Understanding Different Types of Estate Planning Trusts in Boca Raton

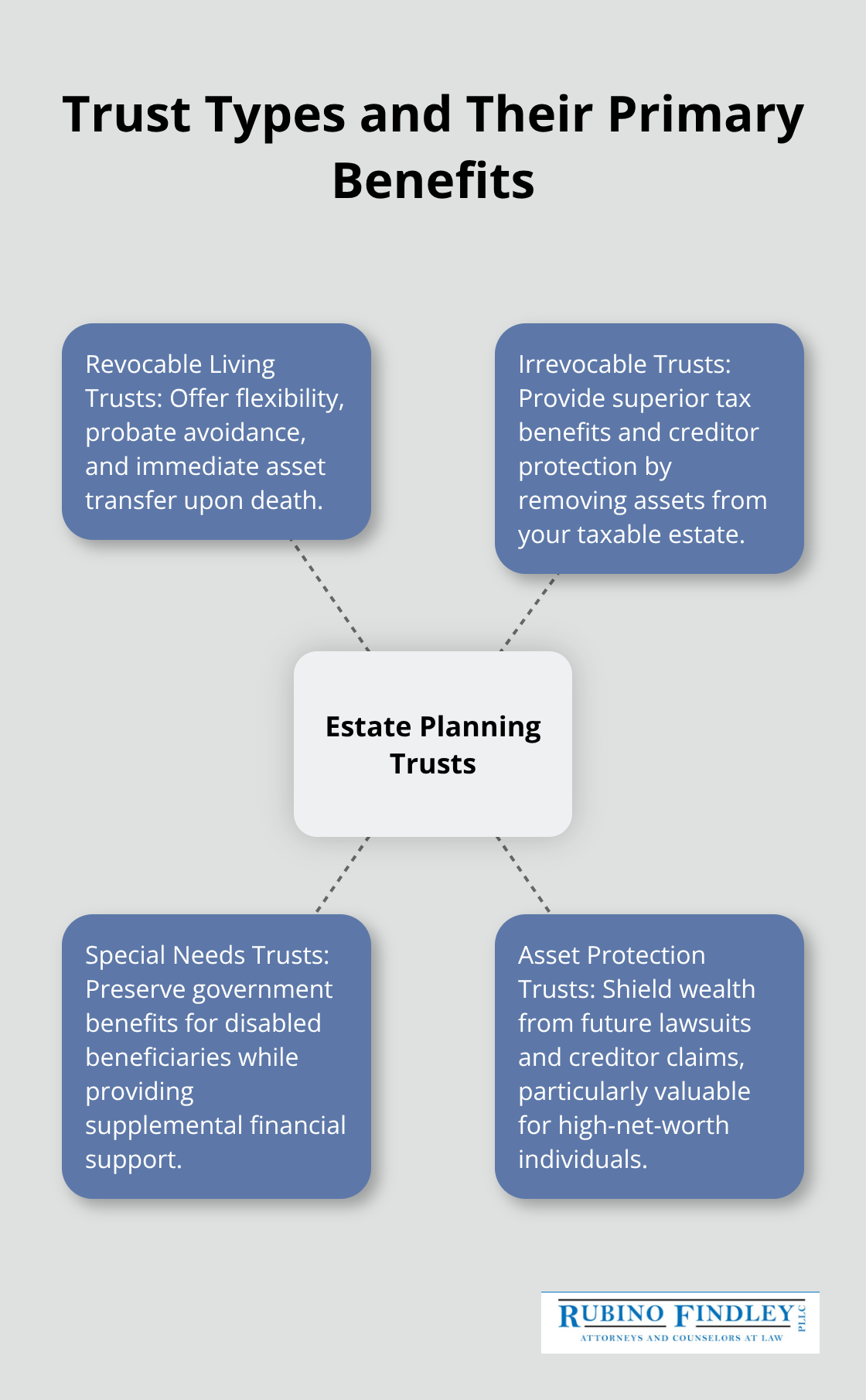

Estate planning trust types offer Florida residents powerful tools for protecting assets and managing wealth transfer. These legal structures provide benefits that standard wills simply cannot match.

At Rubino Findley, PLLC, we help Palm Beach County families navigate the complex world of trusts. The right trust can save thousands in taxes while protecting your legacy for future generations.

What Makes Trusts Different from Standard Wills

A trust creates a legal relationship where one party holds assets for the benefit of another. The trust owner (called a grantor) transfers property to a trustee who manages these assets according to specific instructions. This structure provides immediate benefits that wills cannot offer.

Florida Statute Chapter 736 governs trust operations and gives trustees broad authority to manage assets without court supervision. This legal framework allows trusts to function independently from probate courts.

Probate Avoidance Saves Time and Money

Trusts bypass Florida’s probate process entirely, while wills must go through probate court. AARP data shows probate costs typically consume 3-5% of an estate’s value in Florida. A $500,000 estate could lose $15,000 to $25,000 in probate fees and attorney costs.

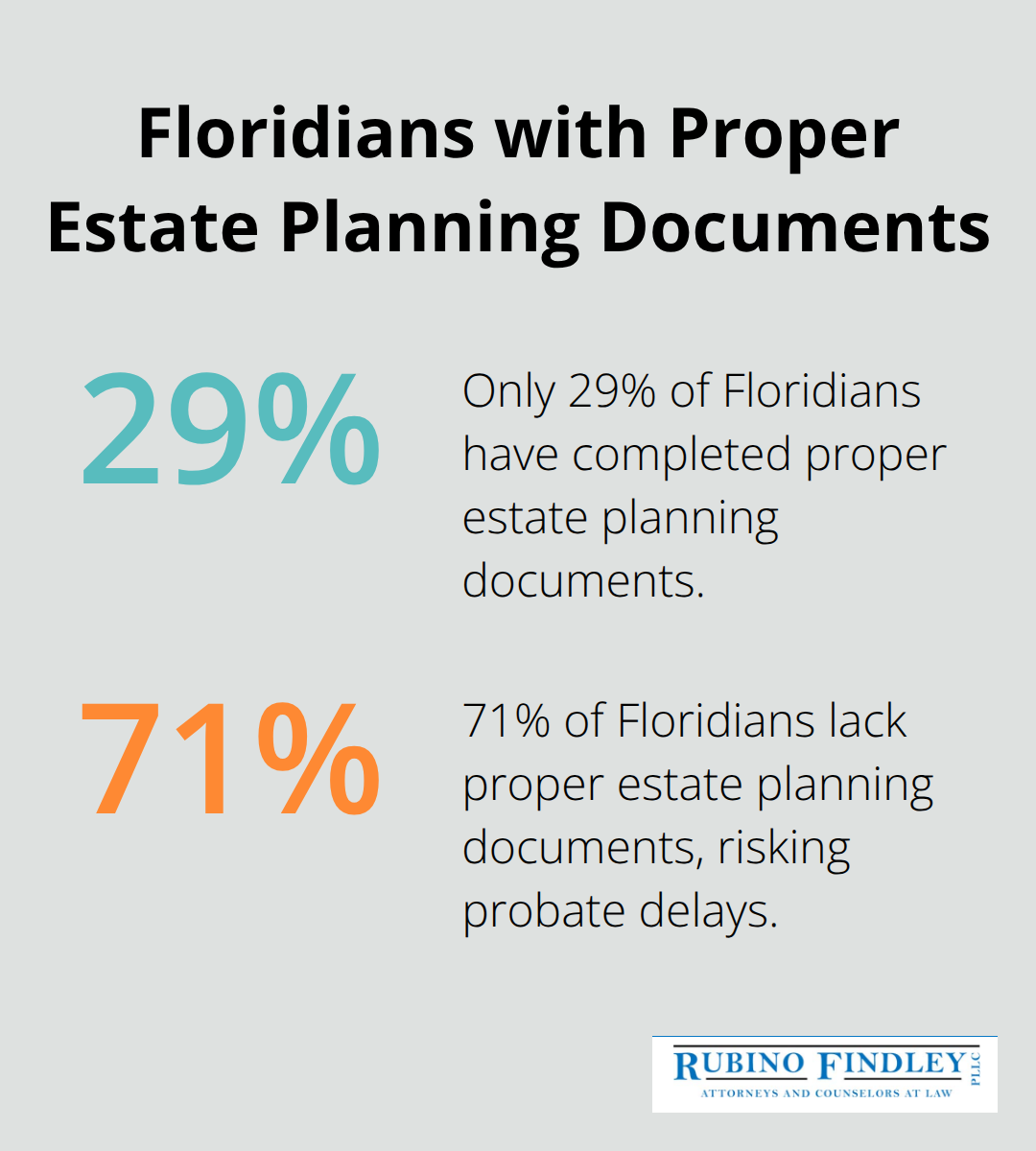

Trusts transfer assets immediately upon death, while probate takes 6-12 months on average. This speed protects families from financial stress during grief. Only 29% of Floridians have completed proper estate planning documents, which leaves most families exposed to lengthy probate delays.

Privacy Protection Keeps Financial Affairs Confidential

Wills become public records during probate and expose your financial affairs to anyone who requests court documents. Trusts remain private documents that never require court filing. This privacy protection shields your family’s financial information from public scrutiny.

Courts maintain detailed records of all probate proceedings, including asset values and beneficiary information. Trusts avoid this public exposure entirely and keep your wealth transfer decisions within your family circle.

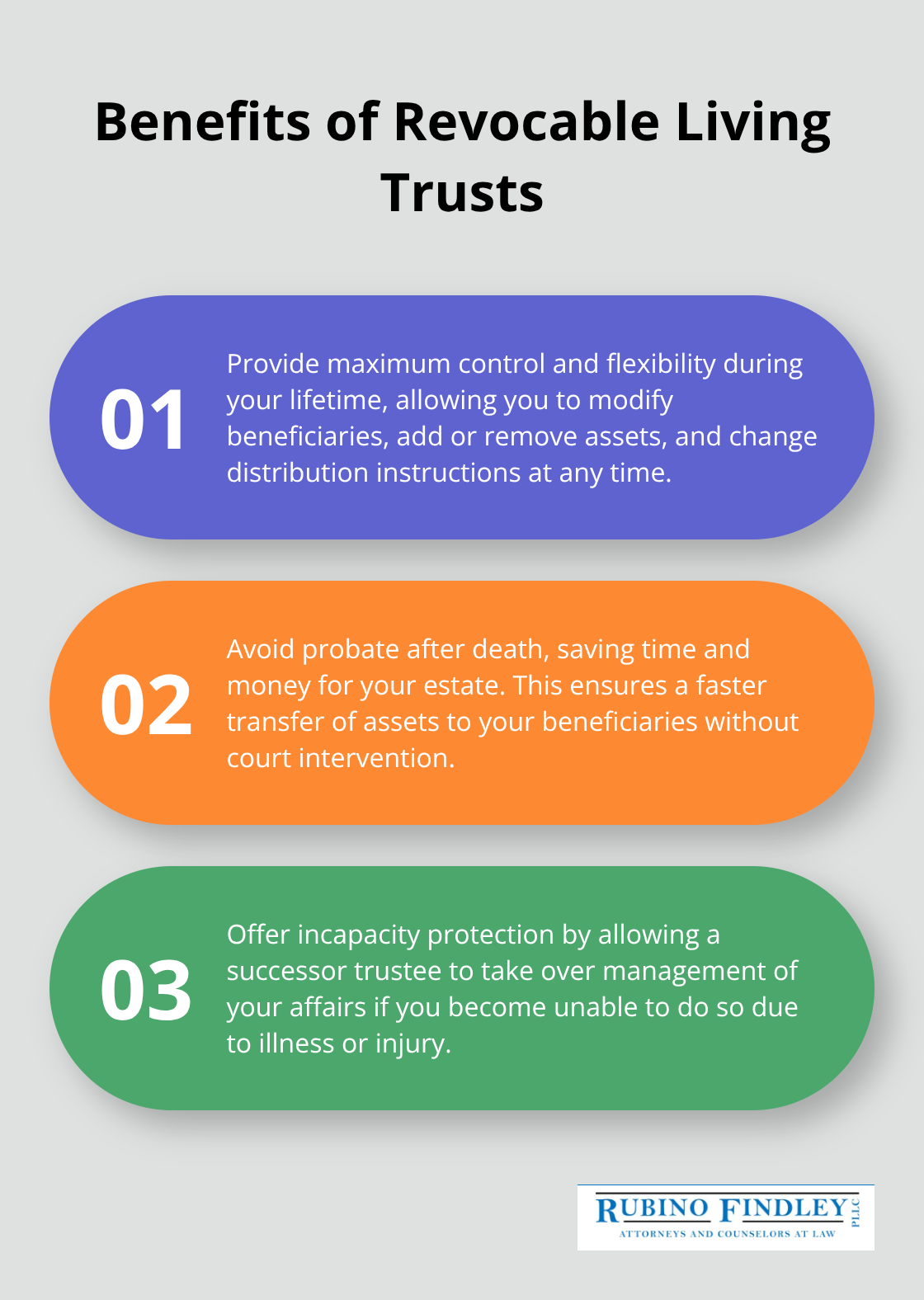

Incapacity Planning Provides Immediate Protection

Trusts provide incapacity protection that wills cannot match. If you become unable to manage affairs due to illness or injury, your successor trustee steps in immediately. Wills only activate after death and leave families without clear authority during medical emergencies.

Florida adults need trusts when they own real estate in multiple states, have minor children, or face potential creditor claims against their assets. These situations require the advanced protection that only trust structures can provide, which leads us to examine the specific types of trusts available to Florida residents.

Which Trust Type Fits Your Florida Estate Plan

Revocable Living Trusts Provide Maximum Control

Revocable living trusts offer Florida residents complete flexibility during their lifetime while they avoid probate after death. These trusts allow you to modify beneficiaries, add or remove assets, and change distribution instructions at any time. The federal estate tax exemption for 2025 stands at $13.61 million per person, which means most Florida families can use revocable trusts without estate tax concerns.

You serve as your own trustee initially and name a successor trustee to take over when you die or become incapacitated. Florida Statute 736.0602 allows you to revoke the trust entirely if circumstances change. Revocable trusts require no separate tax identification number and assets remain part of your taxable estate during your lifetime.

Irrevocable Trusts Lock in Tax Benefits

Irrevocable trusts remove assets from your taxable estate permanently and provide superior creditor protection compared to revocable options. Once you establish an irrevocable trust, you cannot modify its terms or reclaim the assets without beneficiary consent. These trusts reduce estate taxes because transferred assets no longer count toward your taxable estate value.

Wealth Counsel surveys show that 67% of families fail to update beneficiary designations after major life events, but irrevocable trusts prevent this problem through fixed distribution terms. Asset protection trusts shield wealth from future lawsuits and creditor claims (particularly valuable for high-net-worth individuals or those in lawsuit-prone professions).

Special Needs Trusts Preserve Government Benefits

Special needs trusts protect disabled beneficiaries from loss of Medicaid and Social Security benefits while they provide supplemental financial support. These trusts pay for expenses that government programs do not cover, such as therapy, equipment, or recreational activities. Florida allows first-party special needs trusts funded with the disabled person’s own assets and third-party trusts funded by family members.

Pooled trusts managed by nonprofit organizations offer cost-effective options for families with smaller estates. The Social Security Administration requires specific trust language to avoid benefit disqualification (professional legal drafting becomes essential for compliance). Each trust type serves different financial goals and family situations, which makes proper selection vital for your estate plan’s success.

How Do You Select the Perfect Trust Type

Your asset portfolio determines which trust structure provides maximum benefit for your specific situation. Florida residents with assets under $500,000 typically benefit most from revocable trusts that avoid probate costs and provide incapacity protection. Those with estates that exceed $13.61 million face federal estate taxes and need irrevocable trusts to reduce their taxable estate value. Real estate investors should consider asset protection trusts because Florida’s homestead exemption only protects primary residences from creditors.

Asset Categories Drive Trust Selection

Florida’s complex homestead laws create inheritance complications between spouses and minor children that revocable trusts can resolve. Homestead property cannot transfer to a spouse if minor children exist without proper trust plans. Business owners need irrevocable asset protection trusts to shield personal wealth from business liability claims. Investment accounts and retirement assets require different trust strategies because IRA and 401k distributions follow specific tax rules that affect beneficiary plans.

Tax Plans Require Strategic Trust Timing

Florida imposes no state estate tax, but federal taxes still apply to large estates. Irrevocable trusts must be established at least three years before death to avoid IRS gift tax complications under Section 2035. Generation-skipping trusts help wealthy families transfer assets to grandchildren while they minimize taxes across multiple generations. The annual gift tax exclusion allows $18,000 per recipient in 2024 (which means systematic trust funding over time reduces estate tax exposure without triggering gift taxes).

Professional Legal Guidance Prevents Costly Mistakes

Estate planning attorneys become essential because improper trust documentation voids intended benefits and creates costly legal disputes. Trust funding requires precise asset titling and beneficiary designation updates that attorneys handle to prevent implementation errors. Palm Beach County families need attorneys who match trust types to their specific financial goals and family circumstances.

Final Thoughts

Estate planning trust types provide Florida residents with powerful tools to protect assets, minimize taxes, and preserve wealth for future generations. Revocable living trusts offer flexibility and probate avoidance for most families, while irrevocable trusts deliver superior tax benefits and creditor protection for larger estates. Special needs trusts protect disabled beneficiaries without they jeopardize government benefits.

The complexity of Florida’s trust laws and tax implications makes professional legal guidance essential. Improper documentation or trust setup can void intended benefits and create costly disputes for your family. Each trust type serves specific purposes, and you select the wrong structure when you waste money and fail to achieve your goals.

We at Rubino Findley, PLLC help Palm Beach County families navigate these complex decisions through personalized estate plans. We create comprehensive plans that include wills, trusts, and durable power of attorney documents (tailored to your unique situation). Start today by scheduling your consultation to discuss which trust options best serve your family’s needs.