Top Estate Planning Tips in Boca Raton to Secure Your Future

Estate planning protects your family’s financial future and prevents costly legal disputes. Florida residents face unique challenges with homestead laws and tax implications that require careful navigation.

We at Rubino Findley, PLLC have compiled essential estate planning tips to help Palm Beach County families secure their assets. These strategies address common pitfalls while maximizing protection for your loved ones.

What Documents Form Your Estate Planning Foundation

Every Florida adult needs three fundamental documents to protect their family from legal chaos and financial hardship. A comprehensive will serves as your primary directive for asset distribution and guardian appointments for minor children. Florida requires your will to include your signature plus two witness signatures to remain valid under Florida Statute 732.502. Without this document, state intestacy laws determine who receives your property, often creating outcomes you never intended.

Power of Attorney Prevents Family Financial Disasters

Durable power of attorney documents activate when you cannot manage financial decisions due to illness or injury. Florida Statute Chapter 709 mandates specific language for durability, which means the document remains effective during your incapacitation. Choose your agent carefully since they gain broad authority over bank accounts, real estate transactions, and investment decisions. Third parties frequently challenge outdated power of attorney forms, so update yours every three to five years to maintain acceptance by financial institutions.

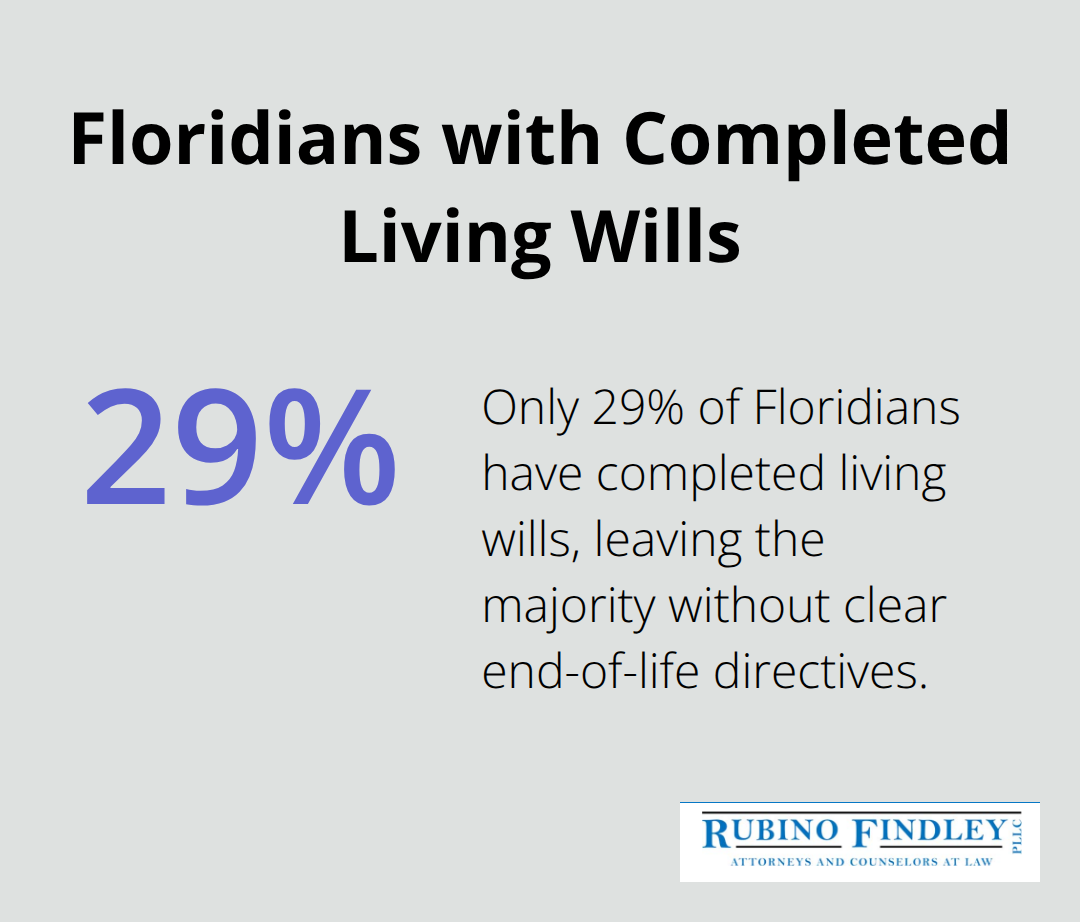

Healthcare Directives Save Families From Impossible Choices

Living wills and healthcare surrogate designations prevent family conflicts during medical emergencies. Only 29% of Floridians have completed living wills according to recent surveys (this leaves loved ones to guess about end-of-life preferences). Your healthcare surrogate gains decision-making authority when doctors determine you cannot communicate medical choices. Include specific instructions about life support, feeding tubes, and pain management to guide your surrogate through difficult situations.

HIPAA authorization forms allow your healthcare surrogate to access medical records and communicate with doctors about your condition.

Document Storage and Access Requirements

Store original documents in a fireproof safe or bank safety deposit box while keeping copies accessible to family members. Florida courts require original wills for probate proceedings (copies cannot substitute for originals in most cases). Provide your healthcare surrogate and power of attorney agent with copies of their respective documents plus contact information for your attorney. Digital copies stored in secure cloud services offer additional protection against document loss or damage.

The next step involves selecting trust structures that align with your specific financial goals and family circumstances.

Which Trust Structure Fits Your Financial Goals

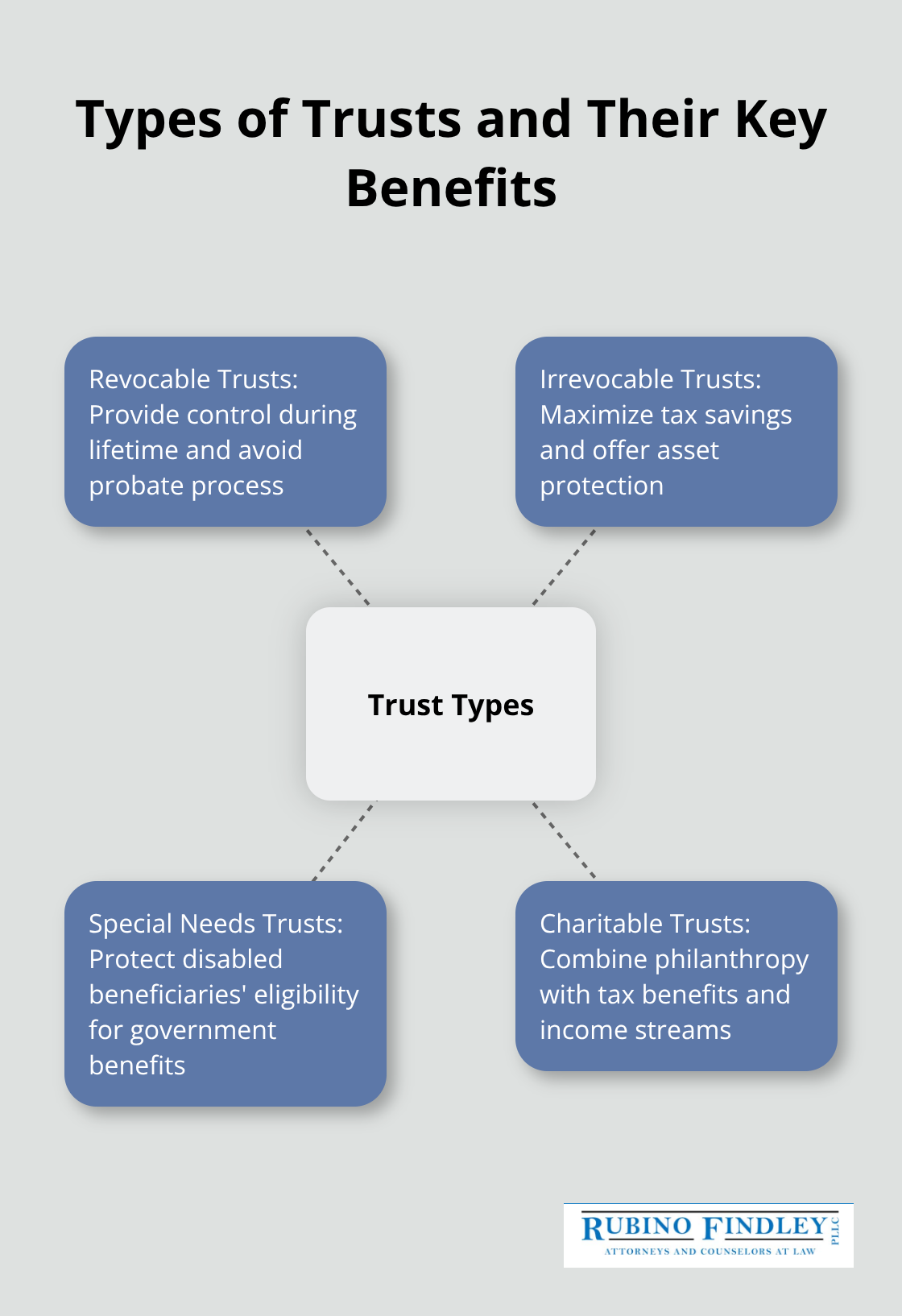

Revocable Trusts Provide Control During Your Lifetime

Revocable trusts allow you to maintain complete control over assets while alive and provide seamless management after death. Assets transferred into revocable trusts avoid Florida’s probate process, which typically costs 3-5% of estate value according to AARP data. Your successor trustee can immediately access trust assets without court approval, which prevents delays that leave families without funds during transitions. However, revocable trusts provide no tax advantages since you still own the assets for federal tax purposes. The 2025 federal estate tax exemption stands at $13.61 million per person (most Florida families avoid estate taxes regardless of trust choice).

Irrevocable Trusts Maximize Tax Savings and Asset Protection

Irrevocable trusts remove assets from your taxable estate permanently and create significant tax benefits for wealthy families. Florida’s lack of state income tax makes irrevocable trusts particularly attractive since trust income faces no state taxation. These trusts shield wealth from creditors and lawsuit risks, though Florida’s homestead exemption already provides substantial protection for primary residences.

Special Needs Trusts Protect Disabled Beneficiaries

Special needs trusts protect disabled beneficiaries’ eligibility for government benefits while they provide supplemental support for quality-of-life expenses. These trusts must comply with federal regulations under 42 U.S.C. § 1396p(d)(4)(A) to maintain Medicaid and SSI eligibility. Proper trust administration allows families to enhance their loved one’s quality of life without jeopardizing essential government assistance programs.

Charitable Trusts Combine Philanthropy with Tax Benefits

Charitable remainder trusts allow philanthropic goals while they generate income streams during your lifetime, with remainder values that go to chosen charities. These trusts provide immediate tax deductions and reduce estate taxes while they support causes you care about. The key disadvantage involves losing control over irrevocable trust assets (careful planning with qualified attorneys becomes essential before implementation).

Trust funding requires proper asset transfers to achieve intended benefits, but many Florida residents make critical mistakes that undermine their estate plans.

What Estate Planning Mistakes Cost Florida Families Most

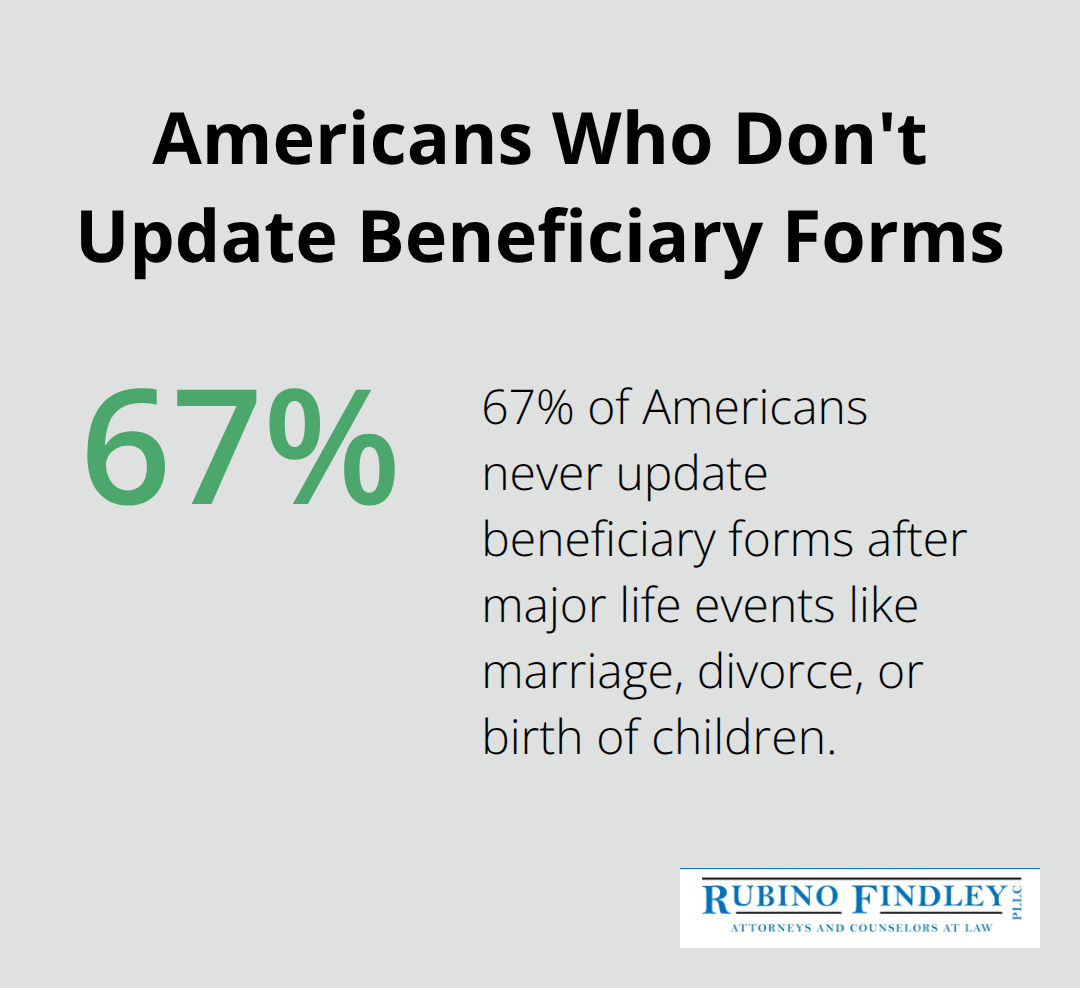

Florida residents lose millions annually through preventable estate planning errors that stem from outdated beneficiary designations and misunderstanding state-specific laws. Retirement accounts with incorrect beneficiaries bypass your will entirely, which means your ex-spouse could inherit your 401k instead of your current family. Financial institutions report that 67% of Americans never update beneficiary forms after major life events like marriage, divorce, or the birth of children (according to Wealth Counsel surveys). Check your IRA, 401k, life insurance, and pension beneficiaries annually because these designations override any instructions in your will or trust.

Florida Homestead Laws Create Unique Planning Challenges

Florida’s homestead exemption protects your primary residence from most creditors but creates complex inheritance rules that many families misunderstand. Your homestead cannot pass freely through your will if you leave behind a surviving spouse and minor children – Florida Constitution Article 10 Section 4 restricts your options to life estate for your spouse or equal division among family members. This forced inheritance structure has destroyed many estate plans where parents assumed they could leave their home to adult children while they provide income to their spouse.

Homestead Property Loses Protection Through Improper Transfers

Homestead property loses its creditor protection if transferred improperly, which leaves families vulnerable to lawsuits and claims. Many Florida residents transfer their homestead to children or trusts without understanding the legal requirements that maintain protection. These mistakes expose previously protected assets to creditors who could never reach them before the transfer.

Digital Assets Disappear Without Proper Planning

Digital assets represent another problem area since most estate plans fail to address online accounts, cryptocurrency wallets, social media profiles, and cloud-stored documents. Without proper planning, these valuable digital properties become inaccessible to your family (and some platforms delete inactive accounts permanently). Create a comprehensive digital asset inventory with login credentials stored securely, and include specific language in your power of attorney documents that grants agents authority over digital properties and online accounts.

Final Thoughts

These estate planning tips form the foundation for protecting your family’s financial future in Florida. Comprehensive wills, proper power of attorney documents, and appropriate trust structures prevent costly legal disputes while they maximize asset protection. Regular updates become necessary after major life events like marriage, divorce, or the birth of children to maintain plan effectiveness.

Florida’s unique homestead laws and tax advantages require careful navigation to avoid common mistakes that cost families millions annually. Updated beneficiary designations and addressed digital assets prevent unintended consequences that bypass your carefully crafted estate plan. Proper implementation of these strategies protects your loved ones from unnecessary complications.

Experienced attorneys who understand Palm Beach County’s specific requirements provide invaluable guidance through complex legal requirements (and help families avoid costly mistakes). We at Rubino Findley, PLLC help families throughout Florida establish wills, trusts, and durable power of attorney documents while we provide probate administration services when needed. Our team offers free consultations to discuss your estate planning needs and create comprehensive plans that honor your wishes while they protect your loved ones from unnecessary legal complications.