Is National Estate Planning Awareness Week Coming Up?

National Estate Planning Awareness Week 2025 is coming up, and it’s the perfect time to think about protecting your family’s future. Most people put off estate planning because they think it’s only for the wealthy or because they’re unsure where to start.

At Rubino Findley, PLLC, we see firsthand how many families in Palm Beach County lack the basic documents they need. This week is your reminder that estate planning isn’t optional-it’s a responsibility you owe to the people you love.

When National Estate Planning Awareness Week Happens

The Dates and History Behind the Observance

National Estate Planning Awareness Week runs October 19–25 in 2026, falling during the third full week of October each year. The U.S. House of Representatives established this observance in 2008 to help the public understand what estate planning is and why it matters for financial wellness. This week transforms estate planning from a background concern into a topic that commands public attention across the country.

The Staggering Planning Gap in America

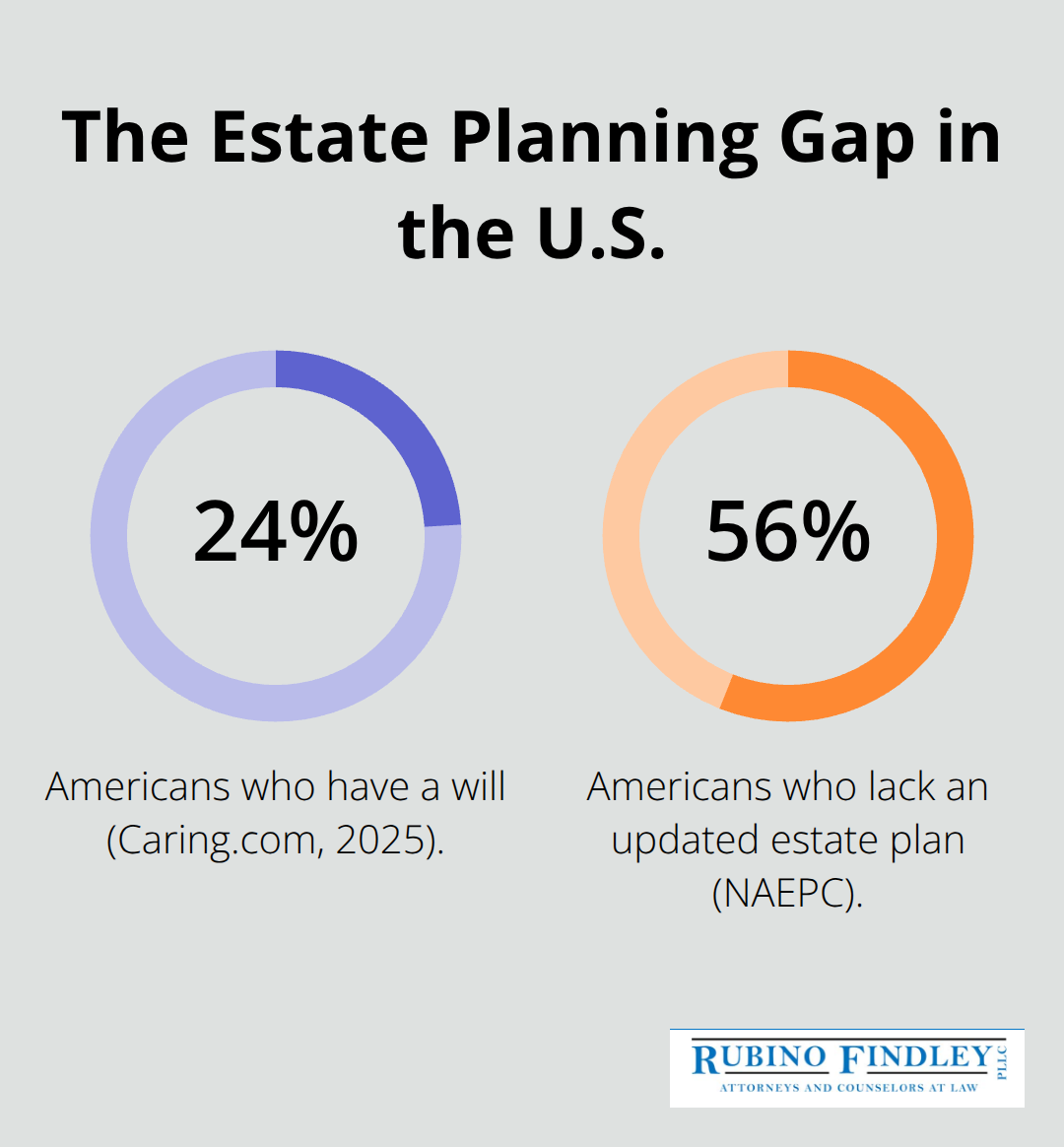

The numbers reveal a troubling reality. Caring.com’s 2025 Wills and Estate Planning Study found that only 24% of Americans have a will, and the National Association of Estate Planners & Councils reports that 56% of Americans lack an updated estate plan. This gap does not stem from indifference-it reflects how people underestimate the urgency of the conversation. During this week, estate planning councils across the country host community outreach events, and nonprofits, financial advisors, and law firms increase their messaging to reach people who might otherwise ignore the topic entirely.

Why This Week Shifts How People Think About Planning

Estate planning applies to anyone with minor children, debt, or assets worth protecting-not just the ultra-wealthy or the retired. When you have a will or trust in place, you control what happens to your property and who makes medical decisions if you cannot. Without those documents, state laws decide for you, and your family faces probate court, delays, and legal fees that drain your estate. This week provides a concrete deadline to stop procrastinating and take action.

If you live in Palm Beach County or the surrounding areas, this observance serves as your prompt to reach out and secure the documents that protect everything you have built. Whether you need a will, trust, power of attorney, or healthcare directive, the week reminds you that estate planning is an act of responsibility-one that protects your loved ones from unnecessary hardship. The next section explores why so many people overlook this protection in the first place.

Why People Skip Estate Planning

The Wealth Myth Keeps People Stuck

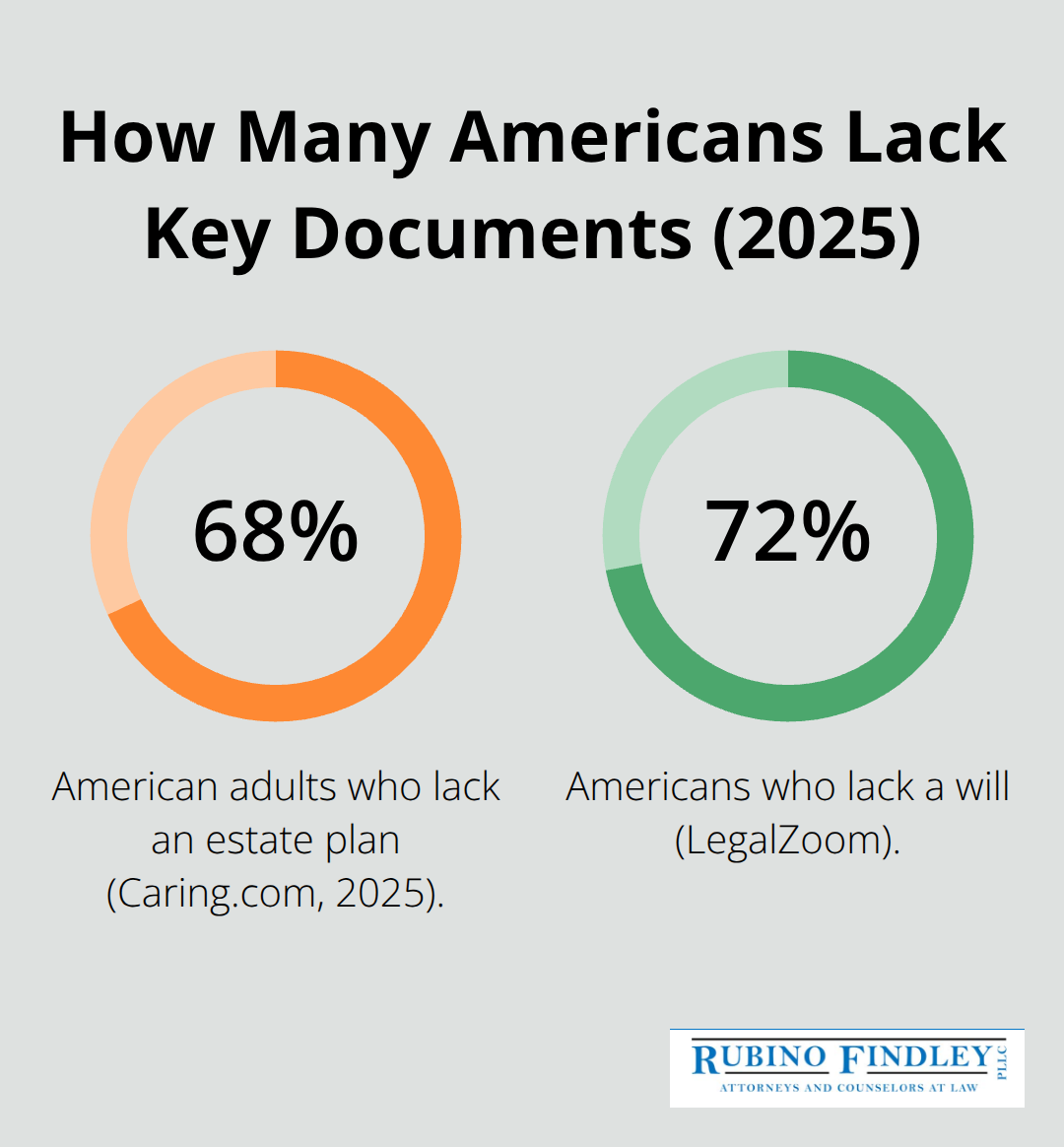

Most people who lack an estate plan aren’t lazy or careless-they’re caught between misconceptions about who needs planning and genuine barriers that make getting started feel overwhelming. The myth that estate planning is only for the wealthy persists despite clear evidence to the contrary. Caring.com’s 2025 study shows that 68% of American adults lack an estate plan, and LegalZoom research found that 72% lack a will. These numbers span all income levels and age groups, yet people convince themselves that planning is something they’ll handle later, after they’ve accumulated more wealth or reached a certain age. In reality, anyone with minor children, a mortgage, a car, or bank accounts needs a will or trust.

What Happens Without Documents

Without these documents, state law determines who raises your children, who inherits your property, and who manages your finances-decisions that rarely align with what you actually want. The emotional weight of confronting mortality also plays a role. Estate planning forces you to think about death, incapacity, and what happens to people you love, which many find uncomfortable enough to avoid indefinitely.

Financial Barriers That Stop Action

Financial barriers compound the problem. People assume estate planning costs thousands of dollars and takes months to complete, so they postpone the conversation. In Palm Beach County, families often think they need to hire an attorney immediately, which delays their decision further. The truth is simpler: starting with a document-gathering checklist and identifying your wishes takes minimal time and money. You can start by listing your assets, deciding who should inherit them, and naming guardians for minor children-all done at home without professional help.

The Awareness-Action Gap

About two-thirds of Americans believe they should have a will by age 55 or sooner, according to Gallup polling, yet this awareness doesn’t translate into action. The gap between knowing you need a plan and actually creating one is where most people get stuck. Breaking the process into small, manageable steps removes the intimidation factor and helps people move forward. The next section outlines what should actually appear in your estate plan so you know exactly what documents protect your family and assets.

What Belongs in Your Estate Plan

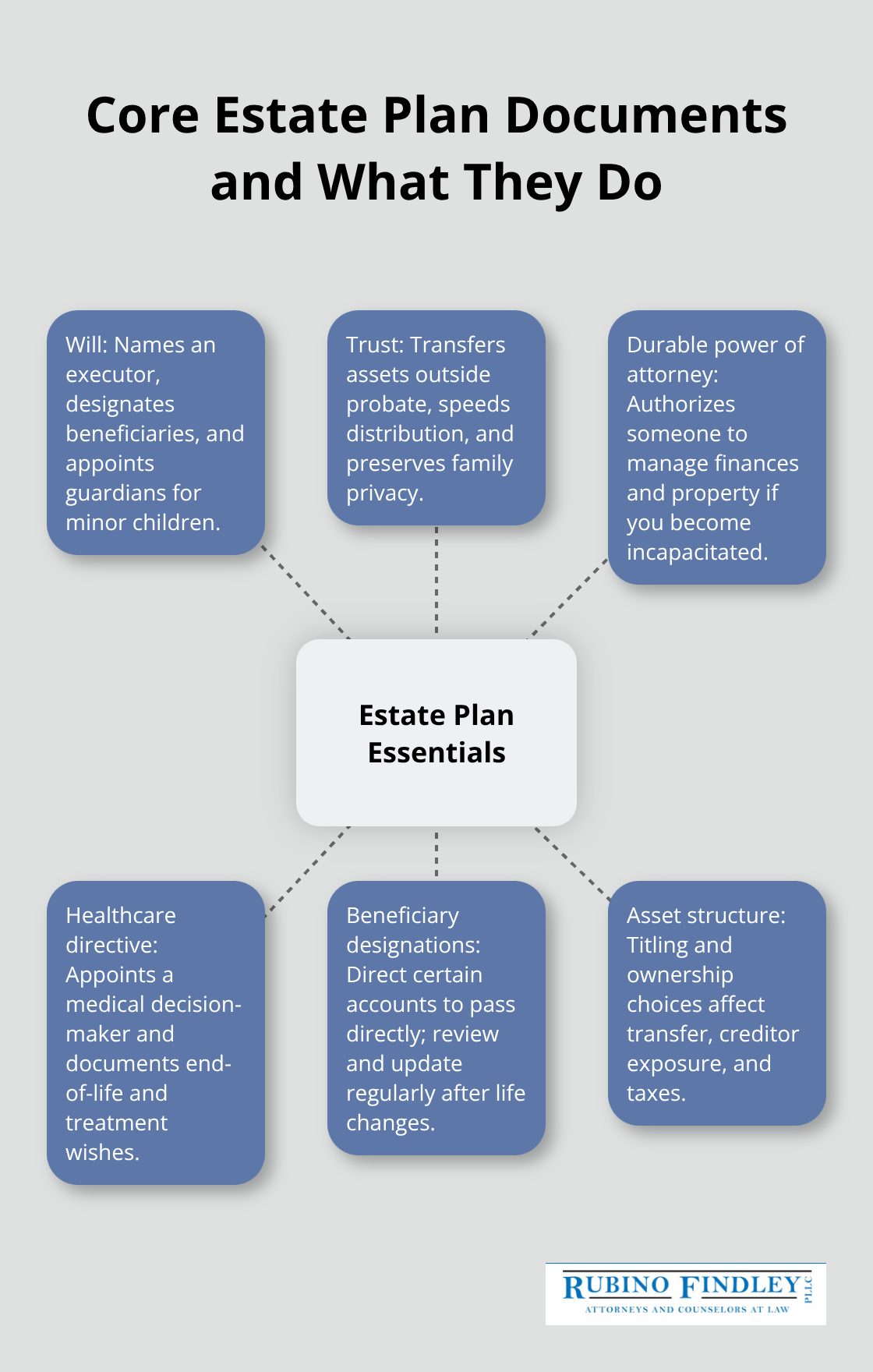

A will and trust form the foundation of most estate plans, but they serve different purposes and work best together. A will names your executor (the person who manages your estate), specifies who inherits your property, and designates guardians for minor children. Trusts transfer assets to beneficiaries outside of probate court, meaning your family avoids months of delays and thousands in court fees. If you own real estate, investments, or substantial bank accounts, a trust protects those assets from probate and keeps your family’s financial details private. Many people in Palm Beach County benefit from having both documents because a will catches anything not transferred to the trust, and the trust handles the bulk of asset distribution smoothly and quickly.

Powers of Attorney and Healthcare Documents

A durable power of attorney names someone to manage your finances and property if you become incapacitated and cannot make decisions yourself. Without this document, your family must petition a court for guardianship, which costs money and takes months. A healthcare directive (also called a healthcare power of attorney) names someone to make medical decisions on your behalf if you’re unable to communicate your wishes. These documents prevent your loved ones from guessing what you want and facing legal barriers when hospitals or doctors need authorization. You can be specific about end-of-life care, organ donation, and other sensitive medical choices, removing that burden from family members during stressful moments.

Beneficiary Designations Prevent Costly Mistakes

Beneficiary designations on life insurance policies, retirement accounts, and investment accounts bypass your will and transfer directly to the named person. Many people overlook updating these after marriages, divorces, or births, which means money goes to an ex-spouse or an outdated beneficiary instead of who you actually want to protect. You should review these designations every three to five years or after major life changes. If you have minor children, naming them directly as beneficiaries is usually a mistake because they cannot legally manage the funds. Instead, name a trust or a responsible adult as beneficiary, with clear instructions about how the money should be used for your child’s education, healthcare, and care.

Asset Protection Through Strategic Structure

Asset protection means understanding which accounts are at risk if creditors come calling. Retirement accounts receive stronger legal protection than regular savings accounts, so you can structure your assets thoughtfully to reduce exposure. You should also consider how co-owned property transfers at death (joint tenancy, tenancy by the entirety, or tenancy in common each carry different consequences). The right structure protects your family’s financial security and prevents unintended transfers or tax complications. An experienced estate planning attorney from Rubino Findley, PLLC in Boca Raton can help you establish wills, trusts, and durable powers of attorney tailored to your situation and goals.

Final Thoughts

National Estate Planning Awareness Week 2025 arrives in October as your signal to act now instead of postponing. The statistics are clear: most Americans lack the documents they need, and waiting only increases the risk that your family will face legal complications, delays, and unnecessary costs if something happens to you. This week applies to anyone who wants to protect their loved ones and control what happens to their assets and medical care.

The documents you need are straightforward: a will or trust, a durable power of attorney, and a healthcare directive. These papers cost far less than people assume and take weeks, not months, to complete. Starting with a simple inventory of your assets and deciding who should inherit them removes most of the intimidation, and you don’t need to have everything figured out perfectly before reaching out for help.

We at Rubino Findley, PLLC work with families throughout Palm Beach County to establish wills, trusts, powers of attorney, and the other documents that protect everything you’ve built. Schedule a free consultation with our team to answer your questions, explain what documents you need, and show you how straightforward the process actually is. Your family’s security is worth the time it takes to plan.