Navigating Administration and Probate Law: What to Know

Florida’s administration probate law affects nearly every family when a loved one passes away. The process can feel overwhelming without proper guidance.

We at Rubino Findley, PLLC understand the complexities families face during probate administration. This guide breaks down what you need to know to navigate Florida’s probate system successfully.

What Does Florida Probate Administration Actually Involve

The Court-Supervised Asset Transfer Process

Florida probate administration is a court-supervised legal process that transfers a deceased person’s assets to beneficiaries or heirs. The process starts when someone files a petition with the probate court, typically within 10 days of death discovery. Florida Statute 733 governs formal administration, which applies to most estates valued over $75,000.

The court appoints a personal representative who manages the estate under judicial oversight. This representative must publish a Notice to Creditors in a local newspaper for two consecutive weeks (creditors then have three months to file claims). The personal representative inventories all assets, pays valid debts, files necessary tax returns, and distributes assets according to the will or Florida intestacy laws.

Assets That Require Probate vs Those That Don’t

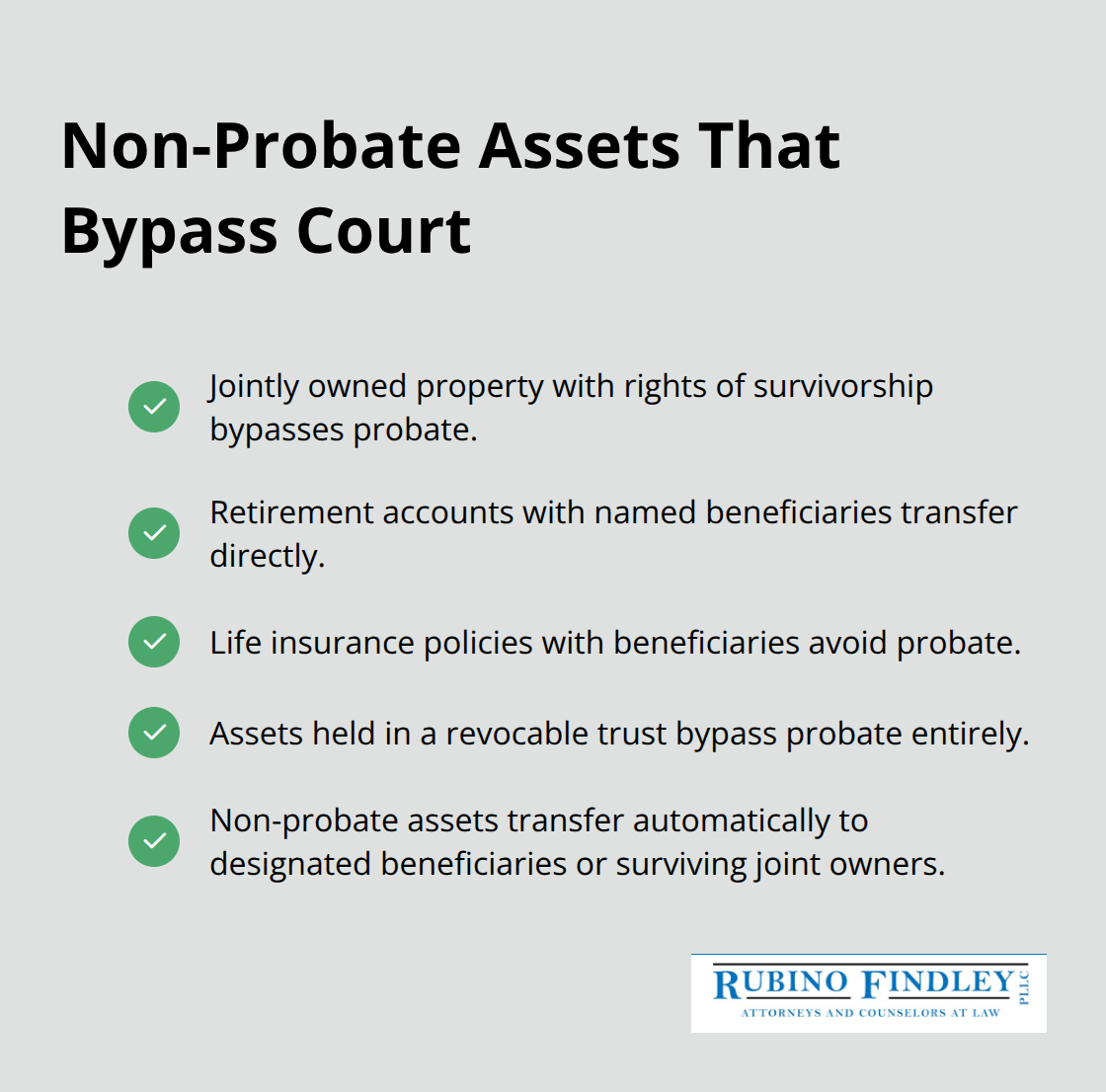

Probate applies to assets owned solely in the deceased person’s name without beneficiary designations. Real estate, bank accounts, investment accounts, and vehicles titled only in the decedent’s name must go through probate. However, jointly owned property with rights of survivorship, retirement accounts with named beneficiaries, life insurance policies, and assets held in revocable trusts bypass probate entirely.

Non-probate assets transfer automatically to designated beneficiaries or surviving joint owners. This automatic transfer saves time and court costs while maintaining privacy for the family.

Florida’s Alternative Probate Options

Florida offers alternatives for smaller estates that streamline the process significantly. Summary Administration applies to estates under $75,000 or when the decedent died over two years ago. This option can conclude in 30-60 days after filing compared to formal administration’s 5-6 month minimum timeline.

Disposition of Personal Property Without Administration handles estates containing only exempt personal property up to $20,000 (including funeral expenses). Complex estates with disputes or unusual assets often extend beyond a year in formal administration.

These timing differences make proper estate planning valuable for families who want to avoid lengthy court processes. The next section examines the most common obstacles families encounter during probate administration.

Common Challenges in Probate Administration

Family Conflicts Over Asset Distribution

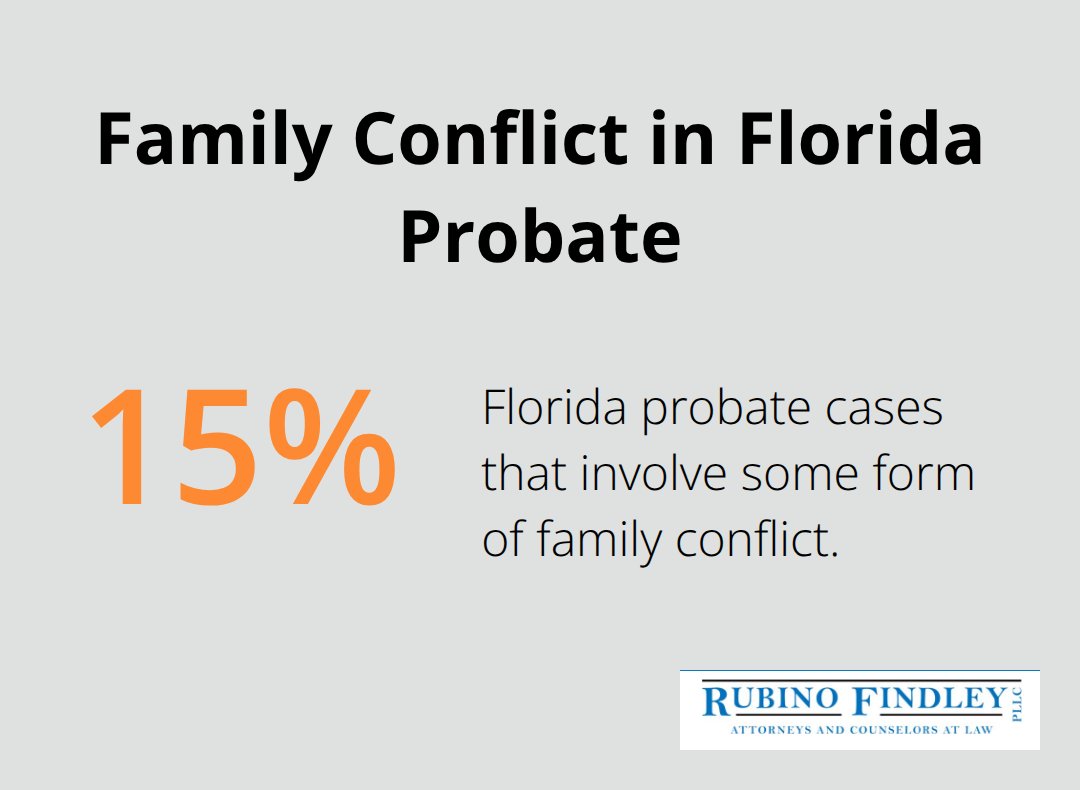

Probate administration frequently triggers disputes between family members who disagree about asset distribution or question the will’s validity. Florida courts see approximately 15% of probate cases involve some form of family conflict, according to the Florida Bar Association. These disputes often center on unequal distributions, perceived favoritism toward certain heirs, or disagreements about the personal representative’s decisions.

Adult children may challenge their stepparent’s inheritance rights, or siblings might dispute who should receive the family home. These conflicts can extend probate timelines by 6-18 months and cost families thousands in additional legal fees. The emotional stress compounds when families must navigate grief while they fight over money and property in court.

Asset Valuation Complexities

Complex assets like business interests, collectibles, and real estate in multiple states create significant valuation challenges that slow the probate process. Professional appraisals for unique assets can cost $500-$2,000 per item, and disagreements about valuations often require multiple appraisals or court intervention.

Personal representatives face difficult decisions when they encounter assets with disputed values. Art collections, family businesses, and investment properties often require multiple professional opinions before the court accepts their worth. These delays add months to the administration process while legal fees continue to accumulate.

Creditor Claims and Debt Management

Creditor claims add another layer of complexity as personal representatives must verify legitimate debts while they protect the estate from fraudulent claims. Florida law requires creditors to file claims within three months of notice publication, but secured debts and ongoing obligations like mortgages continue to accrue interest throughout probate.

Personal representatives who pay invalid claims or miss legitimate debts face personal liability. This responsibility makes careful debt management essential for protection of both the estate and themselves from future legal problems. Medical bills, credit card debts, and business obligations all require thorough review and proper handling.

The complexity of these challenges highlights why proper preparation becomes so important. The next section explores how families can take proactive steps to minimize these common probate obstacles.

How to Prepare for Smooth Probate Administration

Create Comprehensive Estate Planning Documents Now

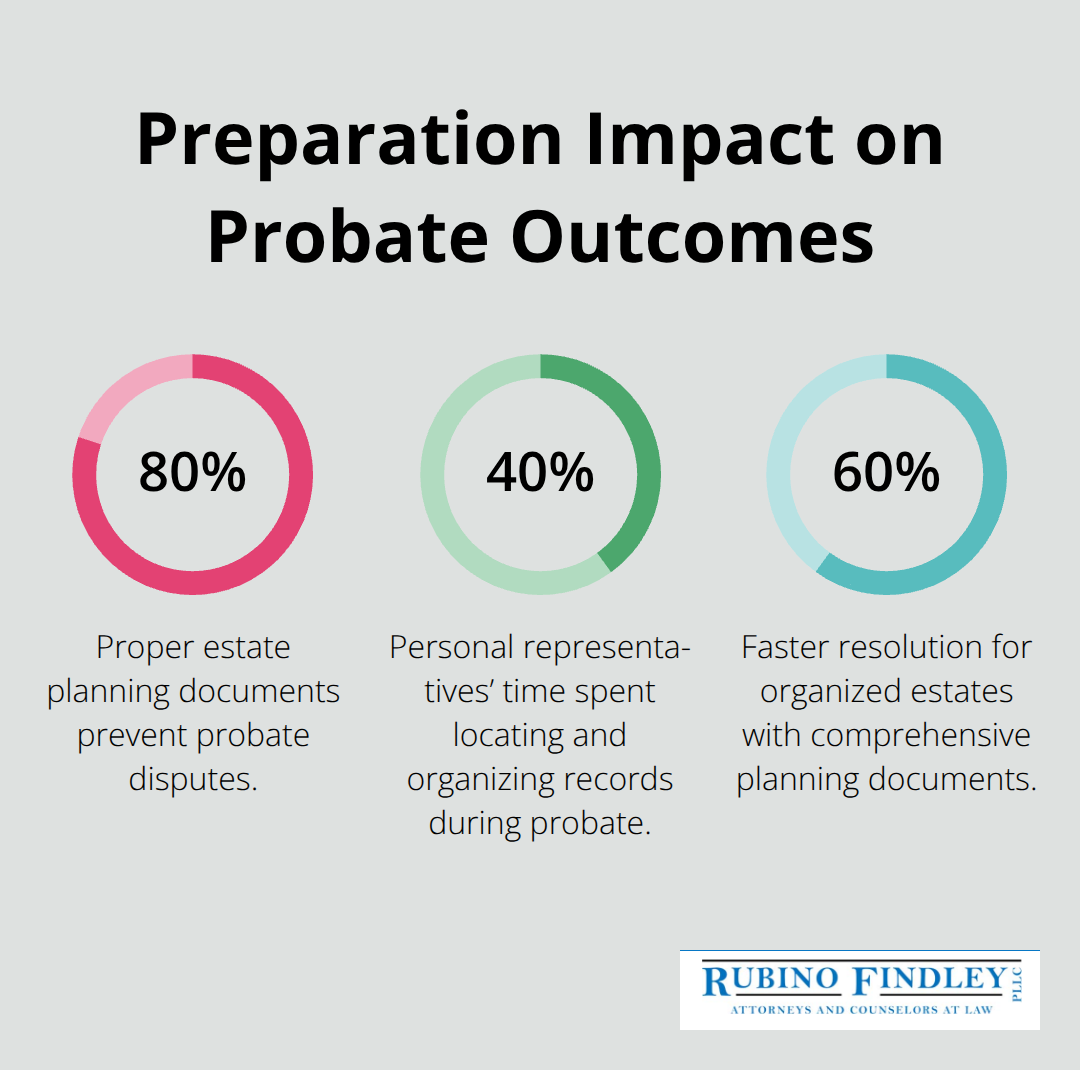

Proper estate planning documents prevent 80% of probate disputes according to the American Bar Association. A valid will must include specific language about asset distribution, appointment of guardians for minor children, and clear instructions for the personal representative. Florida requires two witnesses and a notary for will execution, but self-proving affidavits eliminate the need to locate witnesses later.

Revocable trusts offer superior protection by avoiding probate entirely for trust assets. Trust funding requires transferring ownership of bank accounts, real estate, and investments into the trust name. Many families create trusts but fail to fund them properly (leaving assets subject to probate anyway).

Maintain Organized Financial Records and Asset Documentation

Personal representatives spend 40% of their time locating and organizing financial records during probate administration. Create a master list of all bank accounts, investment accounts, insurance policies, and real estate holdings with account numbers and contact information. Store original documents in a fireproof safe while keeping copies in a separate location.

Digital assets like cryptocurrency, online accounts, and cloud storage require passwords and recovery information for access. Update beneficiary designations annually on retirement accounts, life insurance policies, and bank accounts to match your current wishes. Joint ownership with rights of survivorship transfers property automatically without probate, but this approach can create tax complications and loss of control during your lifetime.

Select Your Personal Representative Strategically

The personal representative choice affects probate duration and family harmony more than any other single decision. Florida law prioritizes surviving spouses, then adult children, but you can name anyone as personal representative in your will. Choose someone who lives in Florida or is willing to hire a Florida resident as co-representative to meet state requirements.

Your personal representative needs strong organizational skills, availability for 6-12 months of active involvement, and the ability to make difficult decisions under family pressure. Avoid naming co-representatives unless absolutely necessary because joint decision-making slows the process and increases costs when disagreements arise (especially in complex family situations).

Final Thoughts

Florida administration probate law requires careful navigation, but proper preparation makes the difference between a smooth process and months of family conflict. Statistics show that organized estates with comprehensive planning documents resolve 60% faster than those without proper preparation. Families who plan ahead avoid the stress and expense that comes with emergency decisions.

Legal counsel protects your family from costly mistakes and procedural delays during probate administration. We at Rubino Findley, PLLC help families throughout Palm Beach County create comprehensive estate plans that minimize probate complications. Our team handles wills, trusts, probate administration, and durable power of attorney documents.

The time to act is now, before a crisis forces your family into emergency planning mode. Every month you delay estate planning increases the risk that your loved ones will face unnecessary legal complications and family disputes (especially when emotions run high after a death). Contact Rubino Findley, PLLC today to schedule your consultation and take the first step toward protecting your family’s financial security and peace of mind.