth to taxes than those who use integrated strategies. Separate advisors often recommend conflicting strategies that create unnecessary complexity and higher costs. Estate plans drafted without understanding current investment structures frequently require expensive modifications when tax laws change.

This disconnect between wealth management and estate planning creates gaps that smart tax coordination can bridge through strategic trust structures.

Which Planning Tools Actually Protect Wealth

Irrevocable Life Insurance Trusts Generate Tax-Free Growth

Irrevocable life insurance trusts remove death benefits from taxable estates while they provide liquidity for estate tax payments. These trusts own life insurance policies outside your estate, which means death benefits pass tax-free to beneficiaries. The 2024 federal estate tax exemption of $13.61 million per person makes these structures valuable for families who approach these thresholds.

Premium payments count as annual gifts and utilize the $18,000 per recipient exclusion. Florida residents gain additional advantages since the state imposes no inheritance tax on trust distributions. Trust ownership prevents policy proceeds from inflating estate values at death.

Dynasty Trusts Preserve Wealth Across Multiple Generations

Dynasty trusts avoid generation-skipping transfer taxes when they distribute income to beneficiaries while they preserve principal indefinitely. Florida allows perpetual trusts, which means assets can grow tax-free across unlimited generations. These trusts typically hold diversified investment portfolios that compound without estate tax erosion at each generational transfer.

WealthCounsel research shows families who use dynasty trusts preserve 40% more wealth over three generations compared to traditional inheritance structures. Asset protection features shield trust property from beneficiary creditors and divorce proceedings. Trust distributions provide flexibility for education, healthcare, and emergency needs while they maintain long-term wealth preservation goals.

Family Limited Partnerships Control Business Assets

Family limited partnerships allow business owners to transfer company interests to children at discounted valuations while they retain operational control. General partners maintain management authority while limited partners receive economic interests without voting rights. Valuation discounts of 20-40% are common due to lack of marketability and minority interest limitations (particularly for closely held businesses).

These partnerships work particularly well for real estate holdings, family businesses, and investment portfolios. Annual gifts of limited partnership interests utilize gift tax exemptions while they gradually reduce estate size. The structure protects assets from creditors who target individual family members while it consolidates family wealth management decisions.

Charitable Remainder Trusts Balance Philanthropy and Tax Benefits

Charitable remainder trusts provide immediate tax deductions while they generate income streams for donors or beneficiaries. These trusts sell appreciated assets without immediate capital gains taxes, then reinvest proceeds to produce regular payments. The charitable deduction reduces current income taxes (up to 50% of adjusted gross income for cash gifts).

Trust assets eventually pass to designated charities, which removes them from taxable estates. Income payments can last for the donor’s lifetime or a specified term up to 20 years. This strategy works well for business owners who want to diversify concentrated stock positions while they support charitable causes.

These sophisticated tools require careful coordination with your overall wealth management strategy to maximize their effectiveness and avoid potential conflicts with other financial objectives.

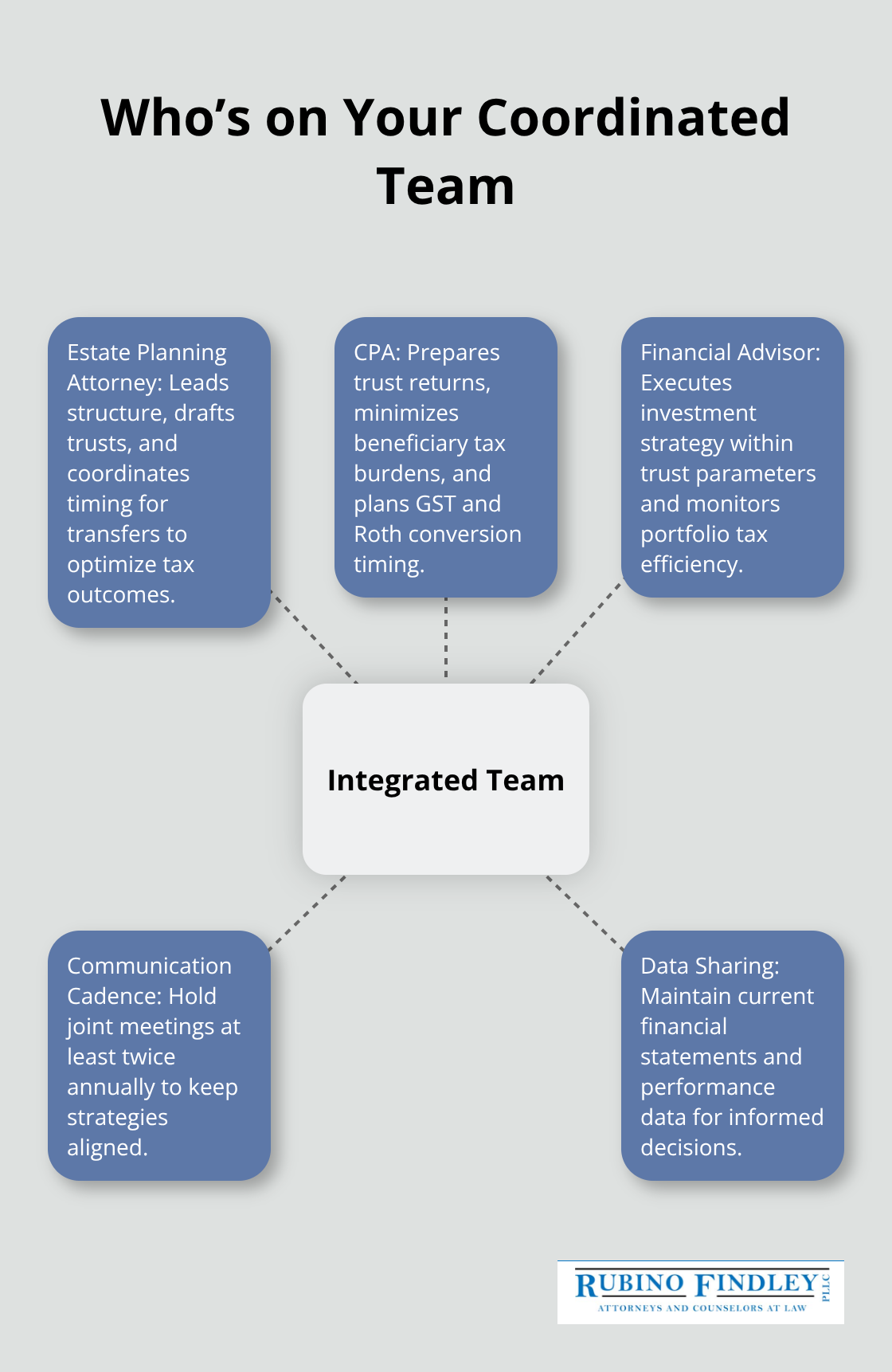

How Do You Build the Right Professional Team

Successful wealth management and estate planning requires coordination between multiple professionals who understand how their recommendations affect other areas of your financial life. Financial advisors who work in isolation from estate planning attorneys create strategies that conflict with tax-efficient wealth transfer goals. The National Association of Estate Planners found that families who use coordinated professional teams preserve 23% more wealth compared to those who work with disconnected advisors.

Your financial advisor should communicate directly with your estate planning attorney before they make significant investment changes that could affect your estate plan structure. Tax professionals must review trust distributions and investment strategies quarterly to identify opportunities for tax-loss harvesting and income shifts. Estate planning attorneys need current financial statements and investment performance data to recommend appropriate trust funding levels and distribution strategies. We recommend joint meetings between all professionals at least twice annually to maintain alignment between wealth accumulation and estate transfer goals.

Estate Planning Attorneys Lead the Coordination Process

Estate planning attorneys should lead the professional team because legal structures determine how all other strategies function. They draft trust documents that specify investment parameters and distribution requirements that financial advisors must follow. Attorneys also identify when business valuations are needed for gift tax purposes and when life insurance policies require restructuring to maintain estate tax benefits.

The attorney reviews all financial recommendations for legal compliance and tax efficiency before implementation. They coordinate with CPAs to time asset transfers with favorable tax years and work with financial advisors to structure investments that support trust objectives. This legal oversight prevents costly mistakes that occur when financial strategies conflict with estate planning documents.

CPAs Handle Complex Tax Coordination

Certified public accountants become essential when trusts generate significant income or when business interests require regular valuations for gift tax reporting (particularly for family limited partnerships). They prepare trust tax returns and coordinate distributions to minimize beneficiary tax burdens while they maintain trust asset growth. CPAs also calculate generation-skipping transfer tax implications for dynasty trusts and determine optimal timing for Roth IRA conversions within estate planning contexts.

Annual tax planning sessions with your CPA should include reviews of trust performance, gift tax utilization, and business succession tax strategies. The CPA works with your estate planning attorney to structure charitable giving that maximizes current deductions while it supports long-term estate tax reduction goals.

Financial Advisors Execute Investment Strategy

Financial advisors implement investment strategies that align with estate planning objectives while they manage day-to-day portfolio decisions. They must understand trust investment restrictions and distribution requirements before they recommend specific securities or asset allocation changes. Advisors coordinate with estate planning attorneys when investment performance affects trust funding needs or when market conditions require strategy adjustments.

The financial advisor monitors portfolio tax efficiency and coordinates with CPAs to harvest losses that offset trust income. They also evaluate insurance needs and work with estate planning attorneys to structure policies that provide estate liquidity without creating additional tax burdens (such as through irrevocable life insurance trusts).

Final Thoughts

Integrated wealth management and estate planning delivers measurable results that separate financial strategies cannot match. Families who coordinate these areas preserve 23% more wealth across generations and reduce tax burdens. The compound effect of tax-efficient investment strategies combined with proper estate structures creates financial legacies that benefit multiple generations.

Palm Beach County residents face unique opportunities with Florida’s favorable tax environment and no state estate tax. Federal estate tax thresholds still require careful planning for high-net-worth families (particularly those approaching the $13.61 million exemption). Professional legal guidance becomes essential as your wealth grows and family circumstances change.

At Rubino Findley, PLLC, we help families throughout Palm Beach County create comprehensive estate plans that work with their wealth management goals. Our team handles wills, trusts, probate administration, and durable power of attorney documents that protect your assets and family. Contact Rubino Findley, PLLC today to schedule your consultation and take the first step toward coordinated wealth management and estate planning.