Where to Find Free Printable Estate Planning Forms

Estate planning doesn’t have to break the bank. Many Palm Beach County residents search for free printable estate planning forms PDF options to get started with basic documents.

We at Rubino Findley, PLLC understand the appeal of these no-cost resources. However, free forms come with significant limitations that could put your family’s future at risk.

Where to Find Free Printable Estate Planning Forms in Boca Raton

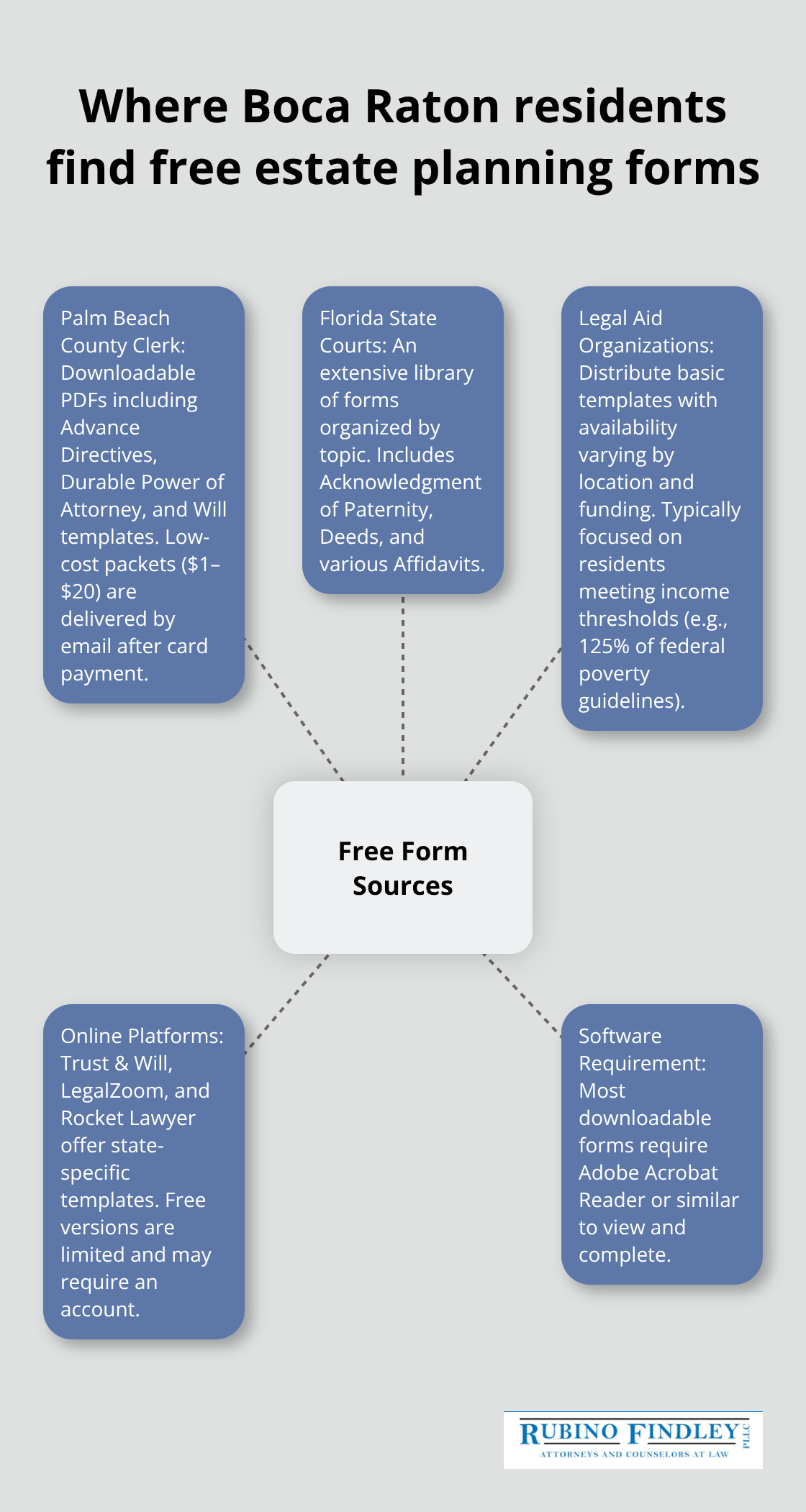

Palm Beach County Clerk Resources

The Palm Beach County Clerk of the Circuit Court provides the most comprehensive collection of free estate planning forms for Florida residents. Their website hosts downloadable PDF documents that include Florida Advance Directives, Durable Power of Attorney forms, and Last Will and Testament templates. These forms comply with Florida statutes and contain detailed completion instructions. The Clerk’s Self-Service Center provides form packets that range from $1 to $20, with fillable PDFs that arrive directly in your email after you pay by credit or debit card.

State Court System and Legal Aid Options

The Office of Florida State Courts maintains an extensive forms library with family law documents that staff organize by topic categories. Their online system contains critical estate planning documents like Acknowledgment of Paternity forms, Deeds, and various Affidavits. Legal aid organizations throughout Palm Beach County also distribute basic estate planning templates, though availability changes based on location and available funds. Many nonprofits focus on low-income residents who meet specific income requirements (typically 125% of federal poverty guidelines).

Online Legal Document Platforms

Trust & Will, LegalZoom, and Rocket Lawyer provide free basic estate planning forms alongside their paid services. These platforms offer state-specific templates that address Florida’s unique legal requirements. However, their free versions typically include limited features and may require account registration. You need Adobe Acrobat Reader or similar software to view and complete most downloadable forms from these sources. The SmartAsset report from January 2025 warns that DIY estate planning through these platforms can lead to costly mistakes and invalid documents.

While these free resources appear attractive for budget-conscious residents, they come with significant limitations that could jeopardize your family’s financial security and legal protection.

Limitations of Free Estate Planning Forms

Generic Templates Miss Individual Family Needs

Free estate planning forms treat every family situation the same way, which creates serious legal gaps. Florida residents with blended families face complex inheritance issues that standard templates cannot handle – stepchildren may inherit assets you intended for biological children, while your own kids get nothing. The Florida Supreme Court finds that poorly executed online wills fail legal validation regularly, forcing families into intestate succession battles.

Business owners encounter even more problems since free forms rarely address partnership agreements or business succession plans. Property ownership structures (joint tenancy, tenancy in common, or community property) need specific legal language that generic templates simply don’t include.

Professional Review Prevents Fatal Document Errors

Free forms provide zero legal oversight, which allows critical mistakes to slip through unnoticed. Florida estate laws demand precise witness signatures and notarization procedures that change based on document type – execution errors make entire documents legally worthless. The SmartAsset report from January 2025 shows DIY estate plans cause probate delays that stretch 18-24 months longer than professionally prepared documents.

Tax consequences go completely unaddressed in free templates, potentially costing your beneficiaries thousands in avoidable estate taxes. Without legal guidance, people frequently select wrong document types – choosing revocable trusts when irrevocable trusts would provide better protection, or writing wills that conflict with existing beneficiary designations on retirement accounts and life insurance policies.

State Law Compliance Requires Legal Knowledge

Florida’s estate planning statutes contain specific requirements that free forms often ignore or misstate. Chapter 732 of Florida statutes governs will execution, while Chapter 765 controls healthcare directives – each has different witness and signature requirements that must be followed exactly. Free templates frequently use outdated language or provisions from other states that Florida courts won’t recognize.

These compliance failures become apparent only after death, when families discover their documents hold no legal weight. Professional legal guidance becomes even more valuable when you consider complex family dynamics and significant assets that demand customized solutions.

When Professional Help Is Necessary

Blended Families Need Custom Legal Solutions

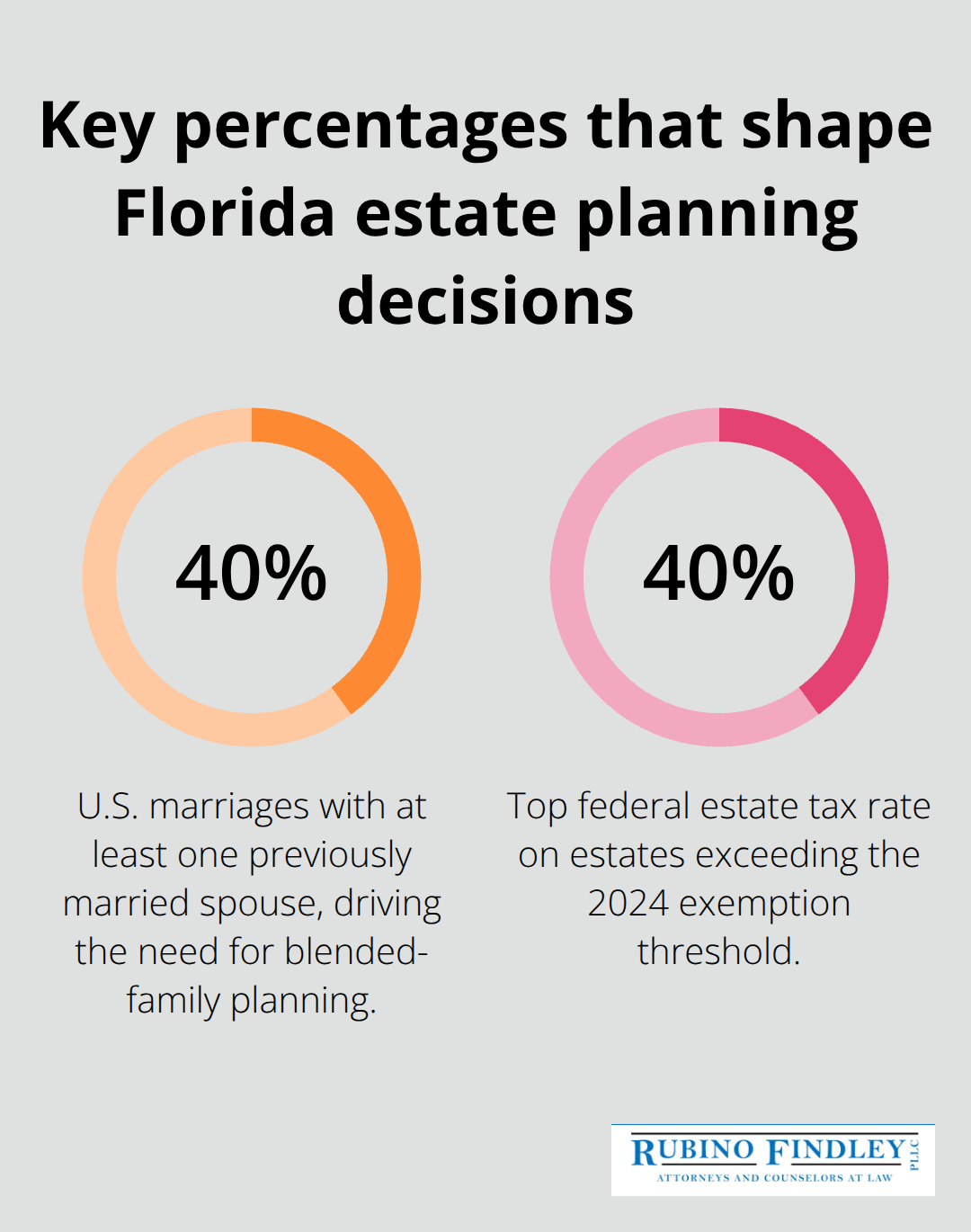

Remarriage with children from previous relationships creates inheritance complications that free forms cannot address. Florida’s intestate succession laws give surviving spouses significant rights that may override your intentions for biological children. Without proper legal documents, your current spouse could inherit assets you meant for children from your first marriage, leaving them with nothing. Professional attorneys draft specific trust provisions that protect both your spouse’s financial security and your children’s inheritance rights. The National Center for Health Statistics reports that 40% of marriages involve at least one previously married spouse, making blended family planning increasingly common.

Step-parent adoption, guardianship appointments, and healthcare decision-making authority need precise legal language that varies based on custody arrangements and parental rights. Free templates ignore these family dynamics completely, potentially creating conflicts that tear families apart during already difficult times.

High-Value Estates Face Complex Tax Consequences

Estates exceeding $13.61 million in 2024 trigger federal estate taxes of up to 40%, while Florida imposes no state estate tax. However, proper planning can reduce or eliminate these burdens through strategic gifts, charitable trusts, and business valuation discounts. Real estate holdings, investment portfolios, and retirement accounts require coordinated beneficiary designations that align with overall estate goals. The IRS reports that improper estate planning costs beneficiaries an average of $28,000 in unnecessary taxes and administrative expenses.

Business Owners Need Succession Plans

Business owners need succession plans that address partnership agreements, buy-sell provisions, and key employee retention. Free forms cannot handle these sophisticated arrangements that often determine whether family businesses survive generational transfers or face forced liquidation to pay estate taxes. Professional attorneys structure these complex documents to protect business continuity while minimizing tax burdens for heirs.

Final Thoughts

Free printable estate planning forms PDF downloads provide Palm Beach County residents with a basic introduction to estate planning concepts. These templates help you identify which documents you might need and understand fundamental legal structures. However, the significant limitations we’ve outlined show why free forms alone cannot protect your family’s future adequately.

Generic templates fail to address Florida’s specific legal requirements and your unique family circumstances. Professional review prevents execution errors and compliance failures that can render your documents legally worthless when your family needs them most. The SmartAsset report confirms that DIY estate planning frequently leads to costly probate delays and family disputes (averaging 18-24 months longer than professionally prepared documents).

We at Rubino Findley, PLLC help Palm Beach County families create comprehensive estate plans that protect their loved ones through proper legal documentation. Our team handles the complex legal requirements while you focus on what matters most – your family’s security. Contact us today to schedule your consultation and learn how proper estate planning can secure your legacy.